Industry Research

Mobile Computing Devices & Tablets Requirements & Preferences in the British Healthcare System

Q3, 2021

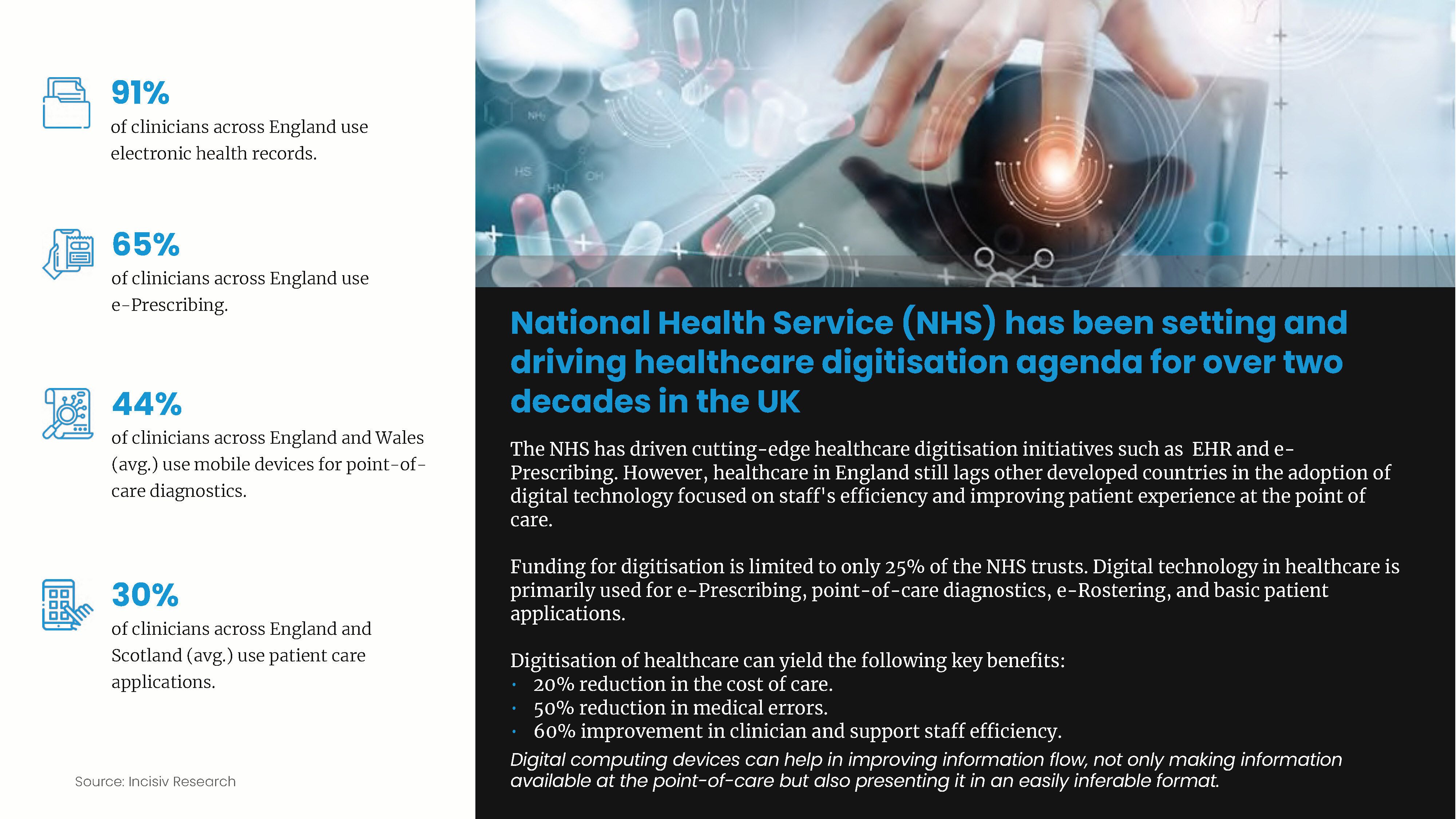

British healthcare faces a critical technology adoption gap as NHS digitization efforts struggle to meet frontline operational demands at the point of care. While high-level systems like electronic health records and e-Prescribing show strong adoption, only a fraction of clinicians utilize mobile devices for diagnostics and patient care applications. Limited funding, technology costs, and the challenge of finding appropriate solutions constrain progress, while healthcare workers cite inadequate resources as the primary barrier to digital transformation. Current mobile devices fail to meet the rigorous demands of clinical environments, lacking essential features like glove-compatible touchscreens, medical-grade durability, and compliance with electromagnetic interference standards.

This report examines the specific requirements driving mobile computing device selection in NHS environments and how purpose-built solutions can transform healthcare delivery. It explores critical functionality gaps across user ease, safety compliance, and operational flexibility while revealing healthcare professionals' preferences for device specifications, operating systems, and authentication methods. The analysis provides frameworks for selecting computing solutions that address diverse clinical use cases while meeting stringent regulatory standards, ultimately enabling the efficiency improvements and patient safety outcomes required for successful NHS digital transformation.

FOUR KEY B2C COMMERCE IMPERATIVES

Incisiv

Incisiv

Here’s a preview of the report. The full report is available for free download via the form below.

As consumers continue to reshape their expectations,

enterprises must contend with a uniquely challenging landscape.

The consumer technology landscape is forever changing.

From Pinterest to TikTok, WeChat to Instagram, new experiences can rapidly gain consumer adoption and relevance.

From augmented reality to voice, smartwatches to chatbots, consumers are constantly embracing new interaction paradigms.

Commoditized convenience is eroding loyalty and margin.

Consumers expect convenience. If you can't deliver it, they'll go elsewhere - e.g. next day shipping becoming the new standard.

Walmart will reportedly lose USD 1 billion on eCommerce revenue of USD 21 billion this year as it faces challenges in its bid to complete against Amazon – from trouble integrating its DNVB acquisitions to impact on margin from its next-day delivery operations.

Consumers value experiences that are curated to fit their lives better.

They want to engage, be served, and transact at their time, their pace, their place. They have little patience, infinite choice and the freedom to swipe left at the slightest hint of friction.