Dated: February 20, 2025

Welcome to The Dirty Martini Digest! This newsletter is built for our technology friends to keep you informed of the latest industry data and enable you to do your job more effectively.

Q1 marches on and with many of our clients segueing from NRF right into sales kick-offs, it’s a busy time. In addition, Q1 is a time for product and partnership announcements. Once that is over, it’s time to execute!

As always, we’re here to help. Perhaps some of the insights shared below can spark some ideas on important challenges you can help solve.

Enjoy this issue of the Dirty Martini Digest.

The Dirty Details - The State of Unified Commerce in Specialty Retail

The incremental value of a shopper that shops a brand across multiple channels is well documented. They spend 15% more on average per order, have a 70% higher retention rate and are worth 1.5x more over their lifetime than a single channel shopper. In addition, from an operations perspective, retailers can be far more efficient with fully mature unified commerce capabilities. Of course, this is all easier said than done as retailers continue to struggle with foundational capabilities that customers now take for granted. This isn't just limited to technology issues, it extends into cultural and operational challenges.

Incisiv, in conjunction with Manhattan Associates just released The State of Unified Commerce in Specialty Retail study. While we know shoppers operate seamlessly across channels, the study confirmed that many retailers are still trying to break out of their silos and loosen the friction it creates in their operations.

Other key findings include:

- 77% of retailers responded that their customer acquisition costs have risen in the last year. This is at least partially driven by operating in siloed channels. So beyond creating poor customer experiences, disconnected channels are damaging company value.

- While for most retailers, digital channels are the starting point for the shopping journey, the store is being redefined as a platform that amplifies brand value across every touchpoint. Store associates are driving this shift and now over 20% of digital sales are being influenced by feedback they provide to their customers.

- The merging of physical and digital has been happening for a while and the findings were that 57% of retailers see interactive digital elements as a key enabler for creating immersive in-store experiences. However, only 23% rate their in-store digital content management capabilities as mature.

- We found that the leaders in specialty retail are embedding commerce naturally into every touchpoint, resulting in 18% lower cart abandonment than their peers.

- On the fulfillment side, retailers that ranked the highest in unified commerce maturity stated 27% lower fulfillment costs. In addition, 72% of retailers stated that real-time inventory visibility and dynamic order routing are critical for operational excellence.

Dive Deeper Into Our Cross-Industry Research and Content

- Getting controls around costs in the supply chain are a huge priority. We worked with Coupa to develop a Playbook on spend management titled: From Traditional to Transformational - The New Direct Spend Playbook. It highlights how enterprises can build smarter, more adaptive systems that can anticipate changes, optimize operations, and drive value creation. For a quick-hit view, here’s an Infographic on the subject.

- If you missed seeing our newsletter last month, we highlighted two important studies around innovation.

Straight from the Shaker

Get practical insights and best practices straight from our industry experts as we shake up and serve up our knowledge to help you improve your go-to-market strategies. We share tips each month to help you stay ahead of the game.

After spending three days walking through hundreds of splashy booths at NRF and seeing the vast majority highlighting many of the same things, this month we will focus on the most fundamental of marketing strategies; messaging. As solution providers seek to differentiate themselves in a sea of competition and a high-degree of ‘sameness of message’, creating a messaging architecture that serves as a foundation that drives all marketing and sales enablement activities is critical.

Here are some best practices we work with our clients to employ:

- Feature or Benefit: It’s critical to detail what the solution is and highlight what the features of your solution do so your ideal customer profiles do their jobs more effectively. The more important piece, however, is to detail what those features mean for the business. This could be operational efficiency, customer satisfaction, improved margins, etc. Any messaging architecture must go beyond the ‘what’ and detail the ‘why it matters’. The solution provider landscape is littered with examples of solutions looking for problems and buyers quickly see through that.

- The More the Merrier: Messaging exercises are not accomplished in an afternoon. Done right they require many iterations and most of all, should have the input from across the organization as well as outside of it. While a messaging architecture is the purview of marketing, gaining feedback from those in the field (e.g., sales) as well as partners provides very valuable color as they are exposed to what your competition is saying and more importantly, customers and prospects. They can help avoid repetition with competitors and address pain points from the market.

- Find the Nugget(s): Believe it or not, not everything your solution offers is totally unique from your competitors. Work with your c-suite, product teams, and sales to bring forth in your messaging the 2-3 capabilities (and what they mean to the business!) that your solutions offer that provides you with your unique value proposition.

- Know How your Personas’ Love Language: Our experience is that solution providers are pretty good at building out their ideal customer profiles at the company or title level. However, when messaging, the same problem statement or terminology is often used, regardless of segment. Some differences are obvious such as grocery vs. apparel, but when you’re trying to appeal to very specific use cases of an executive, they can be very different in, say, fast fashion vs. luxury or athleisure. Understand these idiosyncrasies and create messaging to address them.

On the House

Sip on our team's latest research, speaking sessions, and industry news with a quick scan of our recently published and upcoming work and key takeaways

- Shoptalk 2025 Session: Store Operations that Blend Engagement & Efficiency Incisiv’s Giri Agarwal will be joined by Tractor Supply and Walmart for a session leveraging our own Benchmark Research to discuss how they are optimizing operations to make stores easy to navigate, frustration-free, and full of delight for those savvy customers. If you’re going to Shoptalk, we’d love to meet up! Drop us a line at Dave@Incisiv.com or Bill.little@incisiv.com and we’ll make it happen!

- 2025 Digital Grocery Outlook - Incisiv’s sister company, Grocery Doppio, continues its ongoing analysis of where digital will be making the biggest impact in the industry. The 2025 Outlook digs into how grocers are focusing on rebuilding their digital foundations, how they are better leveraging advanced fulfillment systems and where retail media networks fit in to enhance their efficiency and drive revenue in 2025.

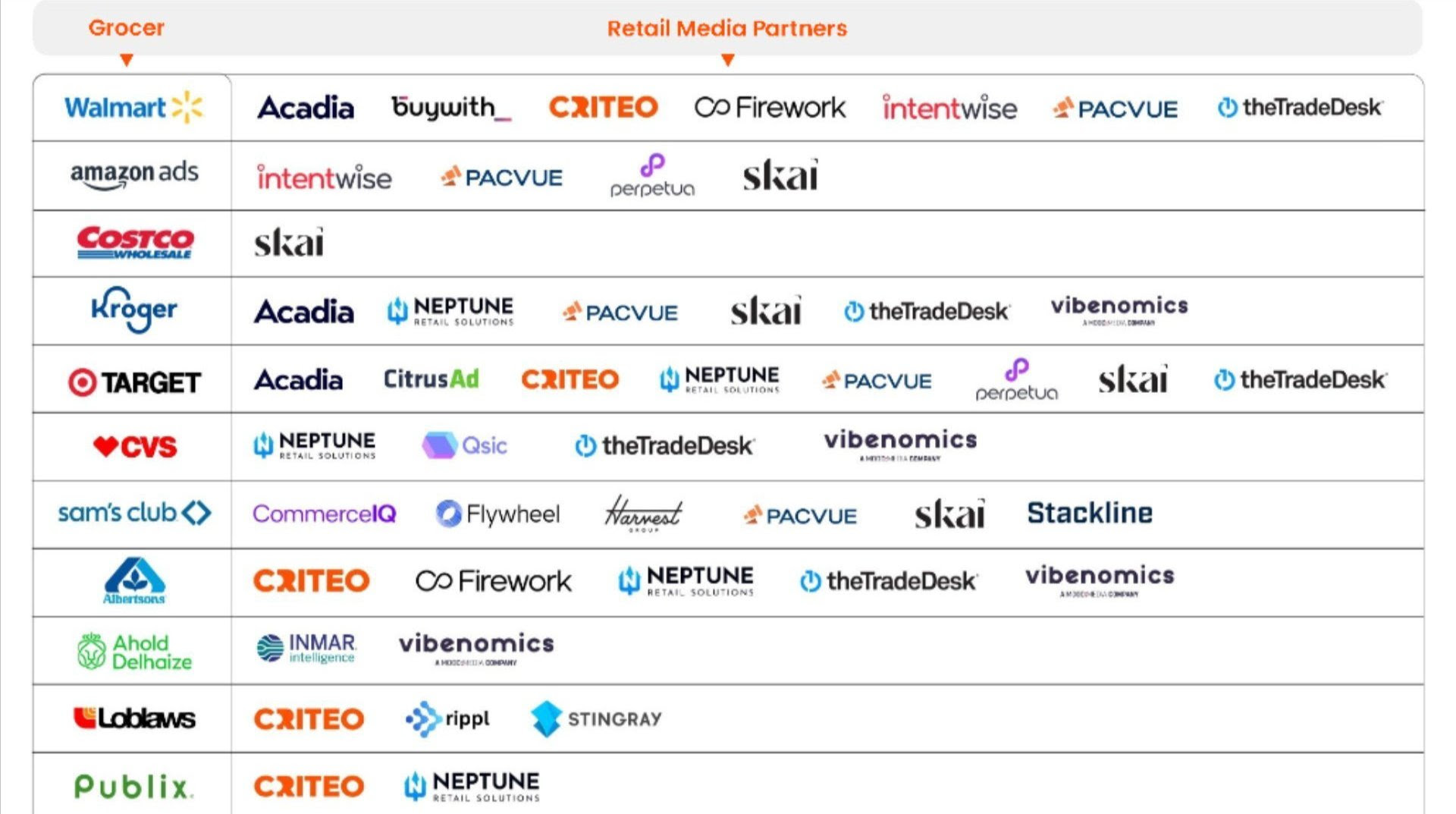

- The Retail Media Ecosystem - Check out this quick-hit graphic (preview below) on the vast ecosystem of retail media players and which retailers they work with. This has become a massive revenue grab for grocery retailers and it’s still early days.

Second Round - Incisiv Event Round-up

Incisiv is hitting the road very soon for a busy first half of travel. Below is where we’ll be - We’d love to meet up and hear about how you’re helping the industry

March

May

June

Walmart Quarter Impresses

Q4 Results were just released today and showed why they are the world’s #1 retailer.

- They crossed $100 billion in eCommerce sales. A figure unthinkable even 3 years ago.

- Total revenues for the three months ending on 31 December jumped by 5.7% versus one year before to reach $173.4bn.

- Operating income rose 13.2% on an adjusted basis.

- Earnings per share were ahead by 5.3% to $1.80.

- That EPS figure excluded a net gain of US 23 cents on equity and other investments.

- At period end, Walmart held $9.9 of cash and cash equivalents.

----

We're here to help you navigate through your biggest challenges and win in this highly competitive market. Anytime you want to talk, book a meeting.

Newsletter Dated: Feb 14, 2023

Does Innovation Still Matter in Retail?

State of the Industry - Innovation in Retail - Key Takeaways.

- Innovation Leaders Far Outperform Their Peers in Revenue Growth

Retailers who are leaders in innovation have a 3-year revenue CAGR of 6.2%, whereas non-leaders have a 3-year revenue CAGR of 0.7%. - Importance of Innovation Recognized but Not Always Practiced:

Despite the majority of retailers recognizing the critical importance of innovation for future growth, only 22% actively encouraged and rewarded risk-taking and experimentation within their organizations. - Innovation Priorities are Focused around Operations:

Retailers' operations-focused innovation priorities are centered around foundational capabilities such as inventory visibility, with 76% of retailers either scaling or exploring innovation initiatives in this area. - Leading Retailers Also Focus on Leveraging Innovation to Drive Customer Experience:

Leading retailers are focusing on utilizing the intelligence gained from inventory data to create better customer experiences. For instance, 65% are scaling or exploring initiatives to help them provide narrower and more accurate delivery estimates to shoppers. - Unifying Customer Experience Across Channels is Top Priority:

Unifying the customer experience across digital and physical channels is retailers' top customer experience-focused innovation priority. The brick and mortar store plays a crucial role in this aspect, as it offers customers the ability to physically interact with products and engage with the brand in person. - Adoption Maturity of Key Innovation Technologies Categorized:

The study includes categorization of key technologies such as artificial intelligence, process automation, robotics, and Internet of Things across an adoption maturity spectrum, helping retailers understand where they fall among peers in these areas. AI stands as the most mature in terms of active adoption or pilots - A Significant Opportunity for Retailers to Improve their Innovation Capabilities:

The study highlights a significant opportunity for retailers to improve their innovation capabilities and drive better business performance. By focusing on unifying the customer experience across channels and utilizing the intelligence gained from inventory data, retailers can enhance their innovation capabilities and stay ahead of the curve in a highly competitive industry. - Conclusion:

The study is an important reminder that retailers need to find new ways to solve the critical challenge of unification across digital and physical channels in order to drive growth. Retailers who invest in innovation will be better positioned to meet the changing needs of customers and remain competitive in the market. To know more about this study click here.