Dated: June 12, 2024

Welcome to The Dirty Martini Digest, Issue #11. This newsletter is built for our technology friends to keep you informed of the latest industry data and enable you to do your job more effectively. Summer is here, so martinis and manhattans will give way to margaritas and aperol spritzes! However, the need for meaningful insights will not wane, especially in a rapidly evolving market. Enjoy this issue of the Dirty Martini Digest…!

The Dirty Details

In this issue’s ‘Dirty Details’ we are going to look at the evolving role of the Store Associate. We know the role of Stores has evolved dramatically in the last 36 months and lessons learned when stores were shuttered have reverberated and remain relevant today. The unification of store and online requires that associates have a far more holistic view of customers, inventory and operations. Retailers cannot unify the customer experience without first assuring the associate experience is cohesive and comprehensive.

In our latest report, Reimagining Store Operations: Unifying the Associate Experience produced in conjunction with Manhattan, we present a comprehensive framework in a playbook format that details how store associates can integrate customer, inventory, product, and operational information into a unified platform.

Some of the key findings from the Report include:

- When it comes to providing a unified customer profile, 71% of retailers equip their associates to review comprehensive order history for enhanced customer insights. However only 13% of retailers enable associates to interact with or make updates to customers' carts or wishlists in real-time.

- When it comes to building unified relationships, 59% of retailers enable their associates to use customizable communication tools for targeted outreach and clienteling but only 14% equip associates to access real-time customer data and make instant recommendations using mobile technology.

- On the unified selling front, 34% of retailers provide tools for associates to customize promotions for individual customers during interactions. However, only 8% equip their associates with technologies to adapt payment and selling options for customers with varying levels of digital access or literacy.

- For unified operations, only 43% of retailers provide quick access to product information, inventory levels, and order management.

Dive deeper into our cross-industry research and content

- The Future of In-Restaurant Dining. This report, our third annual with Toshiba Global Commerce Solutions, outlines a strategic approach for leveraging modern technology to elevate the dining experience. It emphasizes the need for the industry to blend tradition with innovation to meet changing consumer demands. It also details a redefinition of convenience that extends beyond simple meal provision to creating memorable, engaging, and health-conscious dining experiences.

- April 2024 State of Digital in Grocery Scorecard - This report, published on our Grocery Doppio Site, details some of the latest trends in digital adoption in Grocery. The data includes the latest on the hottest trend; media networks; and details on digital sales, basket size, and percentage of sales from third-party platforms. We update this data monthly, so bookmark this page if you have a grocery or convenience target market!

- The Changing Landscape of Restaurant Customer Acquisition & Loyalty - This blog details the pioneering approaches centered on digital engagement and personalized experiences that are revolutionizing the restaurant landscape. It unveils key strategies aimed at elevating digital ordering and fostering customer acquisition and loyalty in the restaurant industry.

Straight from the Shaker

Get practical insights and best practices straight from our industry experts as we shake up and serve up our knowledge to help you improve your go-to-market strategies. We share tips each month to help you stay ahead of the game.

This month we’re going to cover an issue that has come up in several of our recent conversations - The Campaign. As a firm that does strategy and research for primarily tech and services firms, we always encourage our clients to look at content or research from a campaign perspective. What does this mean? Let’s have a look at what we see all the time:

- A demand gen marketer is tasked with generating interest around a particular solution. They go to product marketing or go to a third party and commission a content asset describing the value of said solution. That asset is created and then promoted via email/social or a third-party media player for ‘downloads’. Is that a campaign? No.

We recommend:

- If tasked with generating interest around a particular solution, understand the key buyer profiles and key segments that are most likely to have interest in said solution. From this, set a plan for tonality, key terms that may be unique to that profile or segment and get firm handle on pain points for that ICP.

- In creating the asset set a plan for what derivative content can be created from it and build a calendar for that derivative content. Buyers almost never take action from one touch. Sending a download to a BDR team after a single touch rarely works. If the asset is research, make sure you have license to the data as this creates a rich source by which to create derivative content. Derivative content can include a follow on ebook with SME narrative, infographics, blogs, podcasts, etc.

- Understand what other marketers in your organization are working on. Is there an event that the group is attending where you can time the release of the asset around and build interest/PR? Is there a partner marketing person that would gain value by including that partner in the campaign where you can amplify reach?

- Once you’ve collected this information, you can effectively build a campaign that can add value to the life of a core asset as well as better your chances for a more meaningful engagement with a prospect. Document the plan so you have a roadmap to implement - if you’re being measured by MQLs and you want to deliver ‘leads’ after one touch, push back and suggest you want to further qualify that person to better the firm’s chances for success. It will pay off in the long run.

On the House

Sip on our team's latest research, speaking sessions, and industry news, with a quick scan of our recently published and upcoming work and key takeaways.

- Maximizing Retail Trade Shows We’ve partnered with Rethink Retail and The Ketner Group to produce a summer webinar detailing strategies to implement to maximize your effectiveness at trade events. With the money spent at these events, it is critical to amplify your presence and implement strategies to ensure ROI. We’ll cover:

- Pre-event content strategies to generate awareness.

- Benefits of capturing content at events.

- Key considerations for planning a hosted event.

- Strategies for developing strategic messaging utilizing press announcements and marketing campaigns.

- Methods for distributing content and sharing with the media and analysts.

- Tips for leveraging media briefings and engaging strategies to make meaningful connections during and after the show.

- The Retail Razor Podcast - The Future of Commerce is Unified Commerce. Our own Giri Agarwal joins this popular retail podcast to explore the concept of unified commerce, the integration of AI, and the challenges retailers face in adopting this approach. Key highlights include the importance of customer identification, empowering frontline staff, and rethinking store experiences.

Art on the Rocks

Experience the intersection of technology and creativity each month as we use artificial intelligence to generate a unique art piece that explores a key industry topic.

This image comes from our AI in Grocery event page. Applications for AI in the grocery space are moving at a lightning speed. Tune in next week to hear what the industry is doing with AI.

Second Round

Expand your industry knowledge with our recommended reading, featuring insightful articles and resources that caught our attention this month..

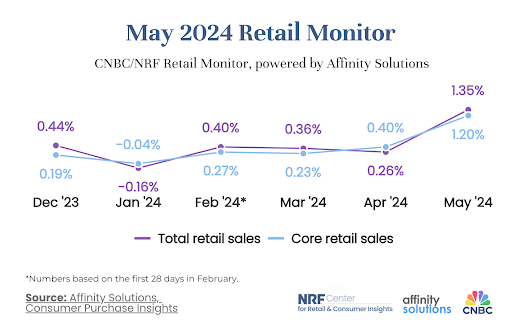

- Retail sales somehow continue to defy expectations. Total retail sales, excluding automobiles and gasoline, were up 1.35% seasonally adjusted month over month and up 3.03% unadjusted year over year in May, according to the Retail Monitor. That compared with an increase of 0.26% month over month and a decrease of 0.6% year over year in April.

----

We're here to help you navigate through your biggest challenges and win in this highly competitive market. Anytime you want to talk, book a meeting.

Newsletter Dated: Feb 14, 2023

Does Innovation Still Matter in Retail?

State of the Industry - Innovation in Retail - Key Takeaways.

- Innovation Leaders Far Outperform Their Peers in Revenue Growth

Retailers who are leaders in innovation have a 3-year revenue CAGR of 6.2%, whereas non-leaders have a 3-year revenue CAGR of 0.7%. - Importance of Innovation Recognized but Not Always Practiced:

Despite the majority of retailers recognizing the critical importance of innovation for future growth, only 22% actively encouraged and rewarded risk-taking and experimentation within their organizations. - Innovation Priorities are Focused around Operations:

Retailers' operations-focused innovation priorities are centered around foundational capabilities such as inventory visibility, with 76% of retailers either scaling or exploring innovation initiatives in this area. - Leading Retailers Also Focus on Leveraging Innovation to Drive Customer Experience:

Leading retailers are focusing on utilizing the intelligence gained from inventory data to create better customer experiences. For instance, 65% are scaling or exploring initiatives to help them provide narrower and more accurate delivery estimates to shoppers. - Unifying Customer Experience Across Channels is Top Priority:

Unifying the customer experience across digital and physical channels is retailers' top customer experience-focused innovation priority. The brick and mortar store plays a crucial role in this aspect, as it offers customers the ability to physically interact with products and engage with the brand in person. - Adoption Maturity of Key Innovation Technologies Categorized:

The study includes categorization of key technologies such as artificial intelligence, process automation, robotics, and Internet of Things across an adoption maturity spectrum, helping retailers understand where they fall among peers in these areas. AI stands as the most mature in terms of active adoption or pilots - A Significant Opportunity for Retailers to Improve their Innovation Capabilities:

The study highlights a significant opportunity for retailers to improve their innovation capabilities and drive better business performance. By focusing on unifying the customer experience across channels and utilizing the intelligence gained from inventory data, retailers can enhance their innovation capabilities and stay ahead of the curve in a highly competitive industry. - Conclusion:

The study is an important reminder that retailers need to find new ways to solve the critical challenge of unification across digital and physical channels in order to drive growth. Retailers who invest in innovation will be better positioned to meet the changing needs of customers and remain competitive in the market. To know more about this study click here.