Digital Maturity Benchmark Report: State of Digital Grocery 2019

Incisiv

Incisiv

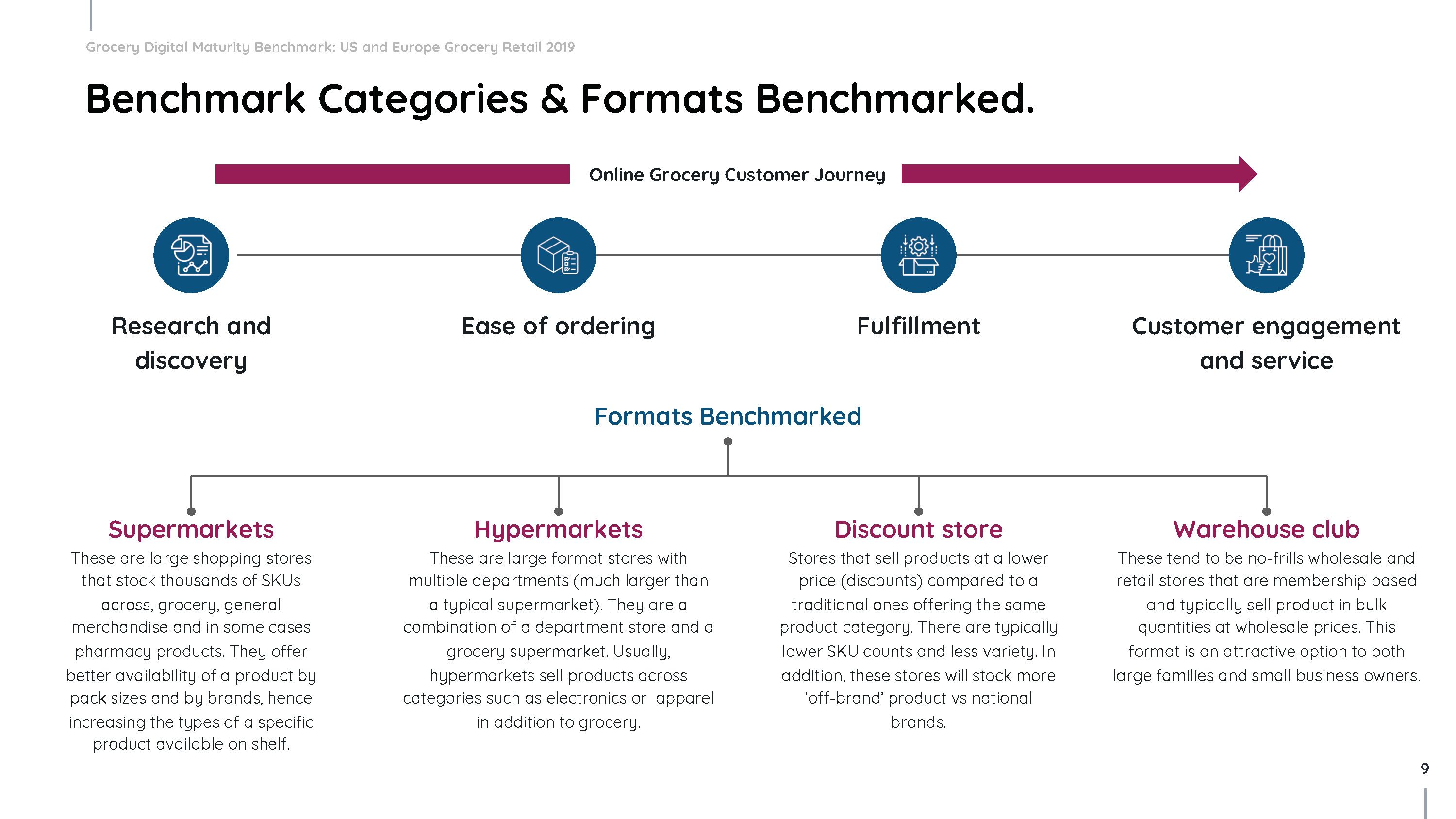

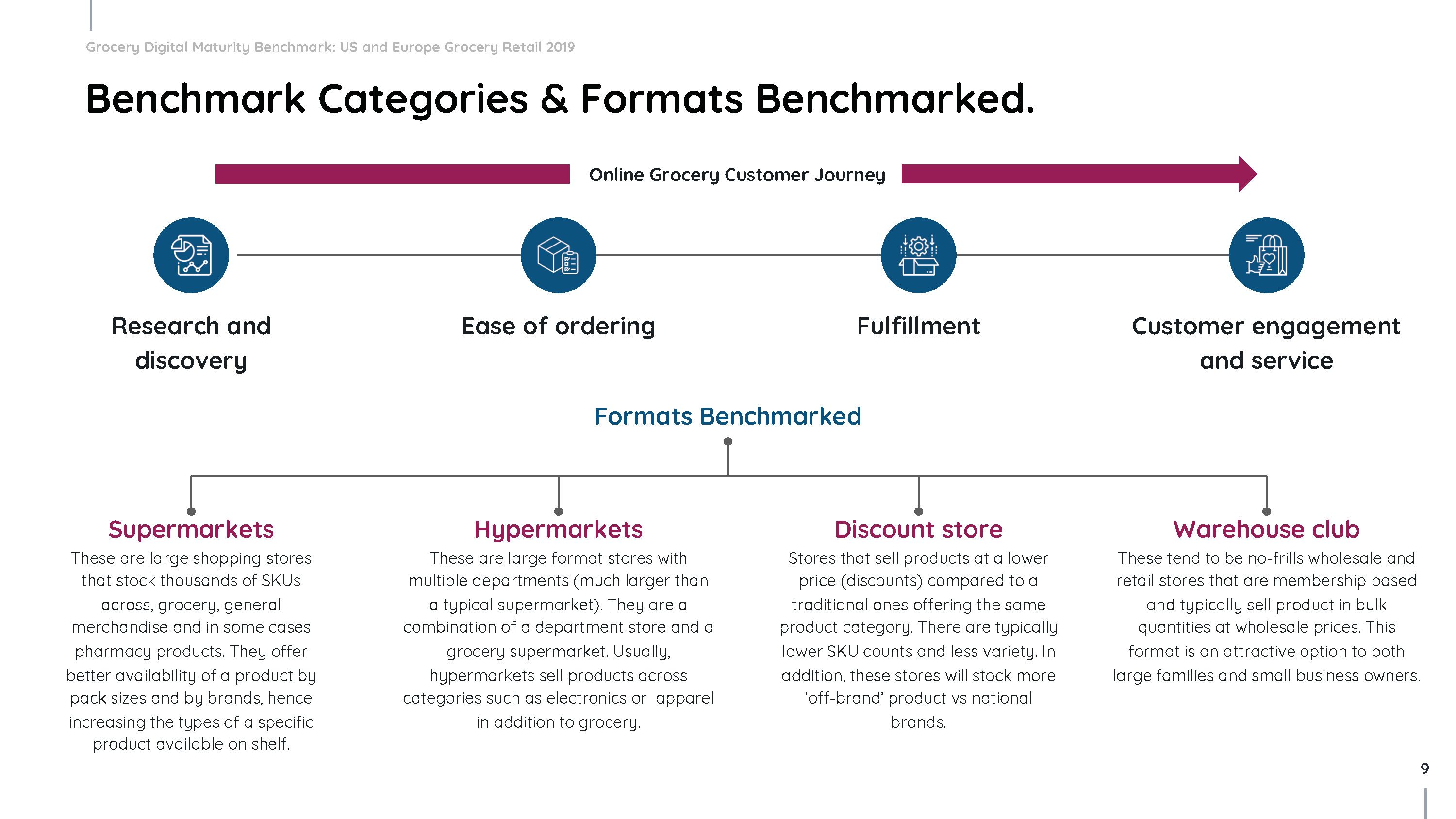

Benchmark Categories & Formats Benchmarked.

Online Grocery Customer Journey

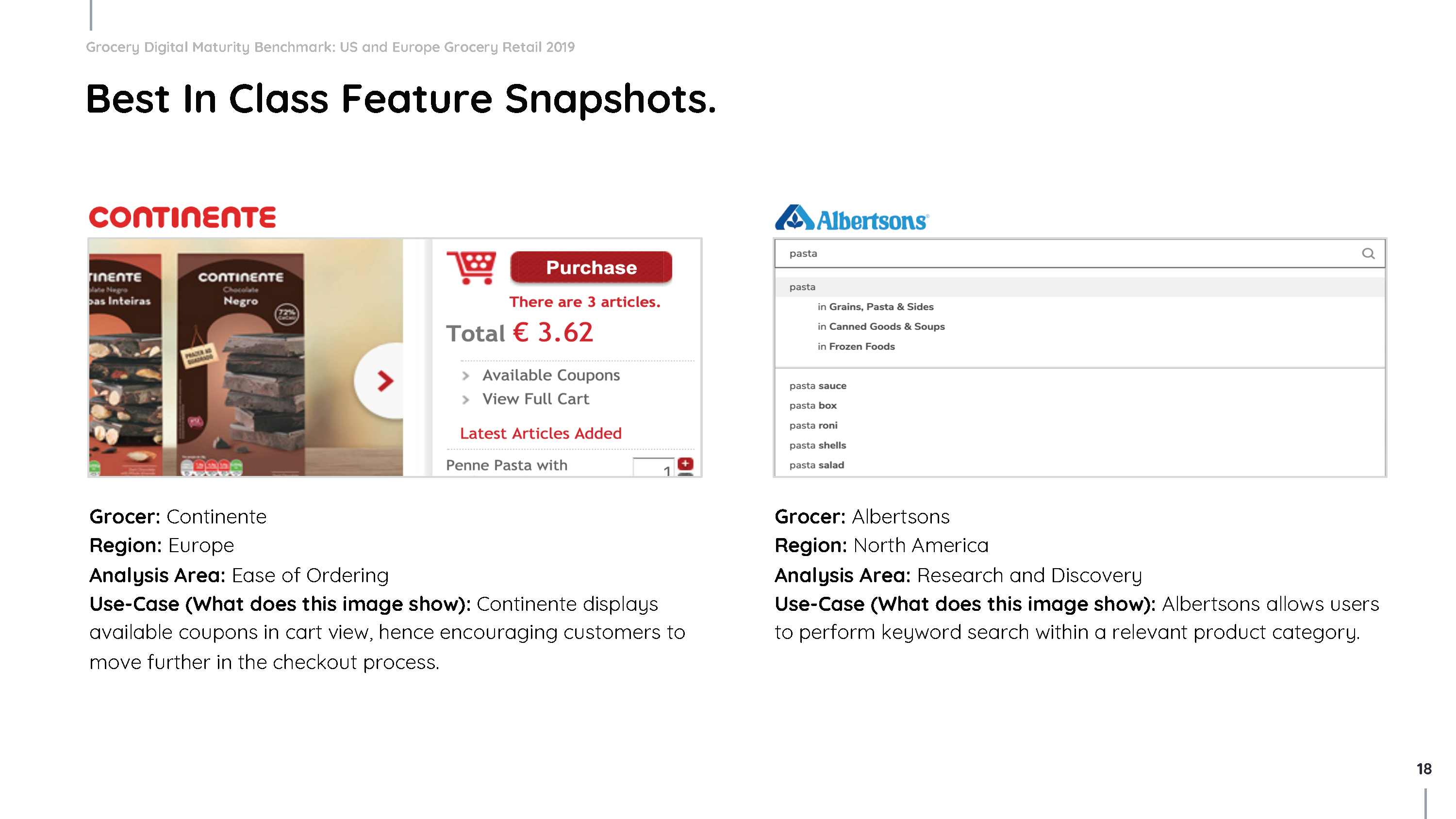

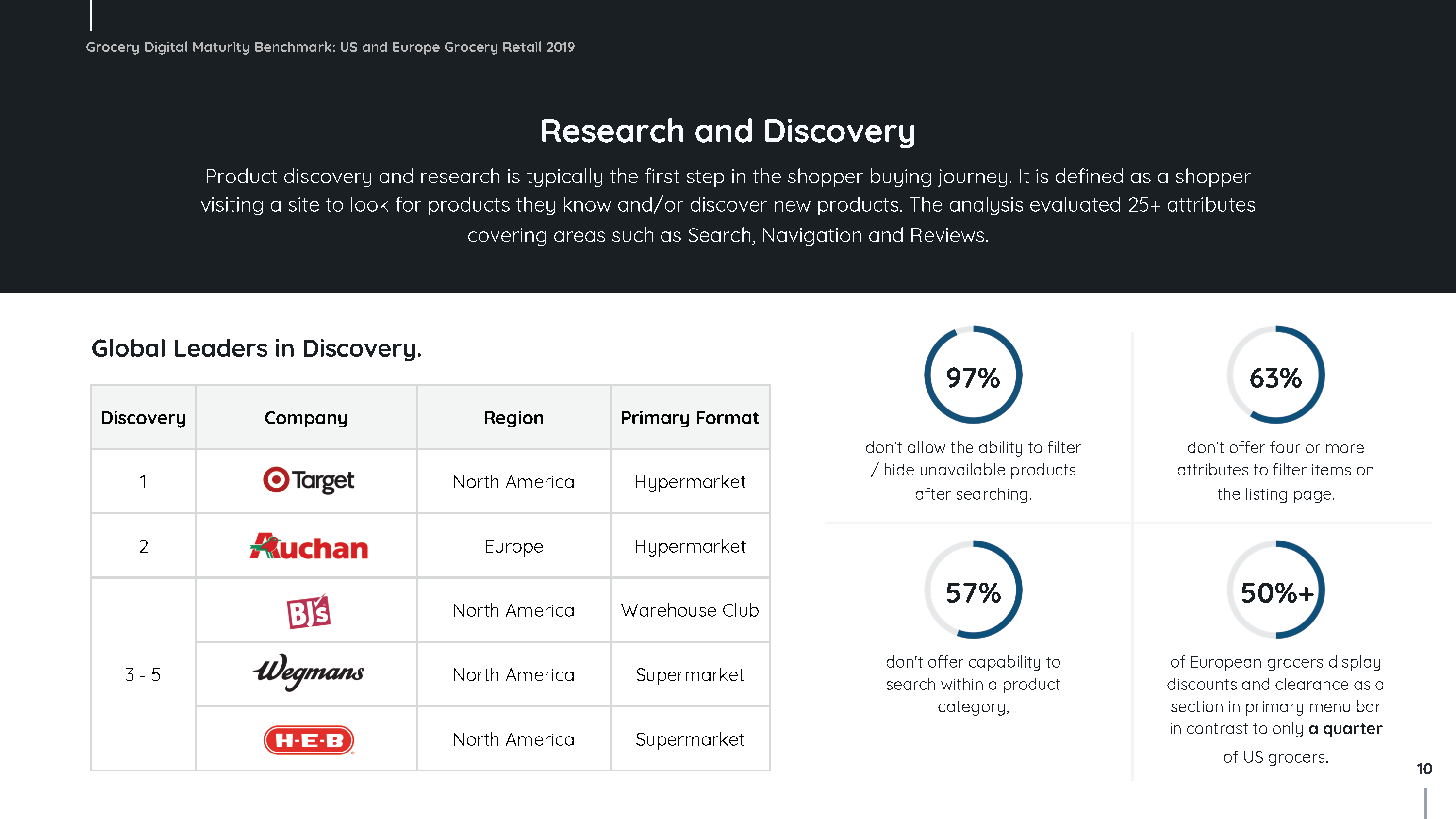

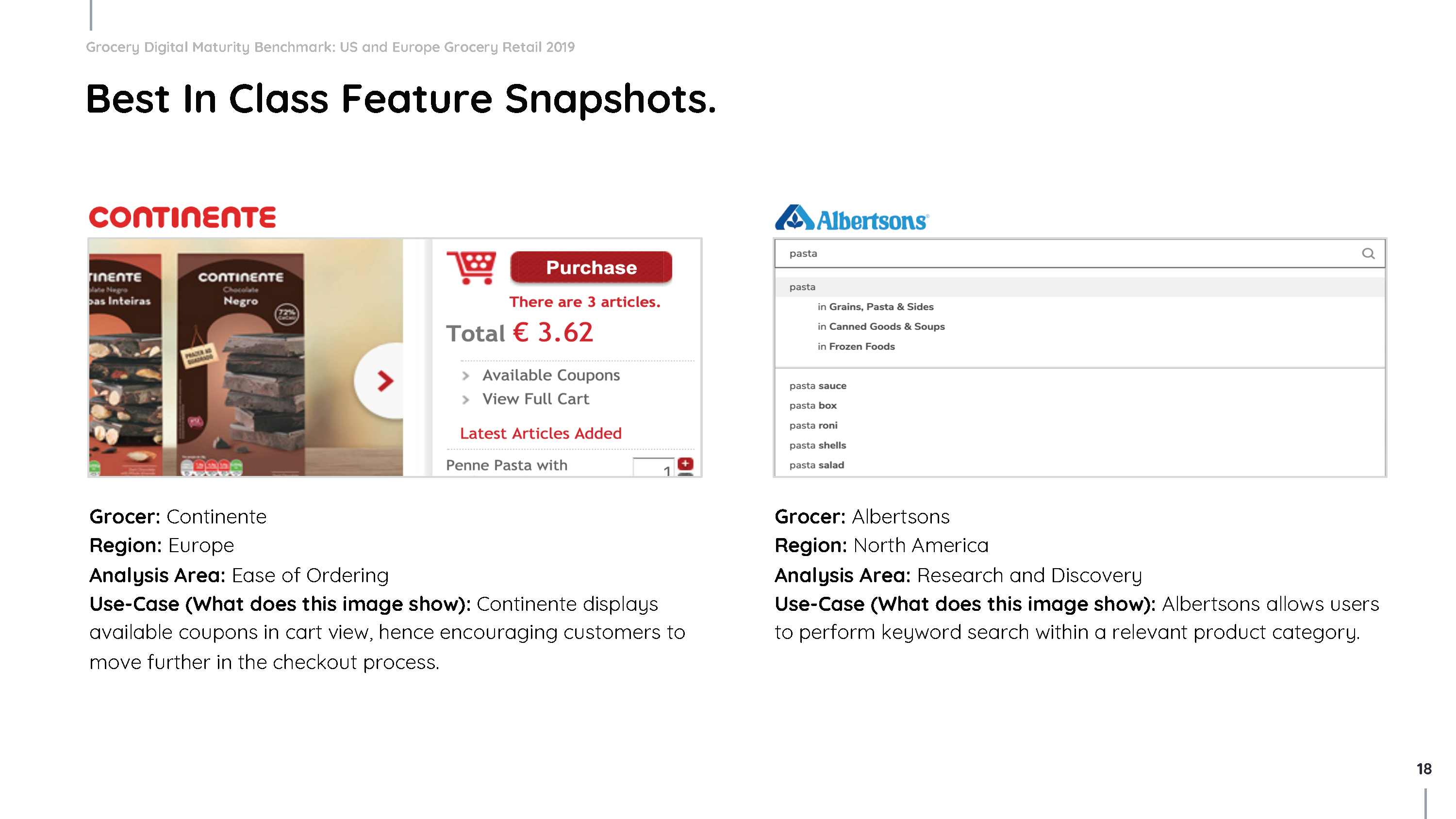

Research and discovery

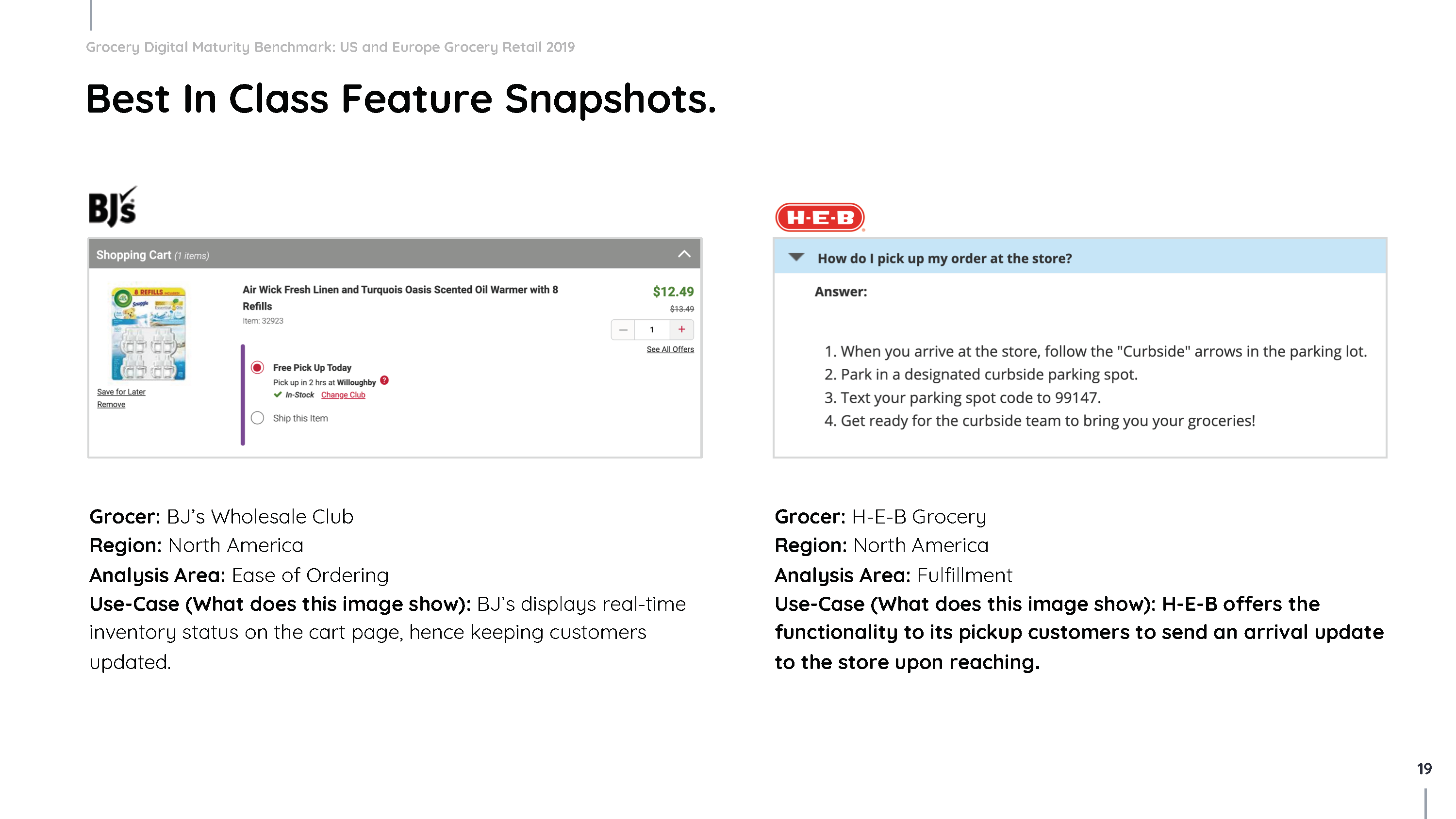

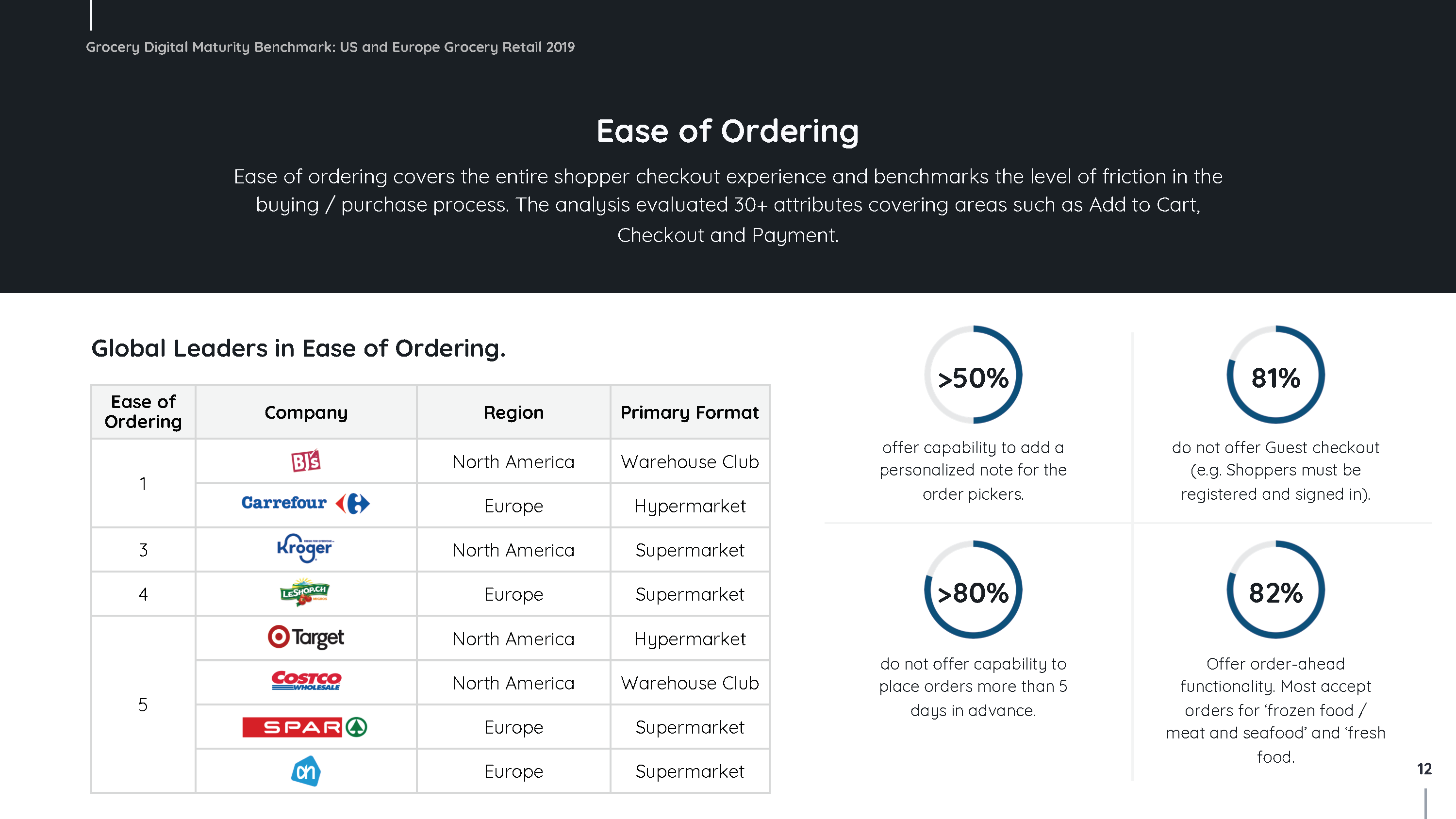

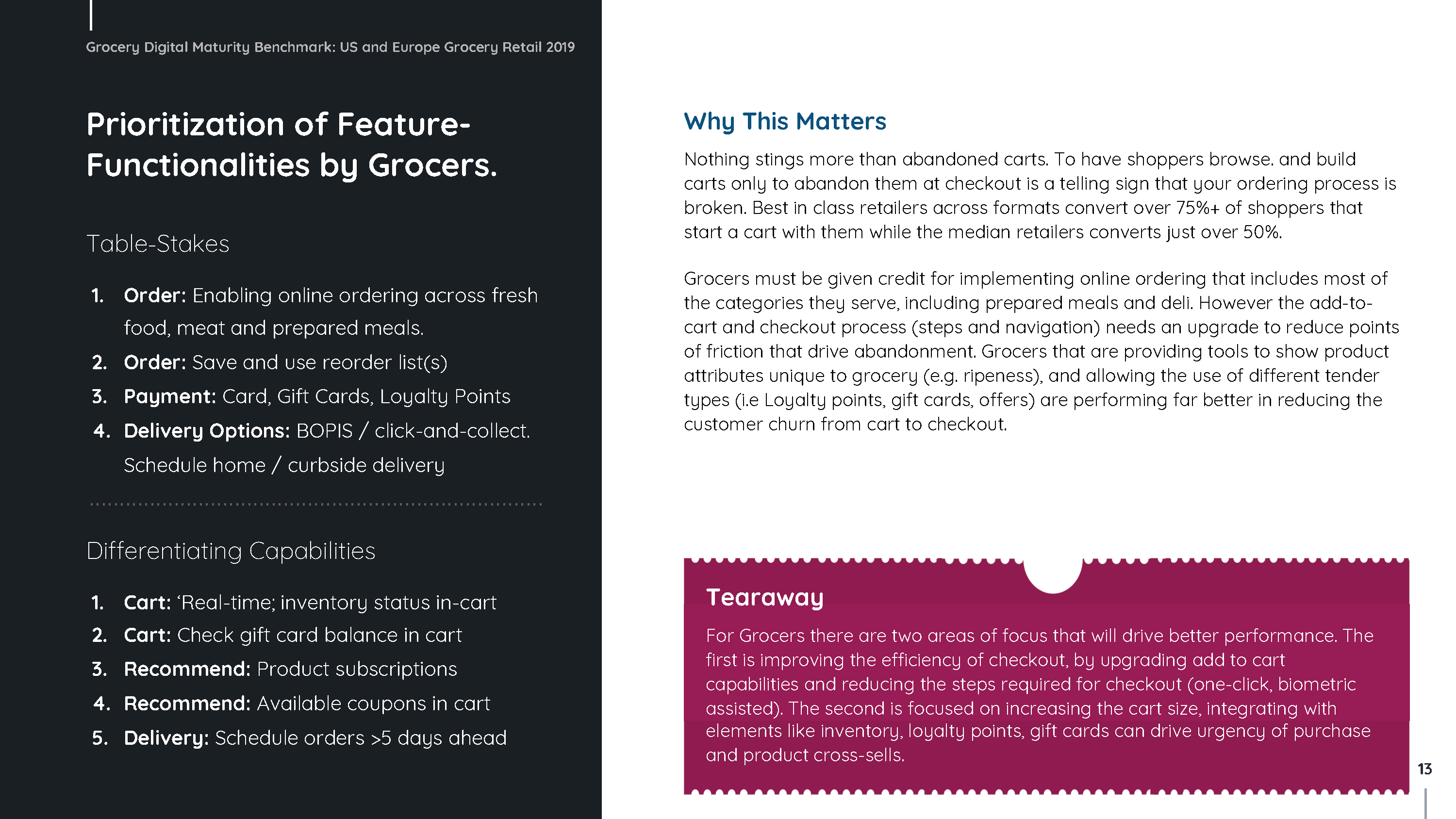

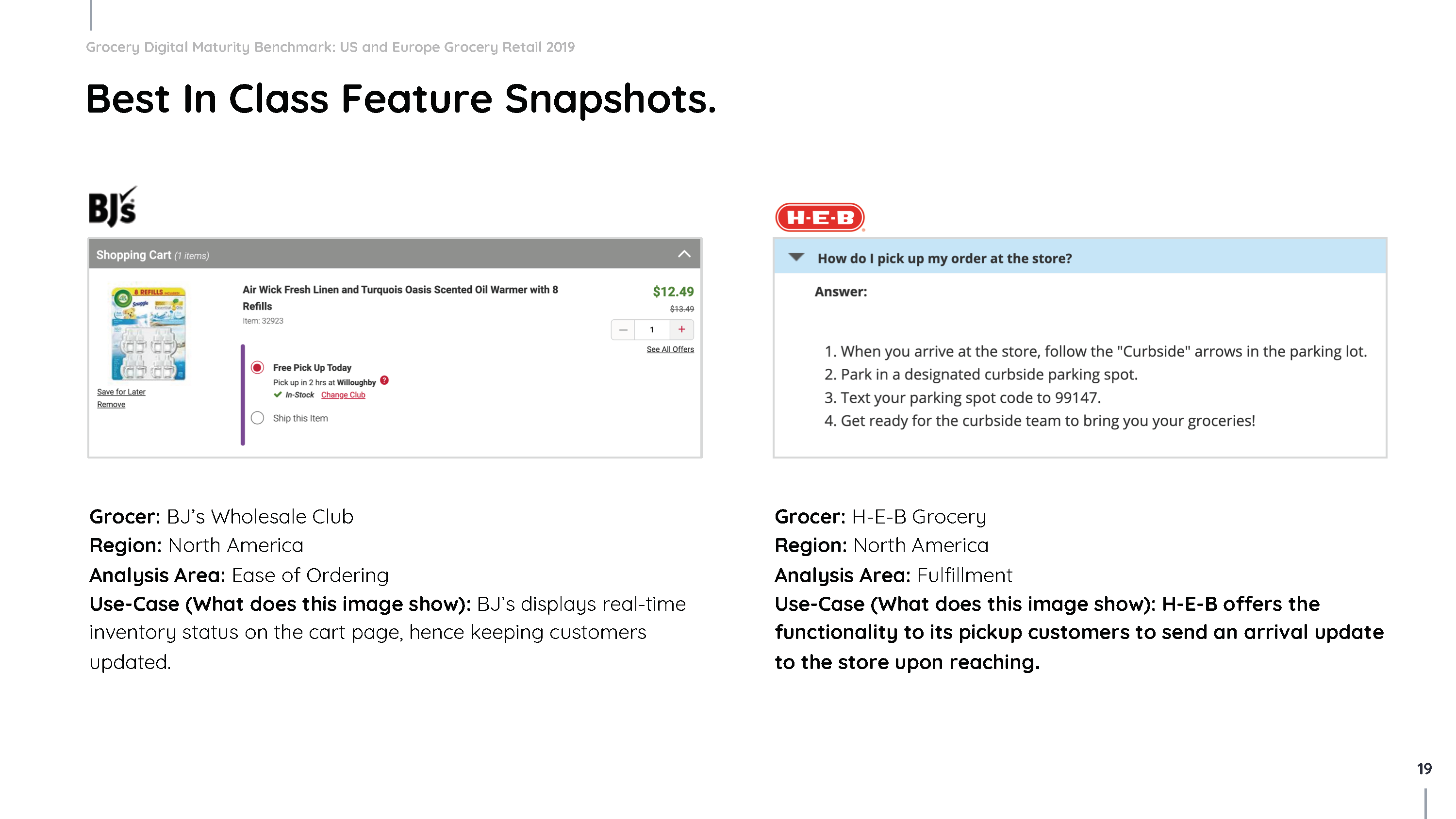

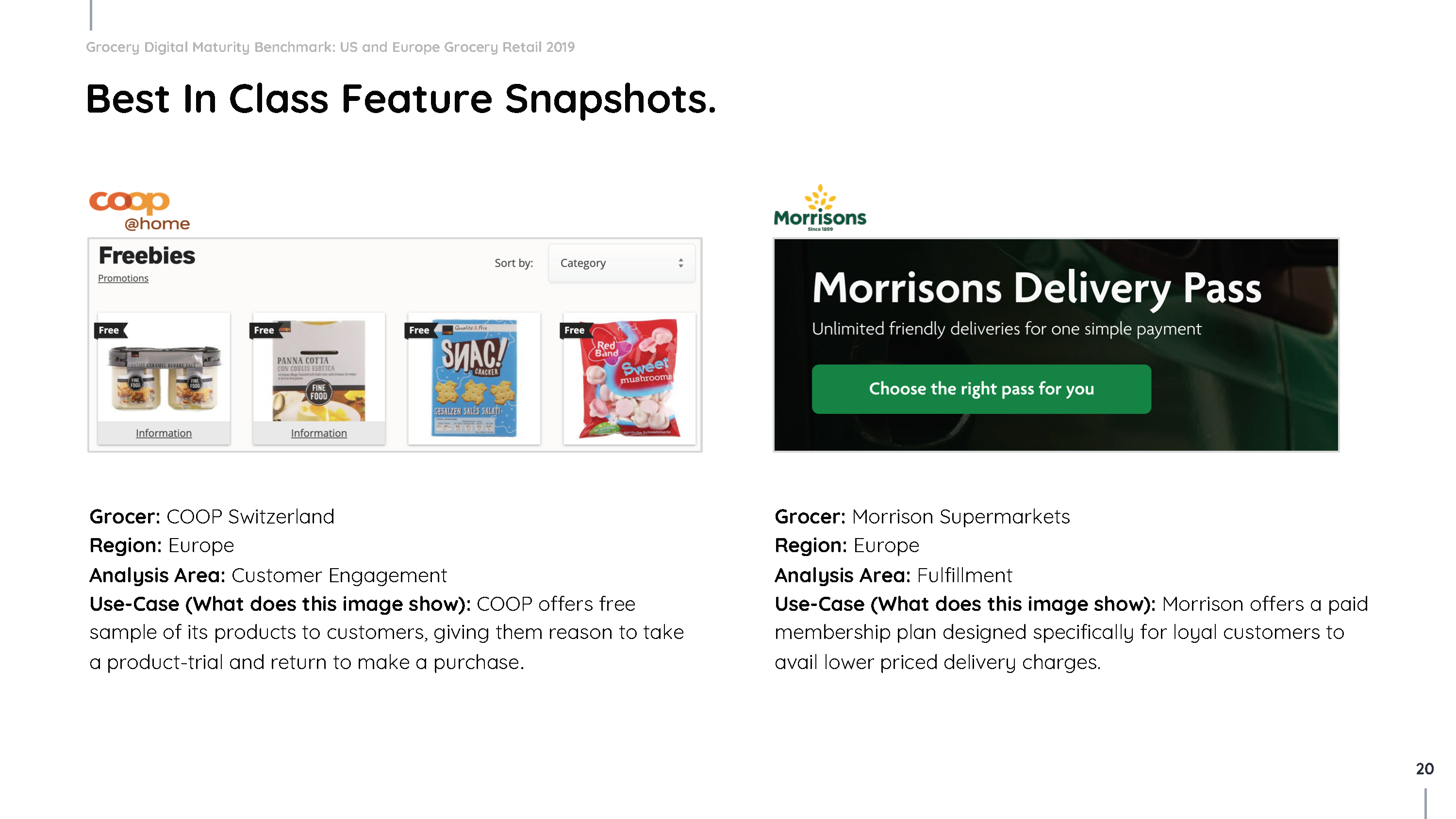

Ease of ordering

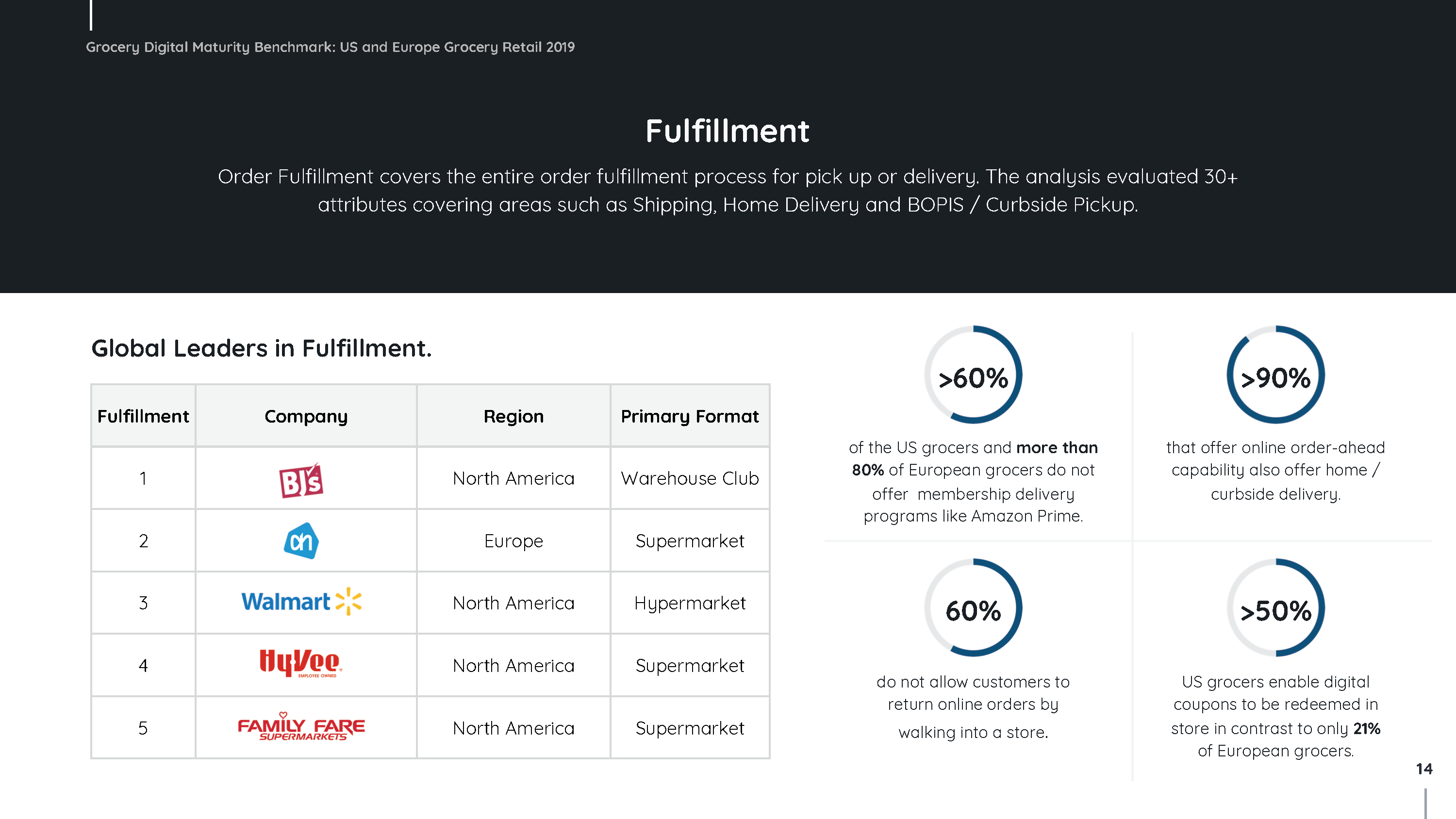

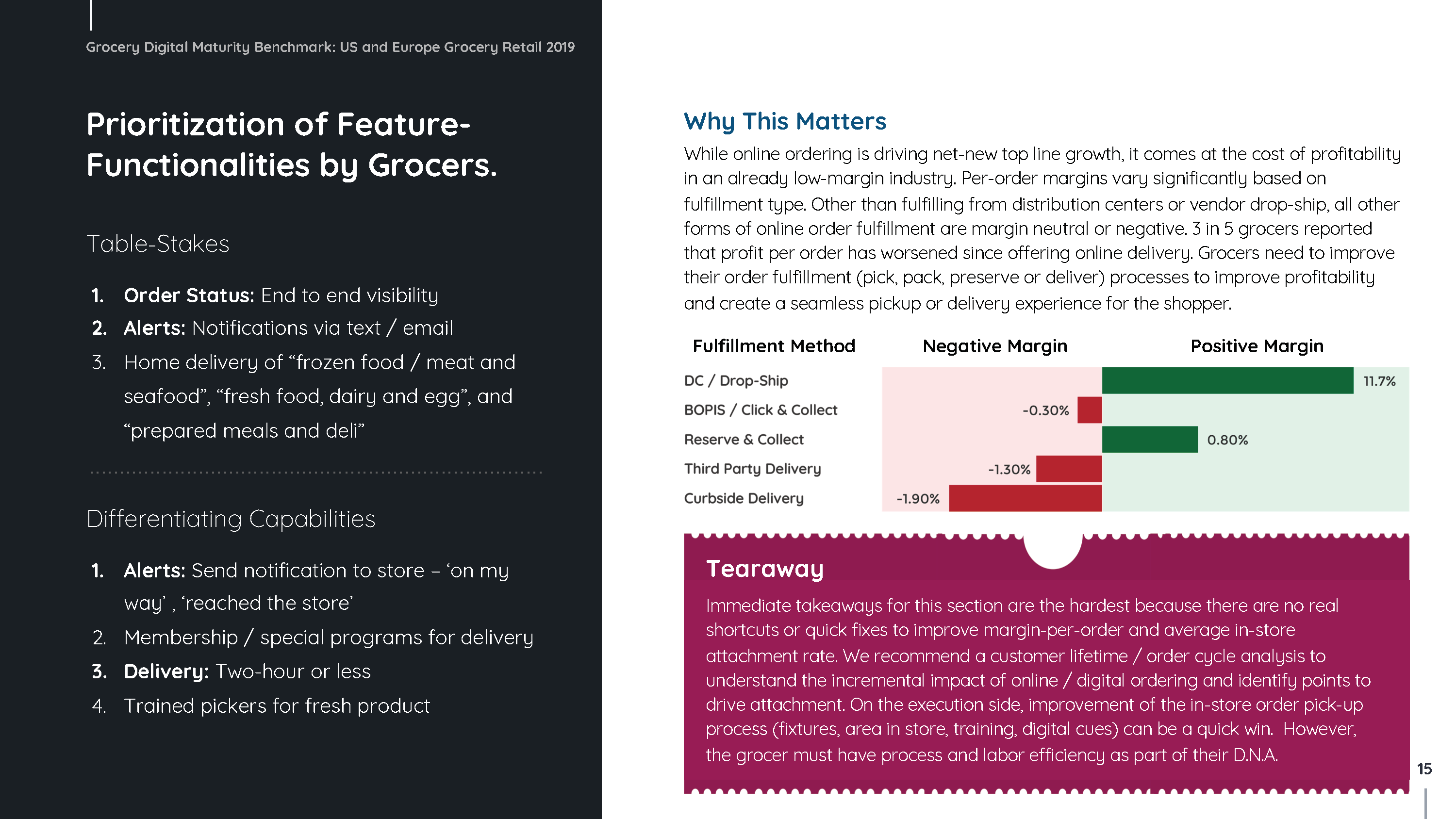

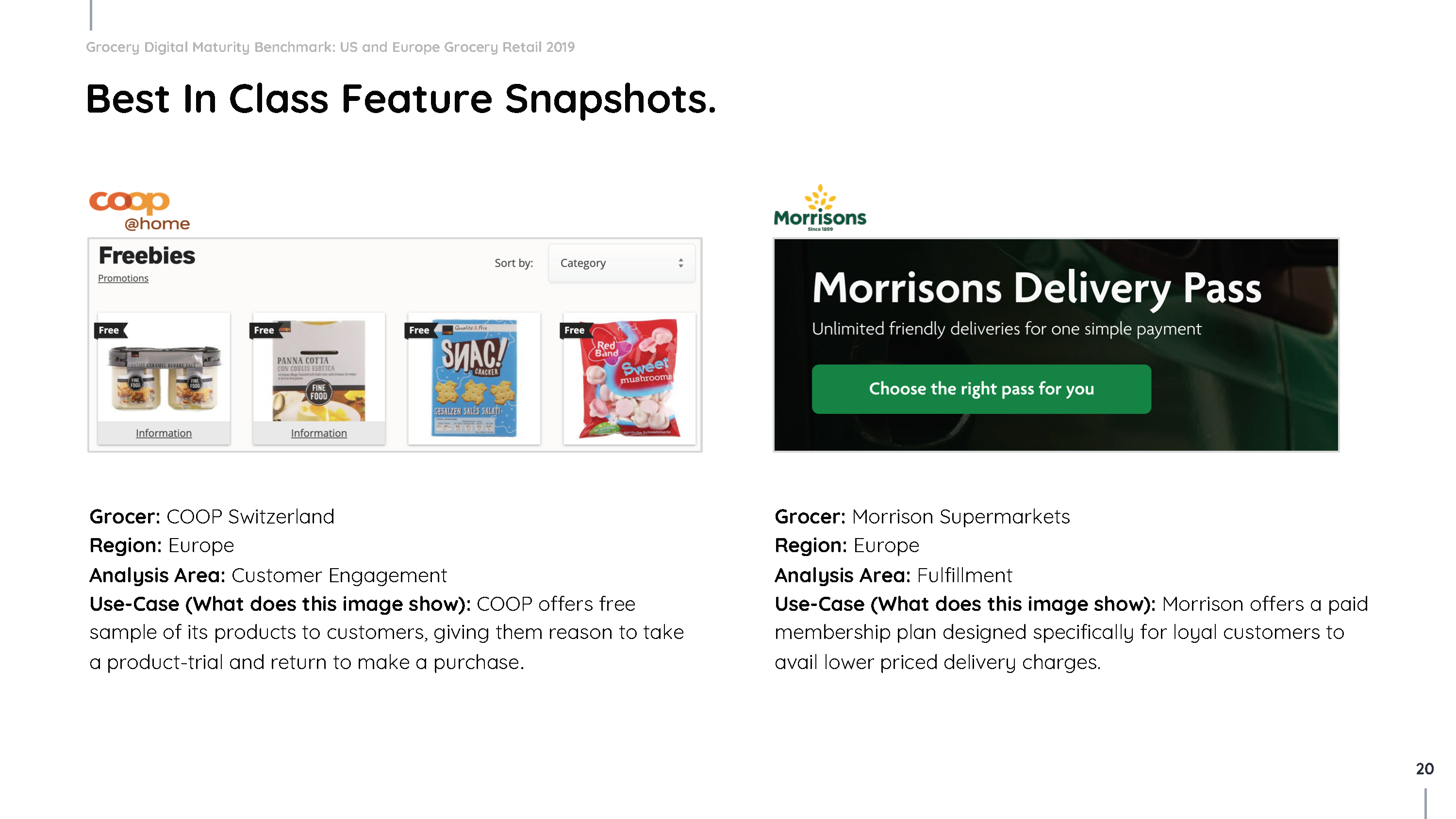

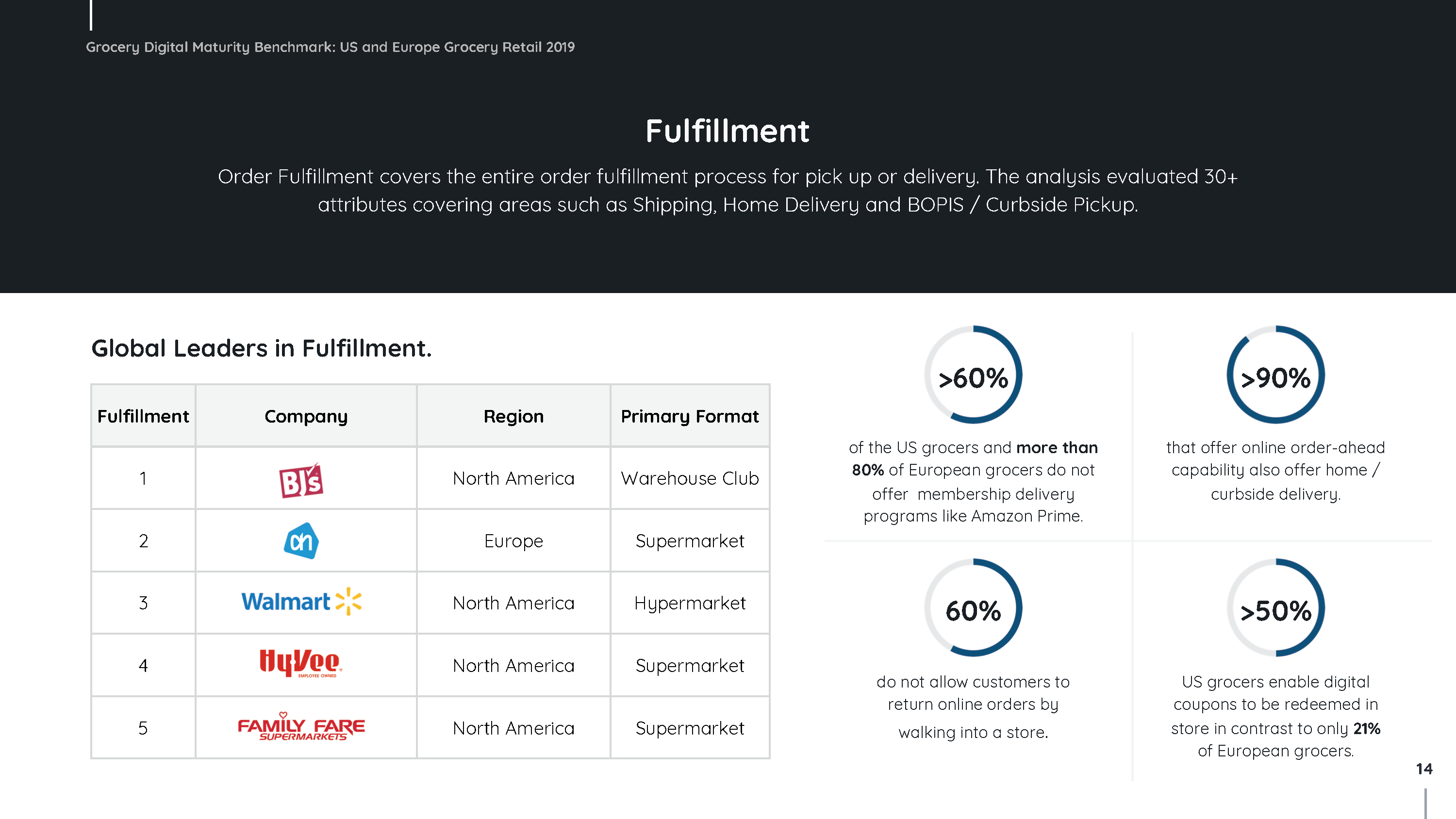

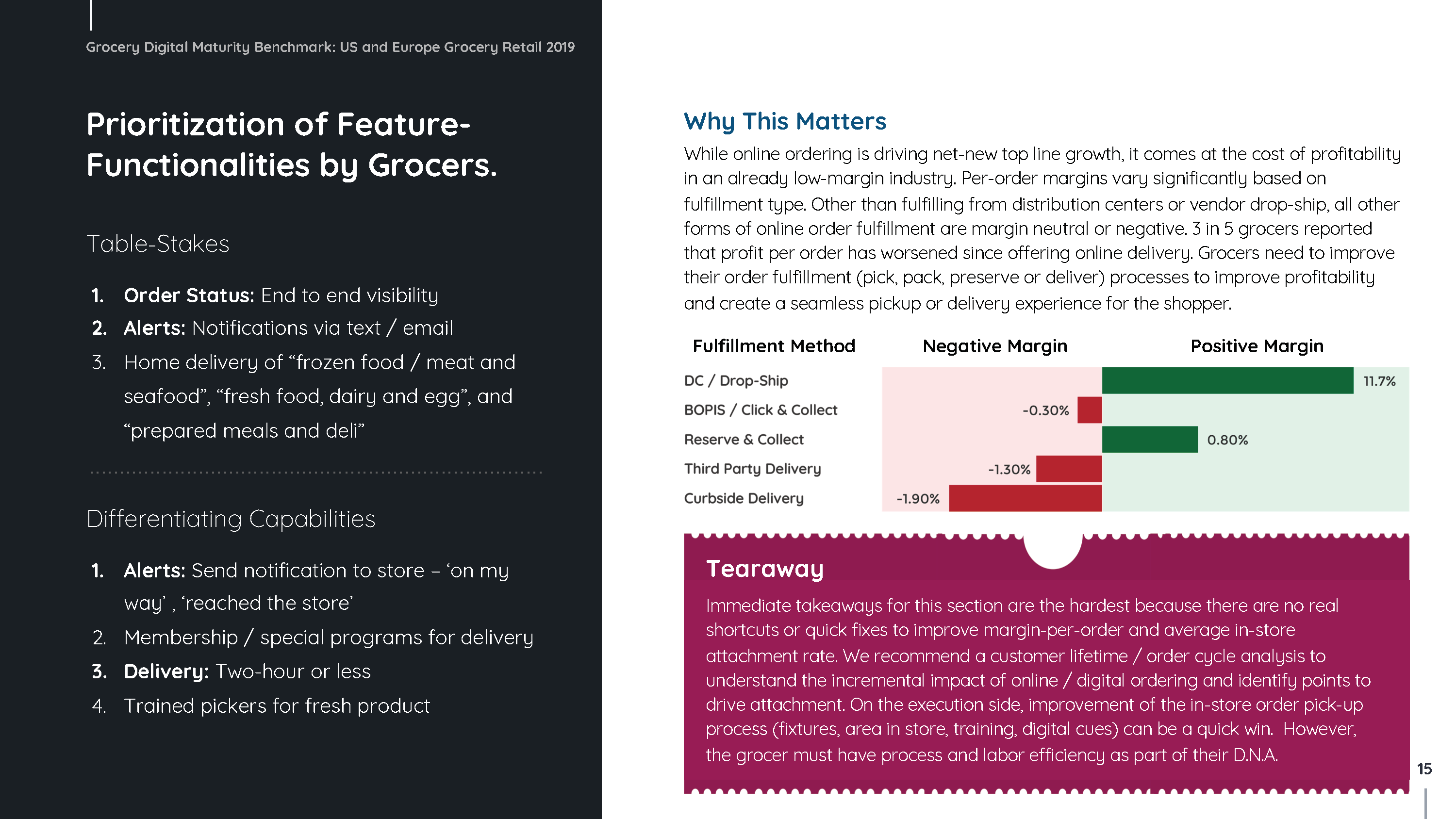

Fulfillment

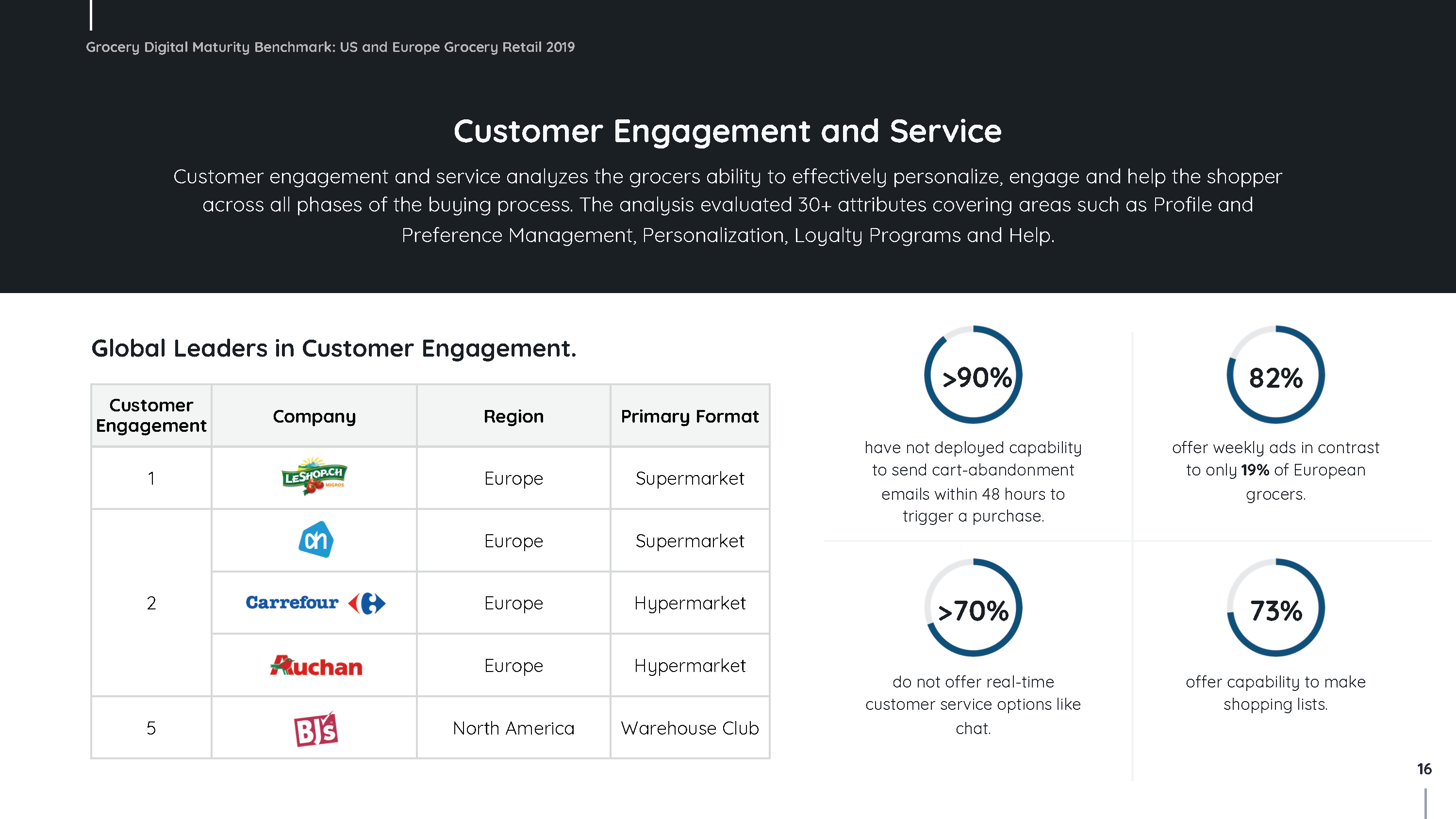

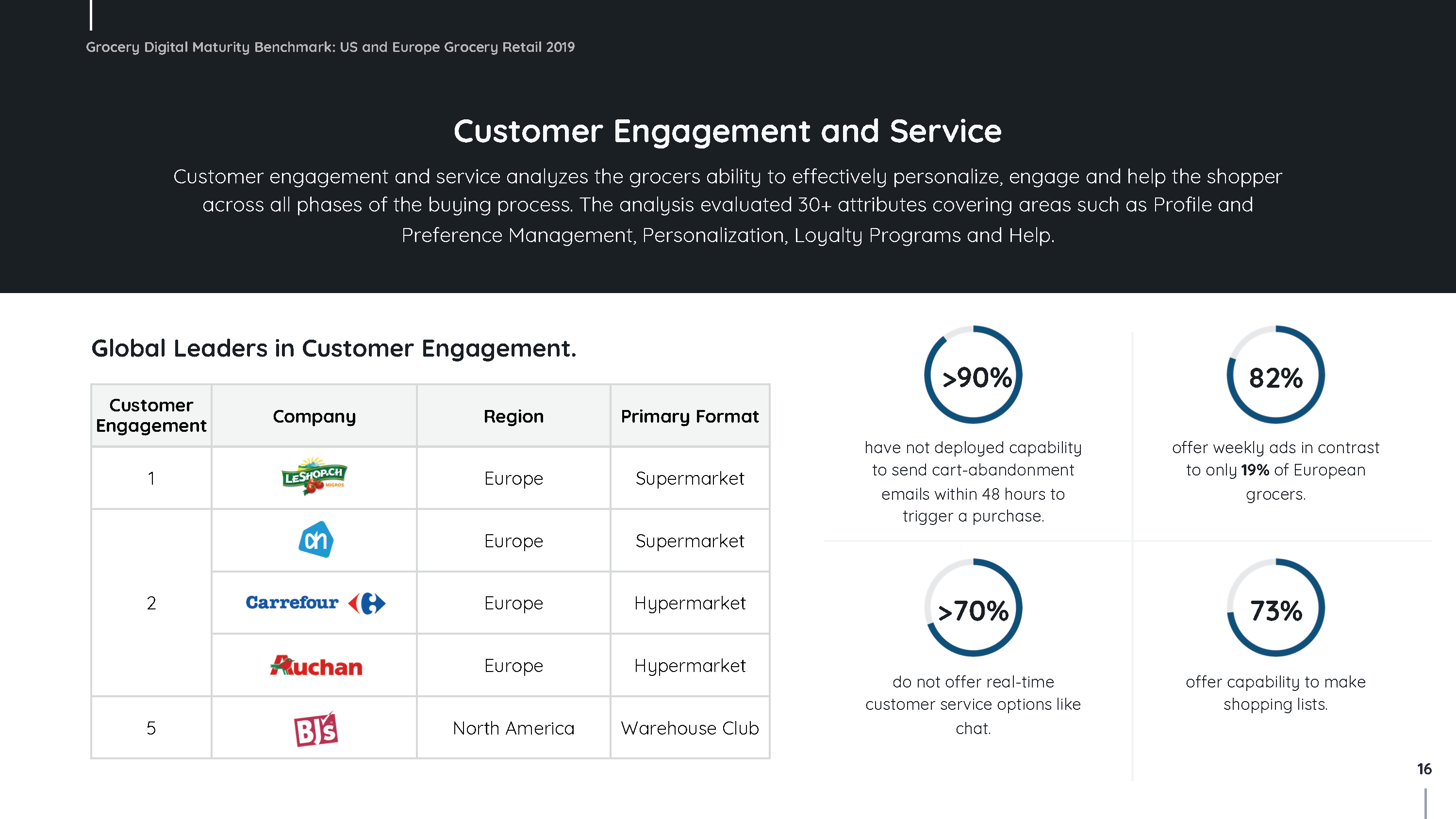

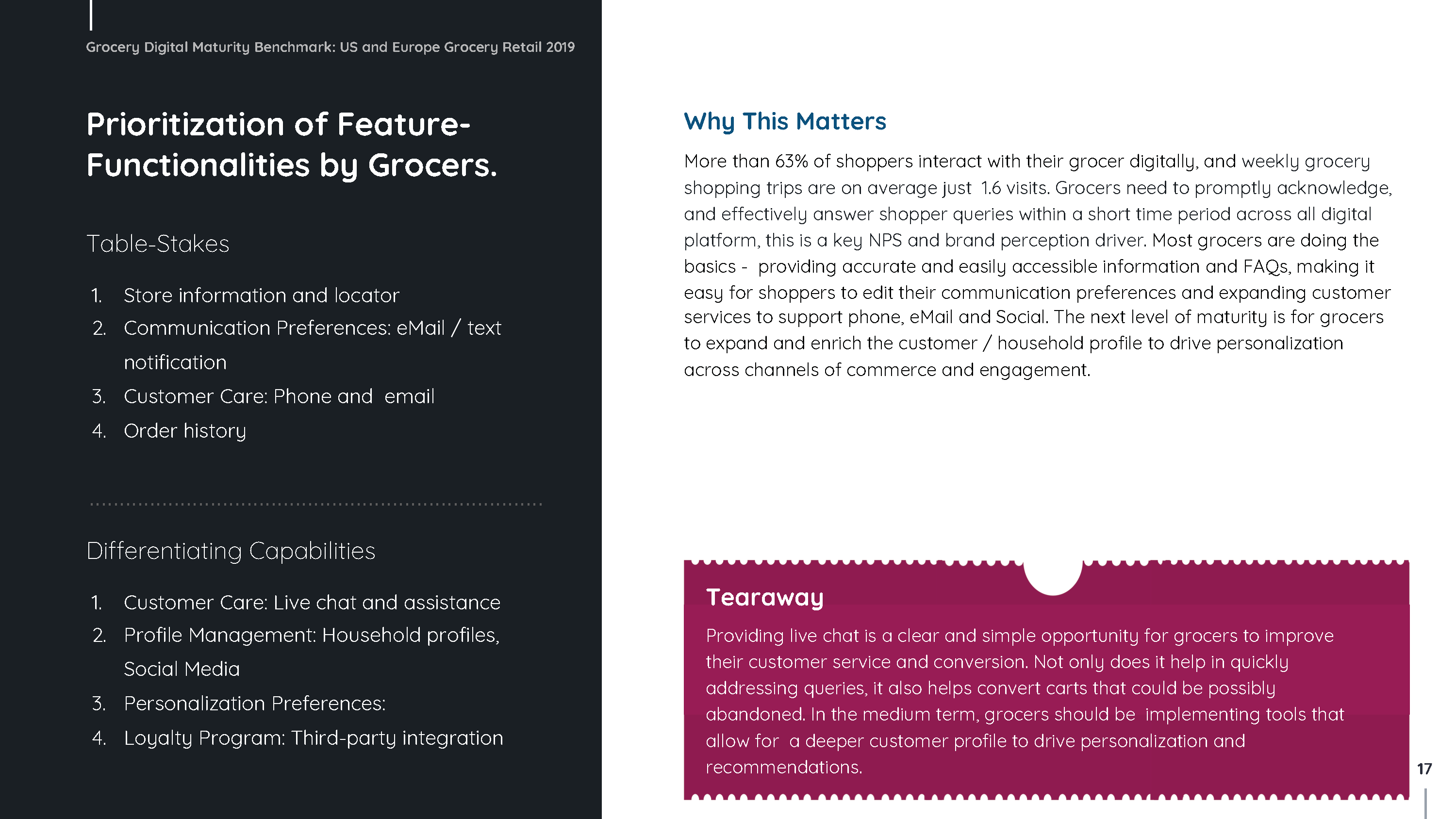

Customer Engagement and Service

Formats Benchmarked

Supermarkets

These are large shopping stores that stock thousands of SKUs across, grocery, general merchandise and in some cases pharmacy products. They offer better availability of a product by pack sizes and by brands, hence increasing the types of a specific product available on shelf.

Hypermarkets

These are large format stores with multiple departments (much larger than a typical supermarket). They are a combination of a department store and a grocery supermarket. Usually, hypermarkets sell products across categories such as electronics or apparel in addition to grocery.

Discount store

Stores that sell products at a lower price (discounts) compared to a traditional ones offering the same product category. There are typically lower SKU counts and less variety. In addition, these stores will stock more ‘off-brand’ product vs national brands.

Warehouse club

These tend to be no-frills wholesale and retail stores that are membership based and typically sell product in bulk quantities at wholesale prices. This format is an attractive option to both large families and small business owners.

Table of Contents.

This is an executive summary report based on Incisiv’s analysis of the digital presence of leading grocery and food banners.

75

grocery retailers / banners in US and Europe analyzed.

125

digital attributes studied for each banner.

15000+

data points from Incisiv’s industry data pool.

Unless otherwise specified, all data cited in this report is from Incisiv’s 2019 Digital Maturity Grocery Report.

We are in a retail renaissance.

Both digital upstarts and incumbent retailers are re-imagining stores as hubs of experience, convenience and service.

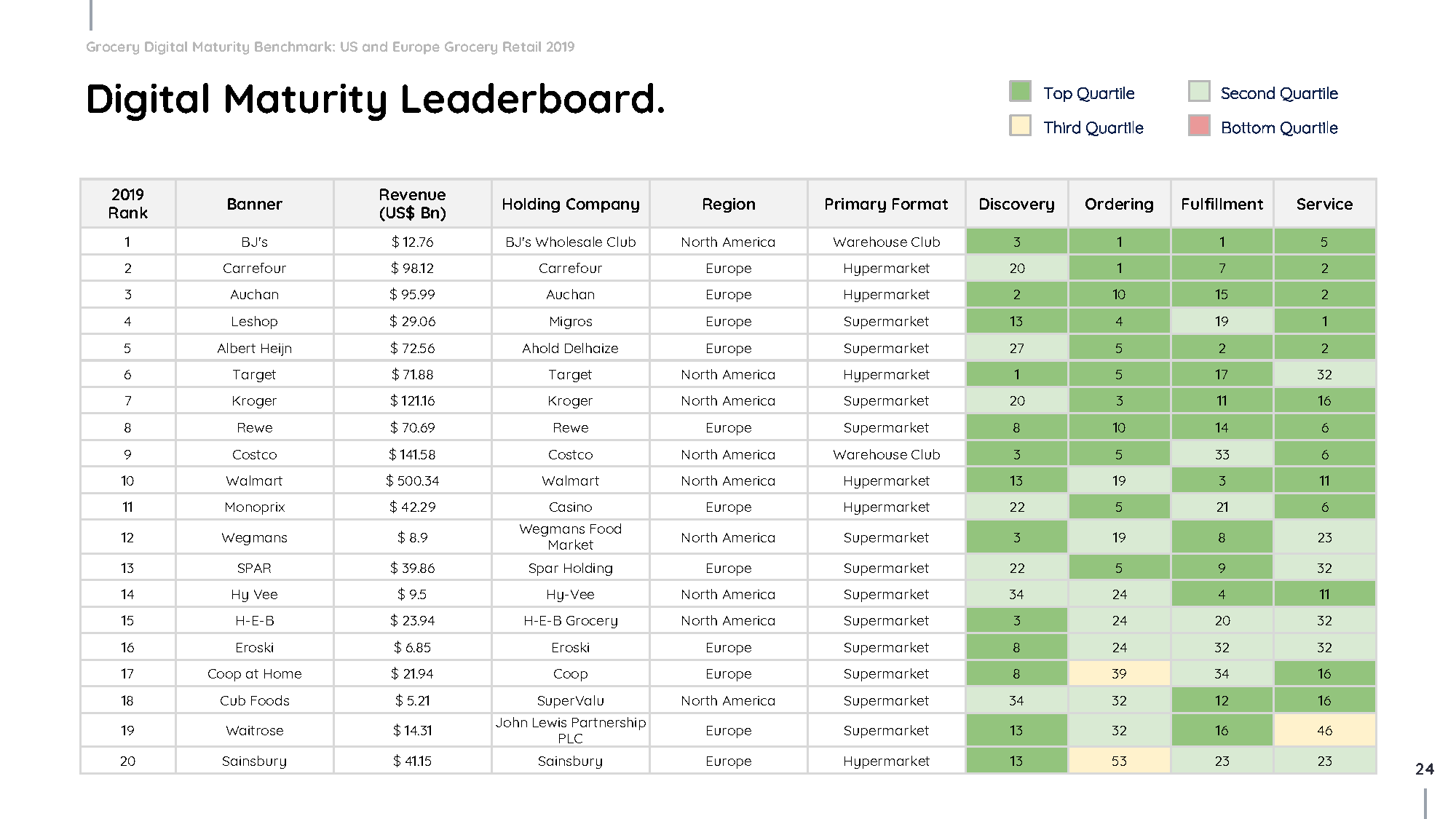

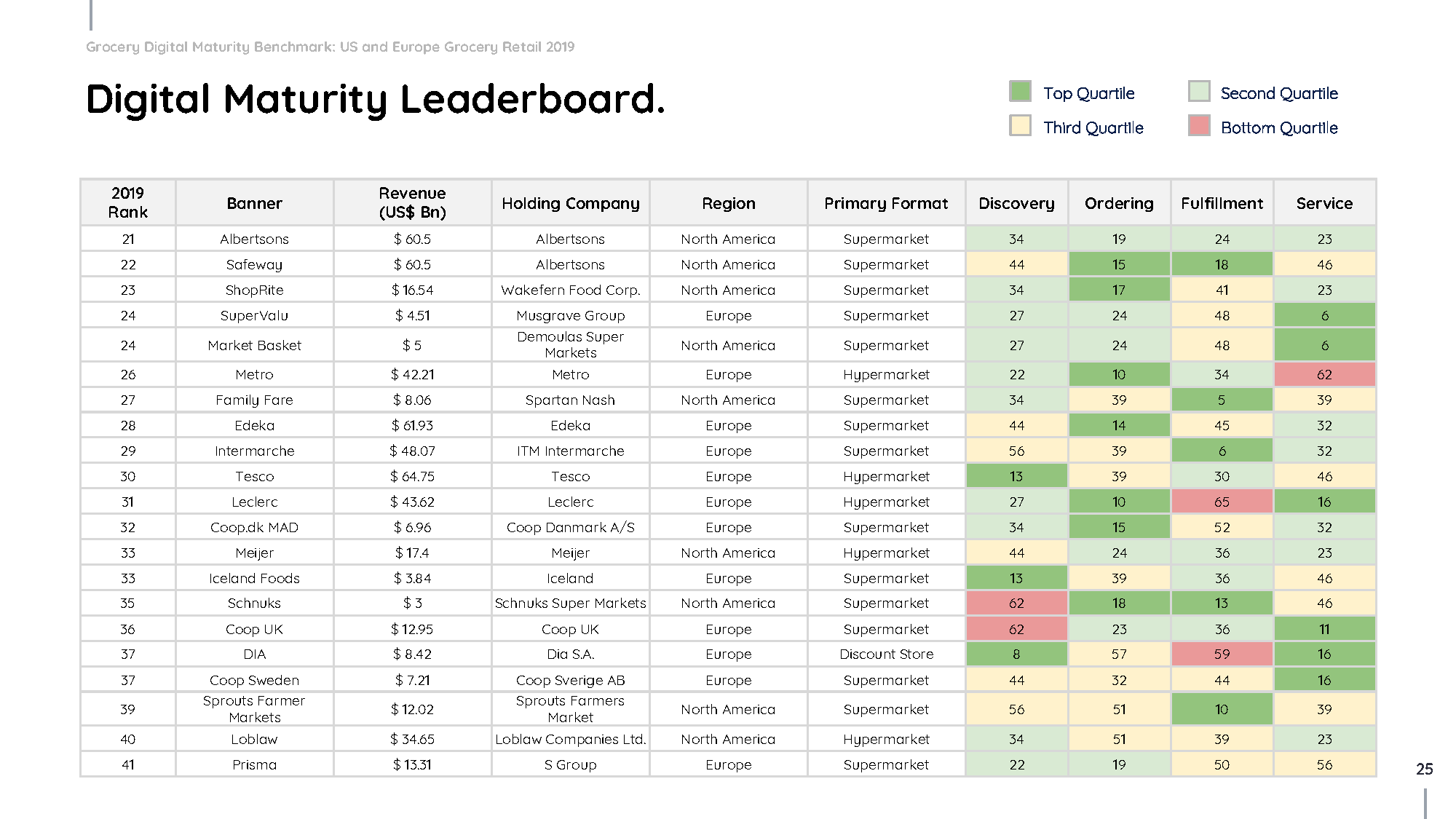

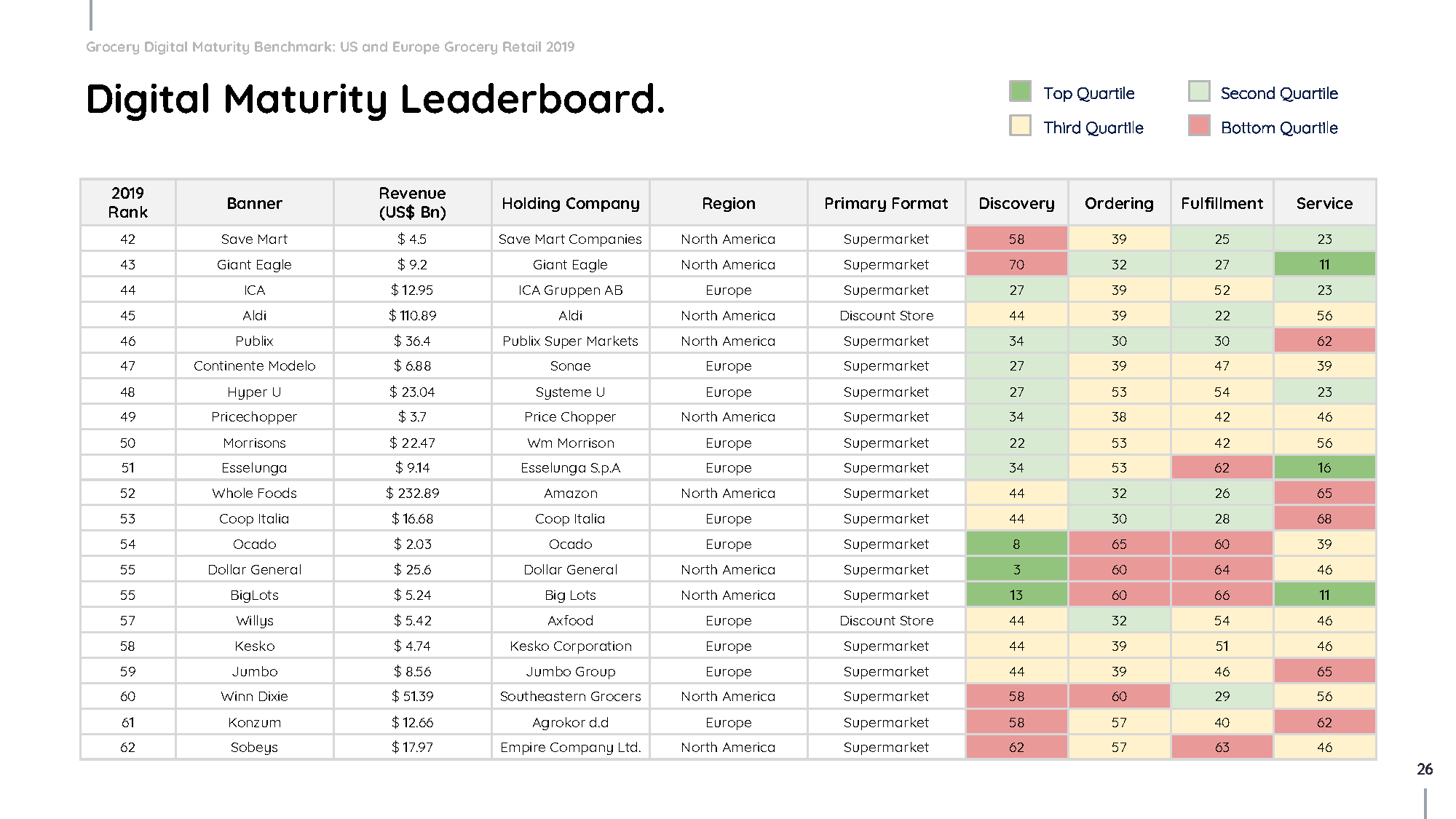

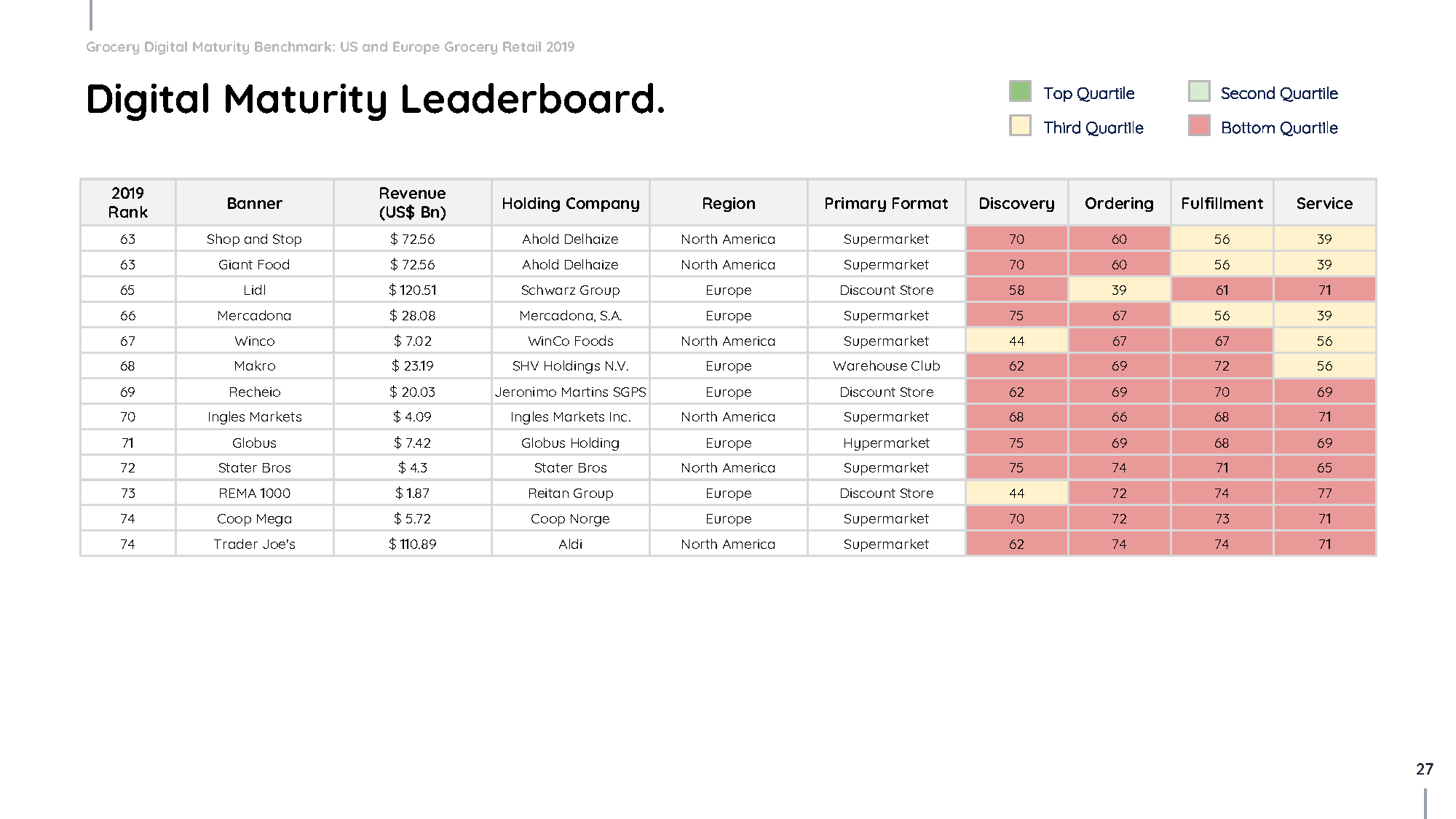

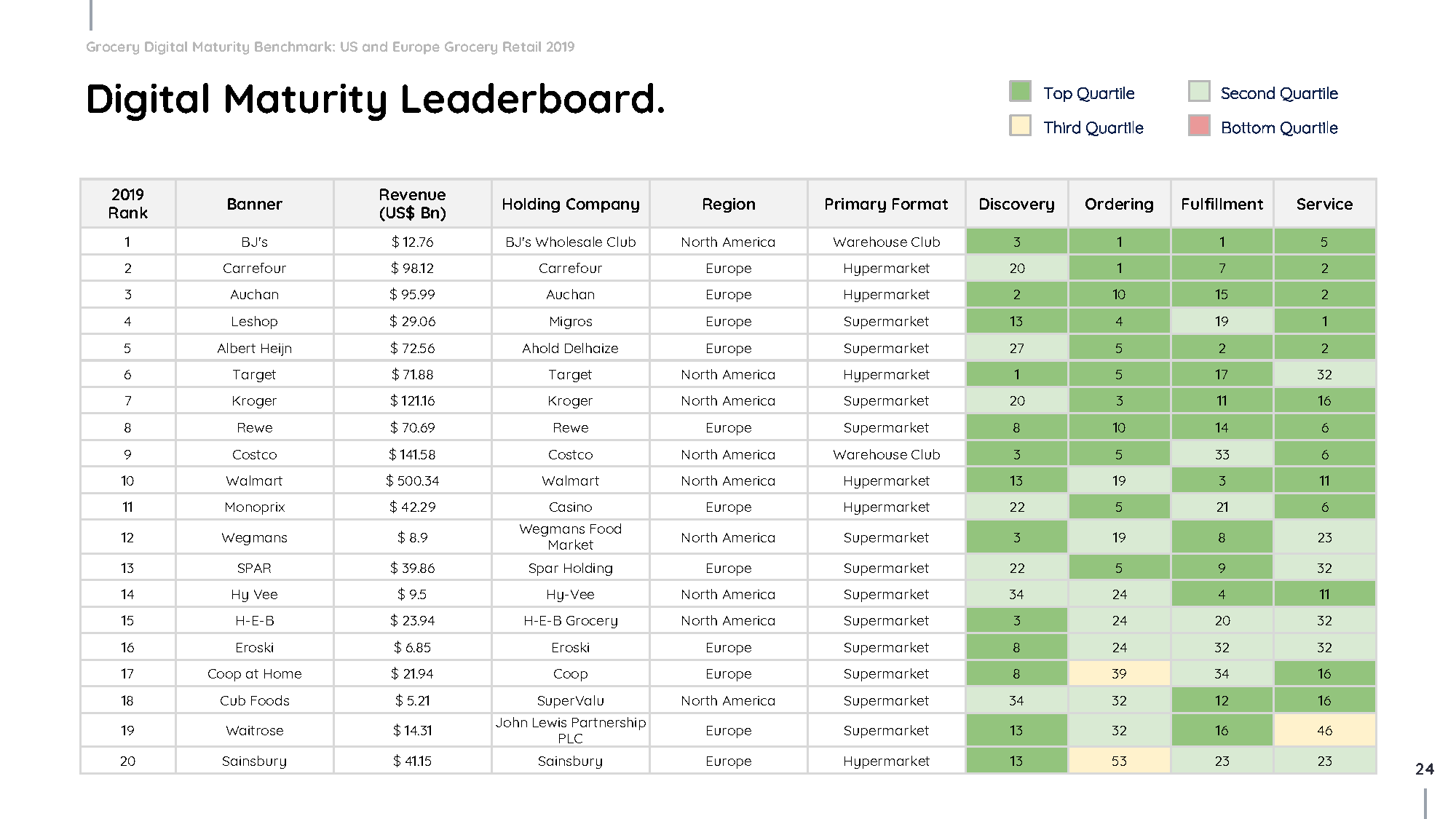

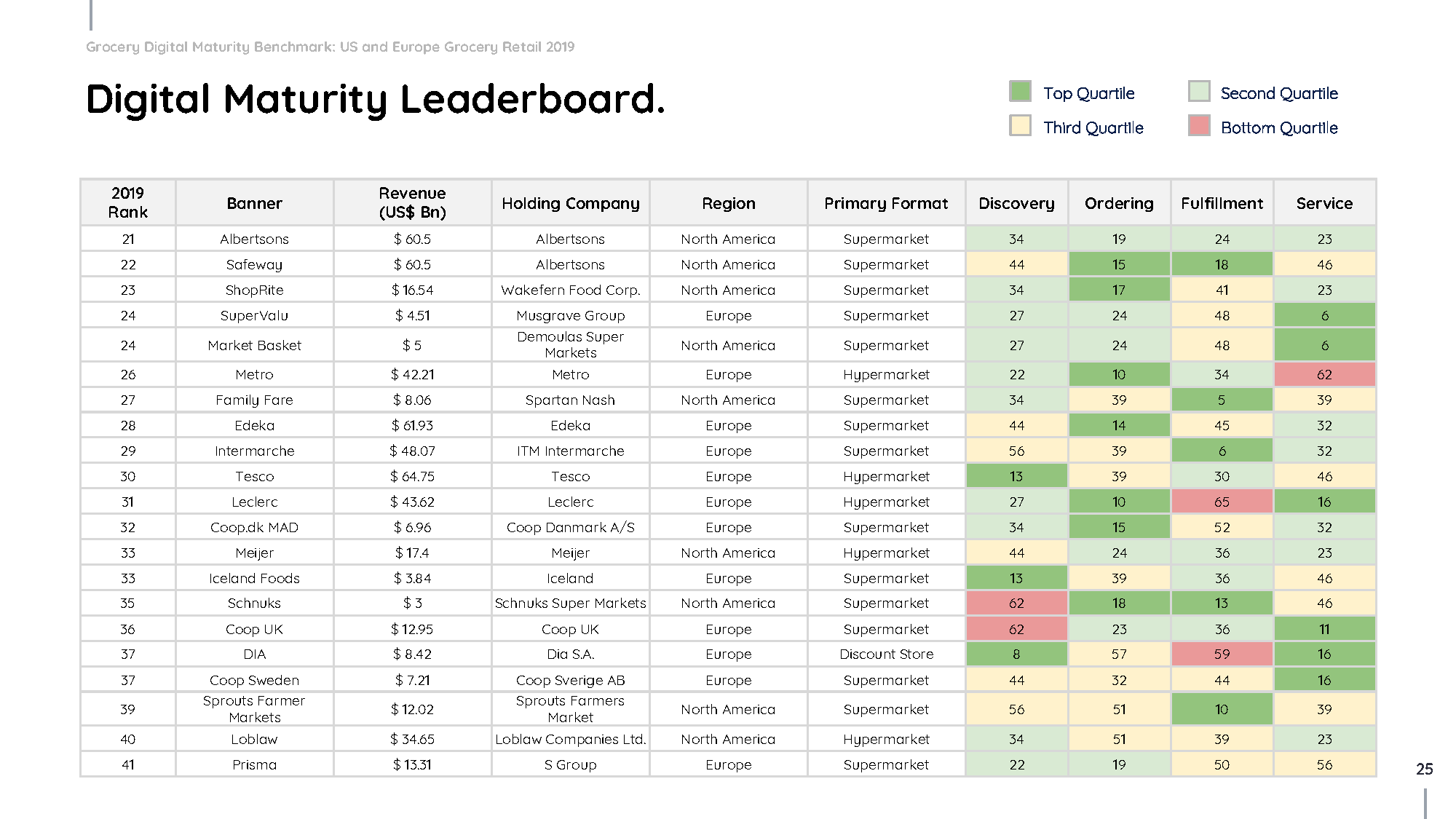

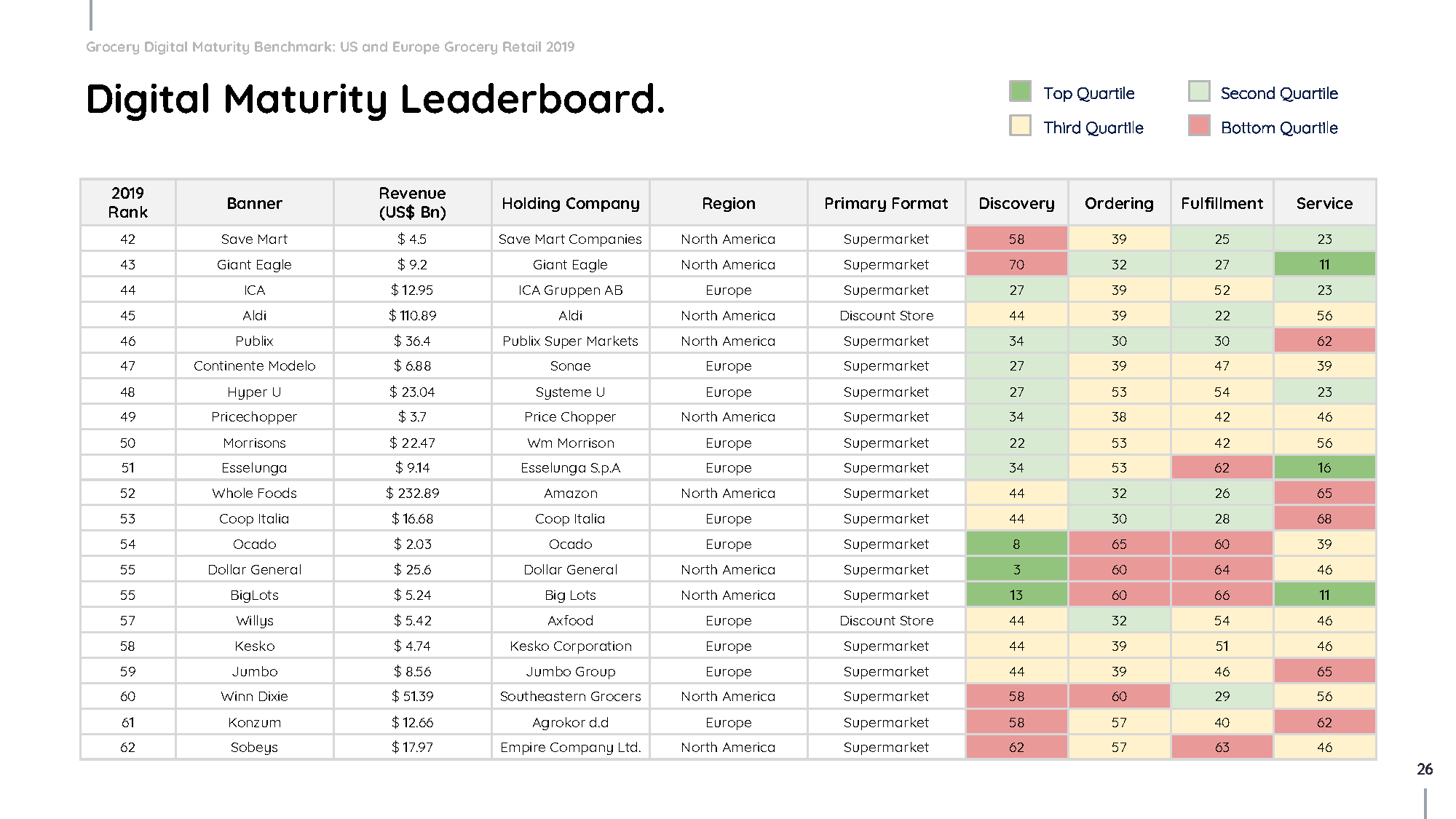

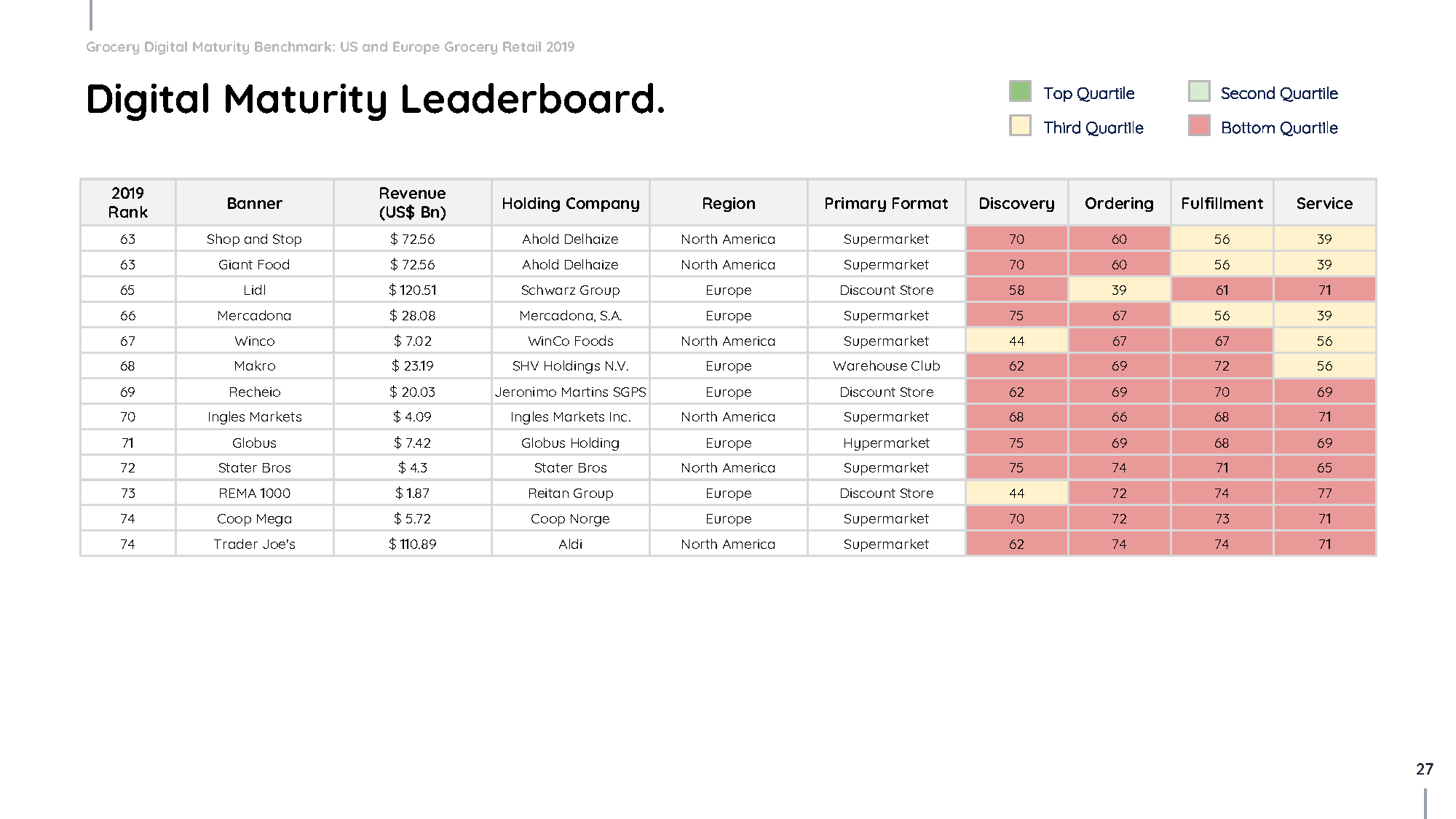

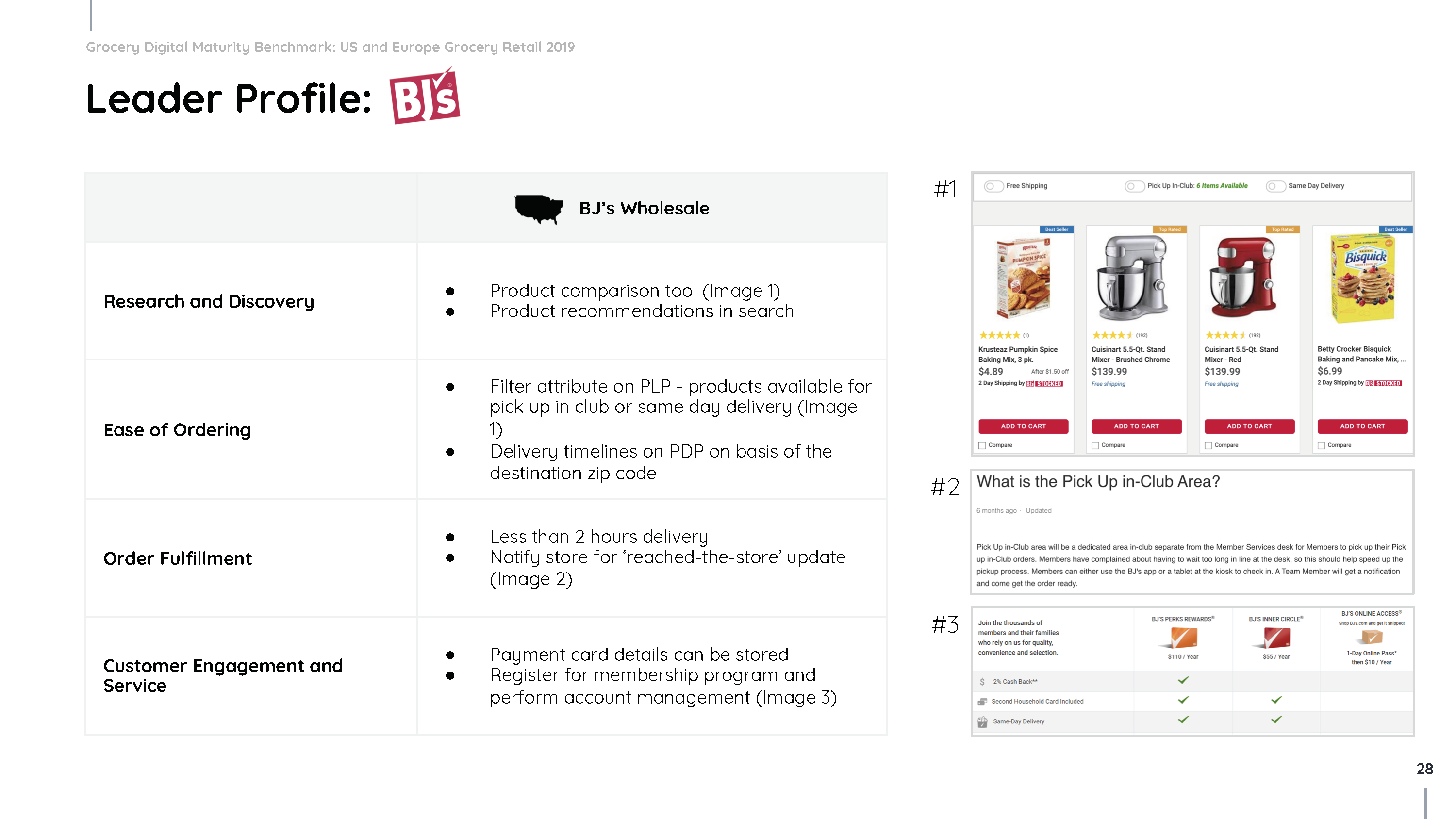

Digital Maturity Leaderboard

To view the complete top 75, download Incisiv’s State of Digital Grocery 2019 Digital Maturity Benchmark Report. The eBook also includes top grocer ranks by user journey stage (e.g. Discovery, ordering, fulfillment etc.)

Experience.

Immerse shoppers in the brand, and engage and delight them to convert brand loyalty into brand love. Shoppers seek:

- Authenticity of brand storytelling

- Immersive experiences that entertain

- The richness of digital in brick and mortar

- Stores that fit increasingly urban lifestyles

1 in 2

retailers say they primarily value stores as drivers of brand value.

Convenience.

Compete more effectively against convenience leaders such as Amazon by using stores to:

- Improve online order fulfillment speed

- Offer new fulfillment options to shoppers

- Ensure online to offline experience continuity

- Reduce friction from payment and checkout

76%

of retailers will increase the number of online orders their stores fulfill.

Service.

Go beyond a transactional relationship to better serve shoppers’ pre and post purchase journey through:

- Timely, empathetic assistance

- Personalized fit and style advice

- Relevant value-added services

- In-store self-service options

4 in 5

retailers plan to improve or increase in-store services in 2020.

Apparel and specialty retailers are experimenting with, and scaling, five unique store formats that deliver a combination of experience, convenience and service. These store formats are reshaping the future of brick and mortar retail.

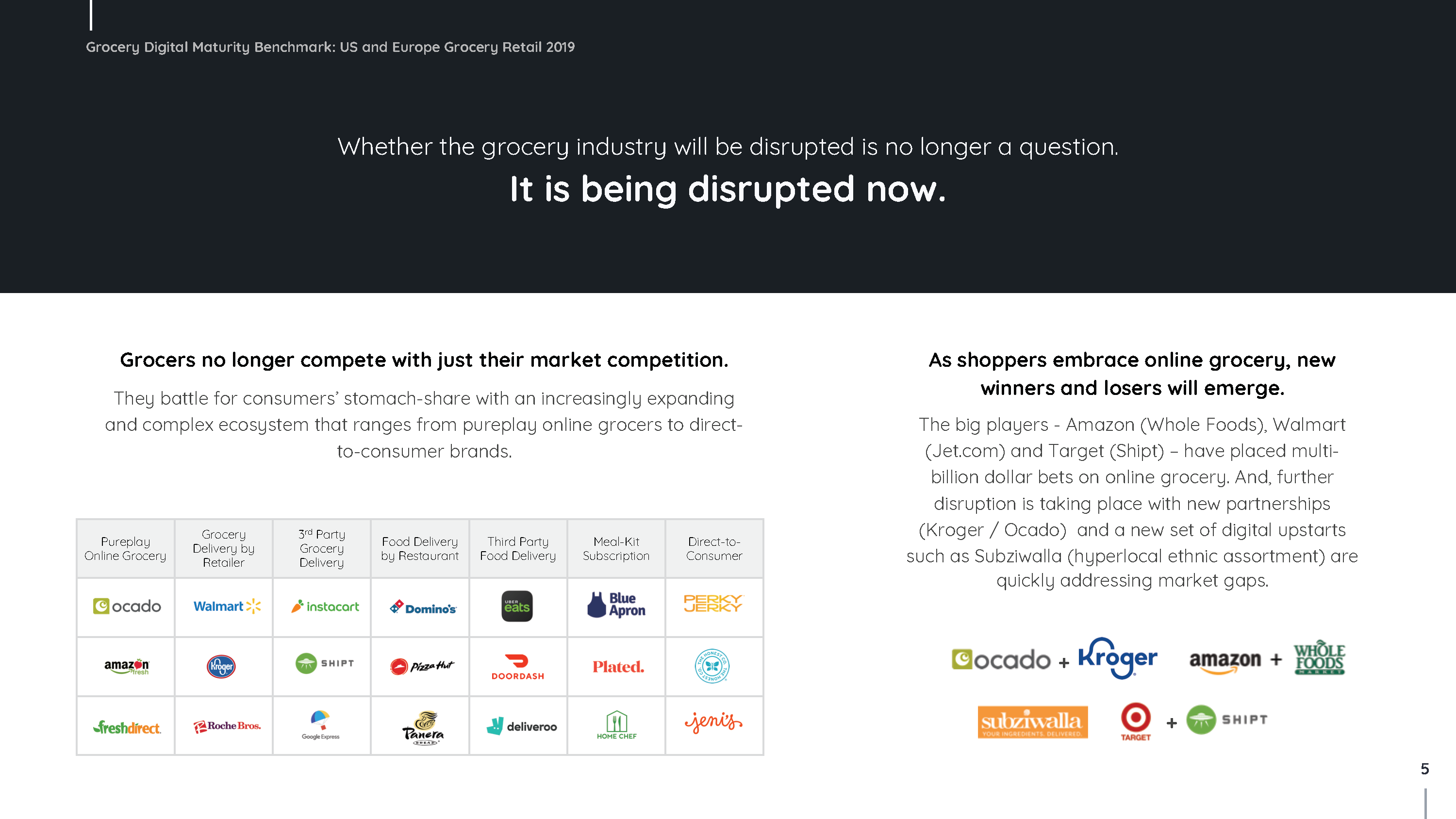

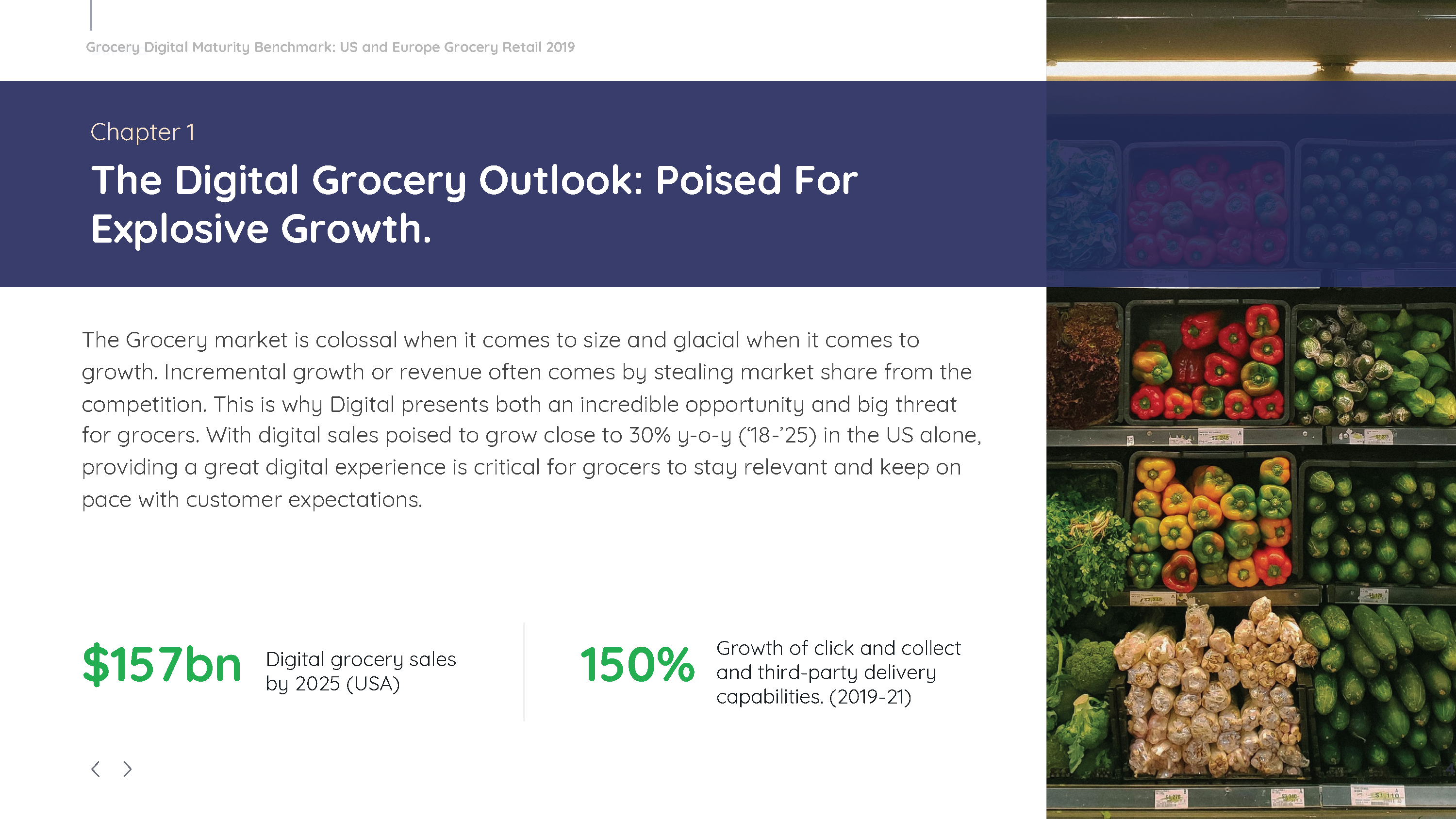

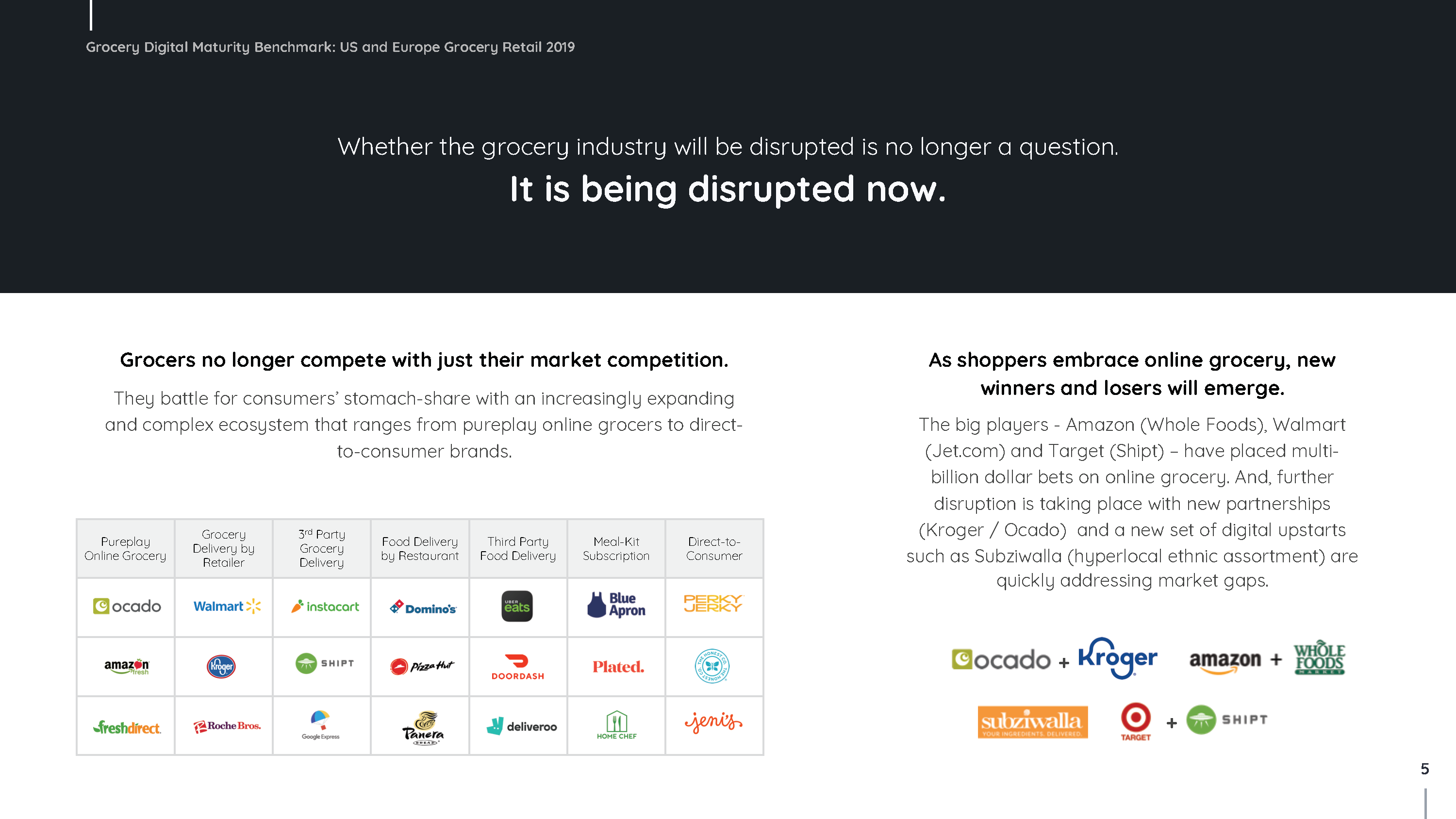

Digital Grocery Outlook: Poised for Explosive Growth.

Not only is digital ordering and engagement a multi billion dollar growth opportunity, it’s fast becoming a base shopper expectation that grocers need to meet.

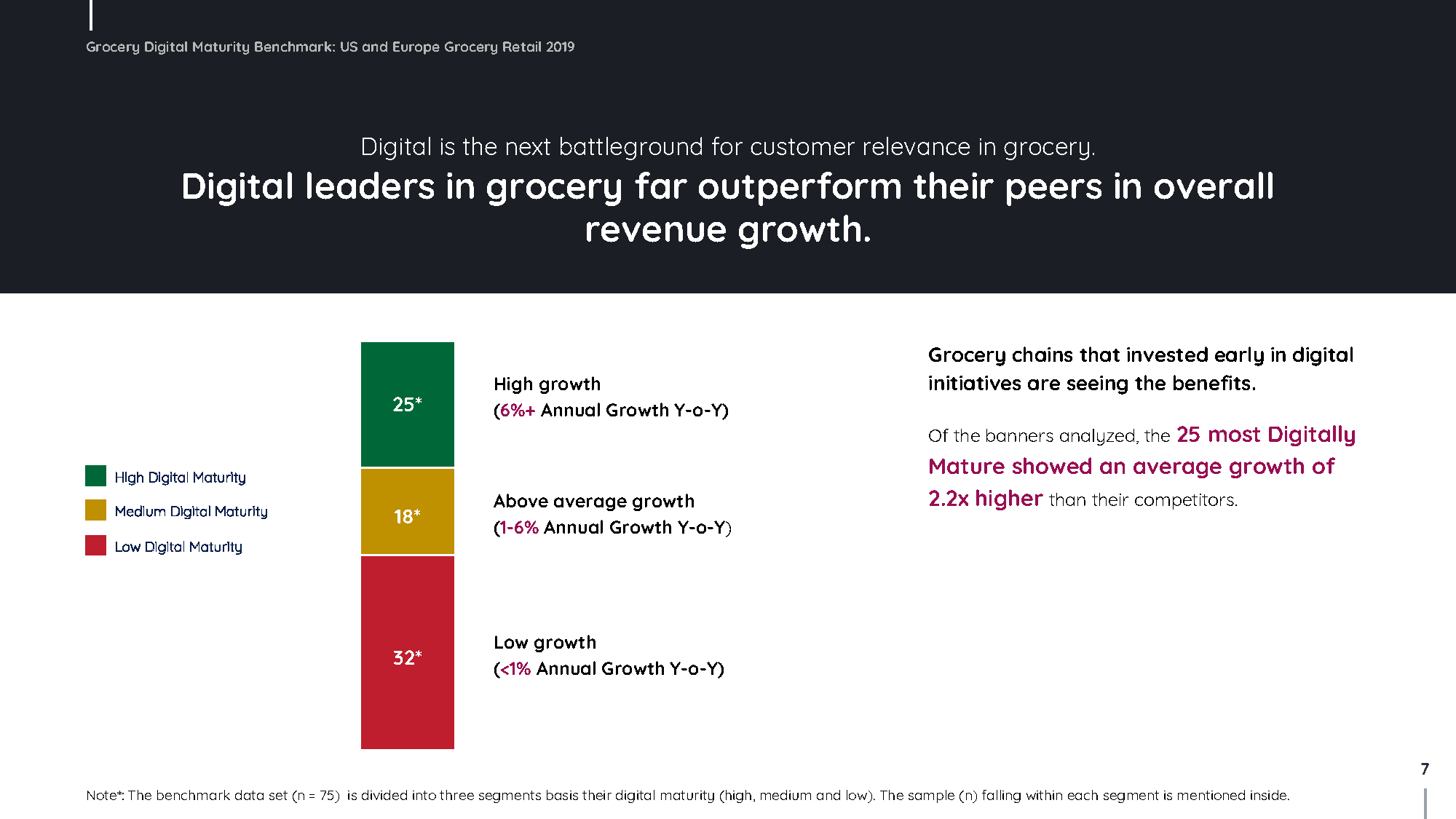

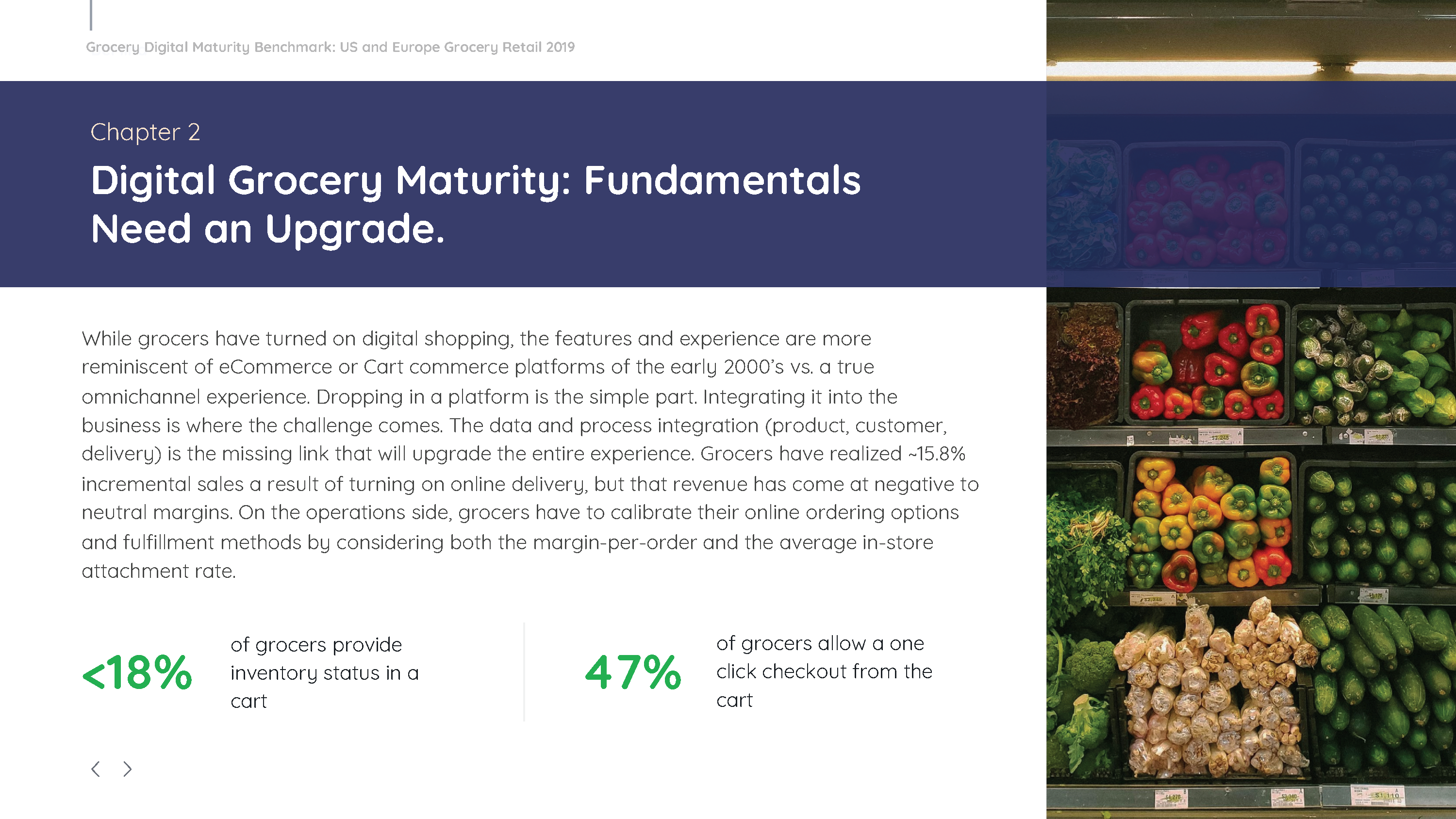

Digital Grocery Maturity: Fundamentals Need an Upgrade.

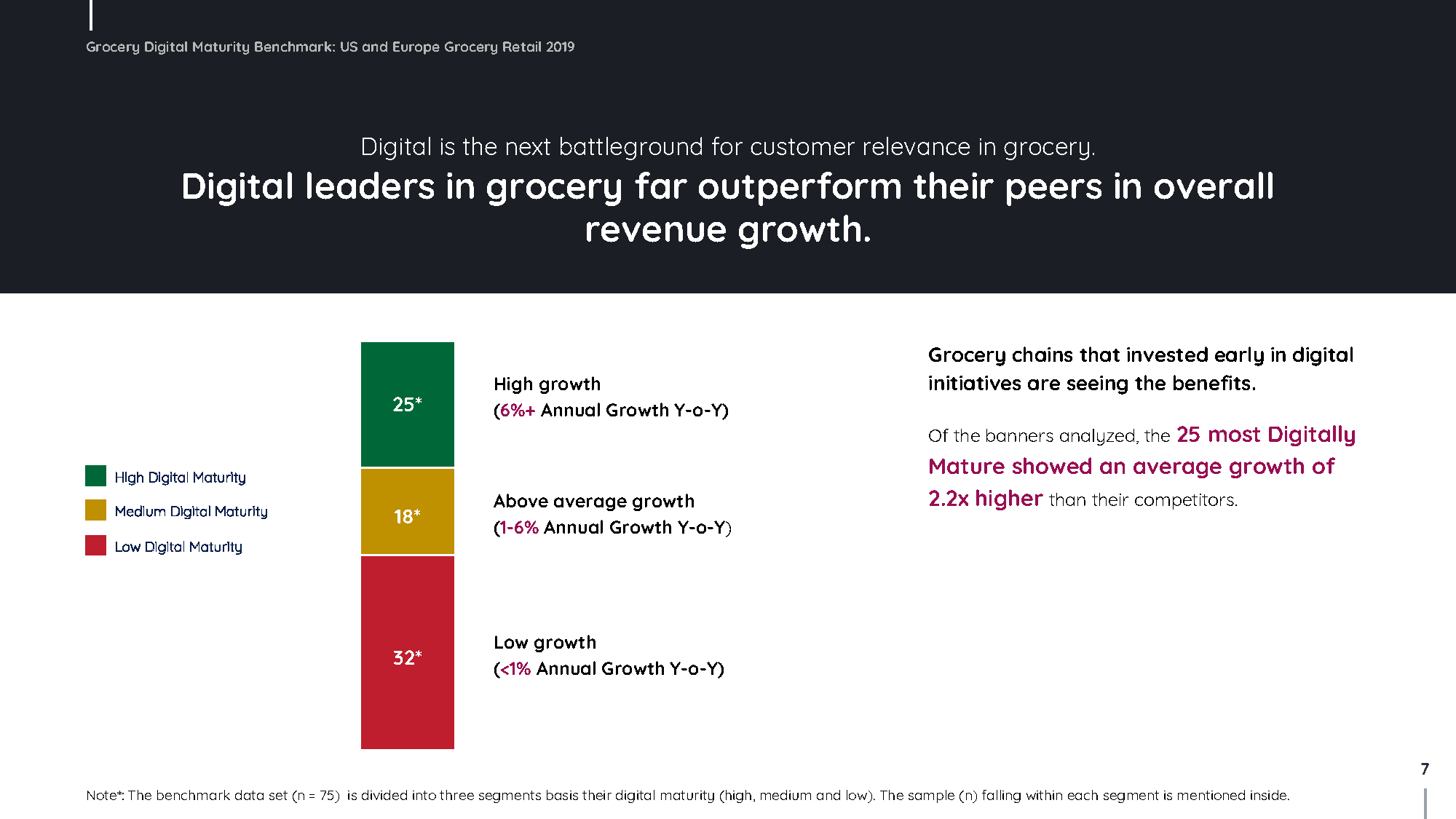

Firms with a higher digital maturity have outperformed their peers, yet overall maturity in the segment remains low. While a few of the leaders are on par with other segments in terms of digital maturity, the majority of grocers have yet to execute on digital commerce basics.

2019 Leaderboard.

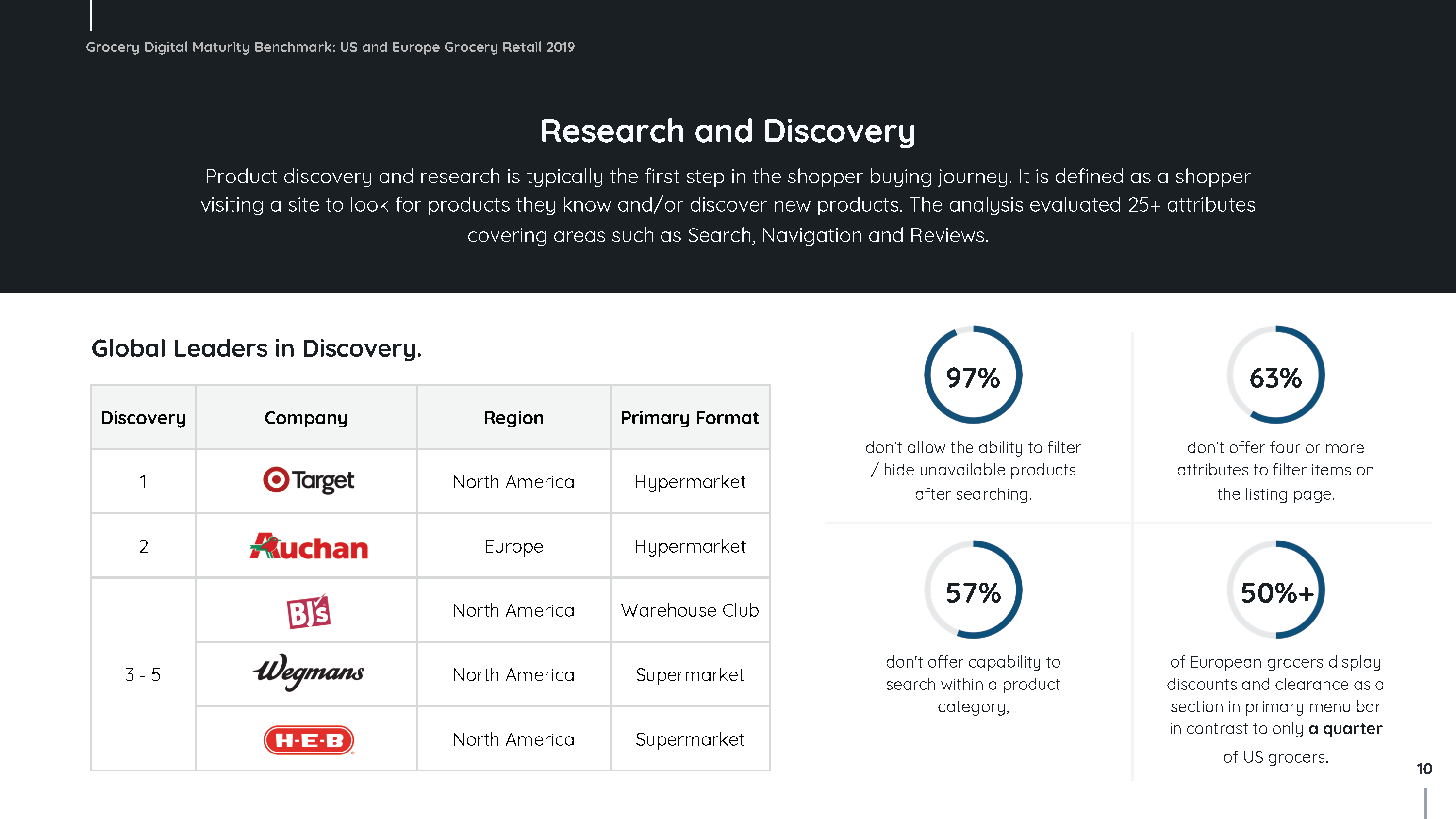

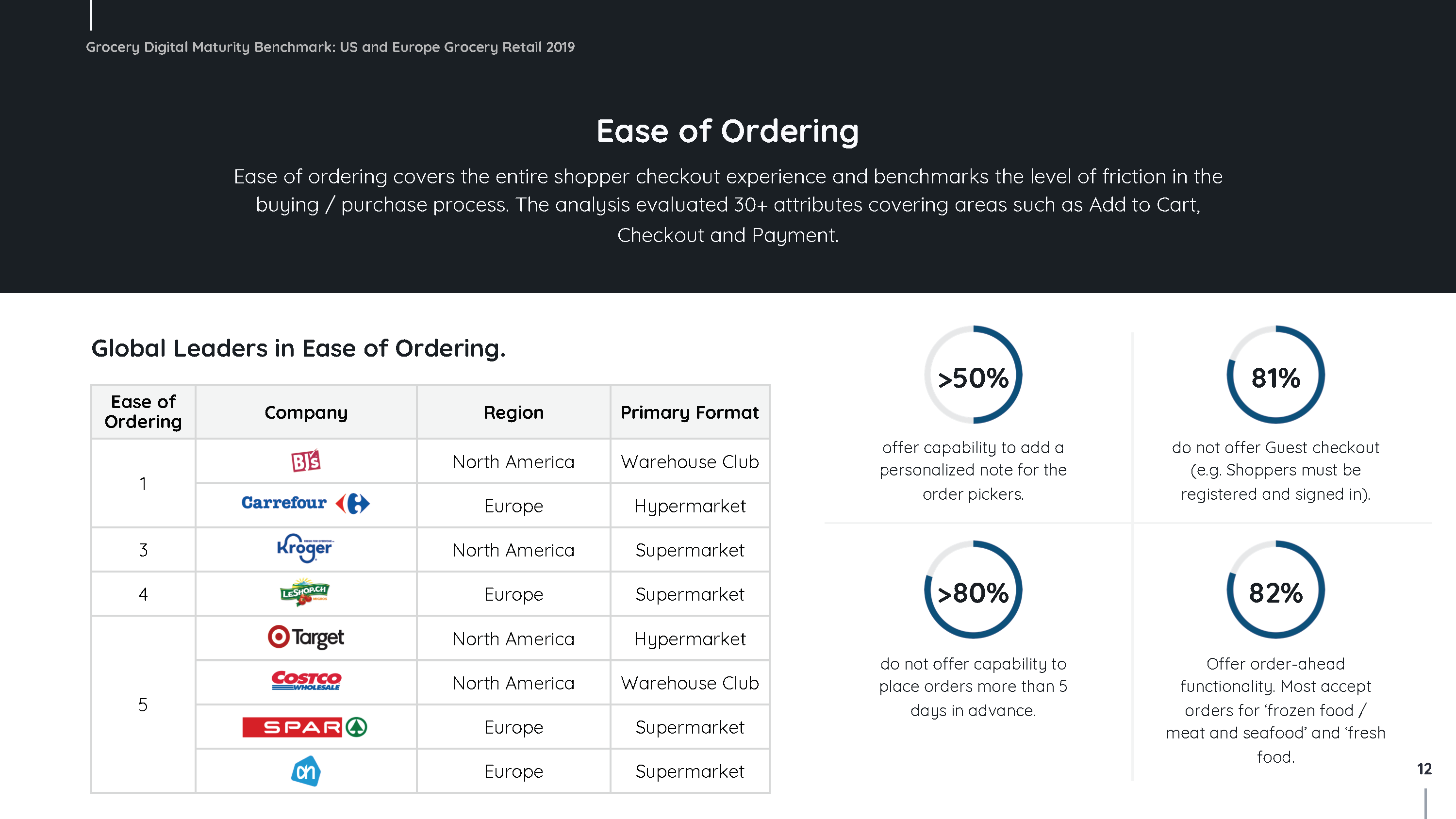

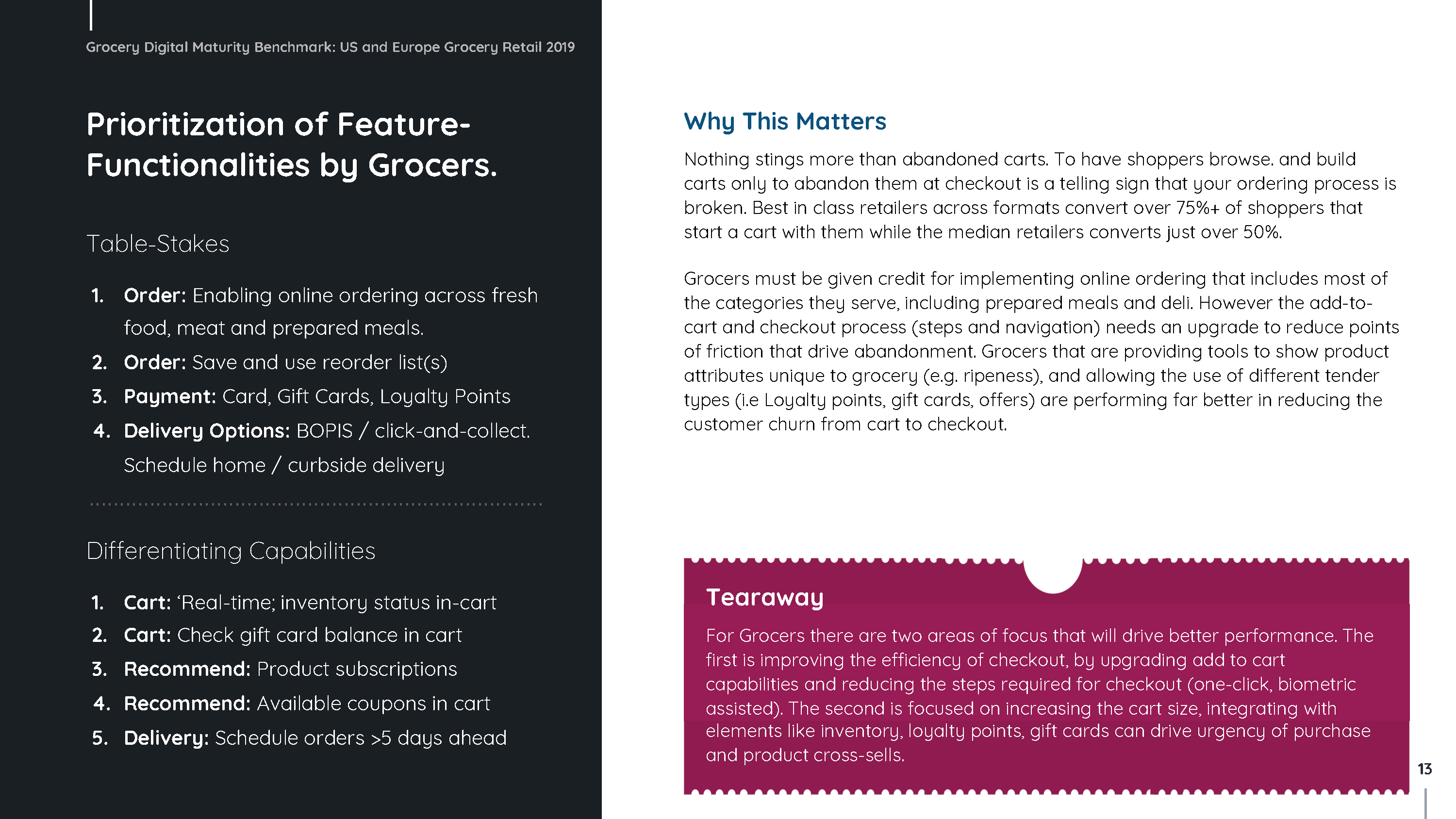

Ranking the Top 75 grocers in US and Europe based on the digital performance of their website. The performance analysis covers four stages of the shopper journey, Product Discovery, Ease Of Ordering, Fulfillment Options and Customer Support. Grocery Digital Maturity Benchmark: US and Europe Grocery Retail 201

Here’s a preview of the report. The full report is available for free download via the form below.