State of the Industry: Retail

Digital Complexity: Thriving in Unpredictable Times

Q3, 2022

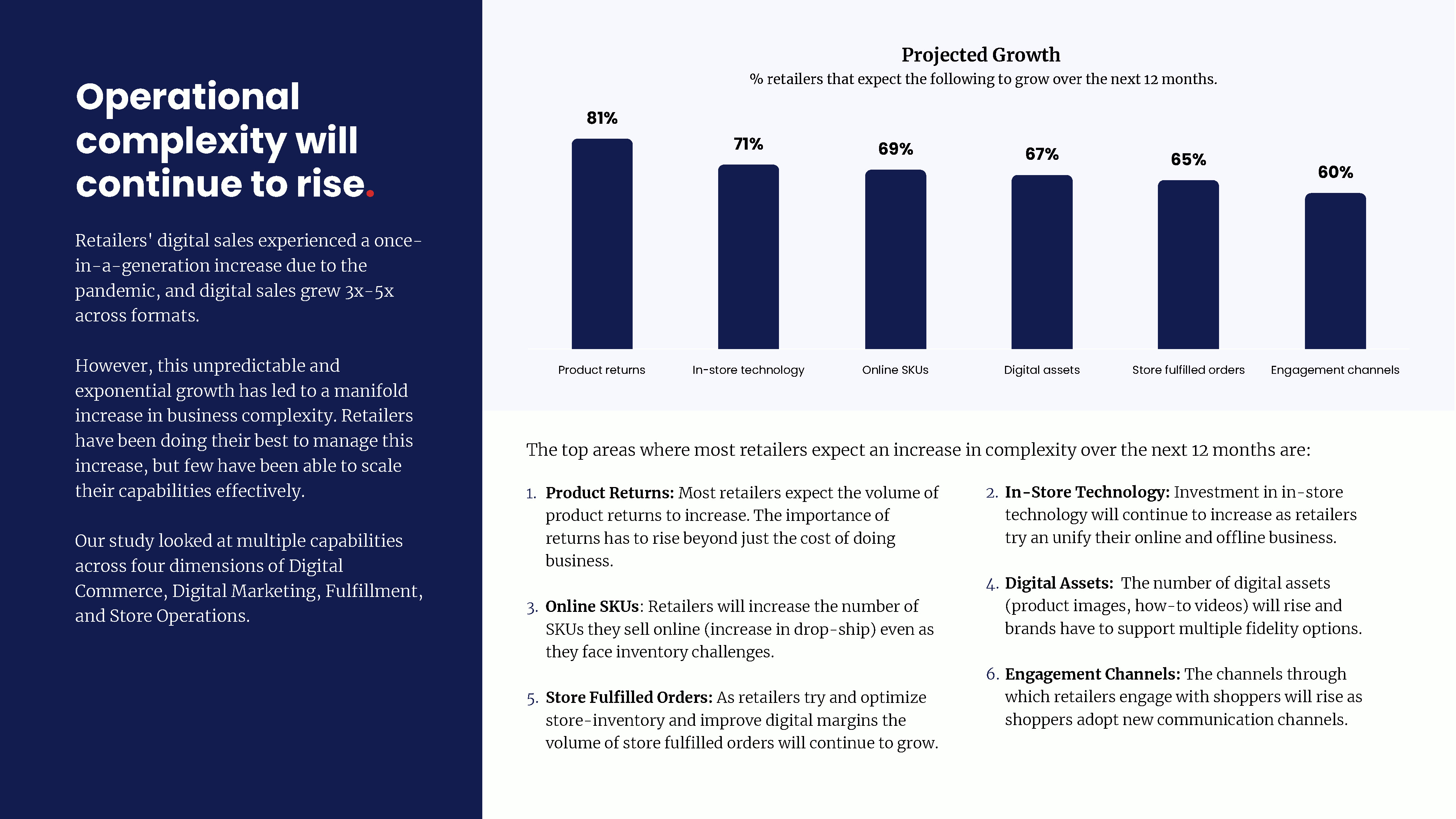

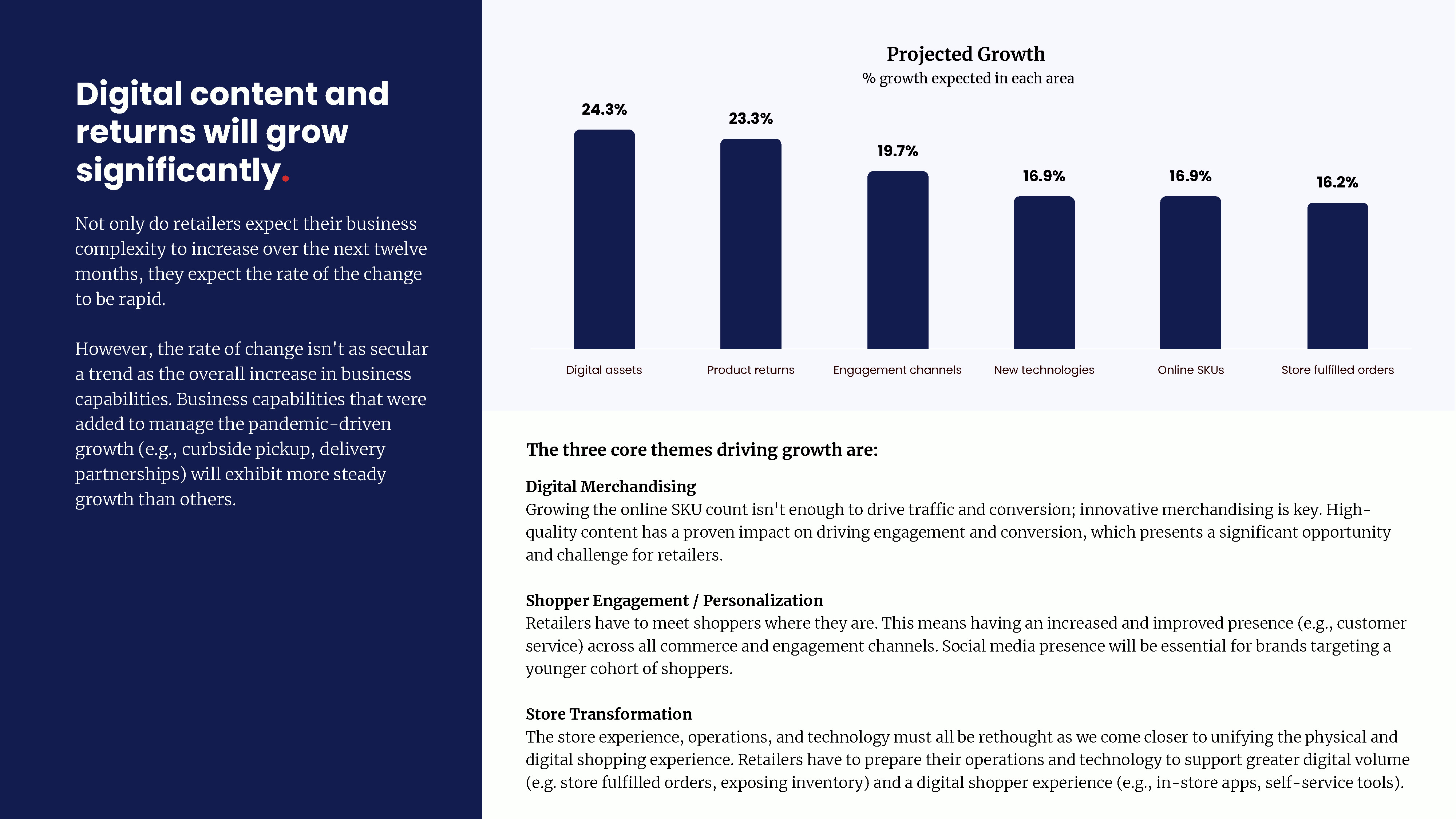

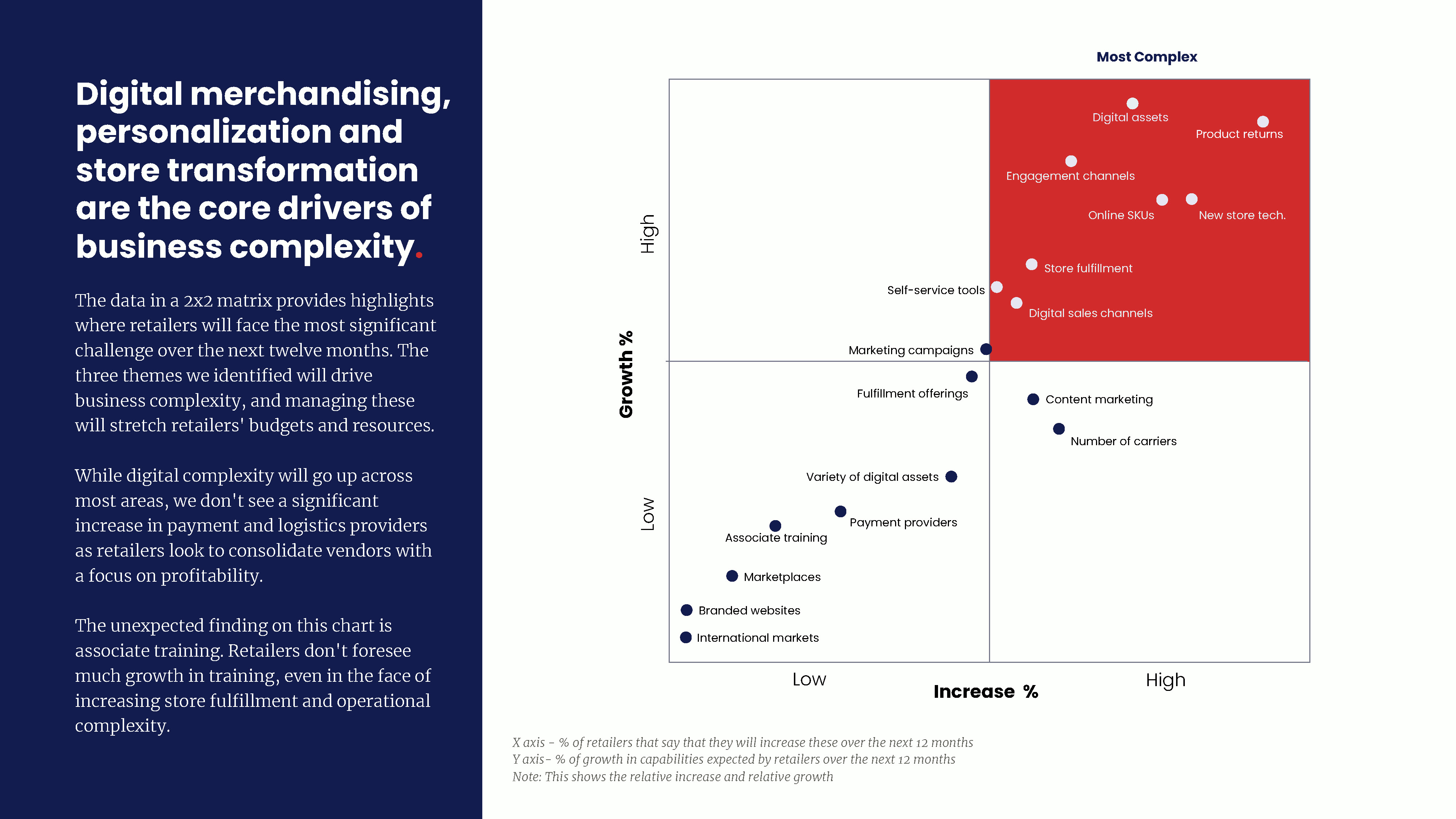

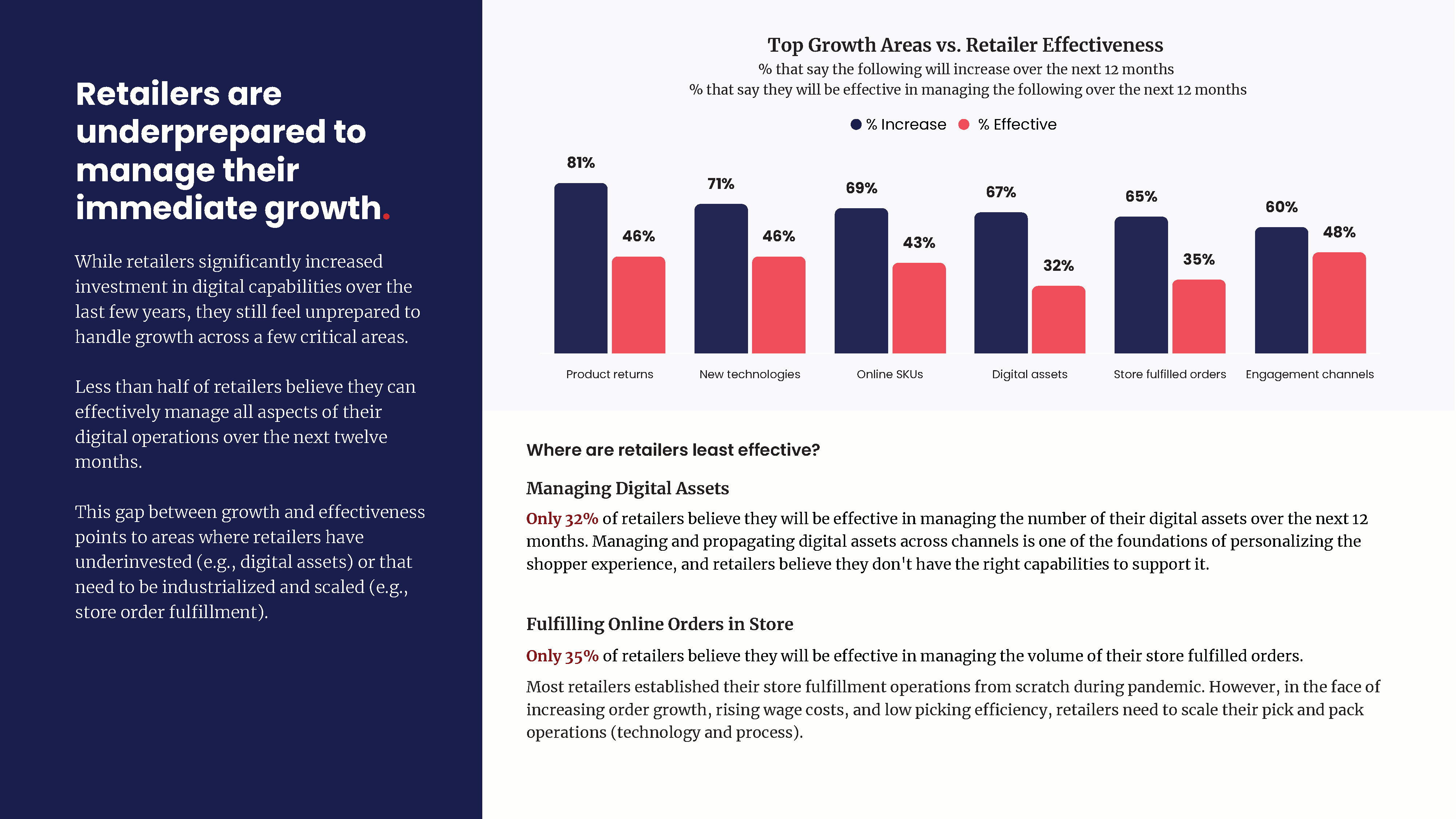

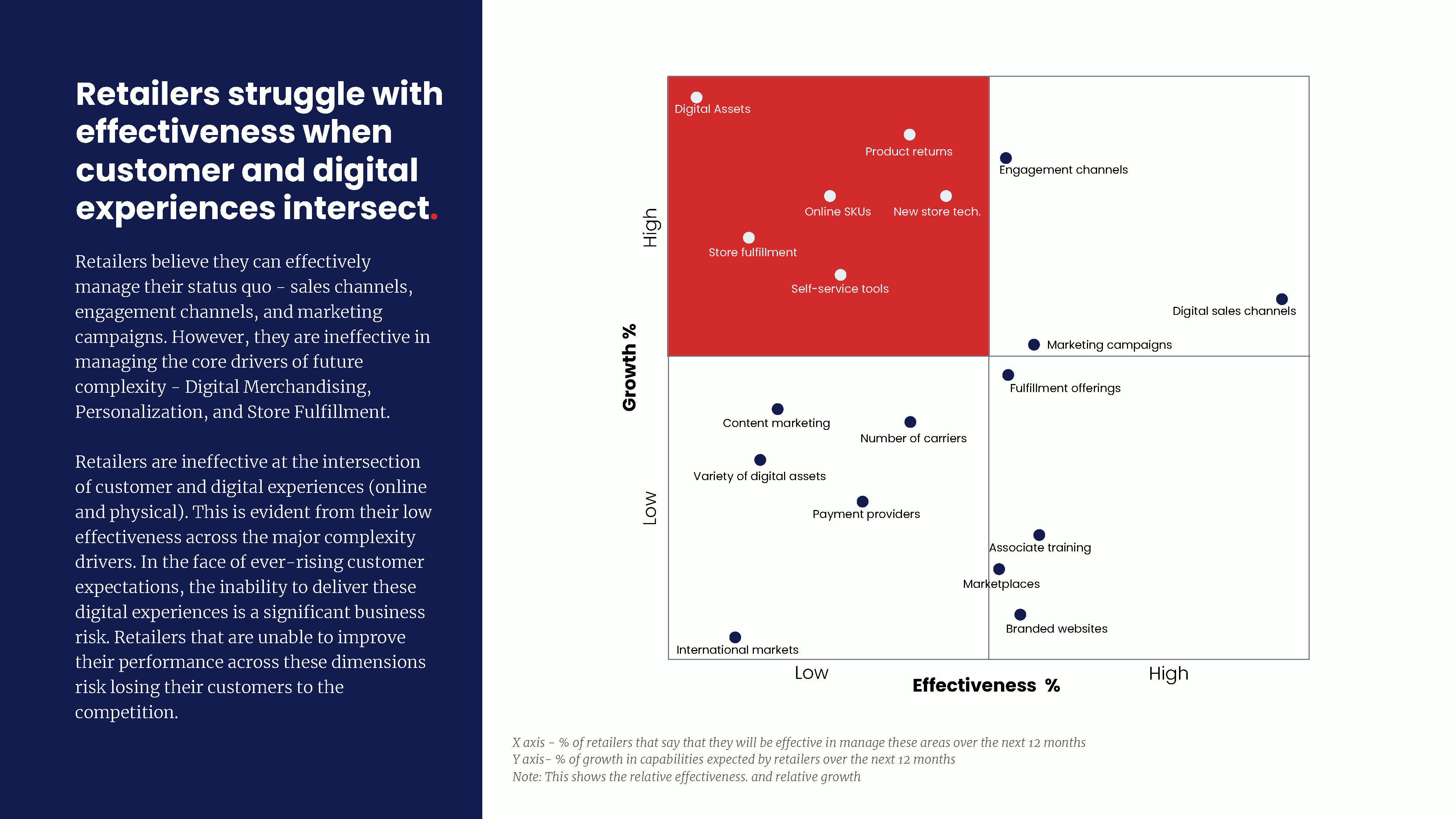

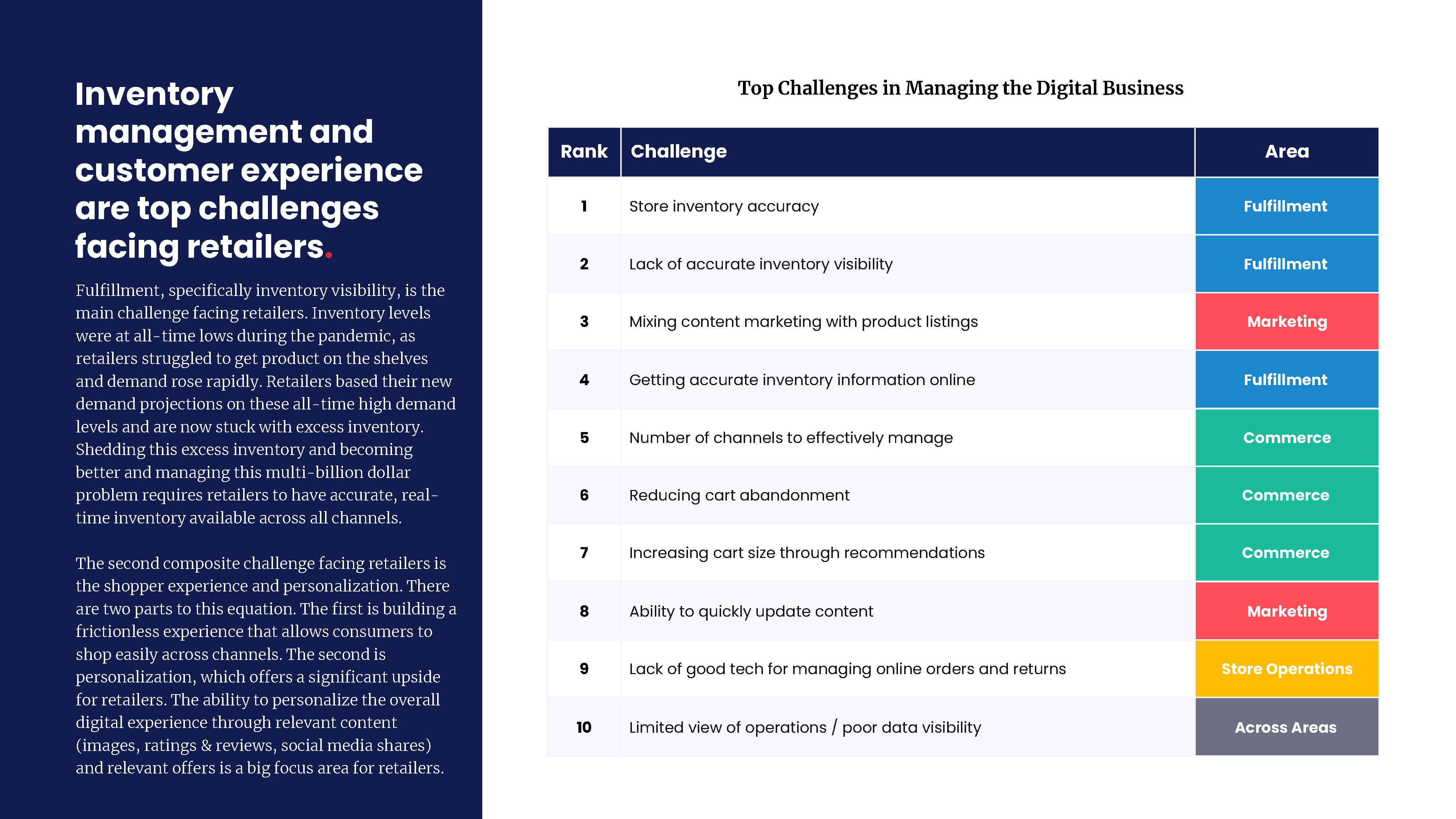

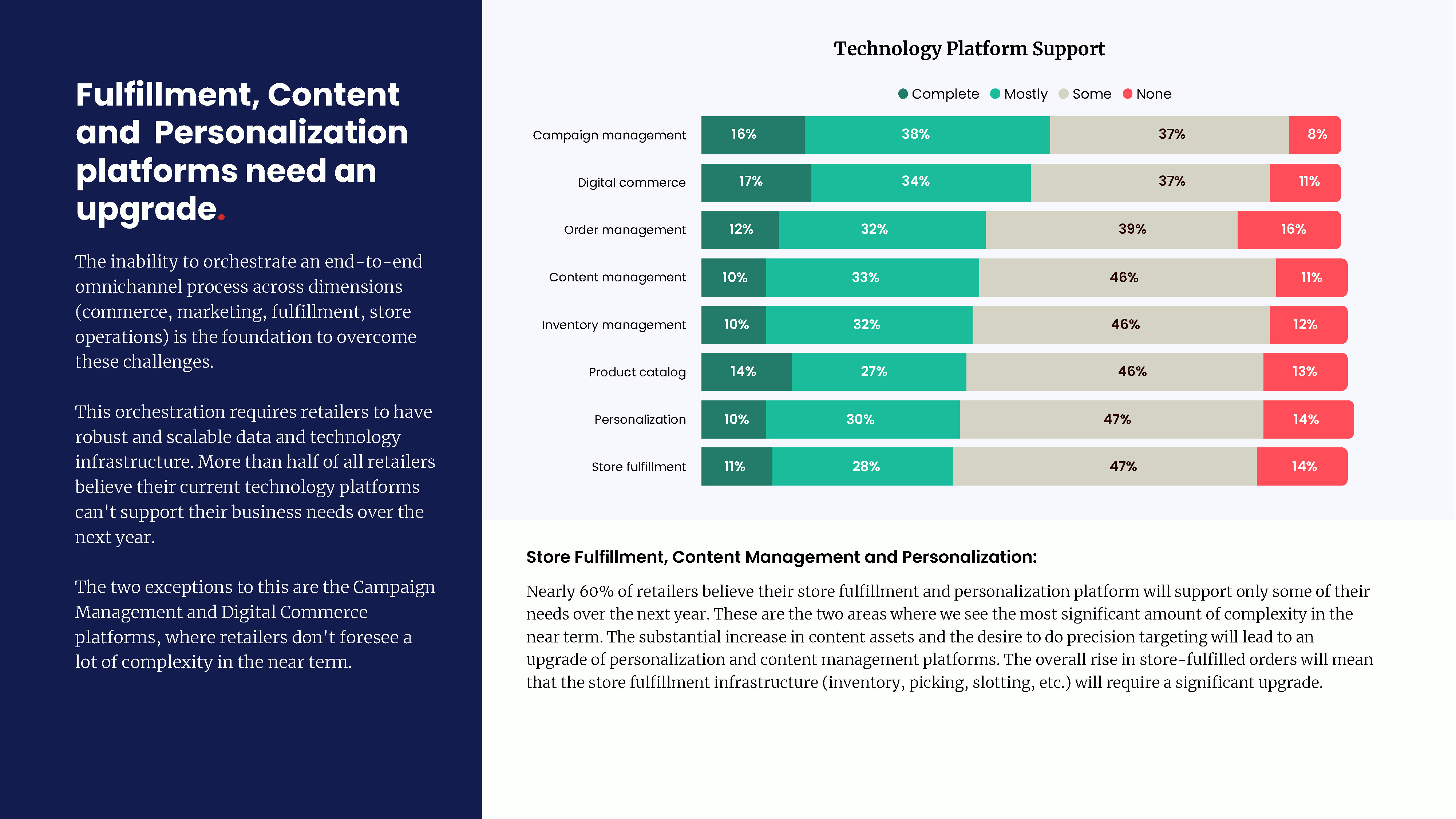

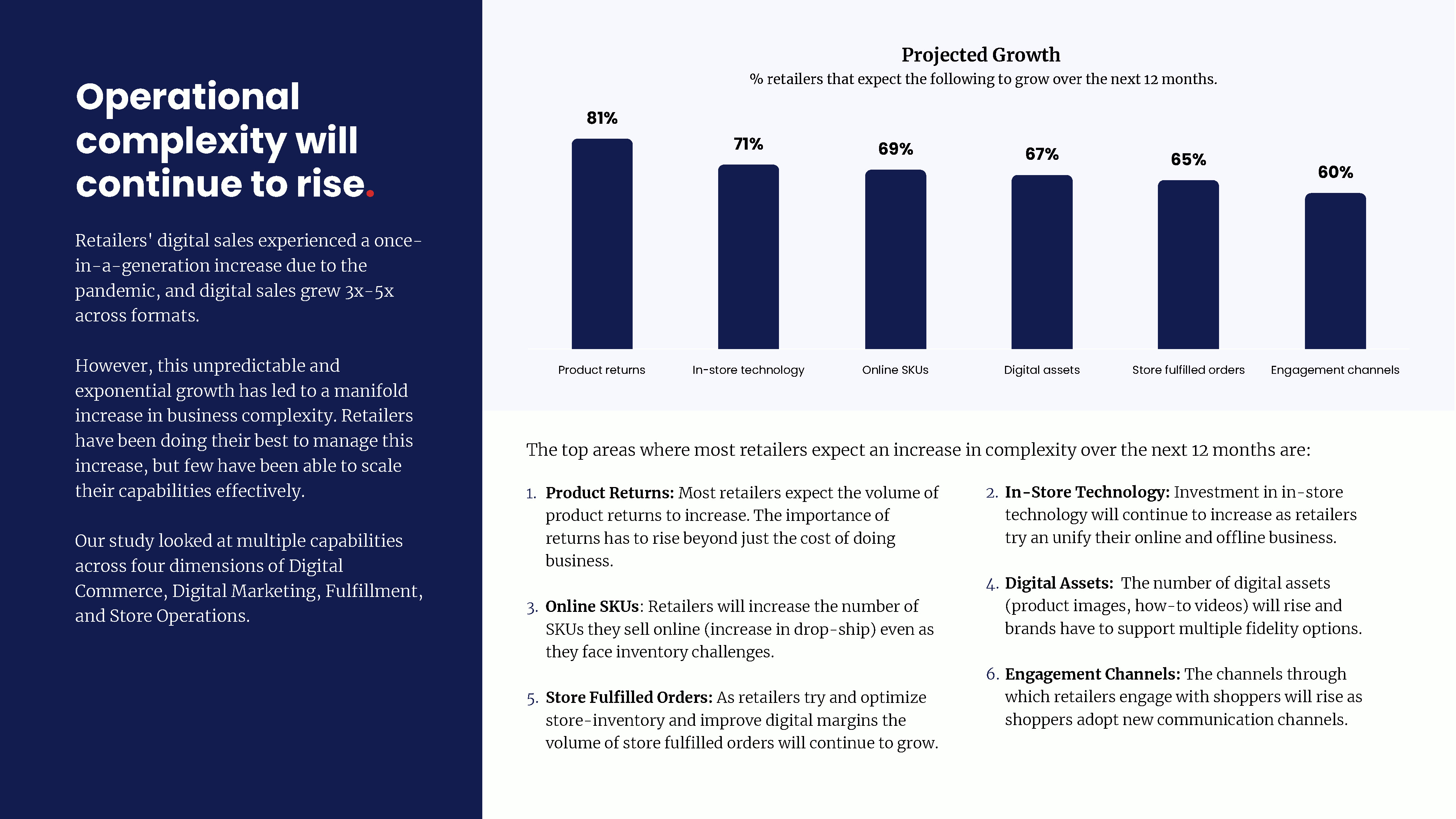

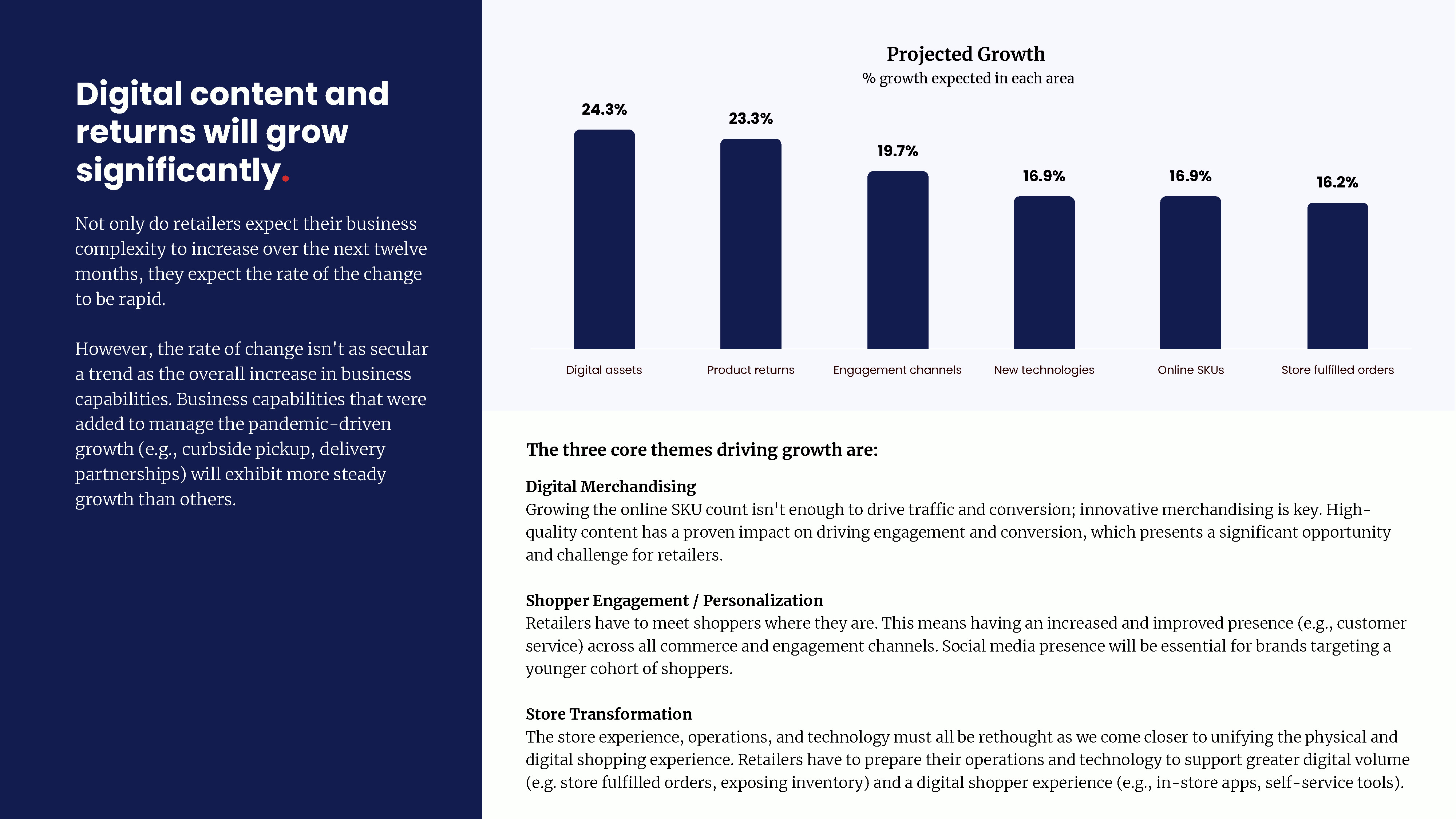

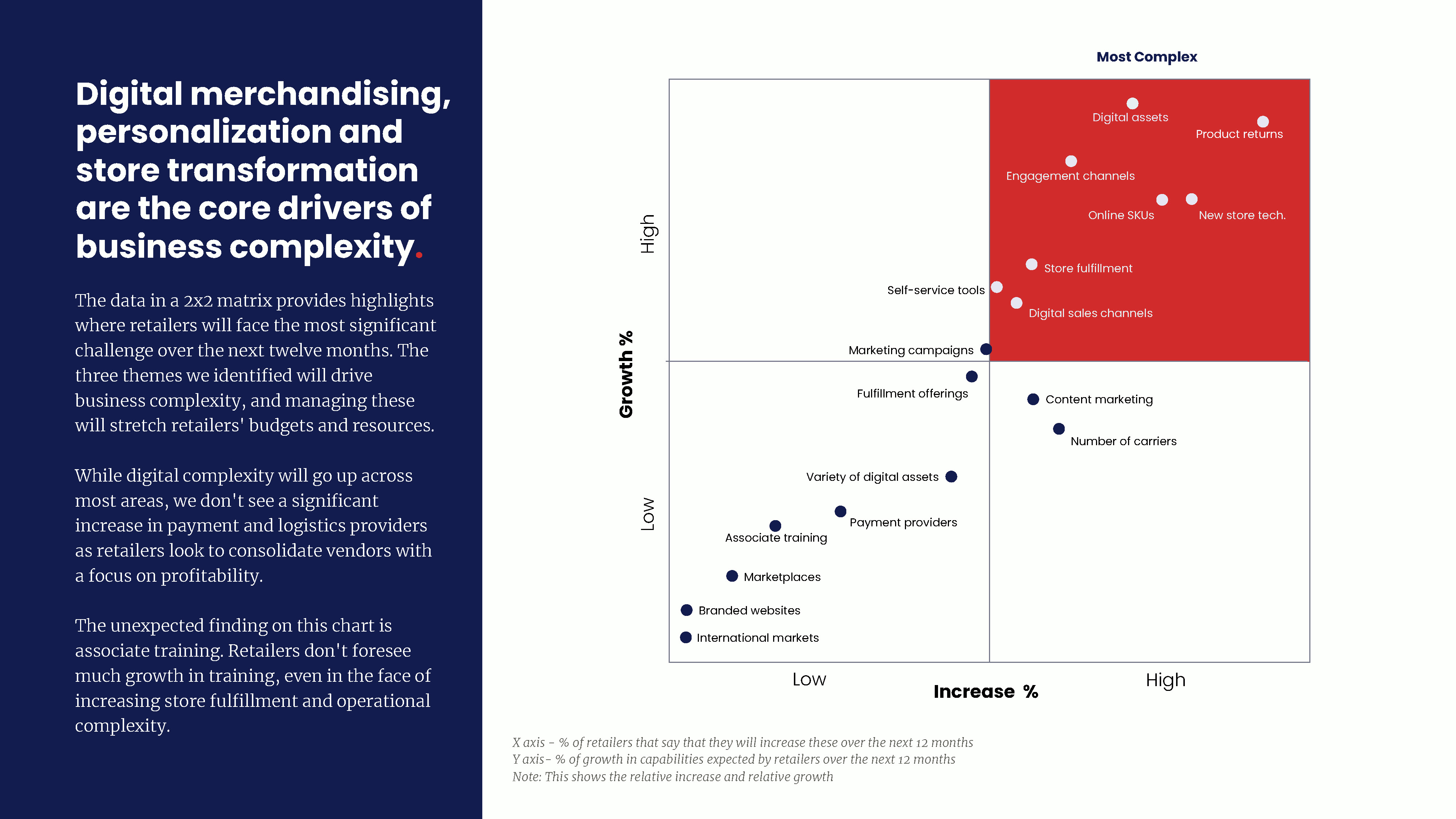

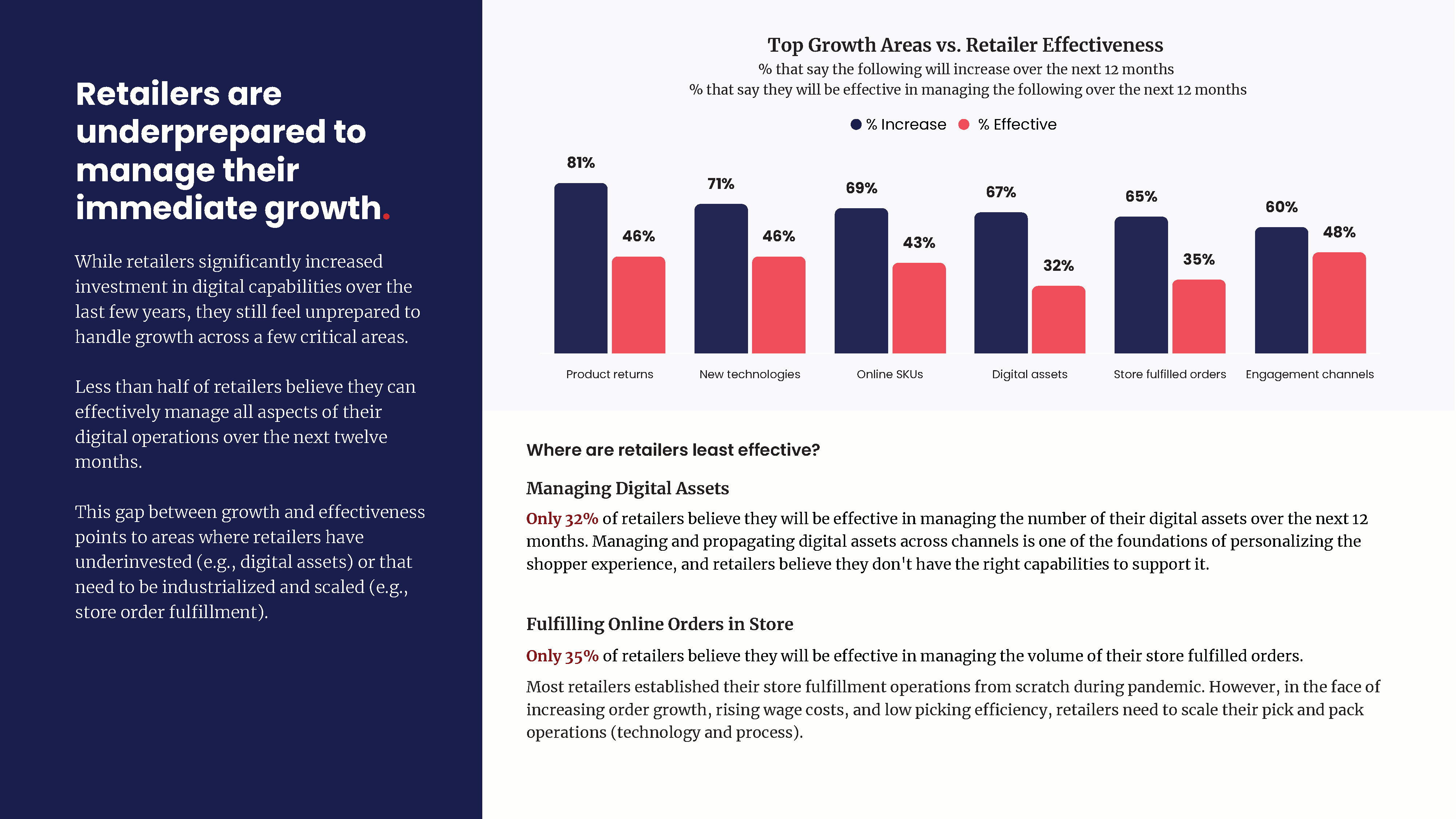

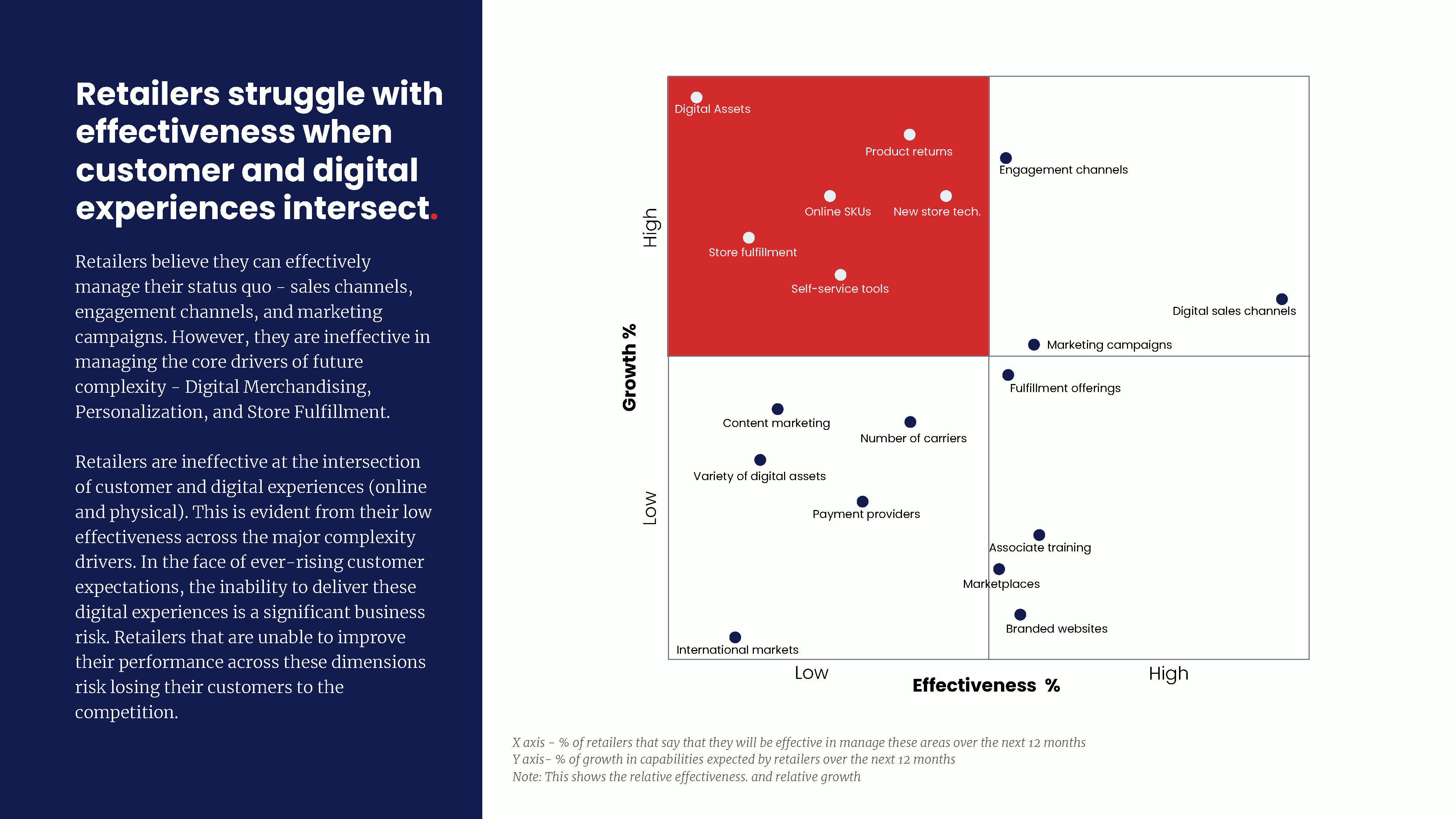

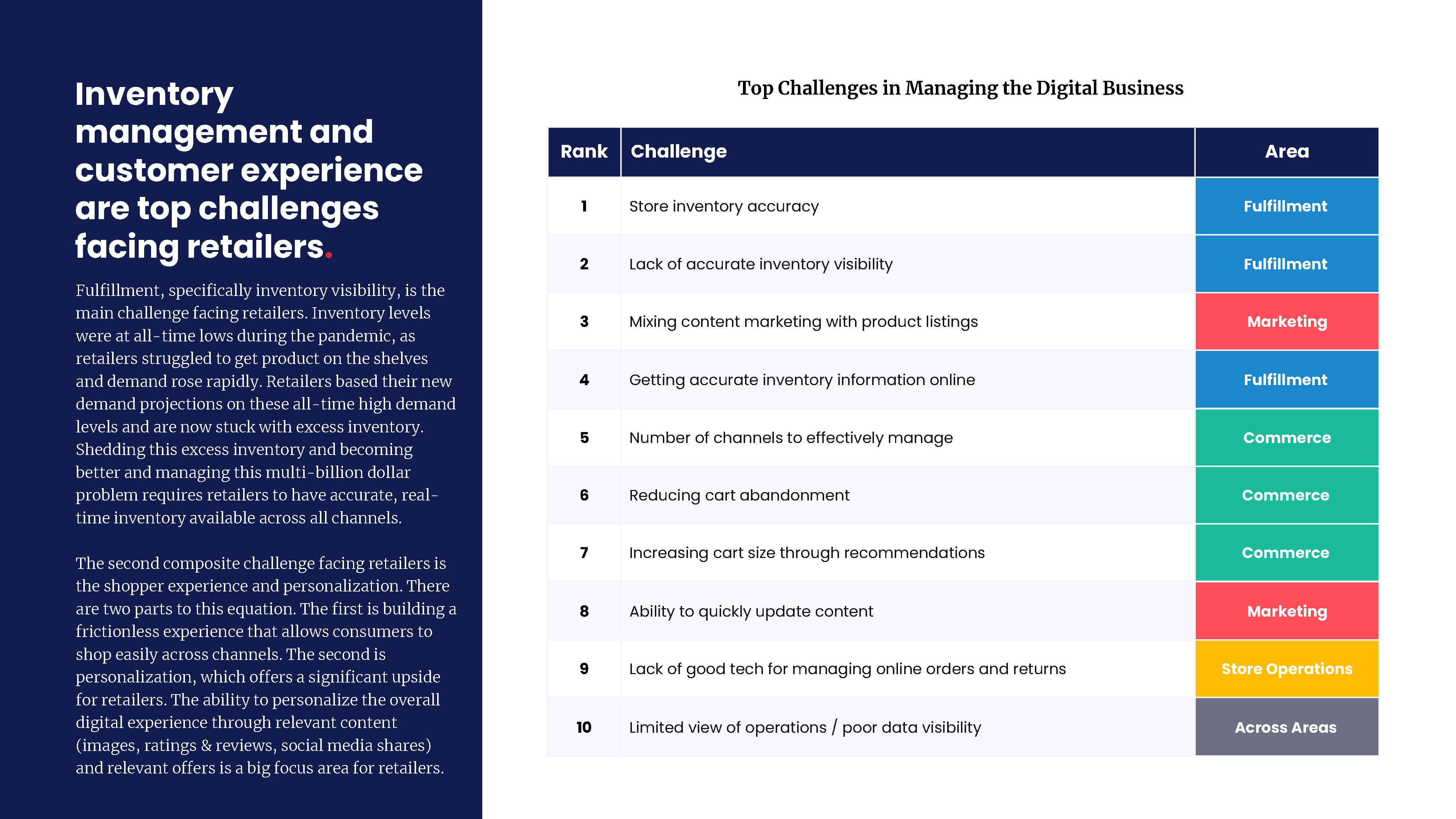

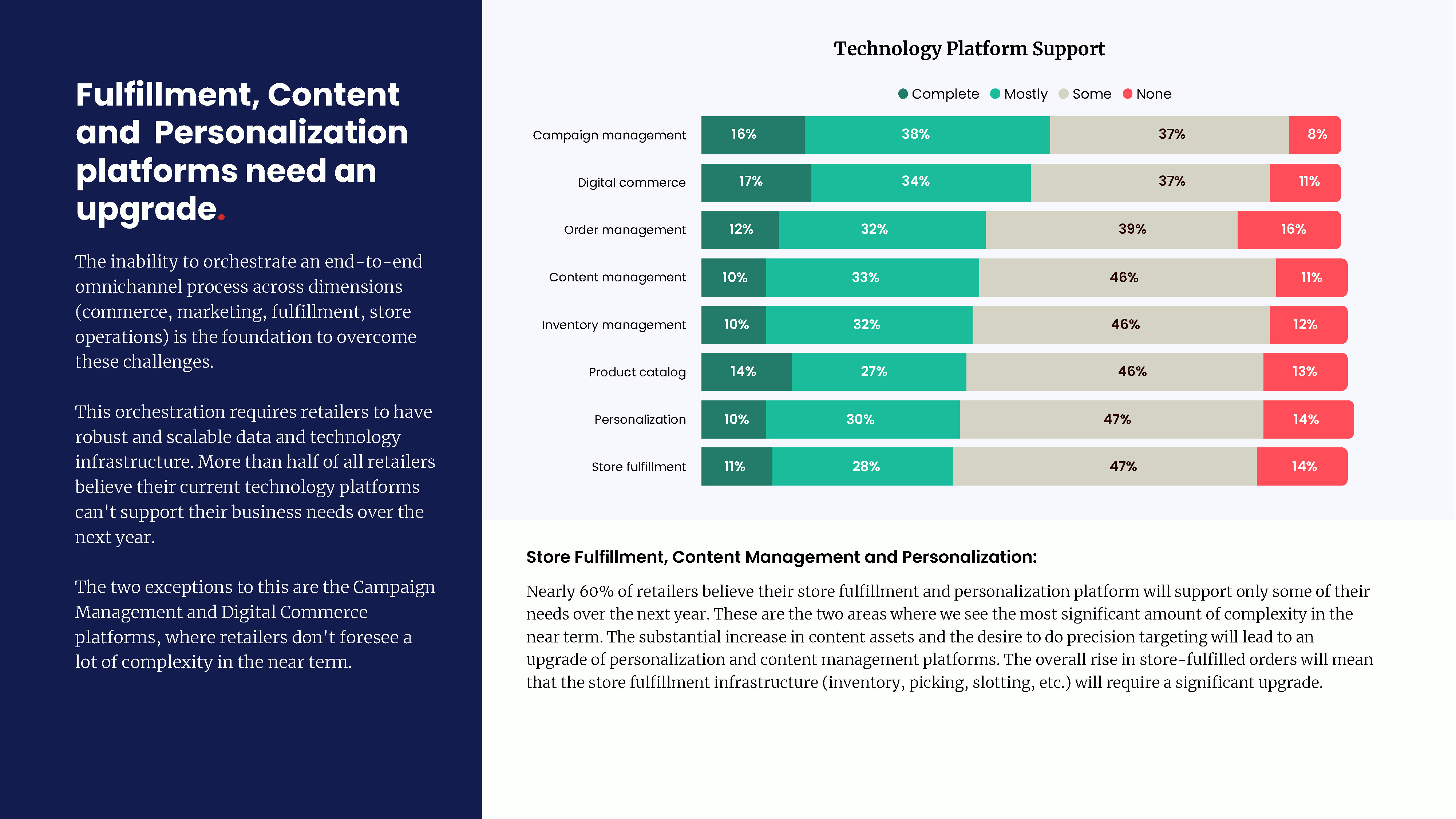

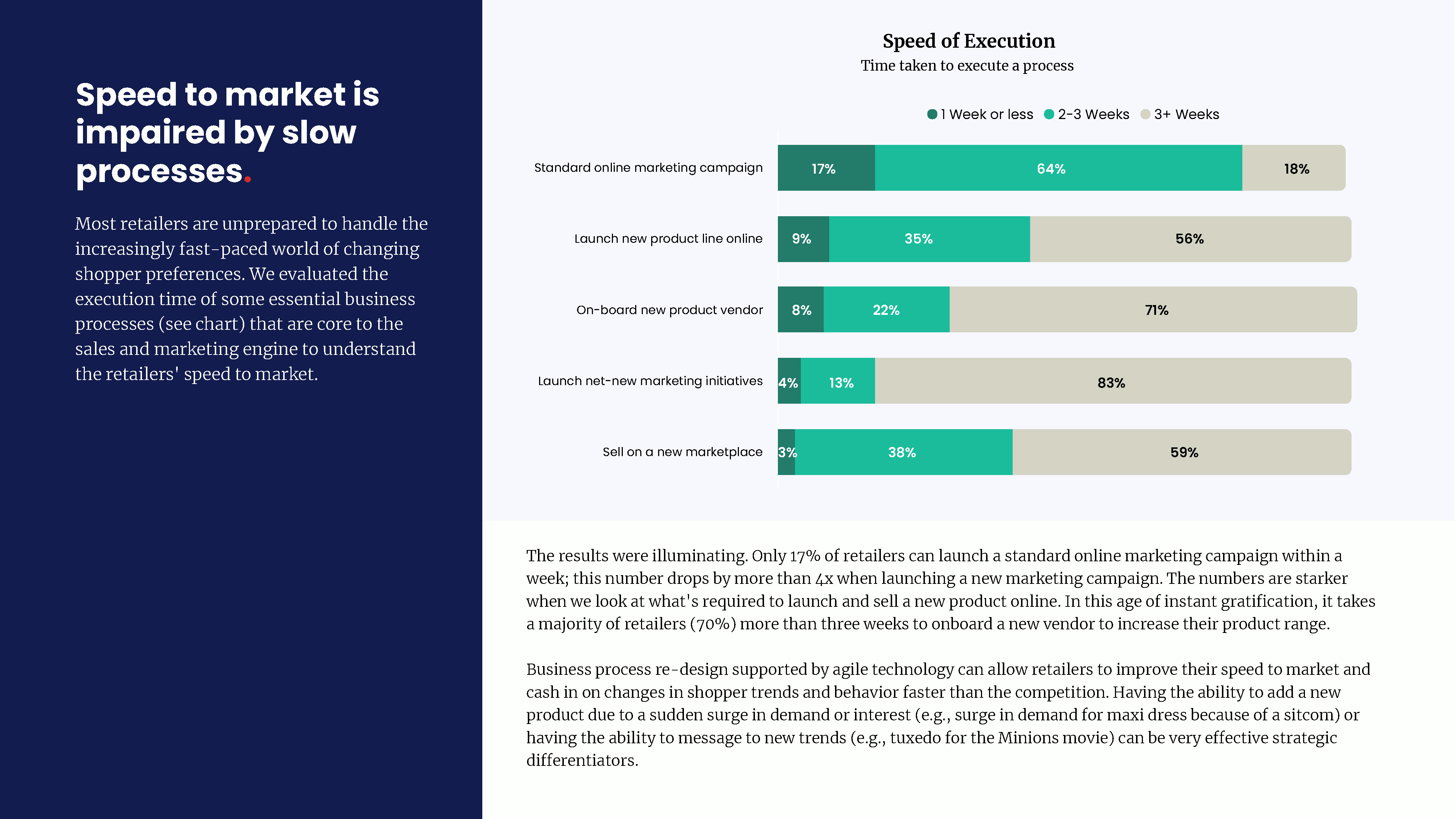

The pace and complexity of digital retail operations is rising rapidly but most brands are underprepared to deal with this rising complexity. Less than half of retailers believe they can effectively manage all aspects of their digital operations over the next twelve months. Retailers need to narrow their focus on capabilities that have the greatest impact for their business model. They need to upgrade their omnichannel capabilities, specifically in areas of digital fulfillment, content management and personalization.

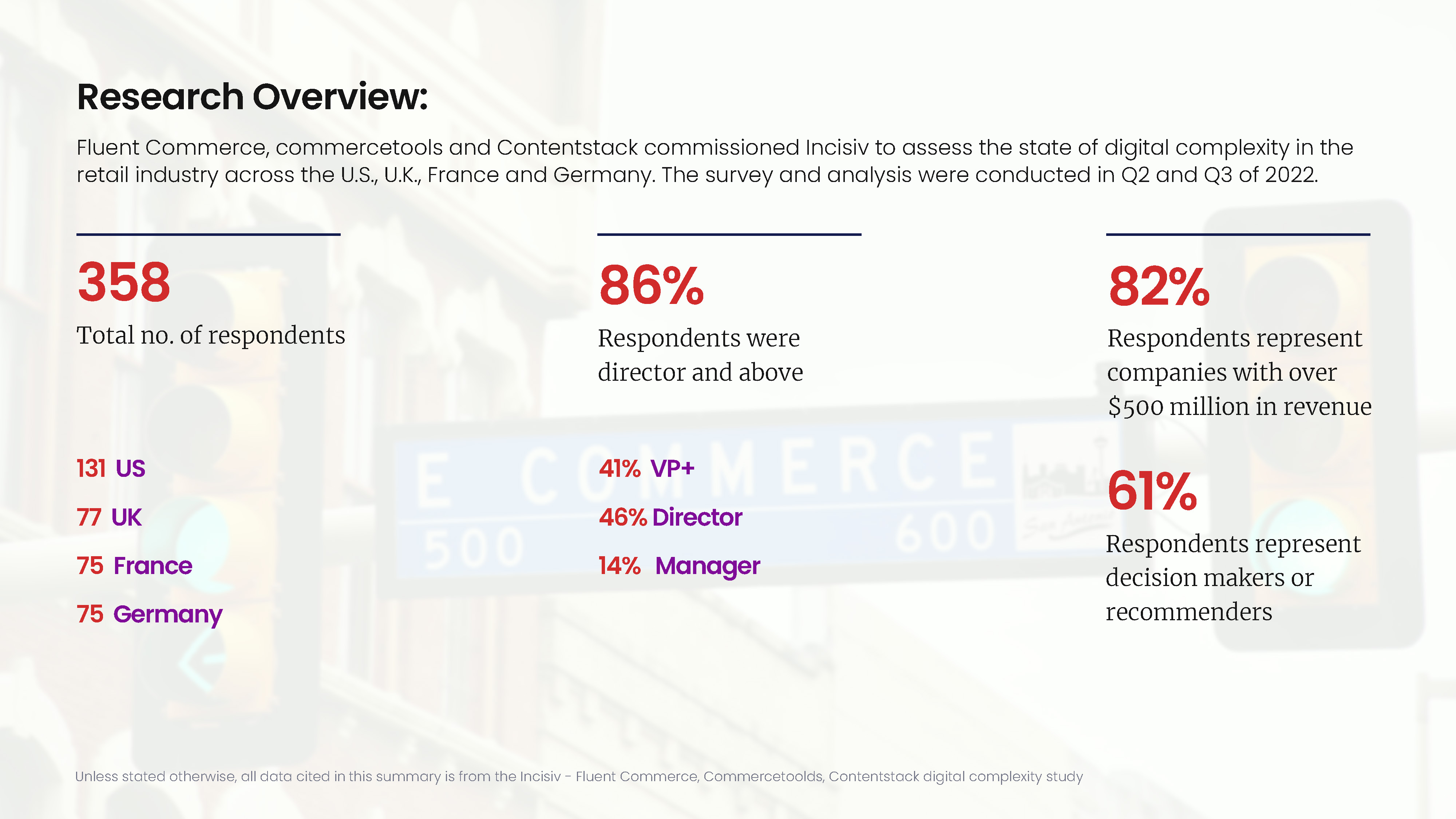

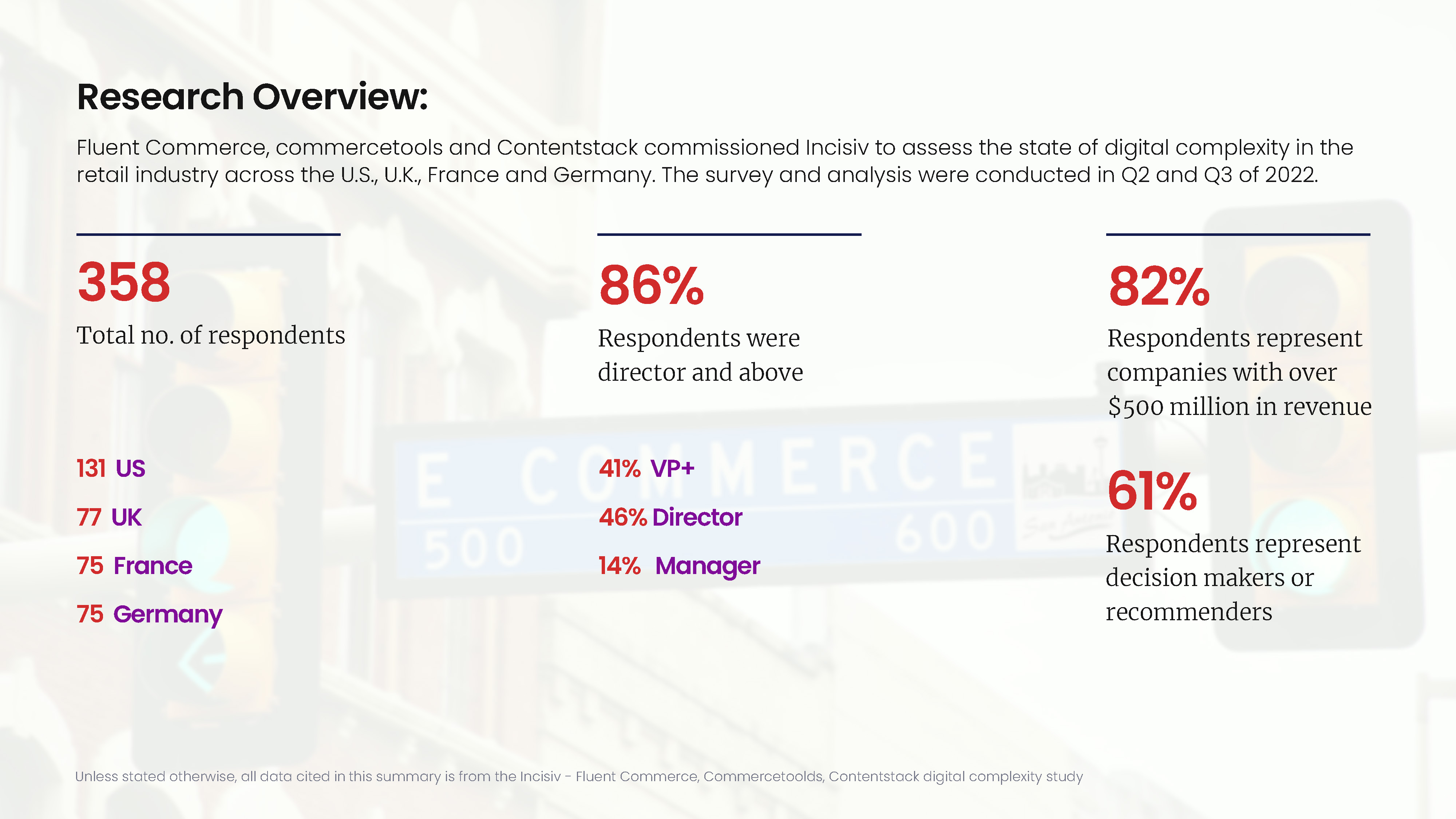

This report in collaboration with Fluent Commerce, commercetools & Contentstack assesses the state of digital complexity in the retail industry across the U.S., U.K., France & Germany.

FOUR KEY B2C COMMERCE IMPERATIVES

Incisiv

Incisiv

Here’s a preview of the report. The full report is available for free download via the form below.

As consumers continue to reshape their expectations,

enterprises must contend with a uniquely challenging landscape.

The consumer technology landscape is forever changing.

From Pinterest to TikTok, WeChat to Instagram, new experiences can rapidly gain consumer adoption and relevance.

From augmented reality to voice, smartwatches to chatbots, consumers are constantly embracing new interaction paradigms.

Commoditized convenience is eroding loyalty and margin.

Consumers expect convenience. If you can't deliver it, they'll go elsewhere - e.g. next day shipping becoming the new standard.

Walmart will reportedly lose USD 1 billion on eCommerce revenue of USD 21 billion this year as it faces challenges in its bid to complete against Amazon – from trouble integrating its DNVB acquisitions to impact on margin from its next-day delivery operations.

Consumers value experiences that are curated to fit their lives better.

They want to engage, be served, and transact at their time, their pace, their place. They have little patience, infinite choice and the freedom to swipe left at the slightest hint of friction.