REPORT

Convenience Store Chains Digital Maturity Benchmark, 2020

Incisiv

Incisiv

Convenience store chains benchmark categories & mobile app segments.

Research and discovery

Online Ordering & Fulfillment

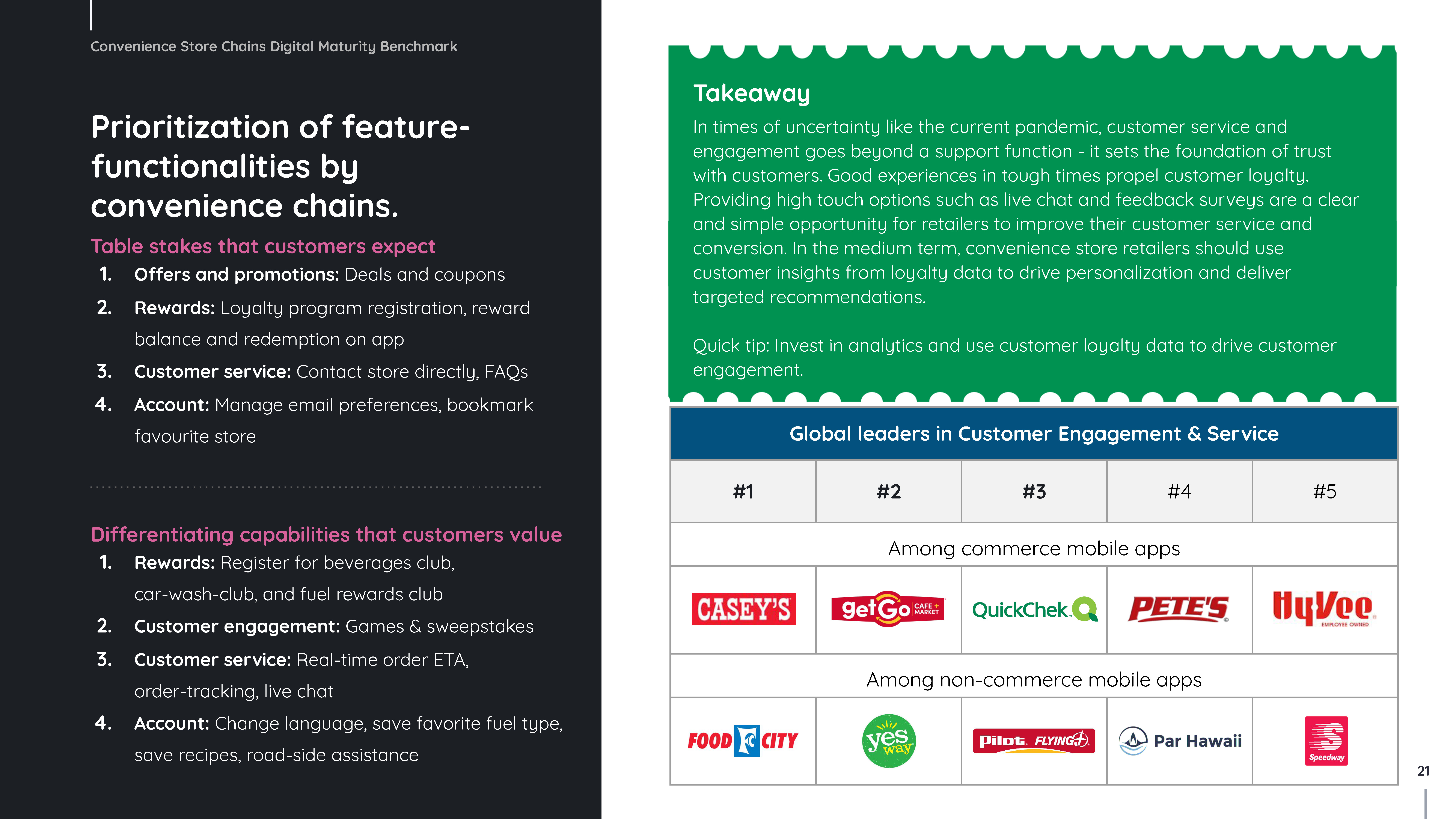

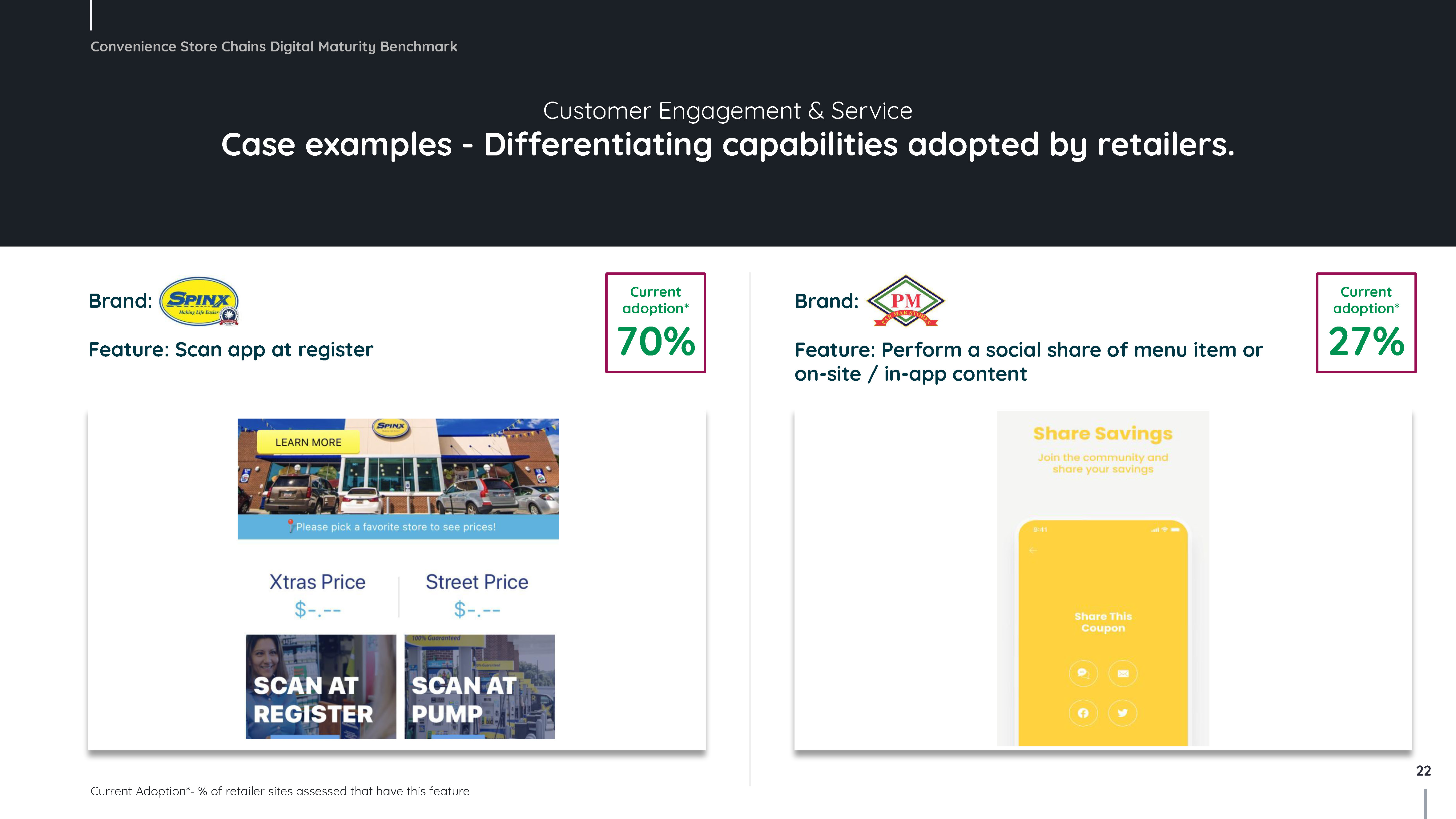

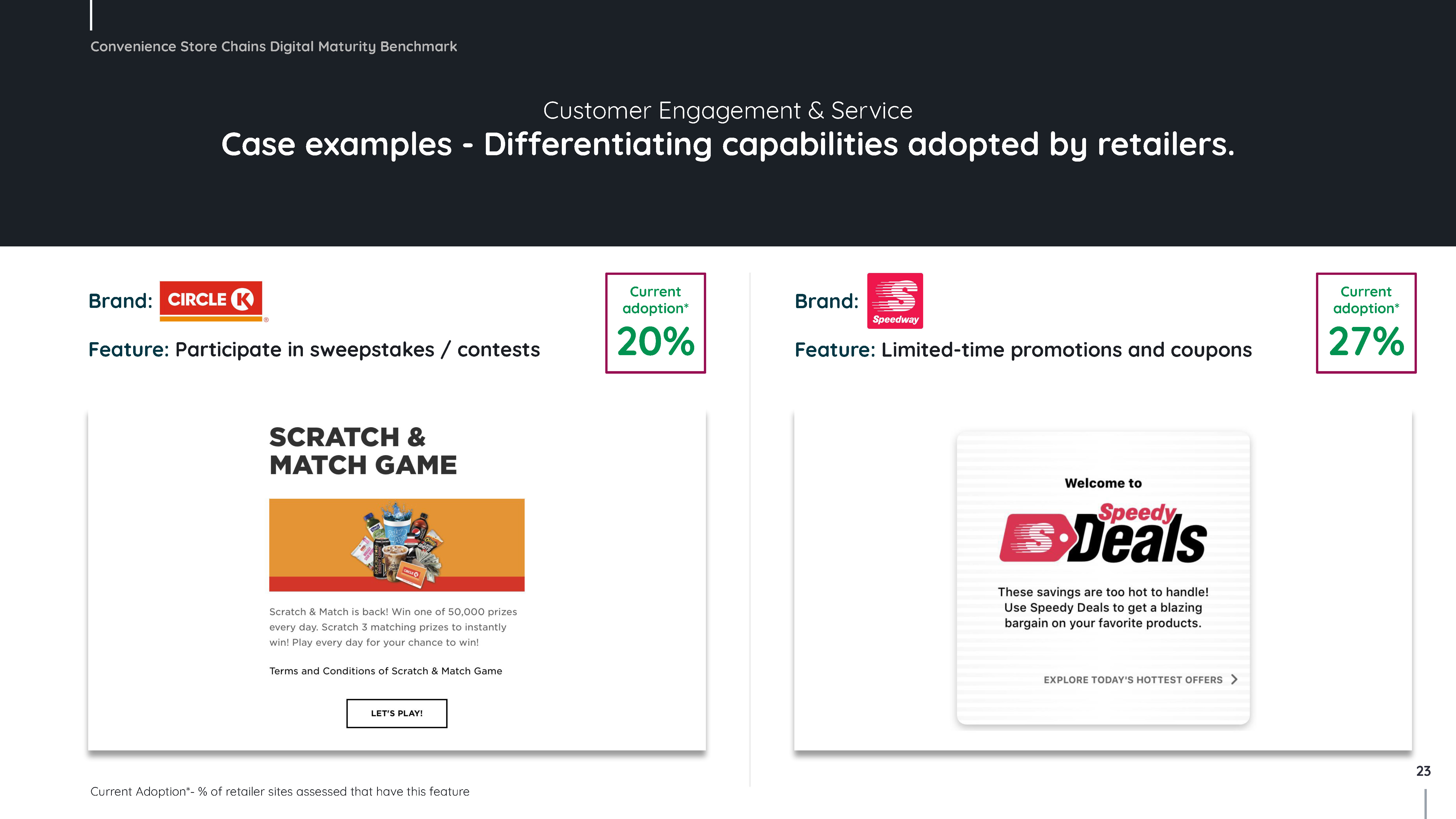

Customer Engagement & Service

Segments benchmarked

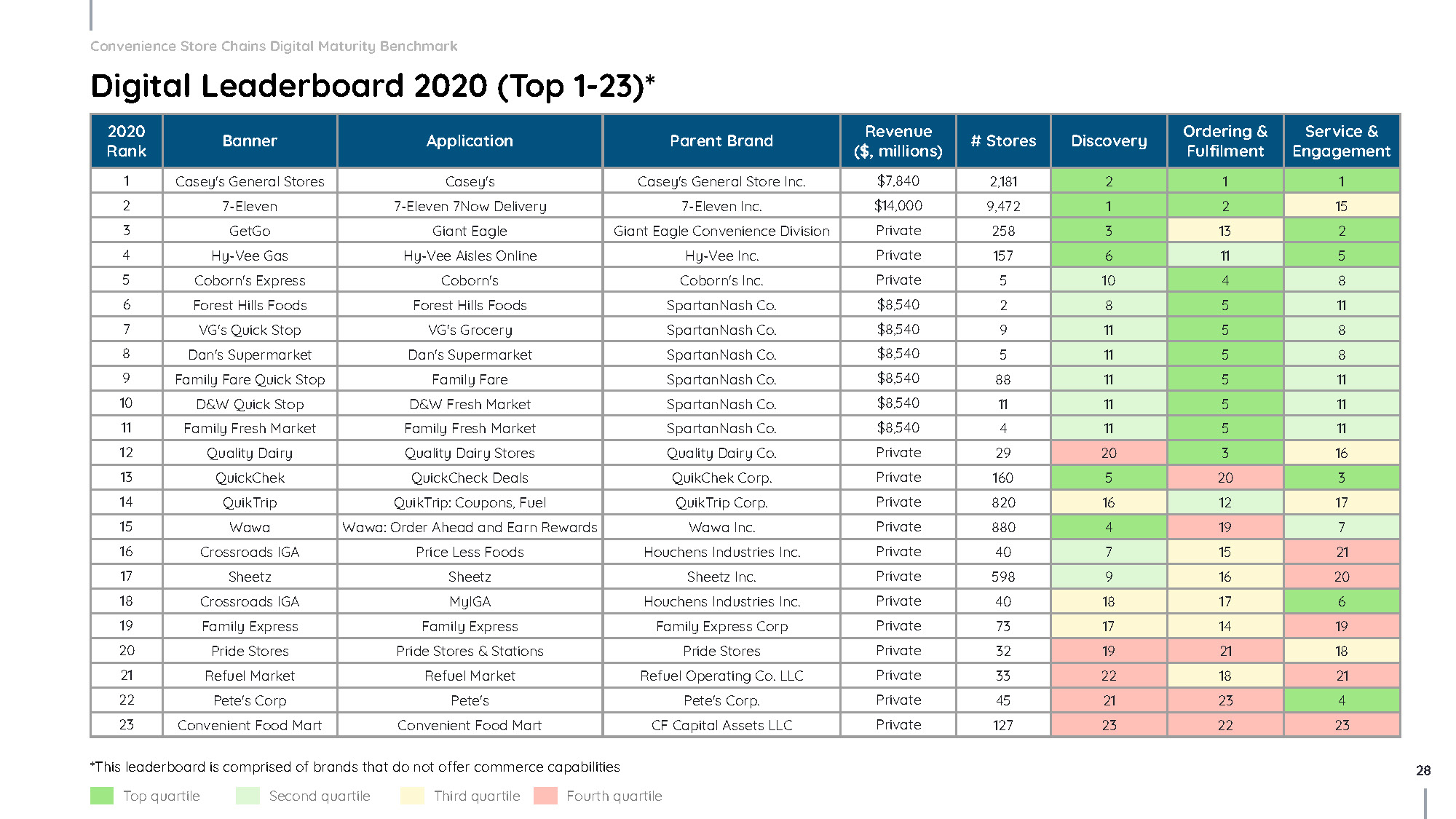

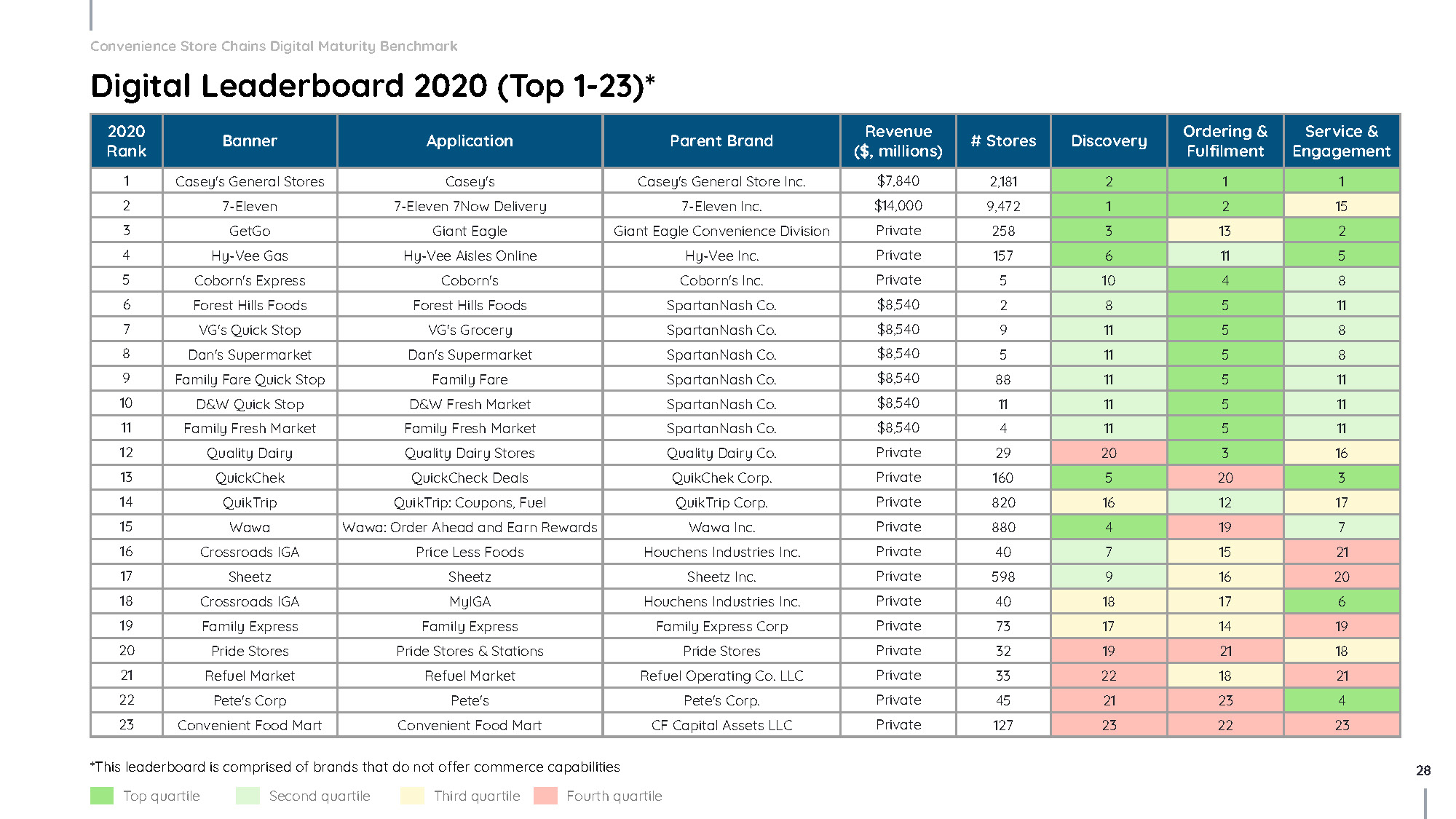

Commerce

Convenience chain mobile applications offering online ordering.

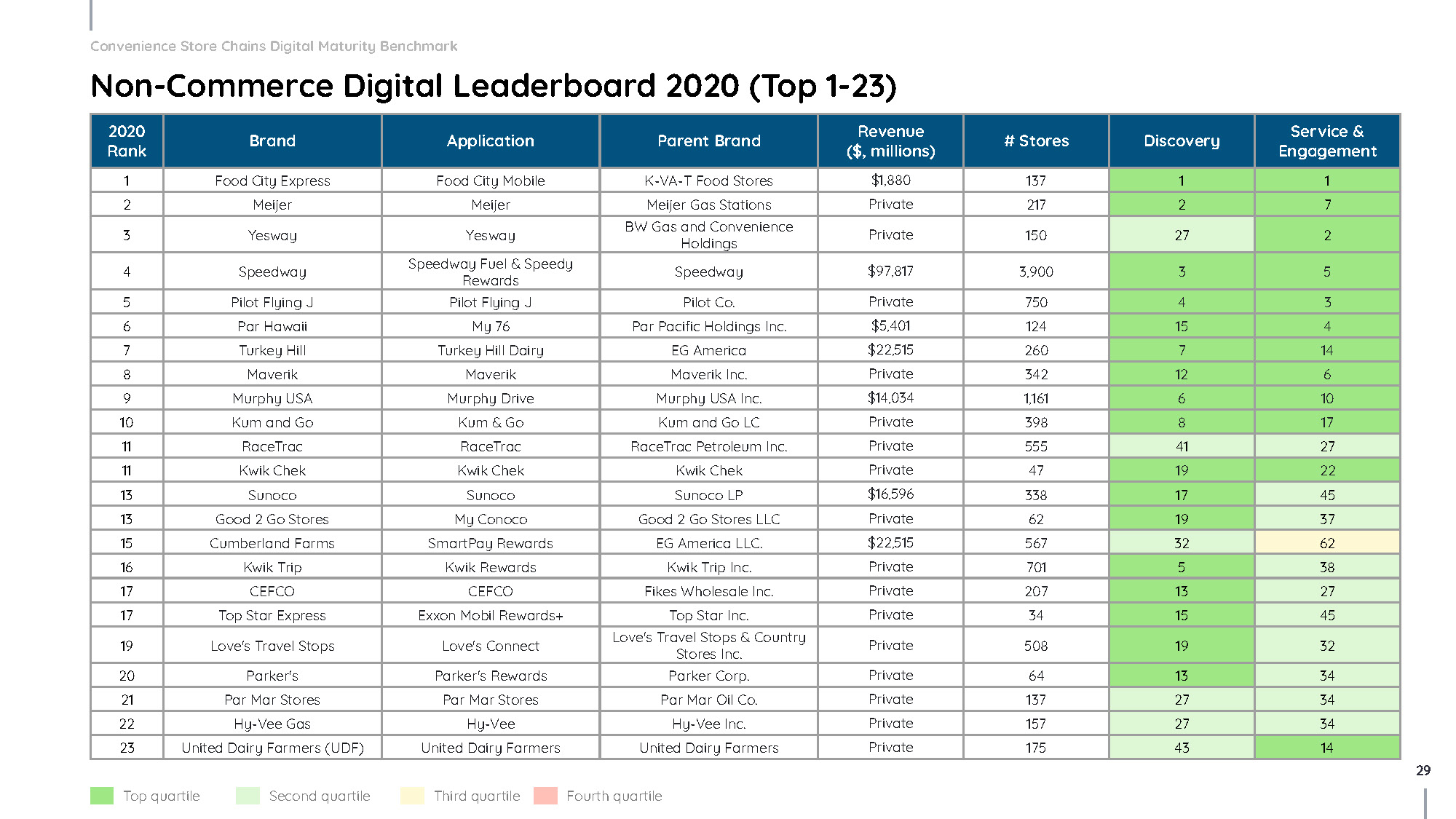

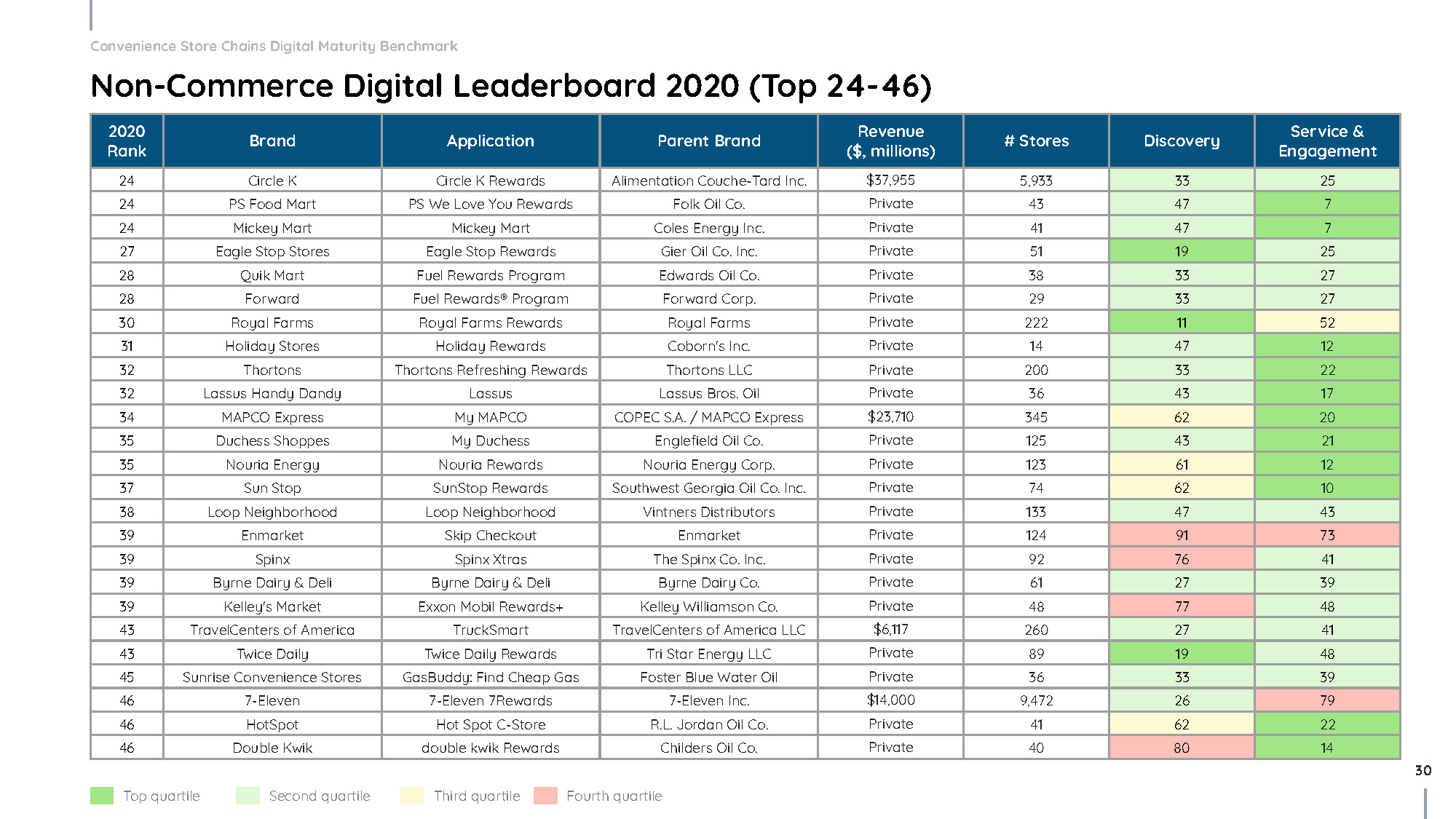

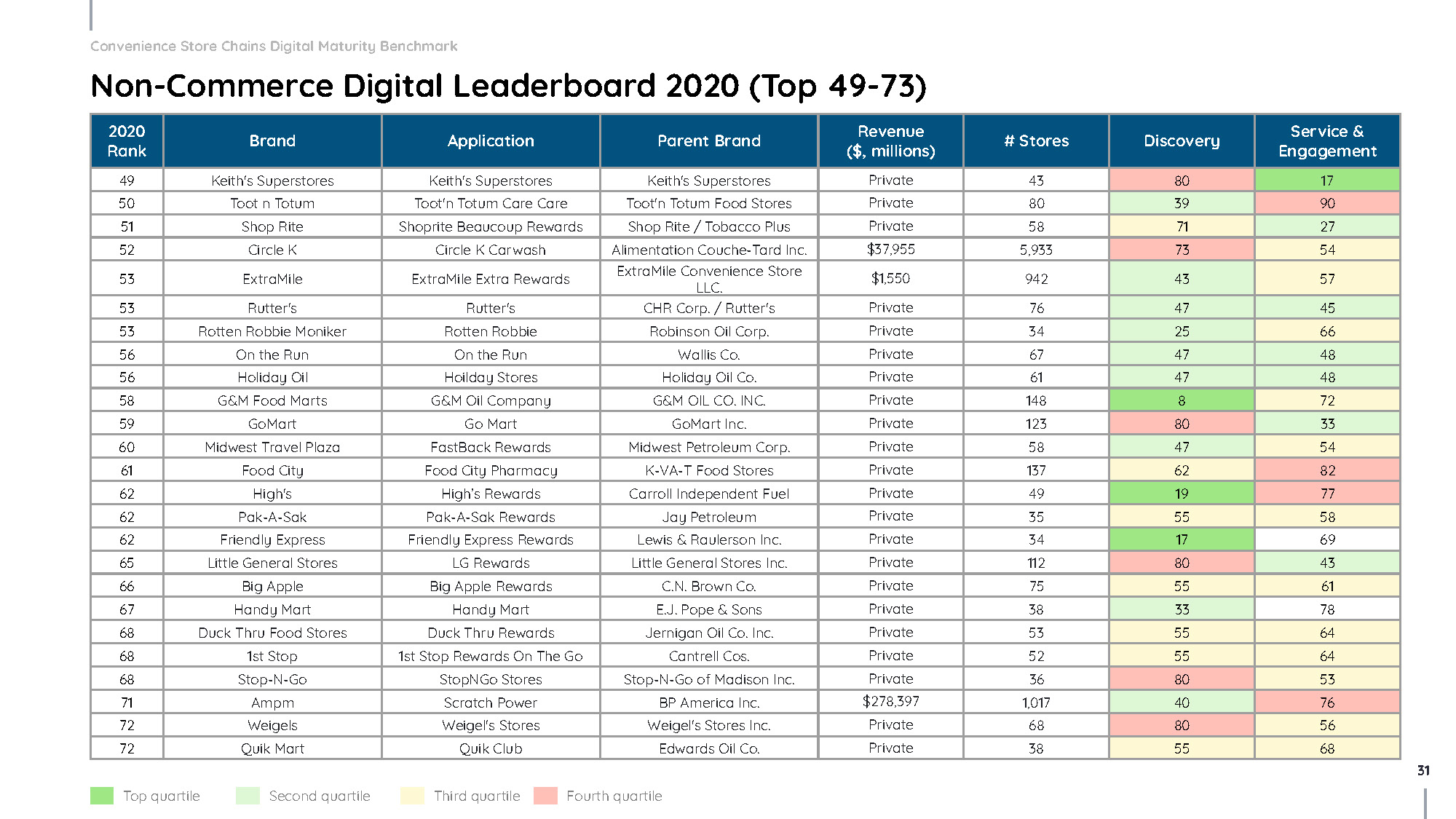

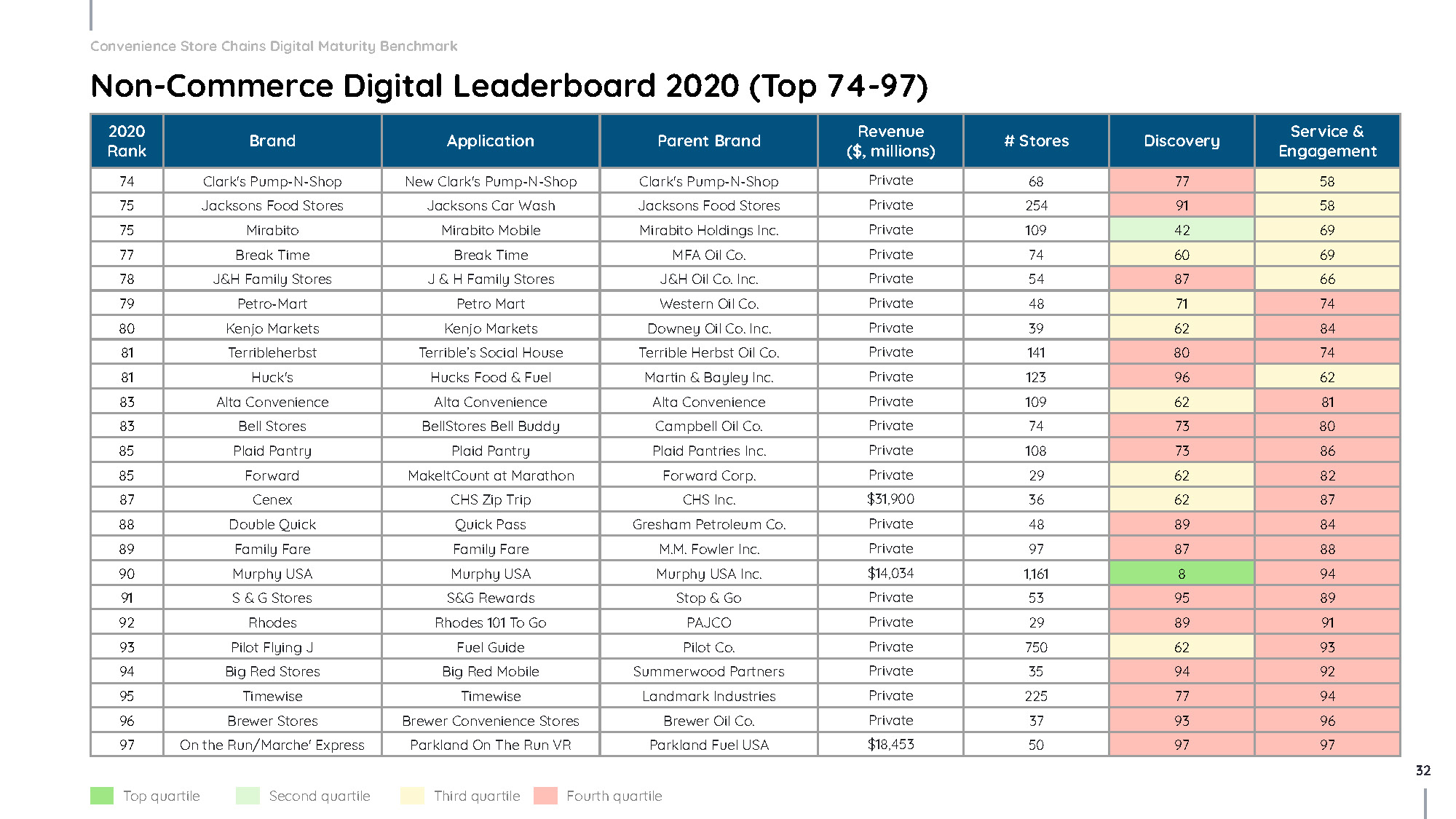

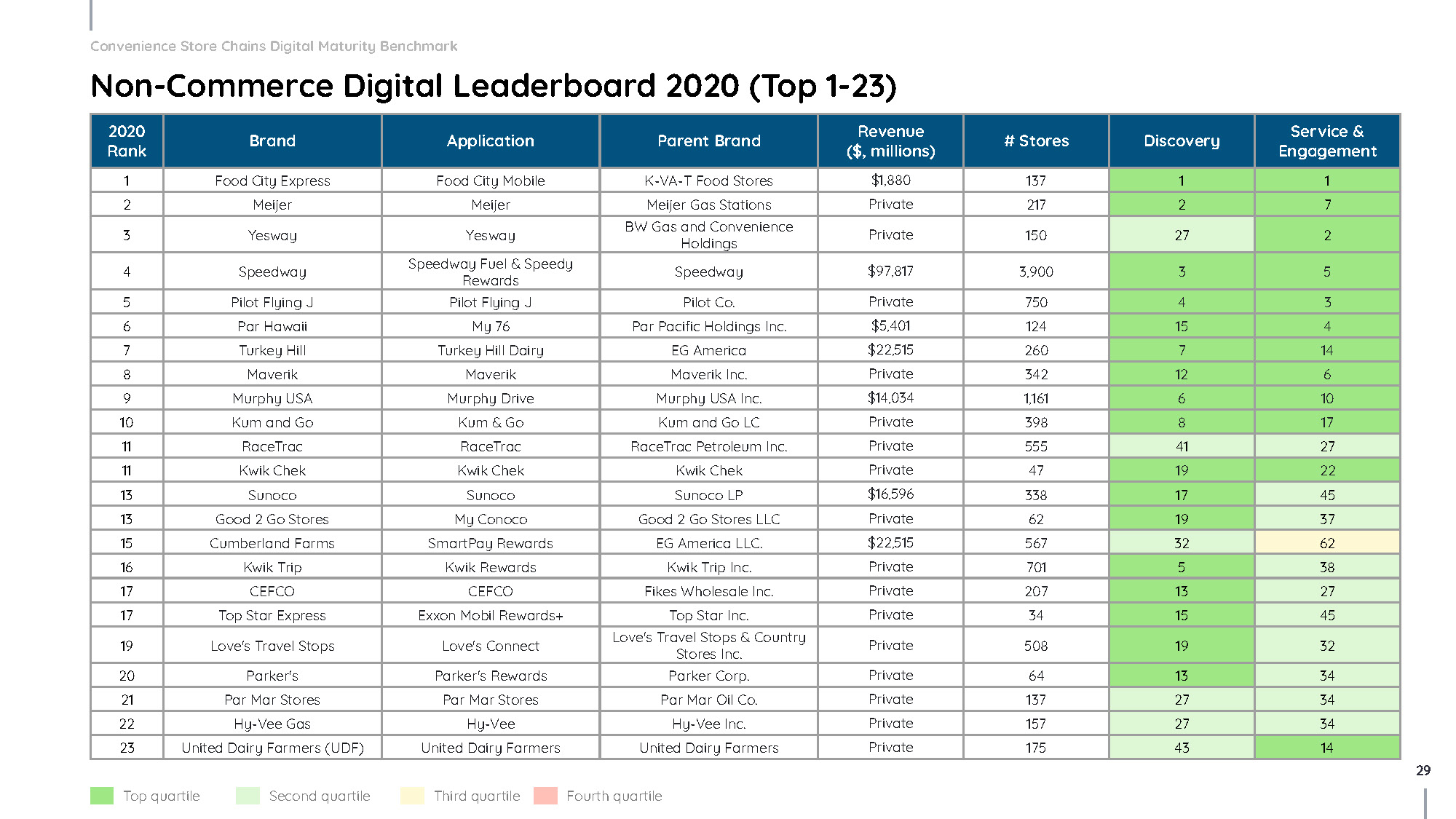

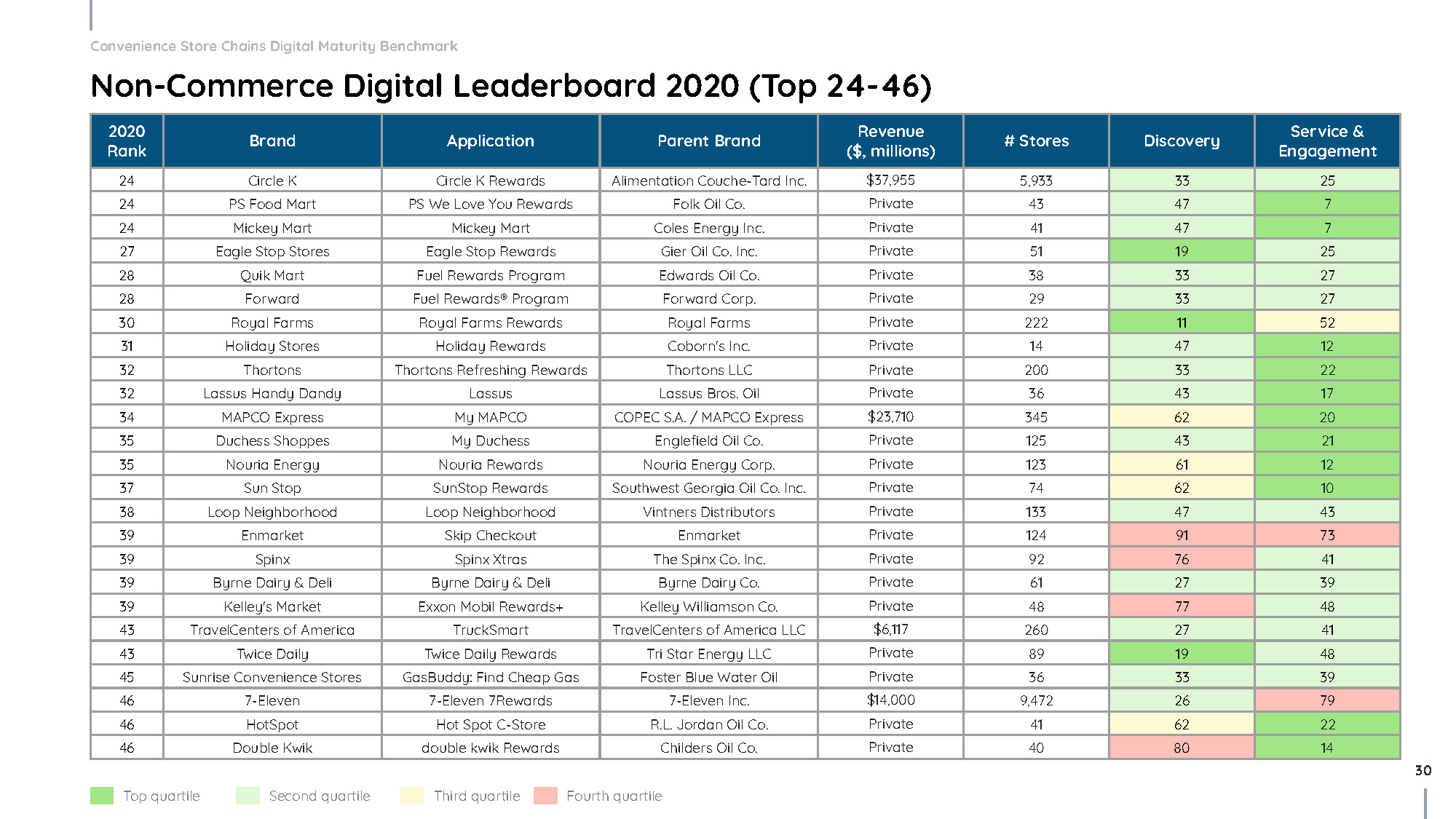

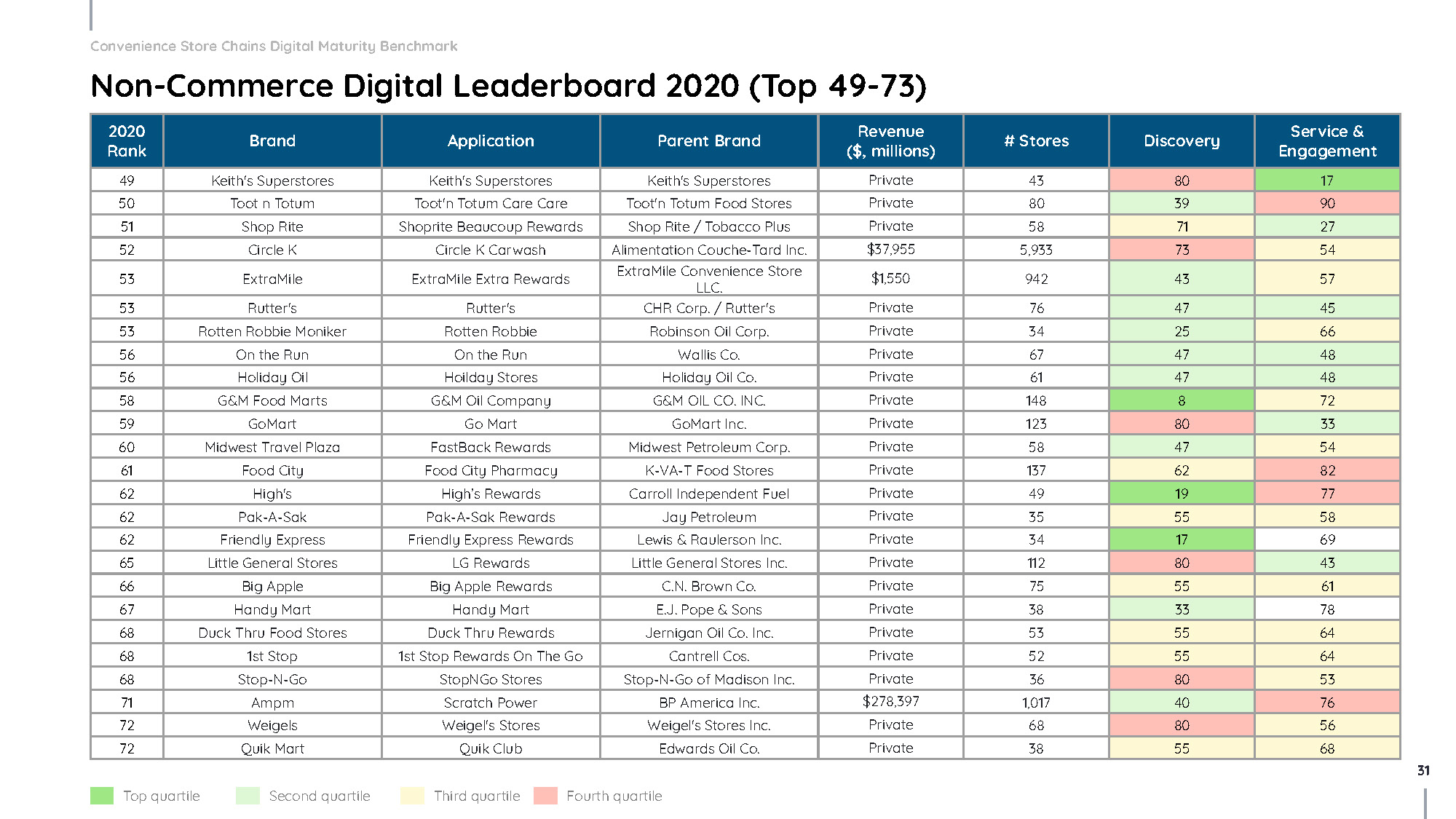

Non-Commerce

Convenience store chain mobile applications with no ordering capability but having other capabilities like rewards management, store information, coupons etc.

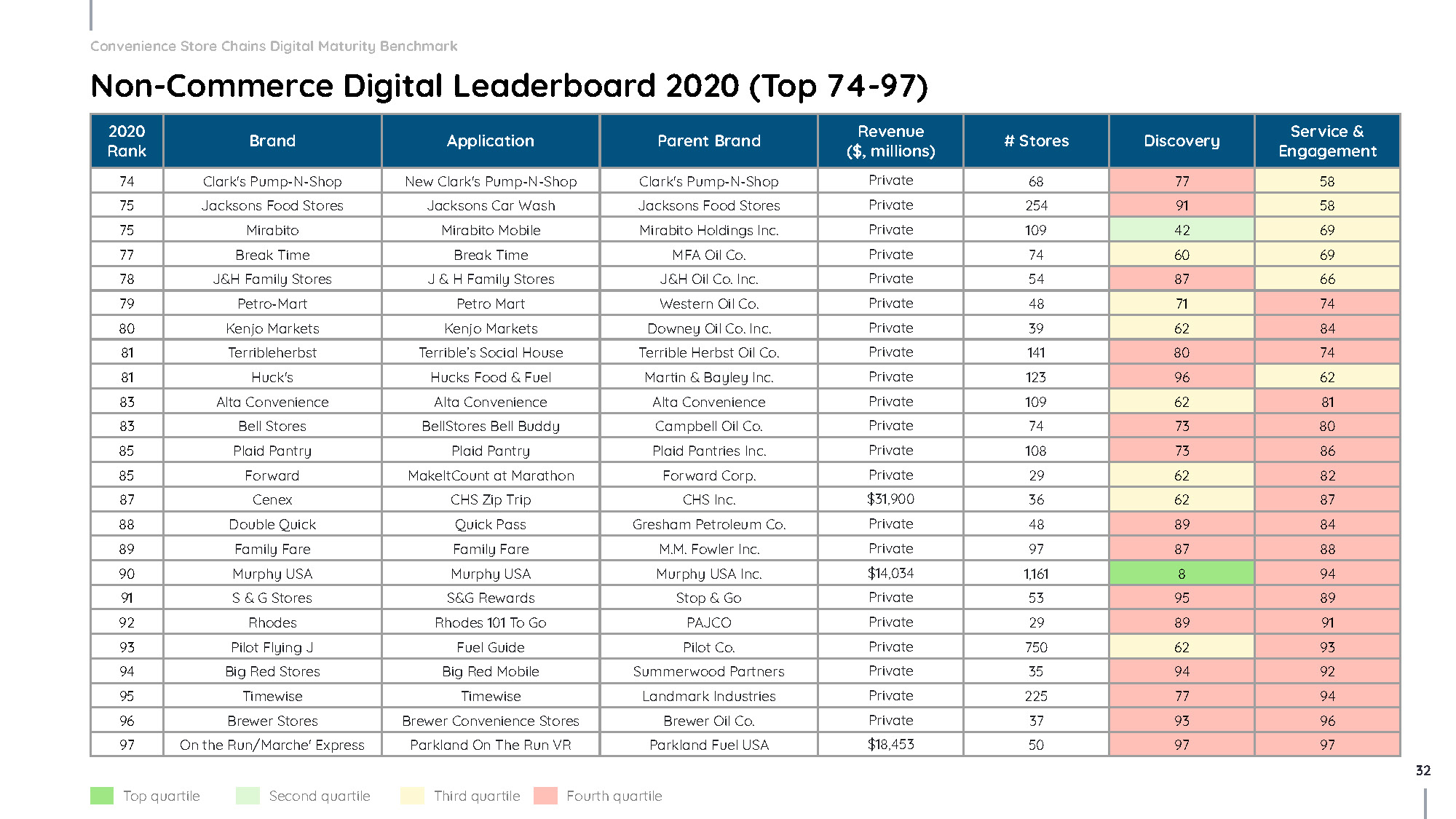

Digital Maturity Leaderboard

To view the complete top 97, download Incisiv’s Convenience Digital Maturity Benchmark, 2020. The eBook also includes top convenience chain ranks by user journey stage (e.g. Discovery, ordering, fulfillment etc.)

Here’s a preview of the report. The full report is available for free download via the form below.