2021 Buyers' Guide

Point-of-Sale Software for High-Touch Retailers

Q4, 2020

This Buyers' Guide provides a framework for high-touch retailers to plan and prioritize important capabilities for 2021 and beyond.

Point-of-Sale Software for High-Touch Retailers

Limited product visibility, uncertain demand and lack of product availability are stress-testing the global supply chain. With business-as-usual no longer an option, leaders must focus on building a resilient supply chain to ensure sustained growth.

Incisiv

Incisiv

Here’s a preview of the report. The full report is available for free download via the form below.

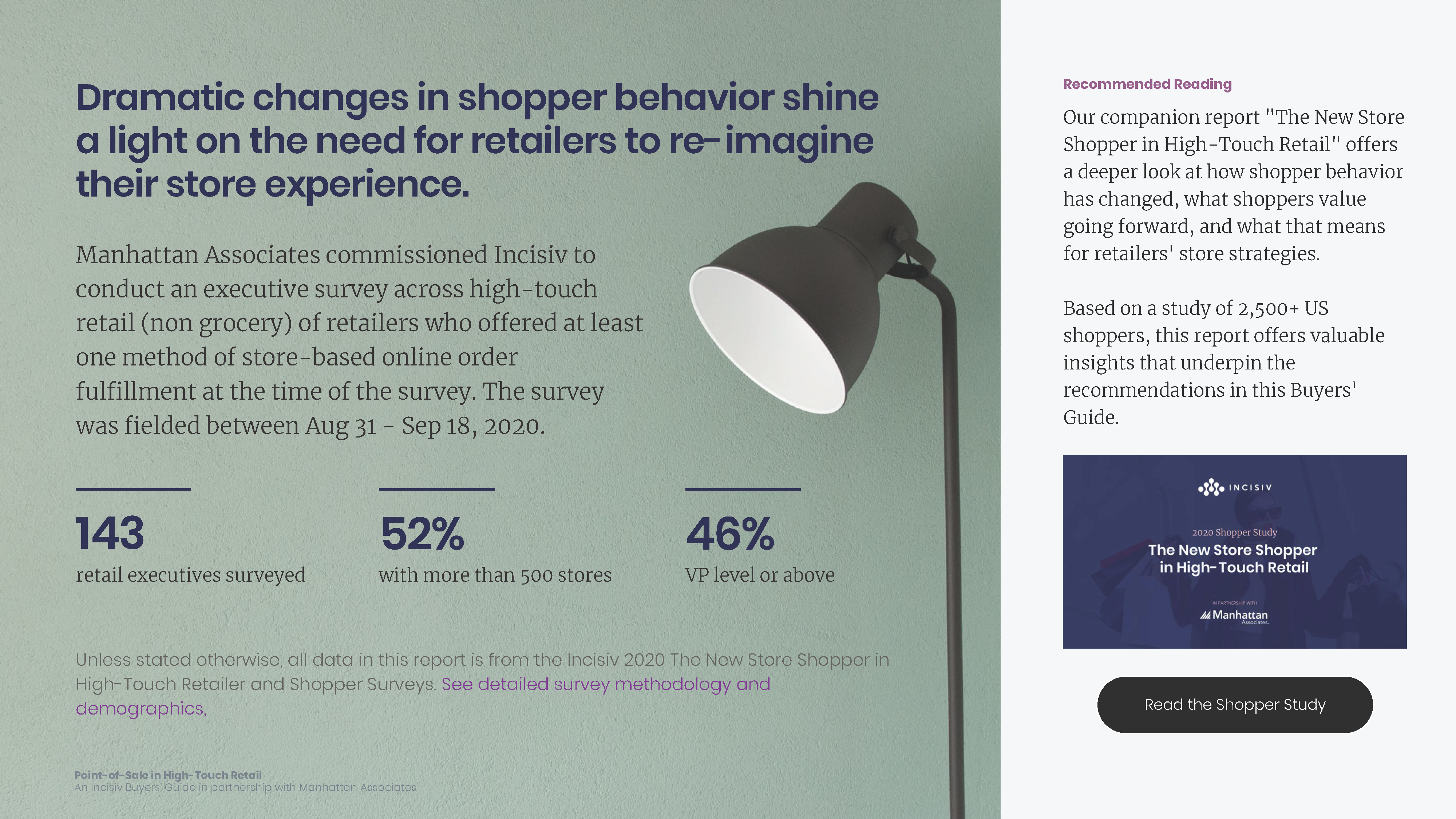

Dramatic changes in shopper behavior shine a light on the need for retailers to re-imagine their store experience.

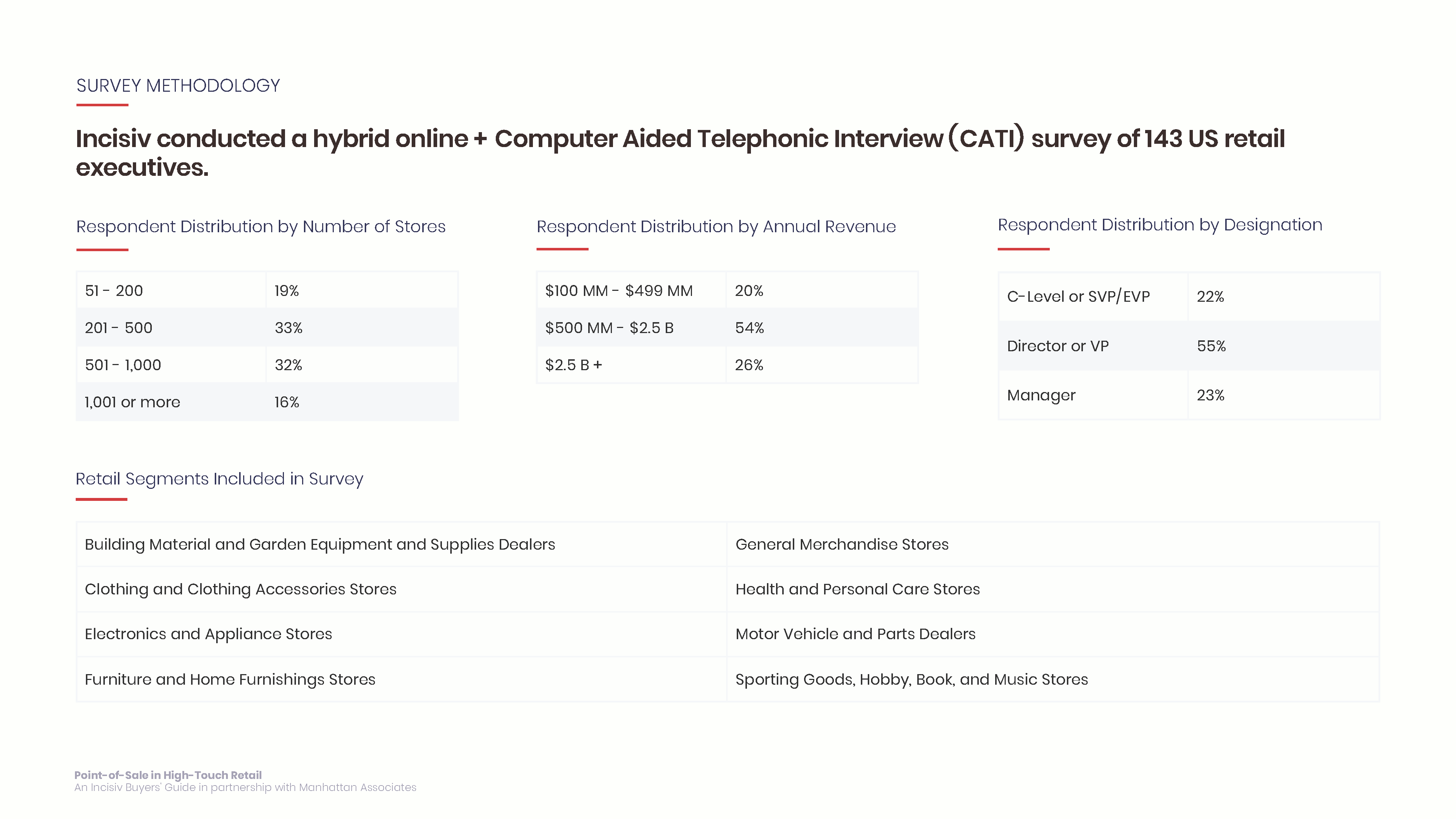

Manhattan Associates commissioned Incisiv to conduct an executive survey across high-touch (non grocery) retailers who offered at least one method of store-based, online order fulfillment at the time of the survey. The survey was fielded between Aug 31 - Sep 18, 2020.

143

retail executives surveyed

52%

with more than 500 stores

46%

VP level or above

As the economy re-opens and retailers lay go-forward plans, the question becomes: how will these changes impact shopper behavior?

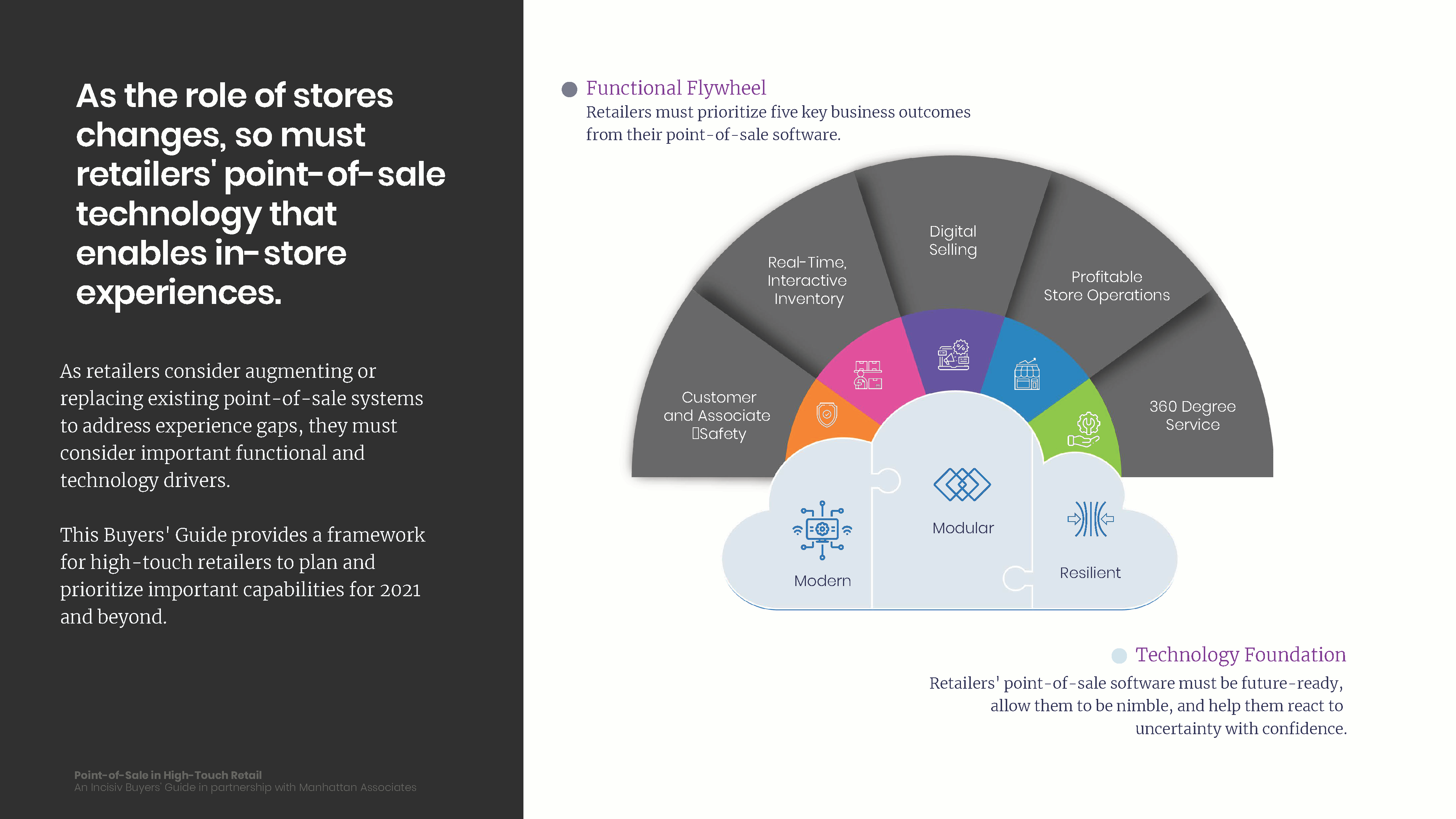

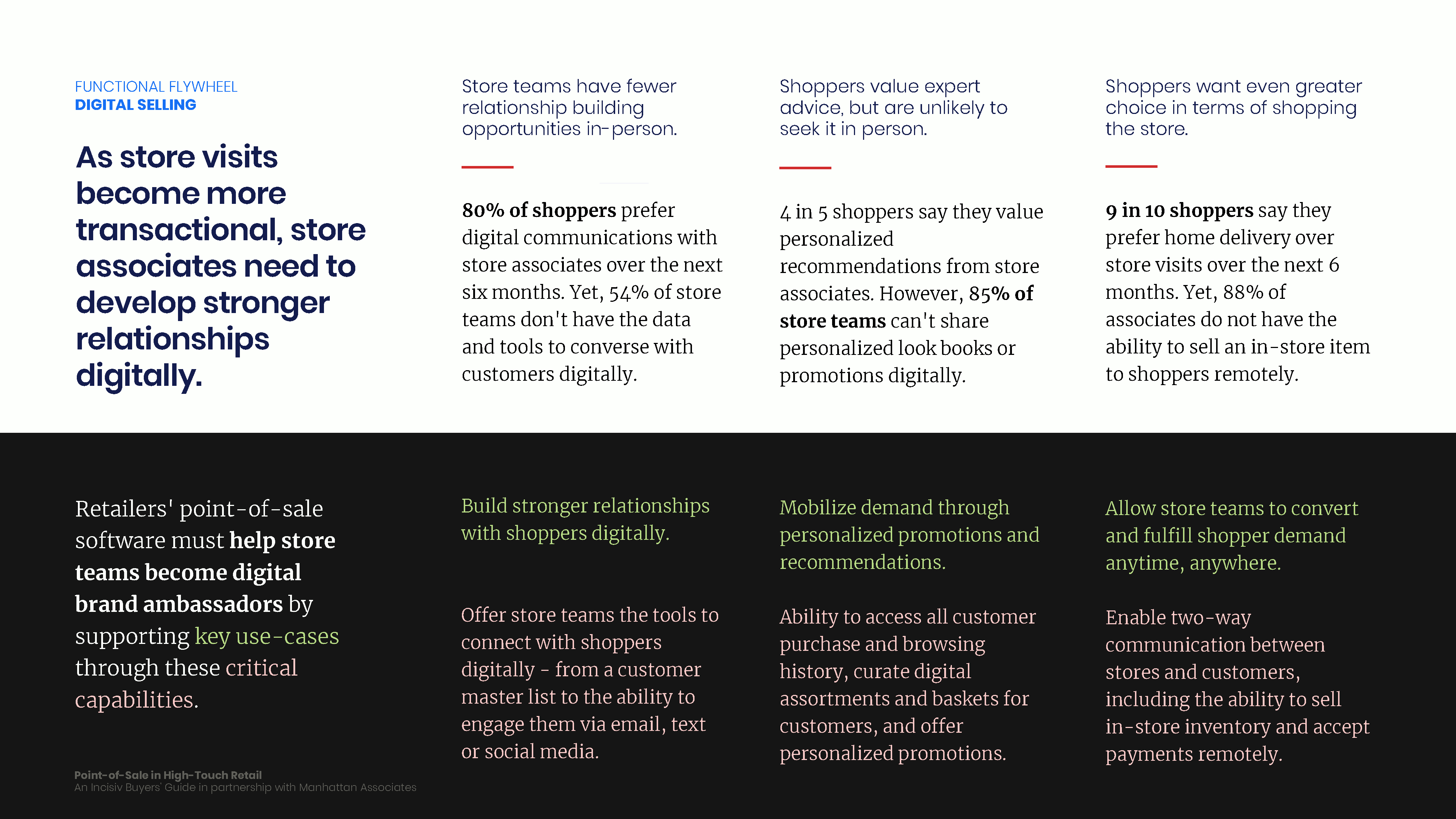

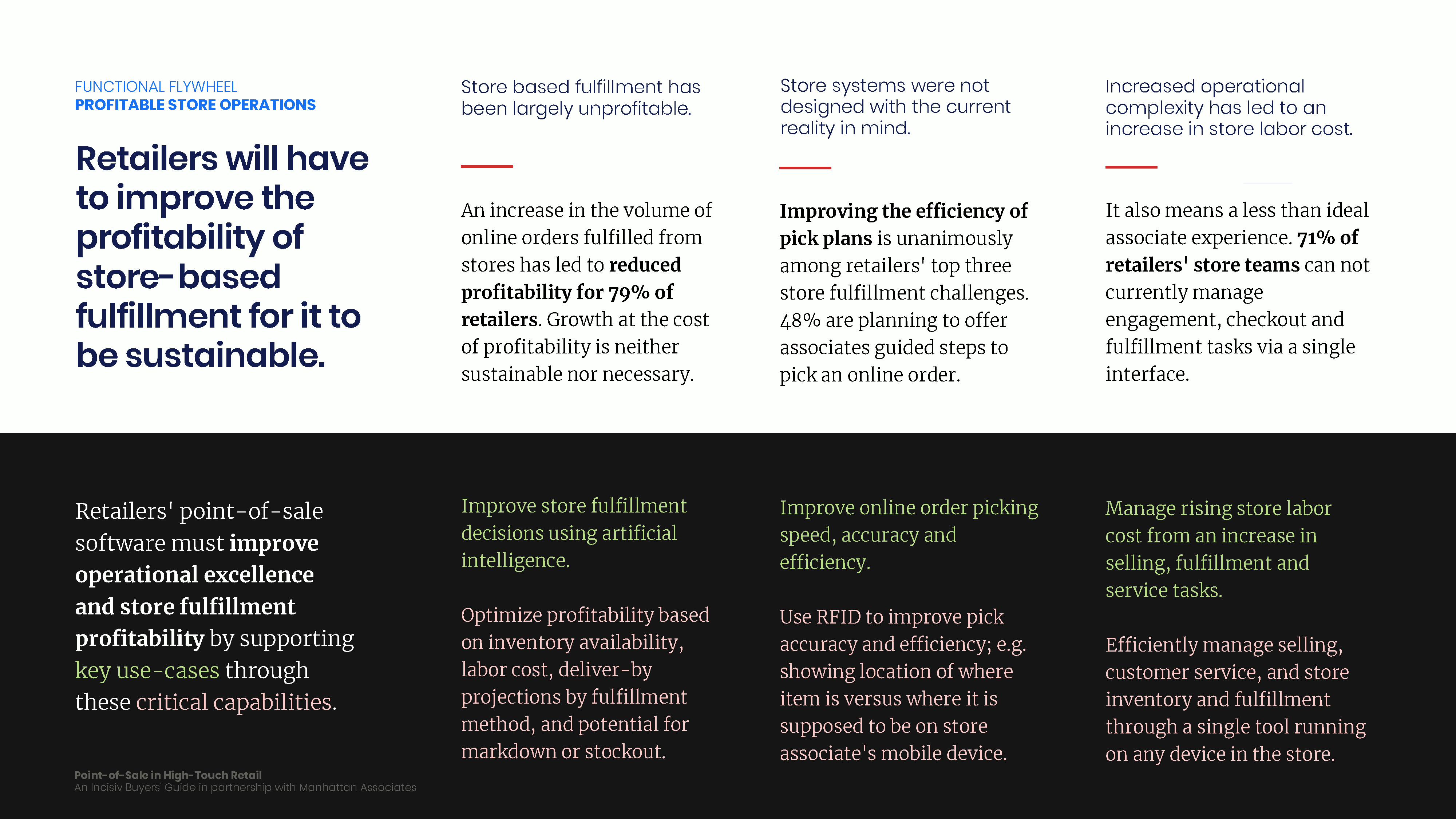

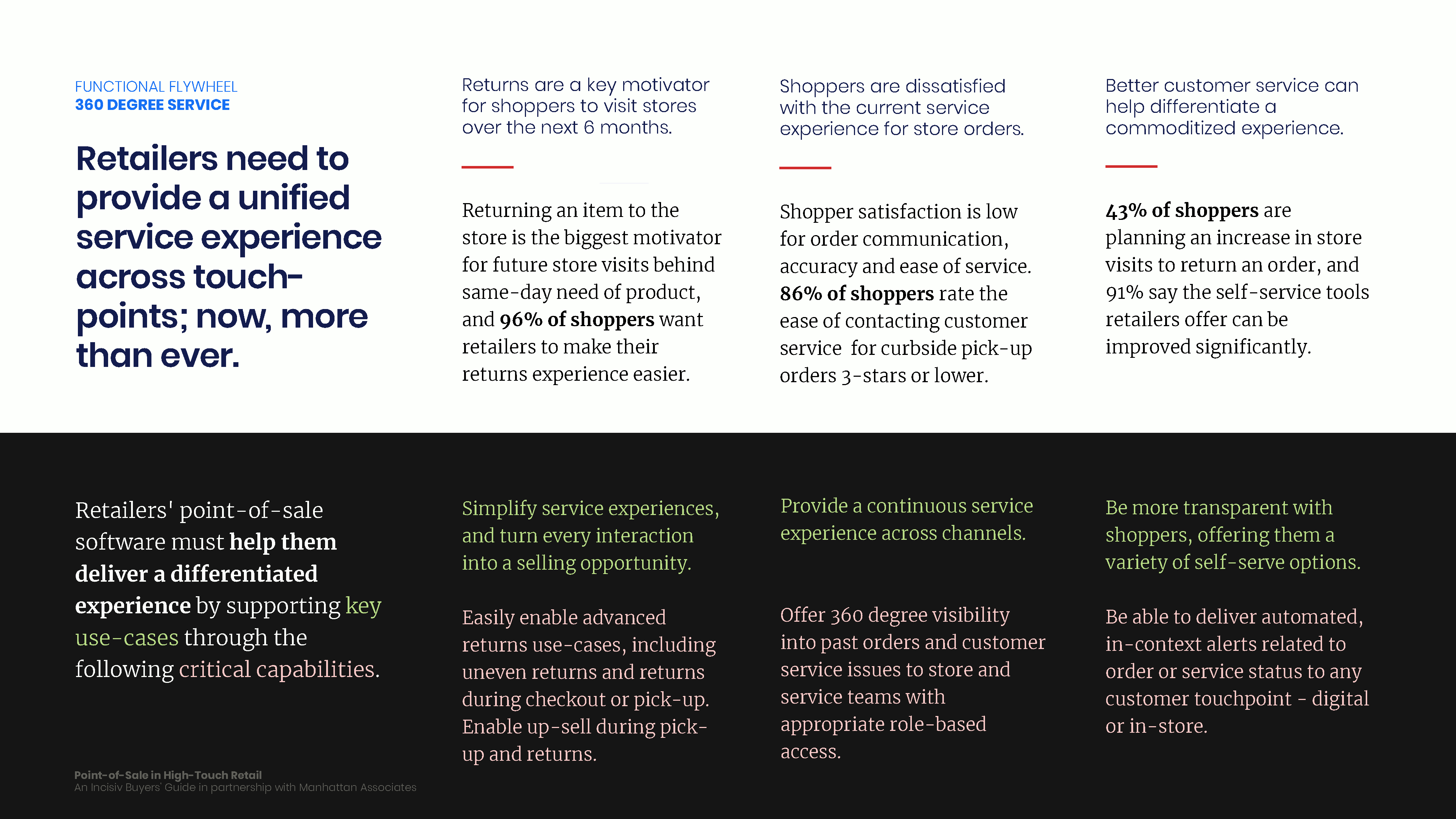

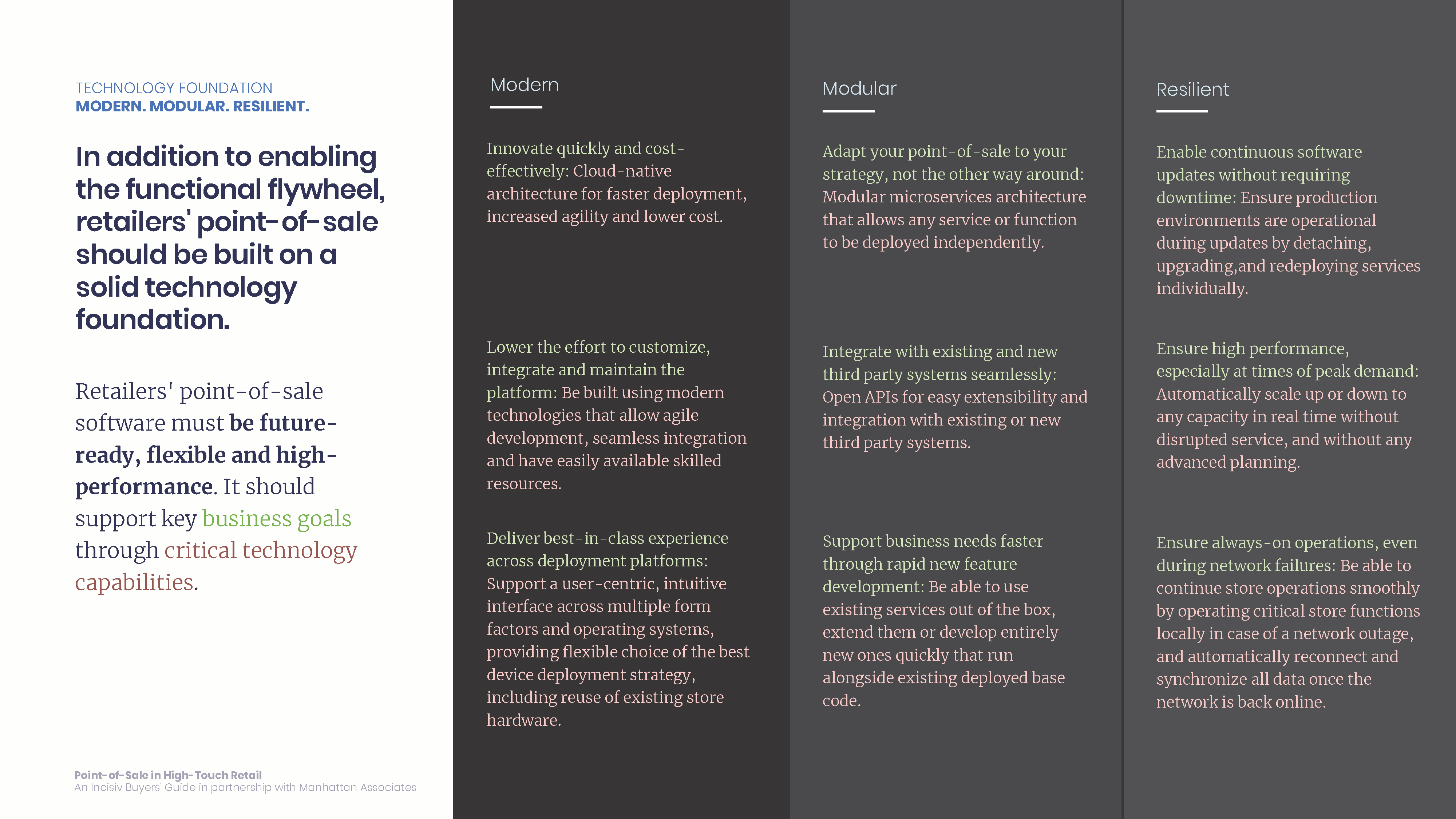

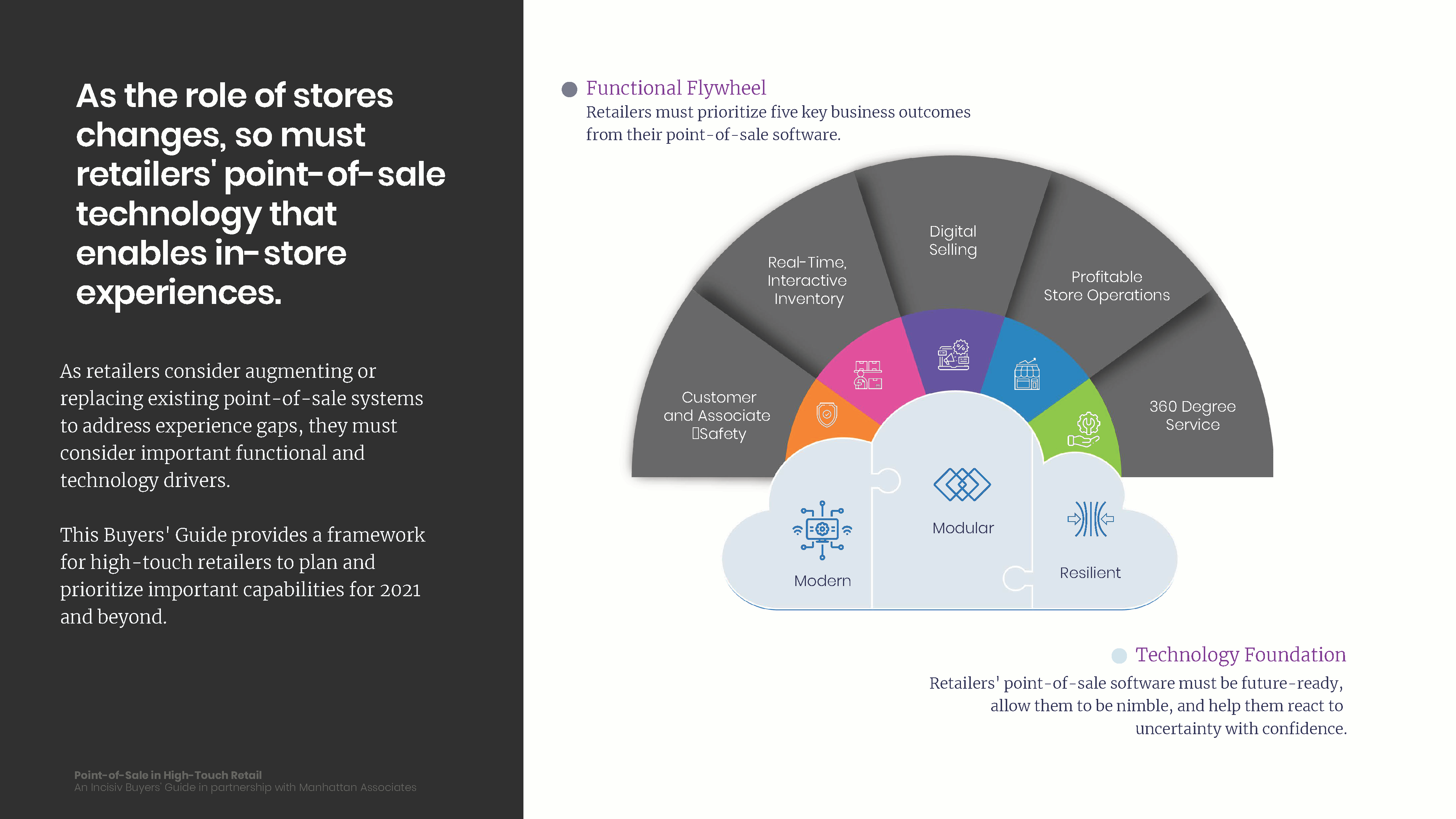

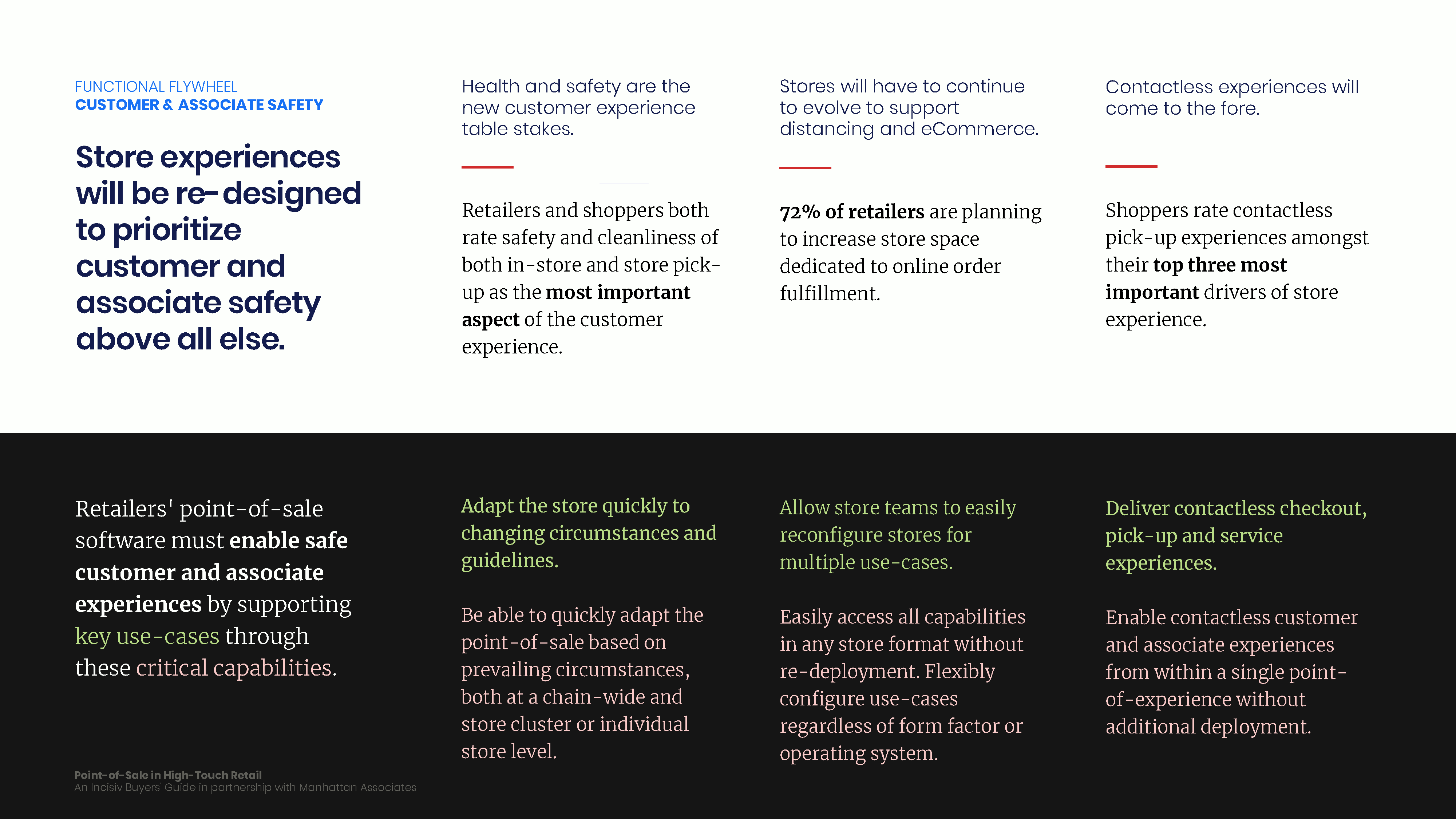

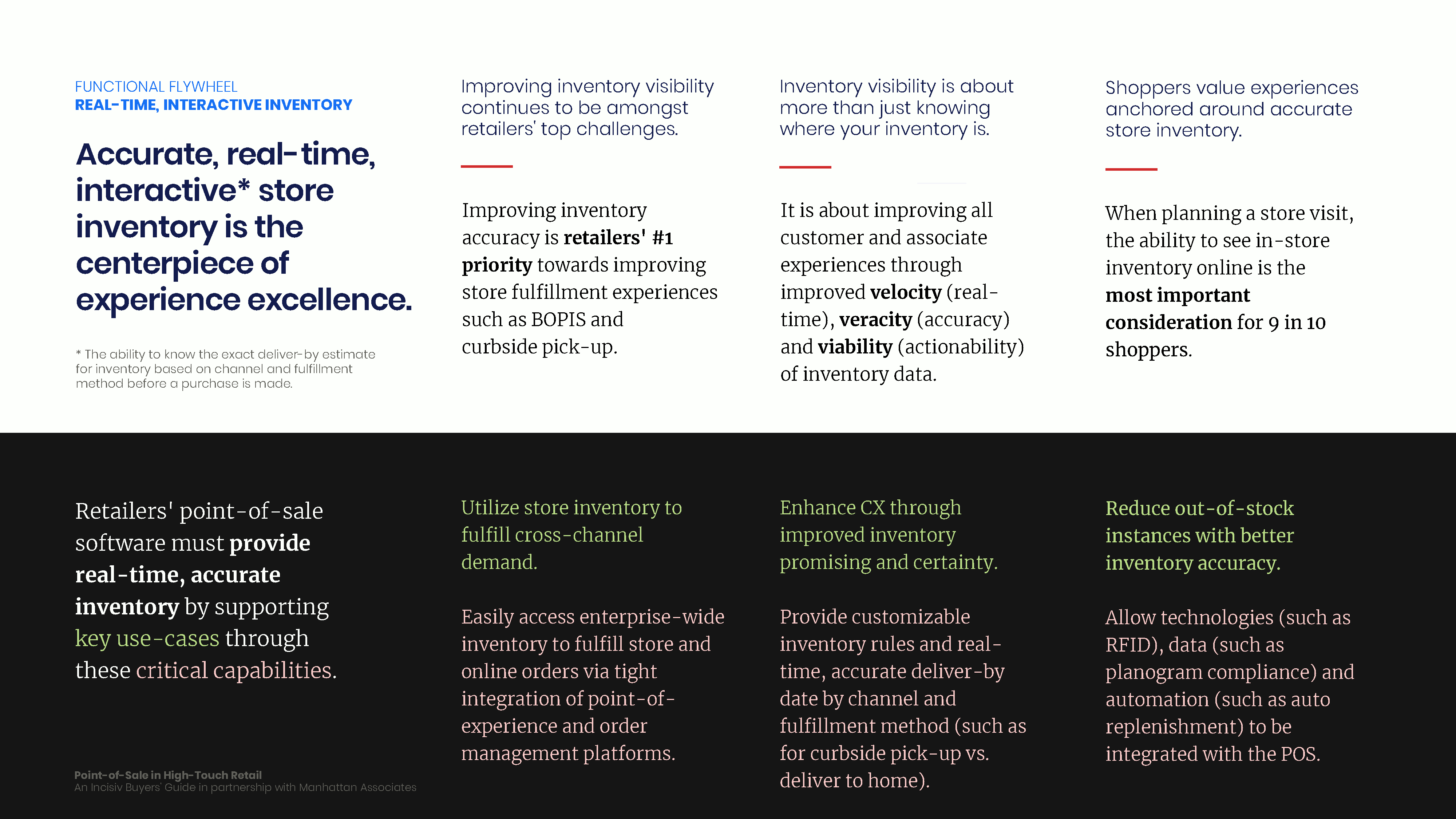

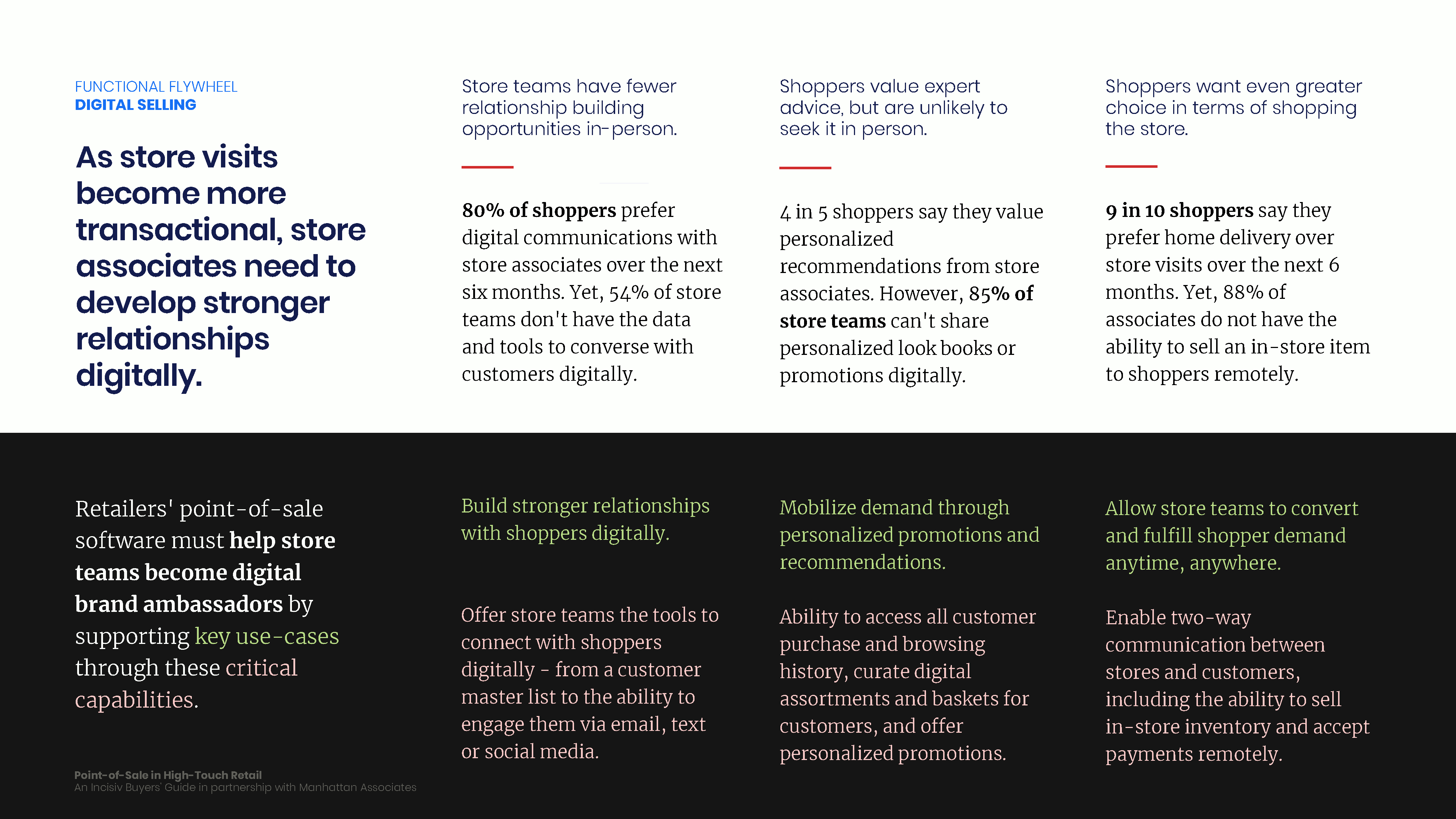

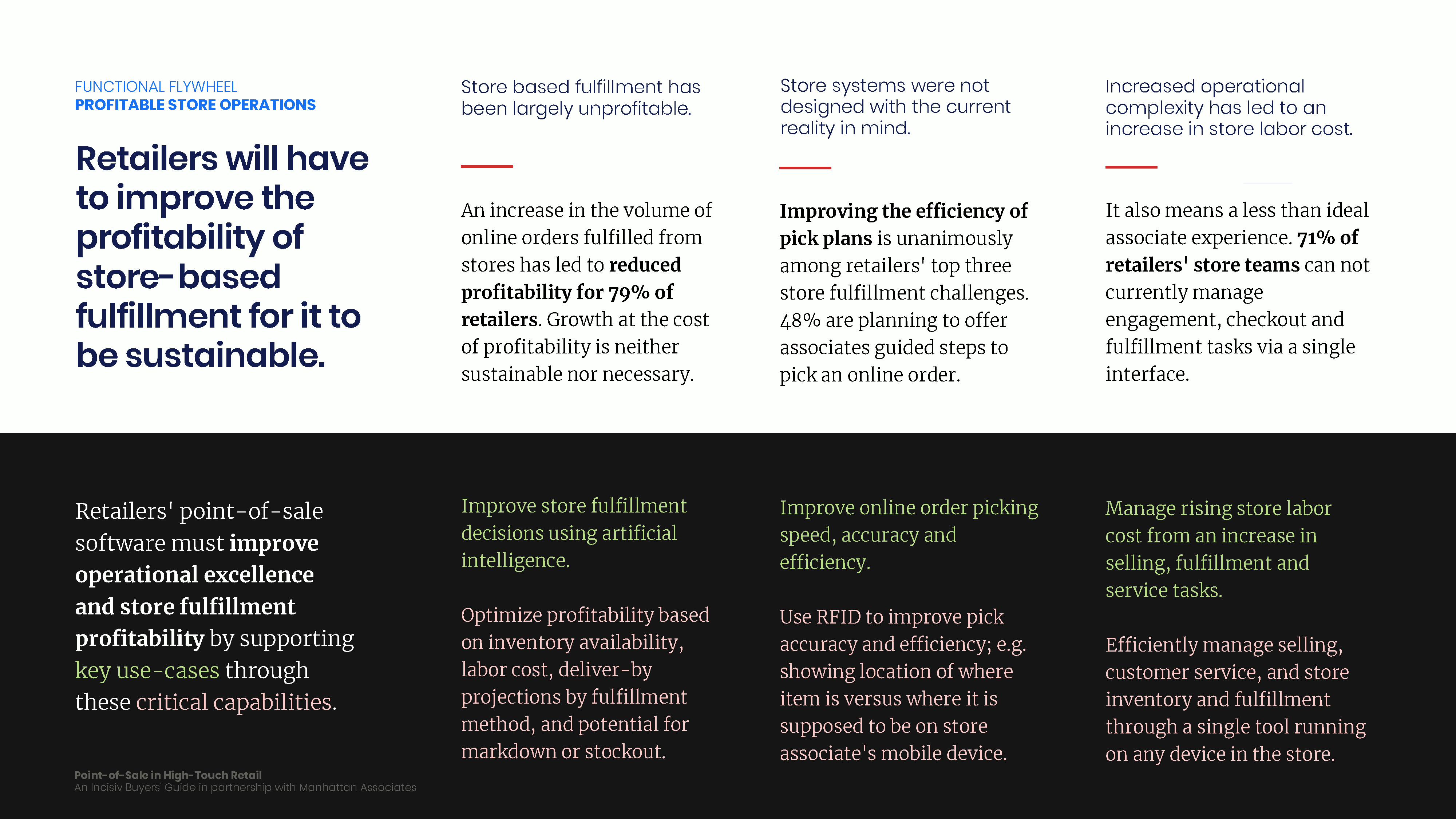

As the role of stores changes, so must retailers' point-of-sale technology that enables in-store experiences

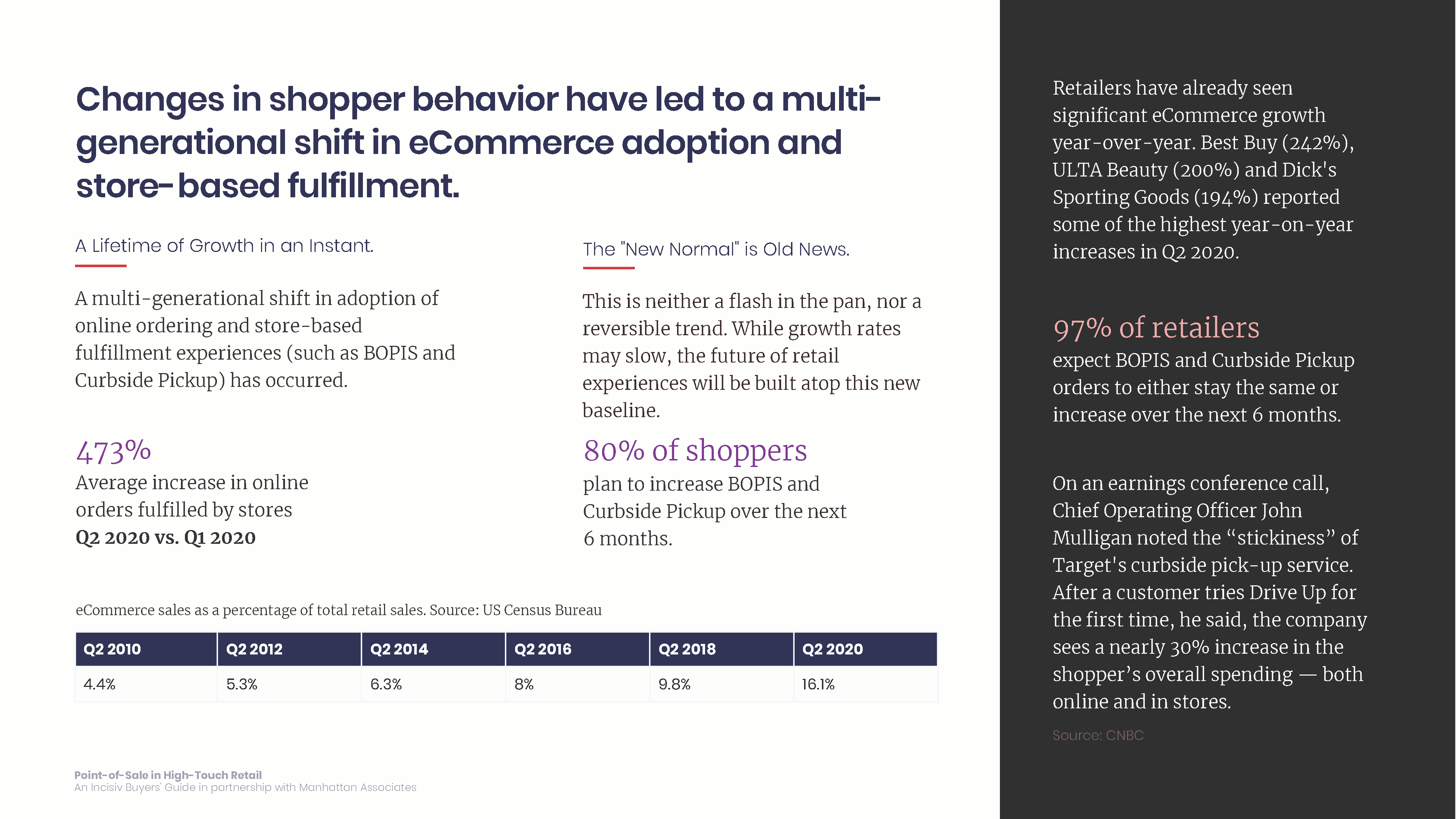

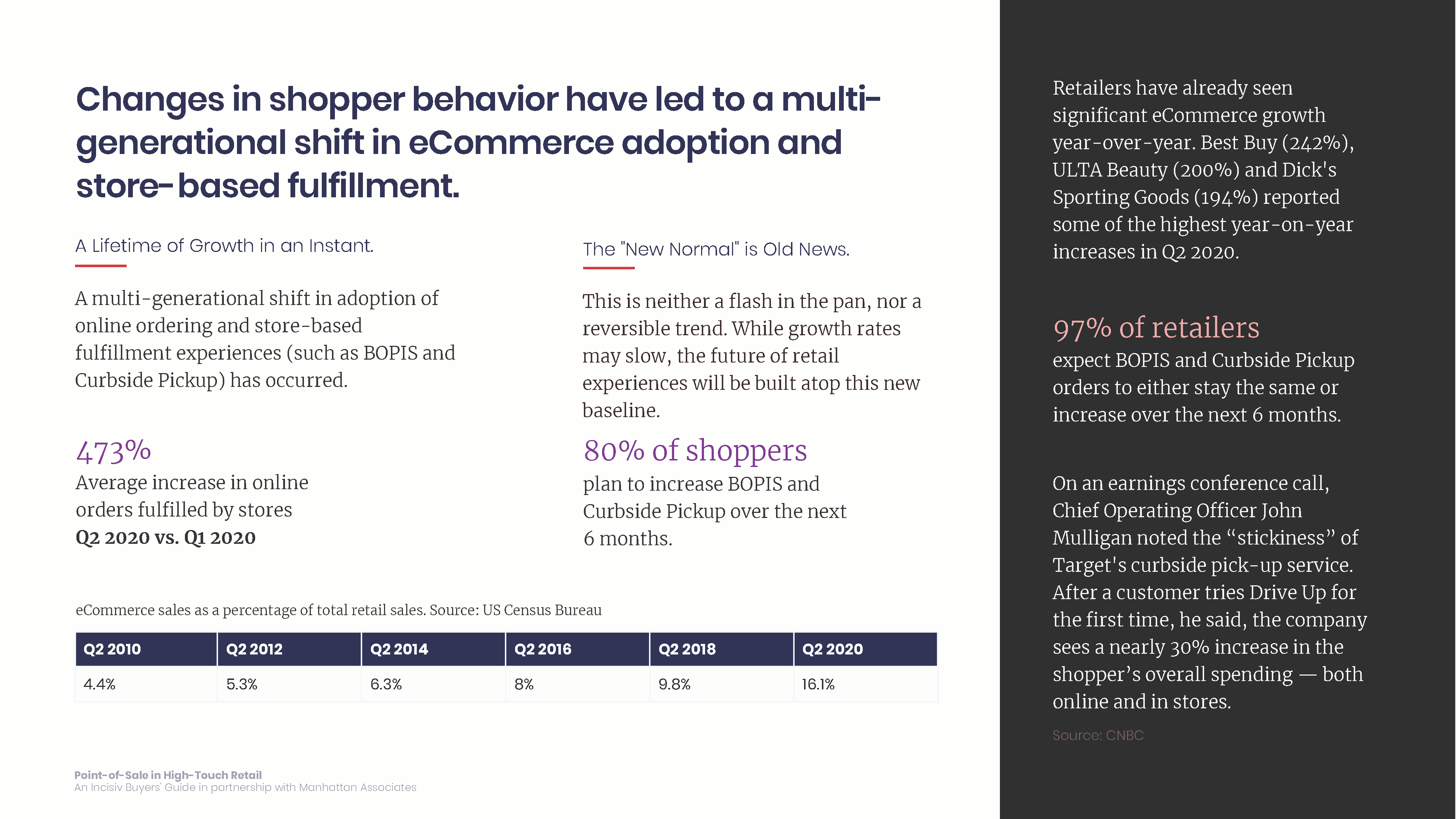

A Lifetime of Growth in an Instant.

A multi-generational shift in adoption of online ordering and store-based fulfillment experiences (such as BOPIS and Curbside Pickup) has occurred.

473%

Average increase in online orders fulfilled by stores Q2 2020 vs. Q1 2020

The "New Normal" is Old News.

This is neither a flash in the pan, nor a reversible trend. While growth rates may slow, the future of retail experiences will be built atop this new baseline.

80% of shoppers

plan to increase BOPIS and Curbside Pickup over the next 6 months.

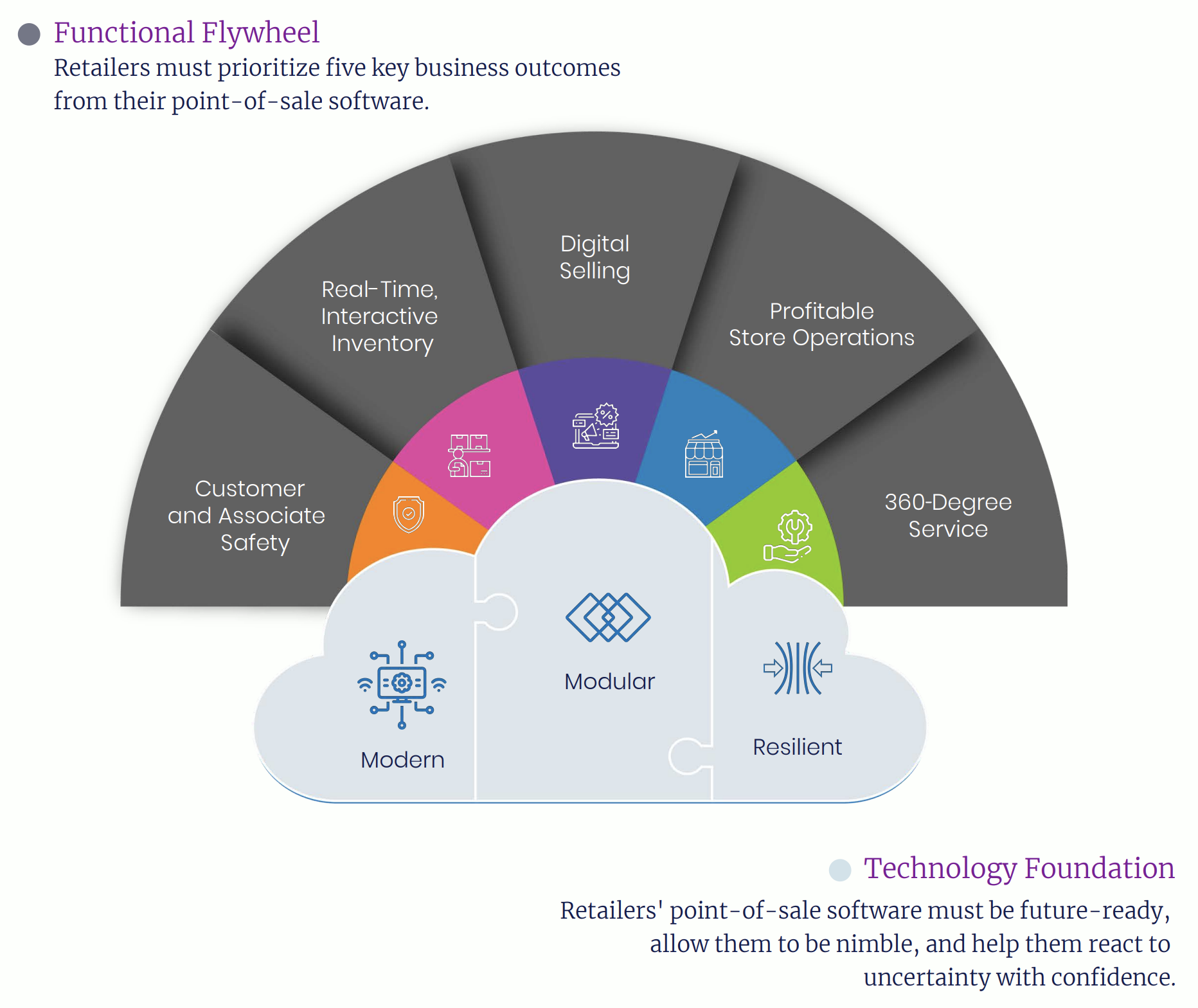

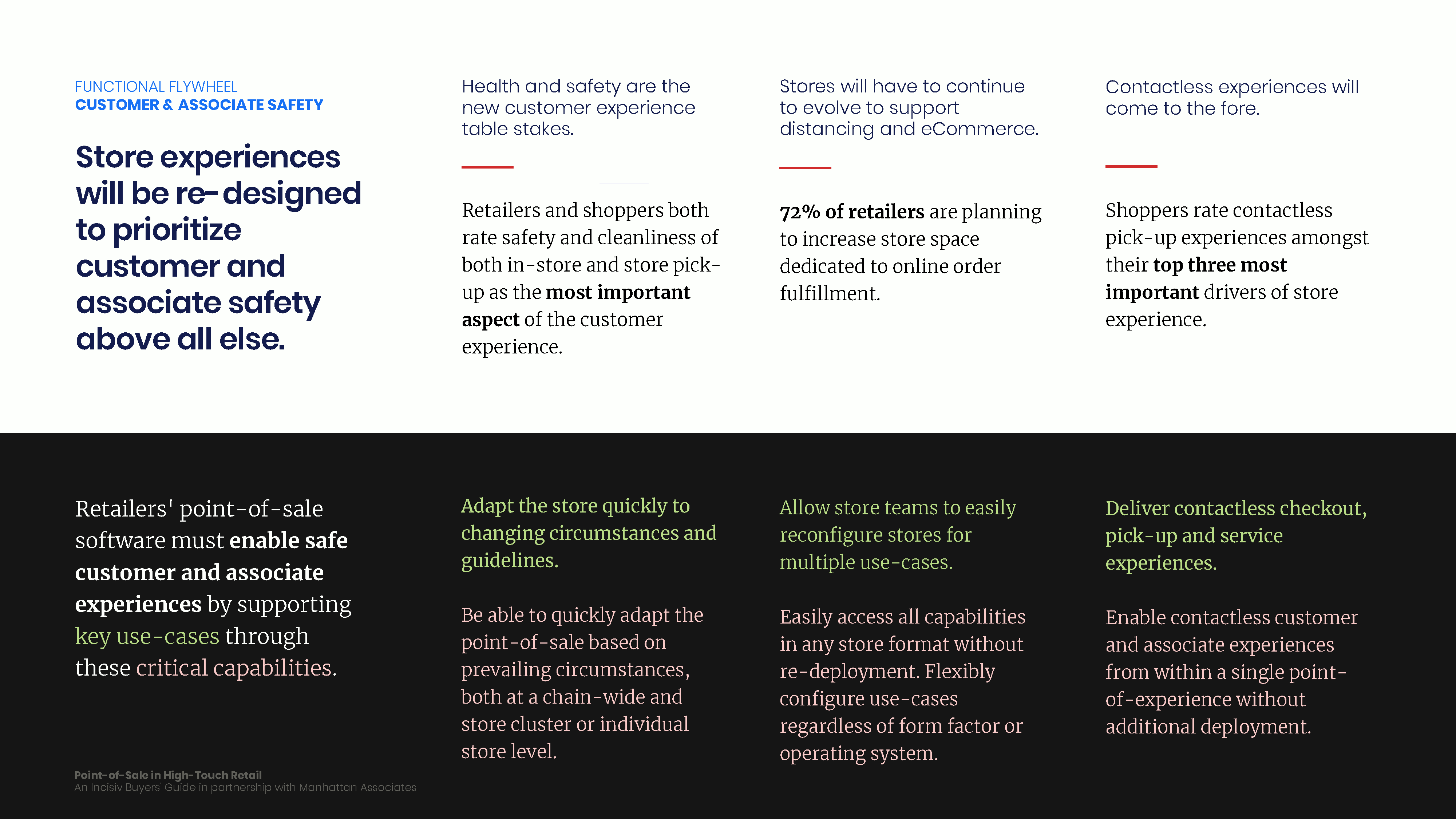

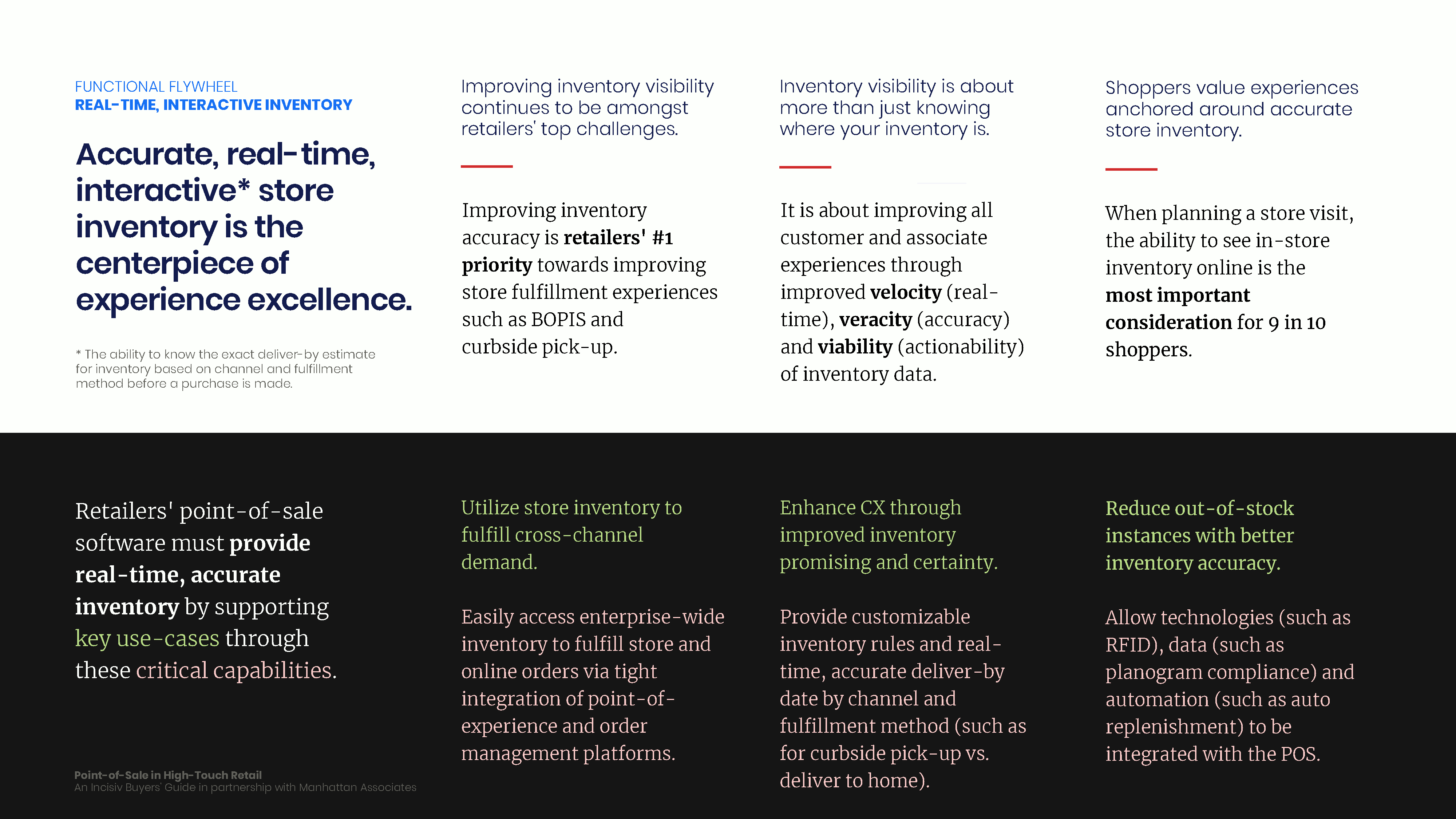

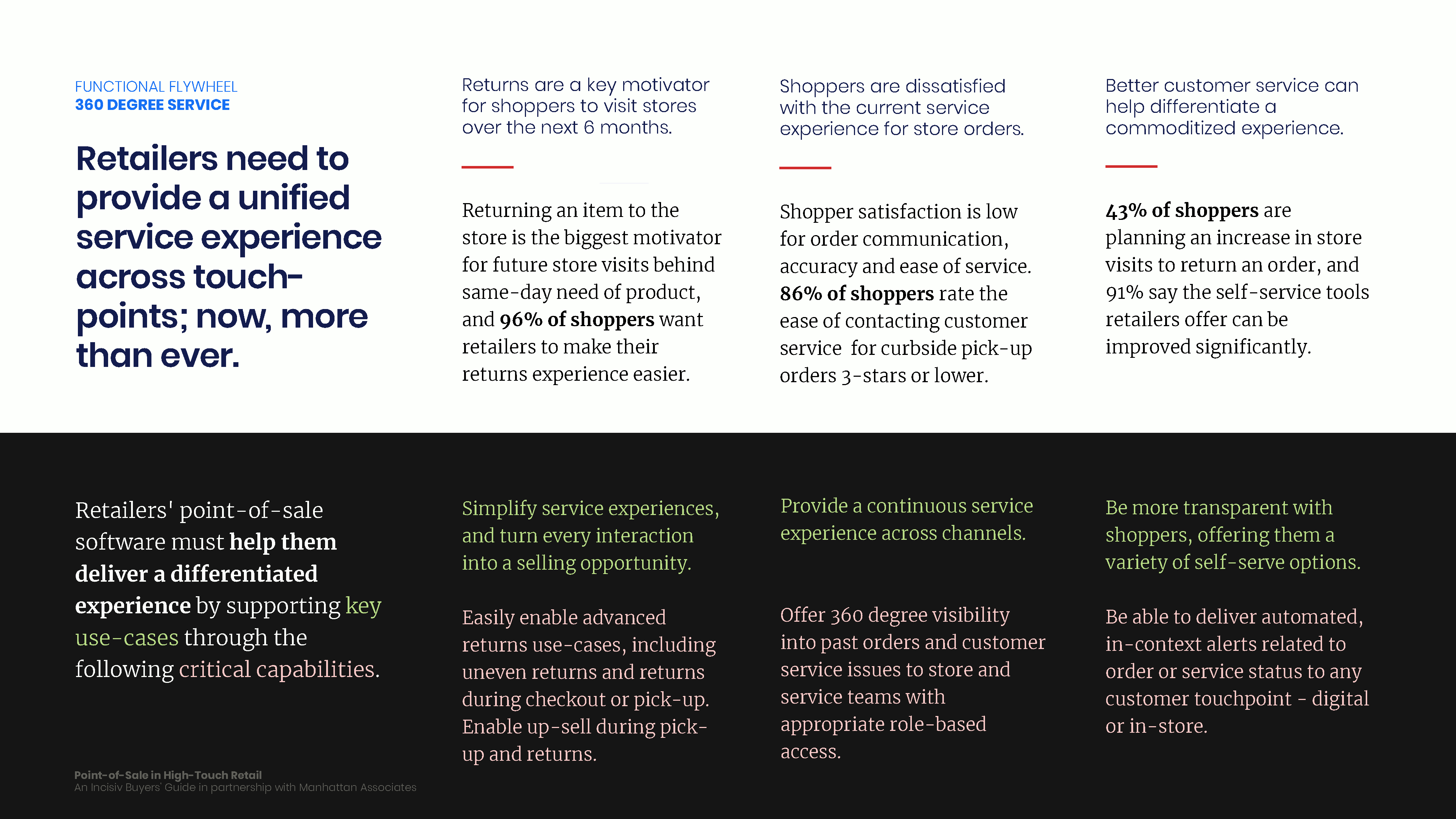

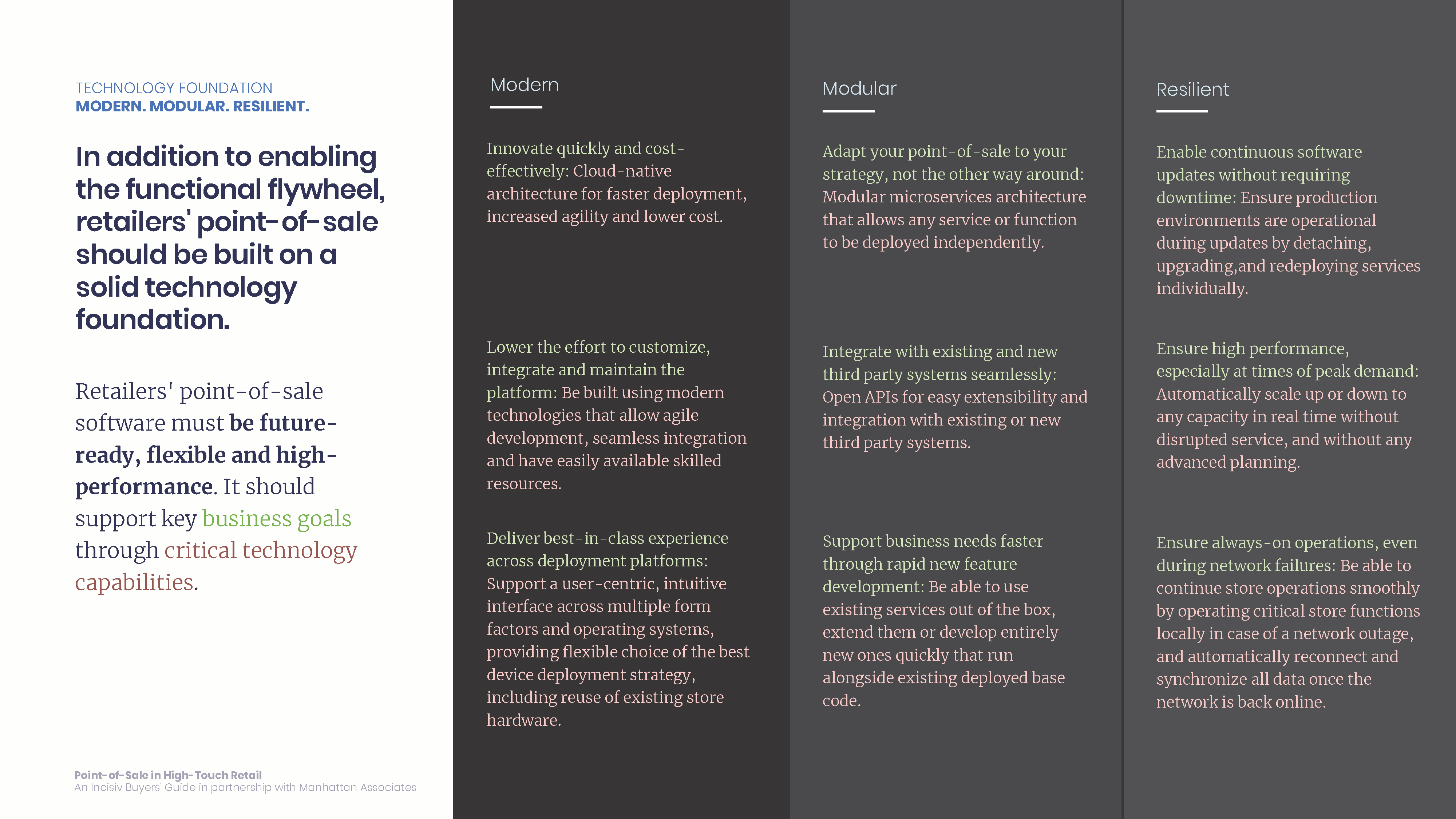

As retailers consider augmenting or replacing existing point-of-sale systems to address experience gaps, they must consider important functional and technology drivers.

This Buyer's Guide provides a framework for high-touch retailers to plan and prioritize important capabilities for 2021 and beyond.