REPORT

Apparel Digital Maturity Benchmark, 2020

Incisiv

Incisiv

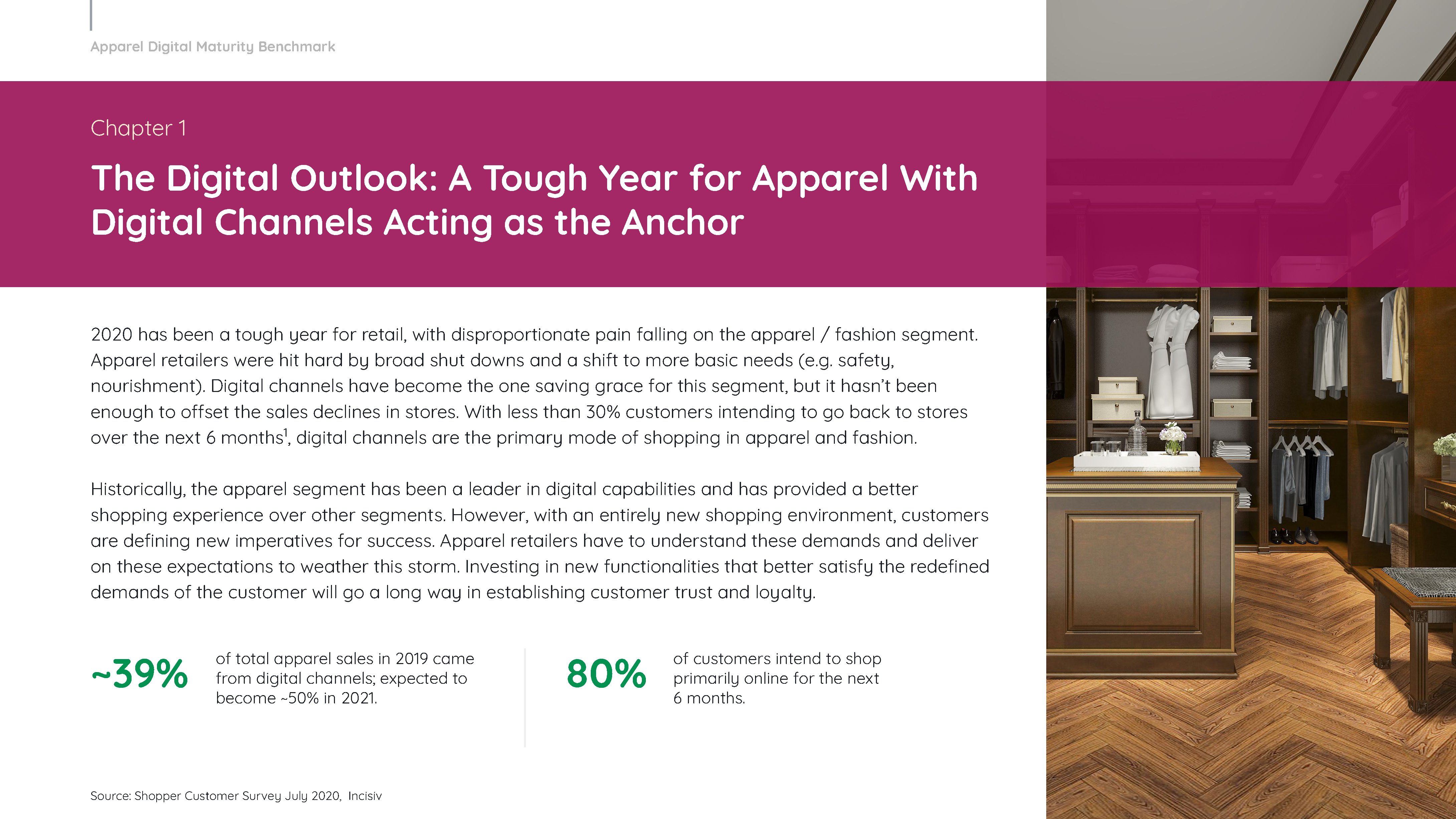

Apparel benchmark categories & formats benchmarked.

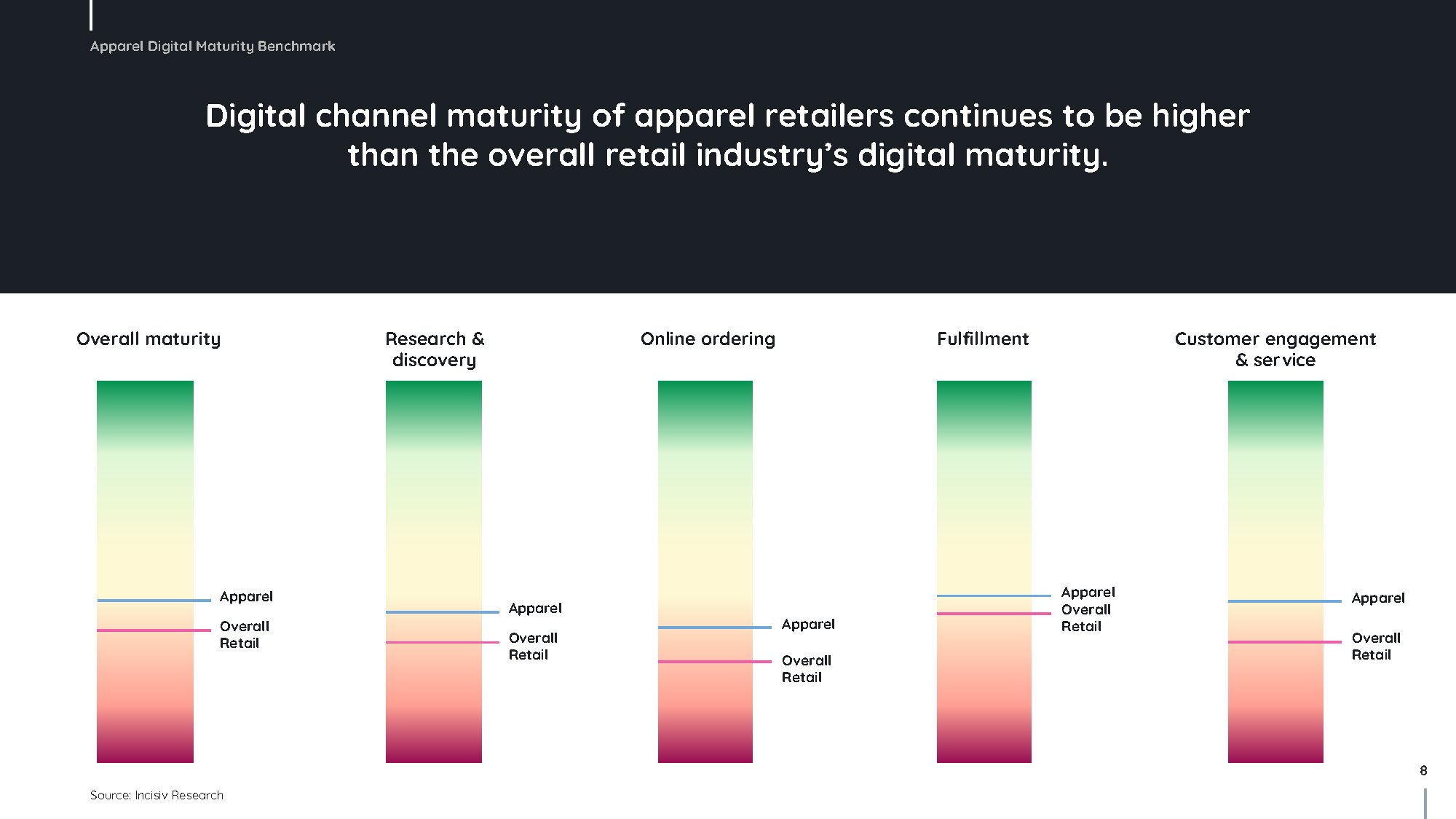

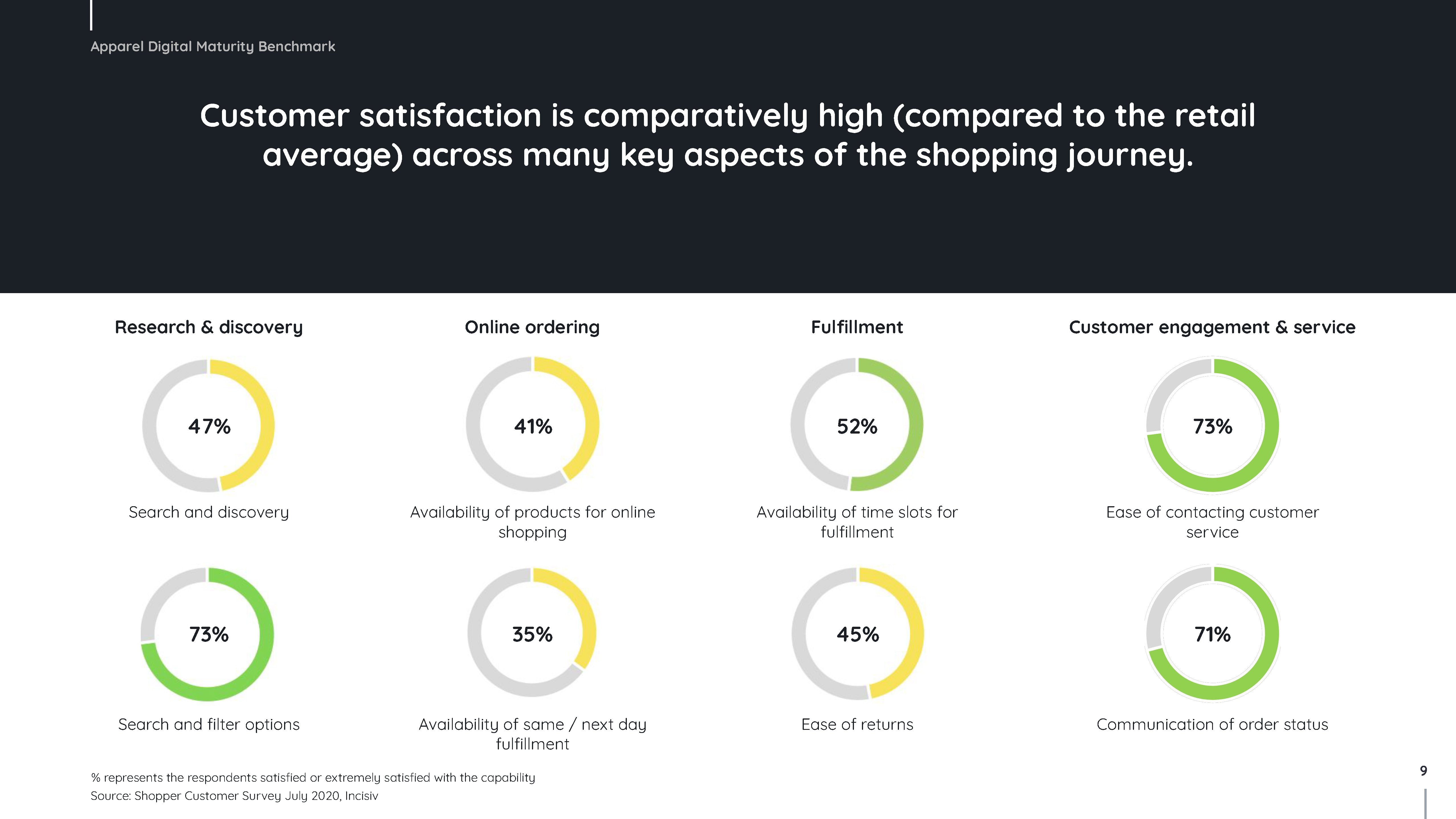

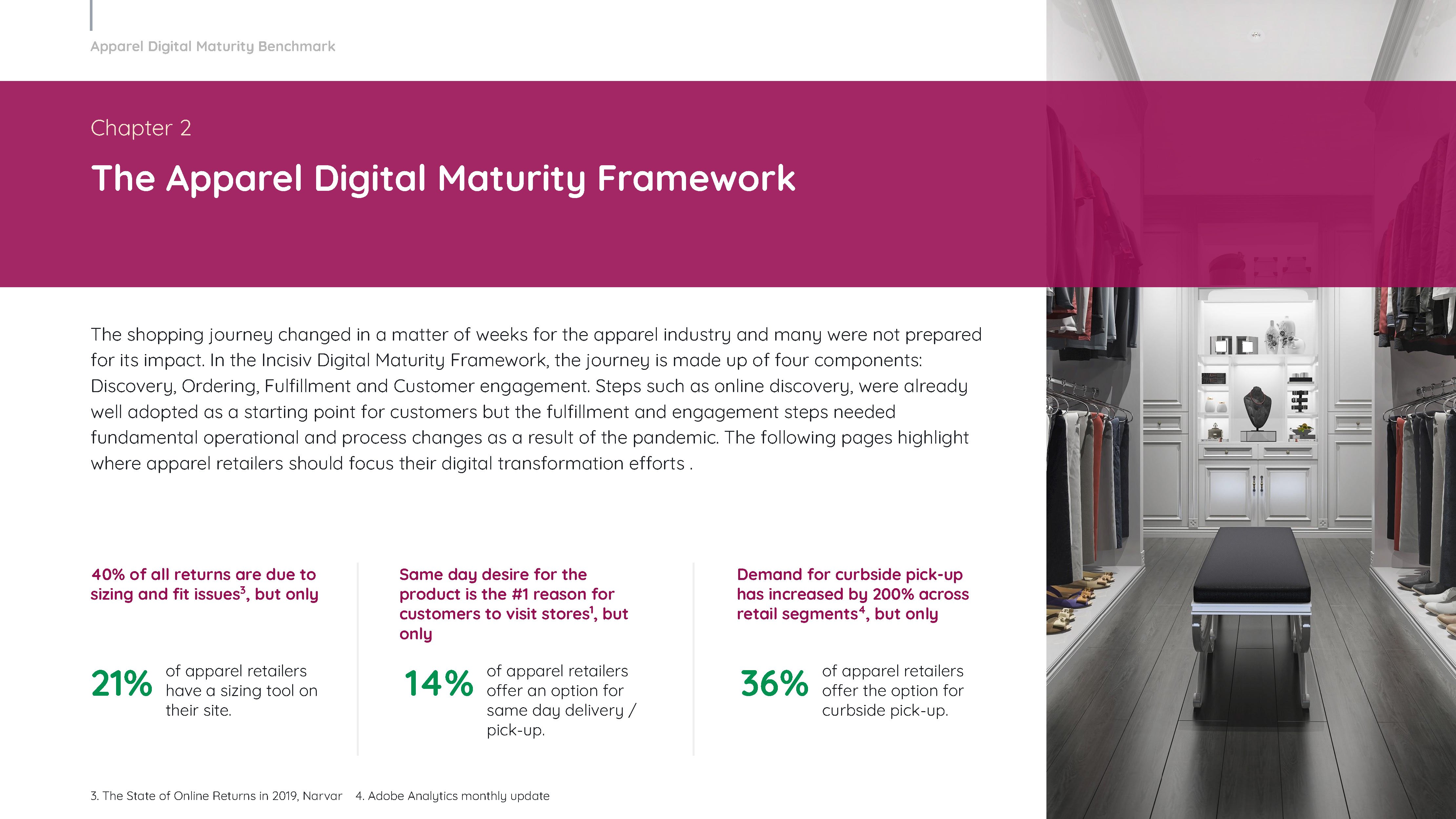

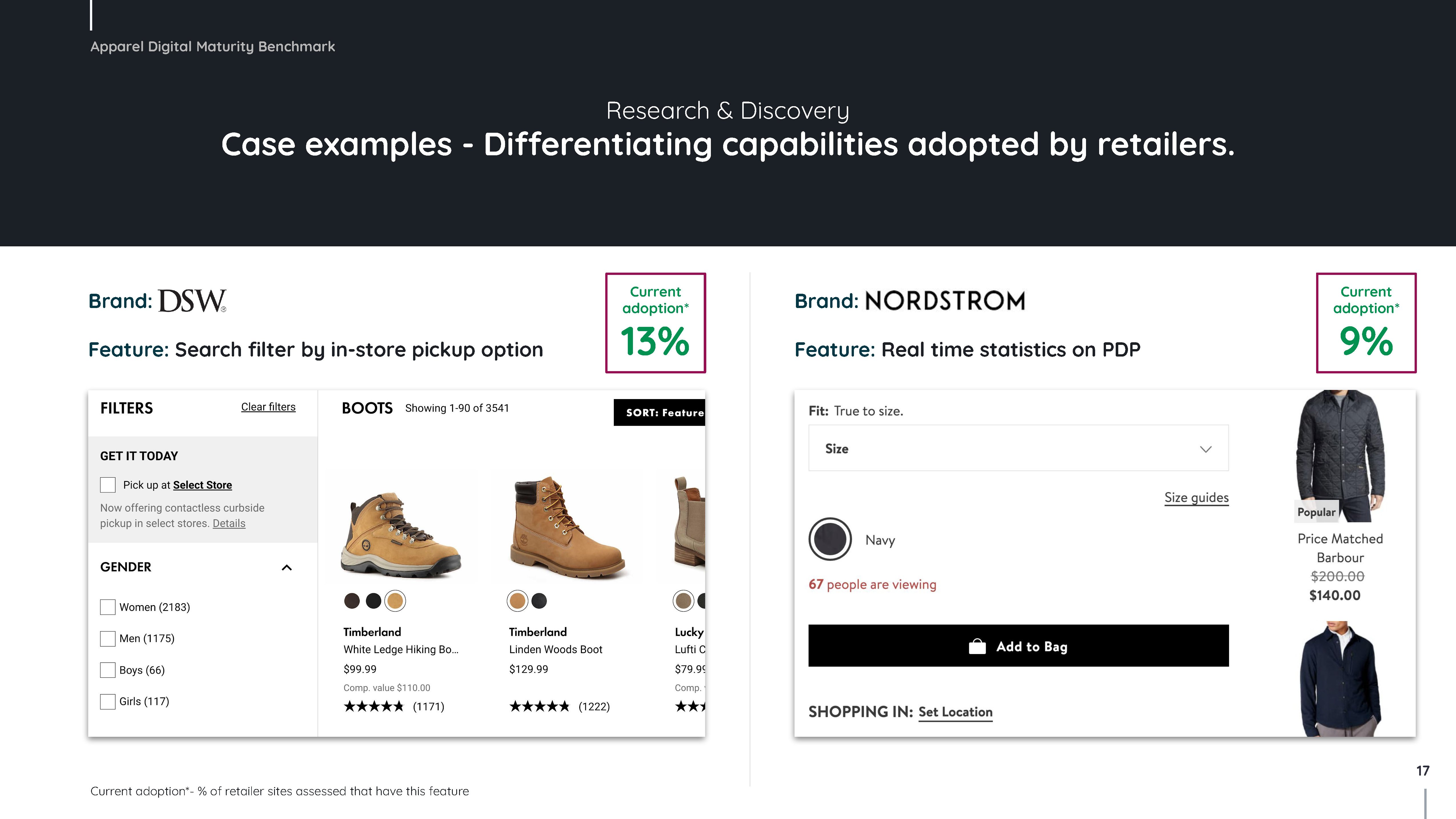

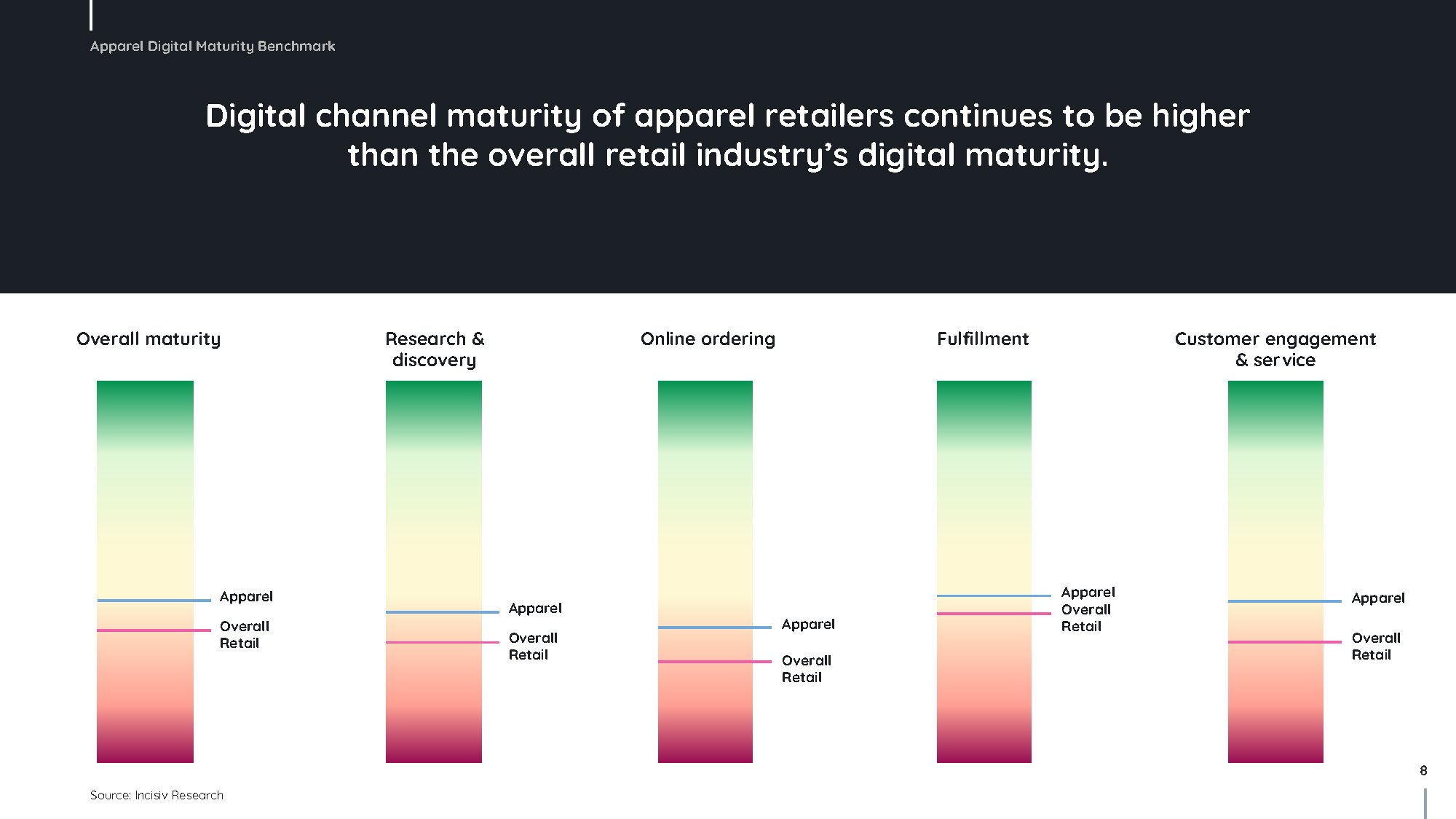

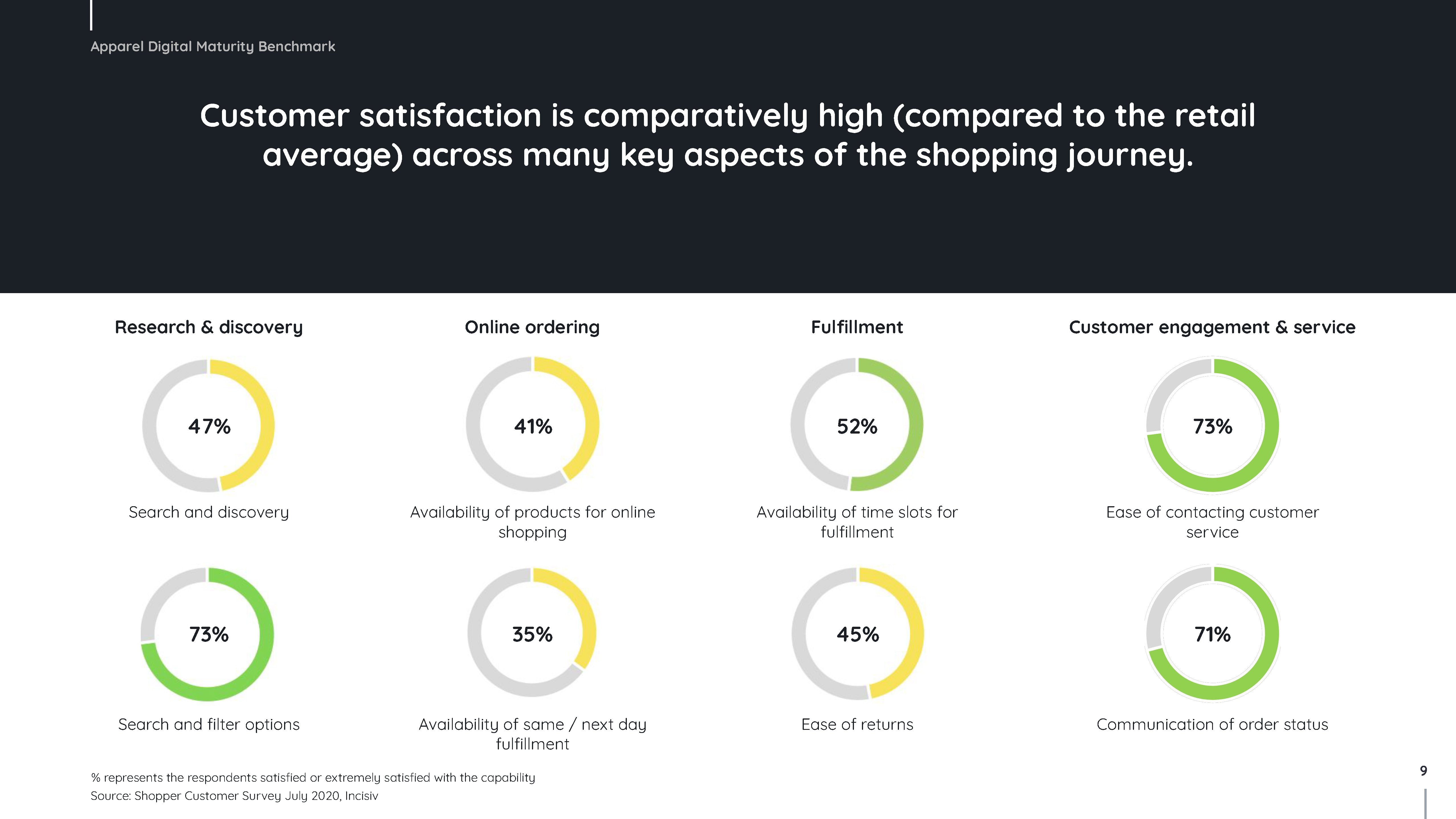

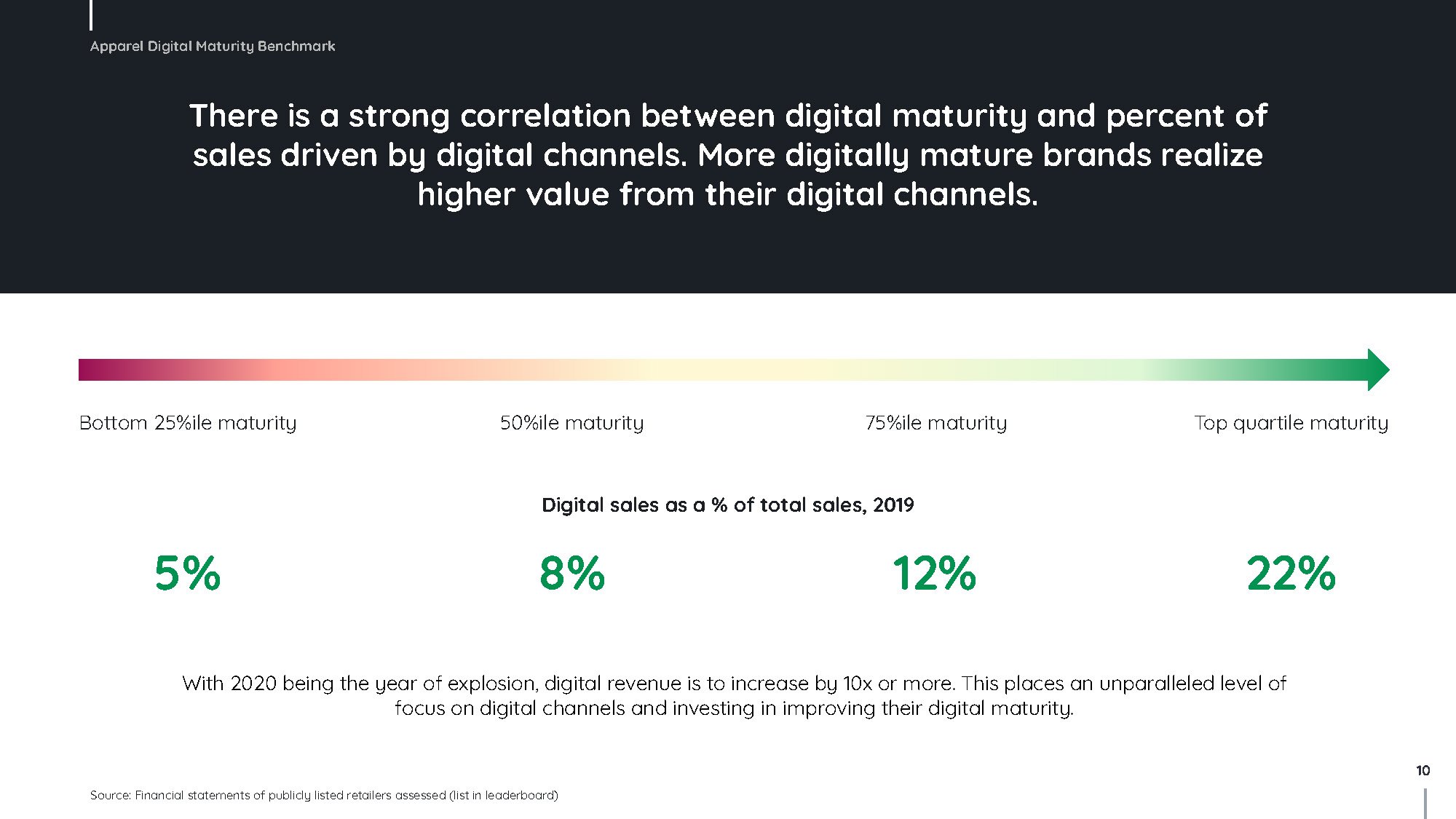

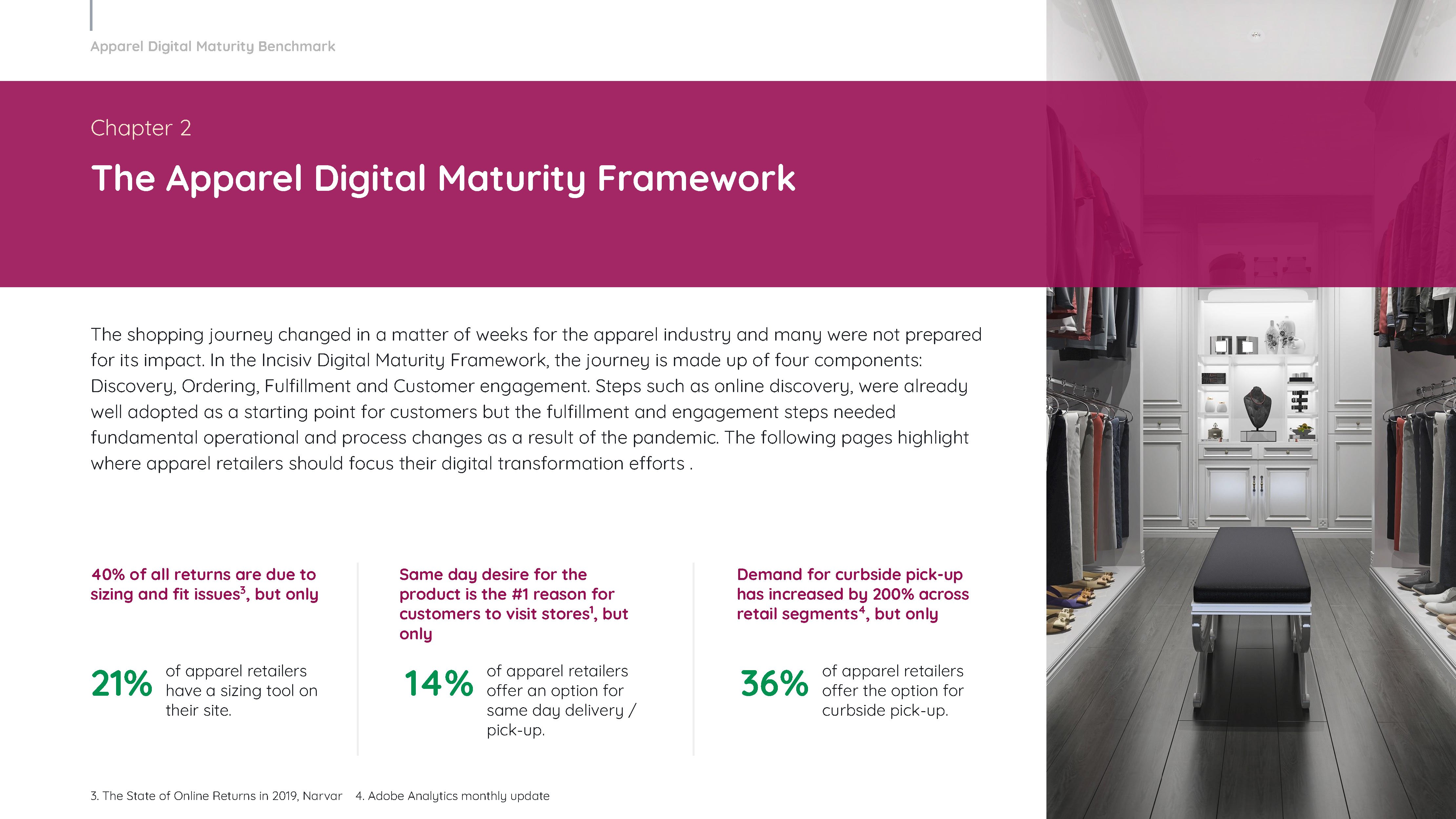

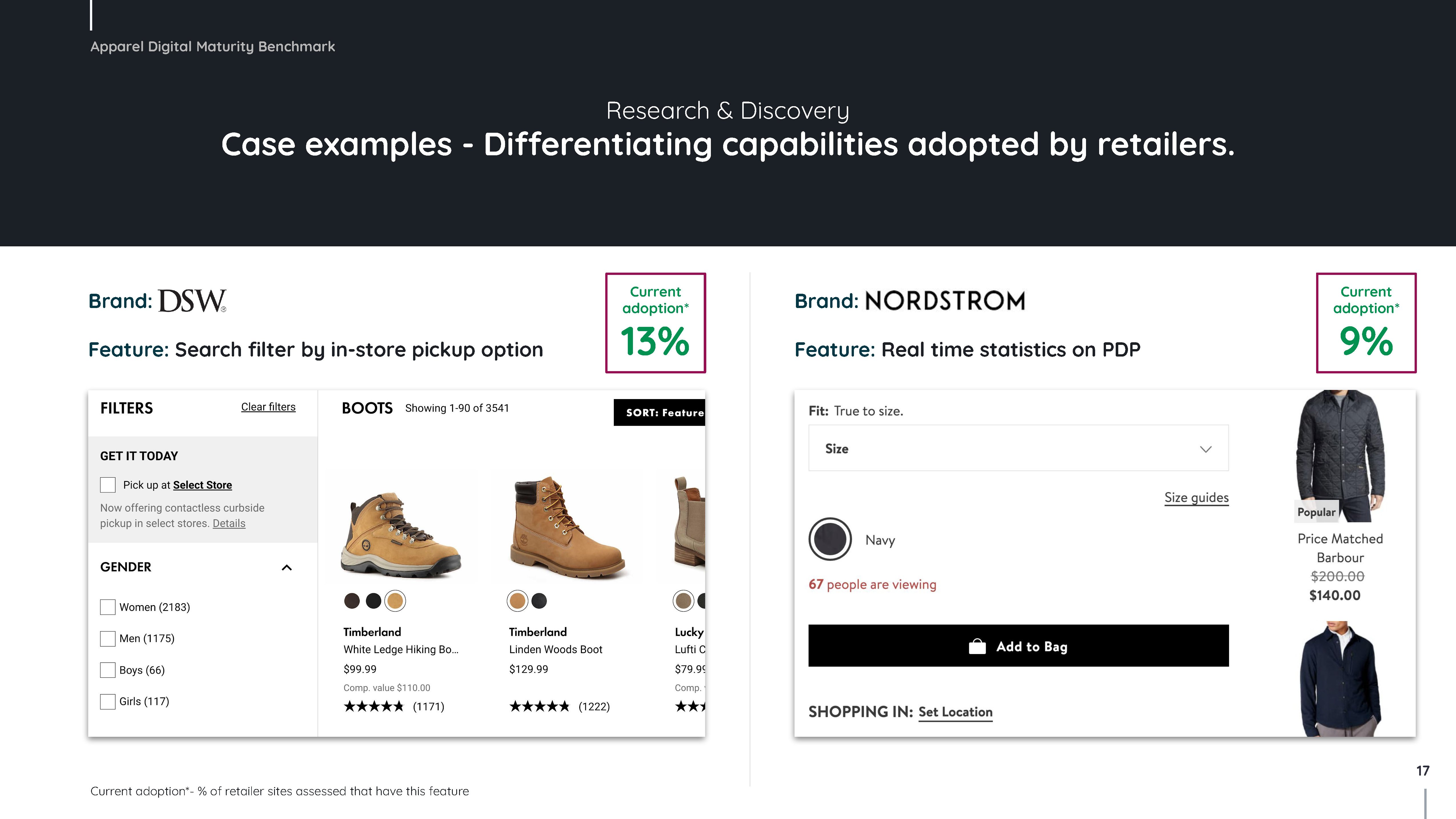

Research and discovery

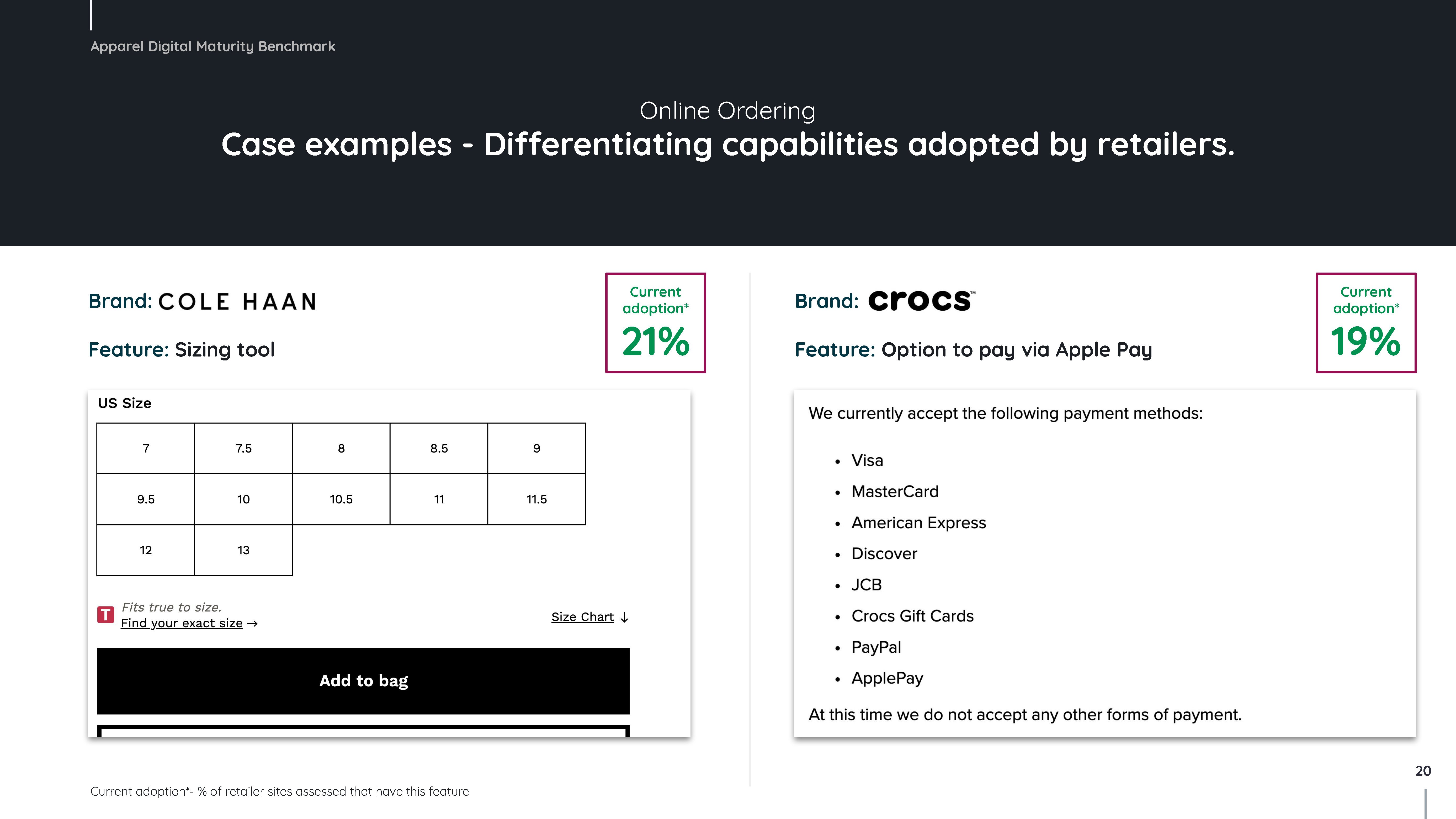

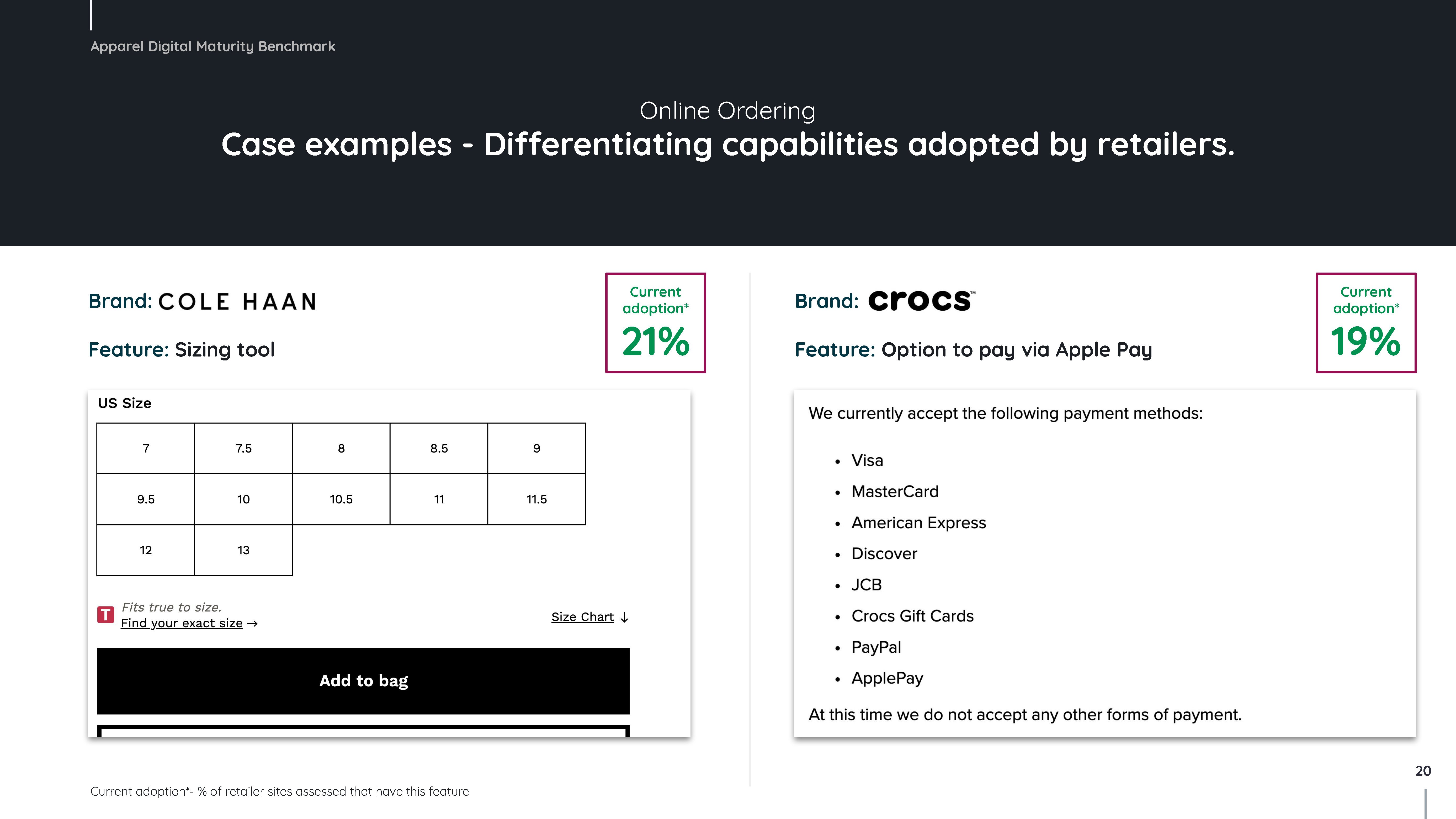

Online Ordering

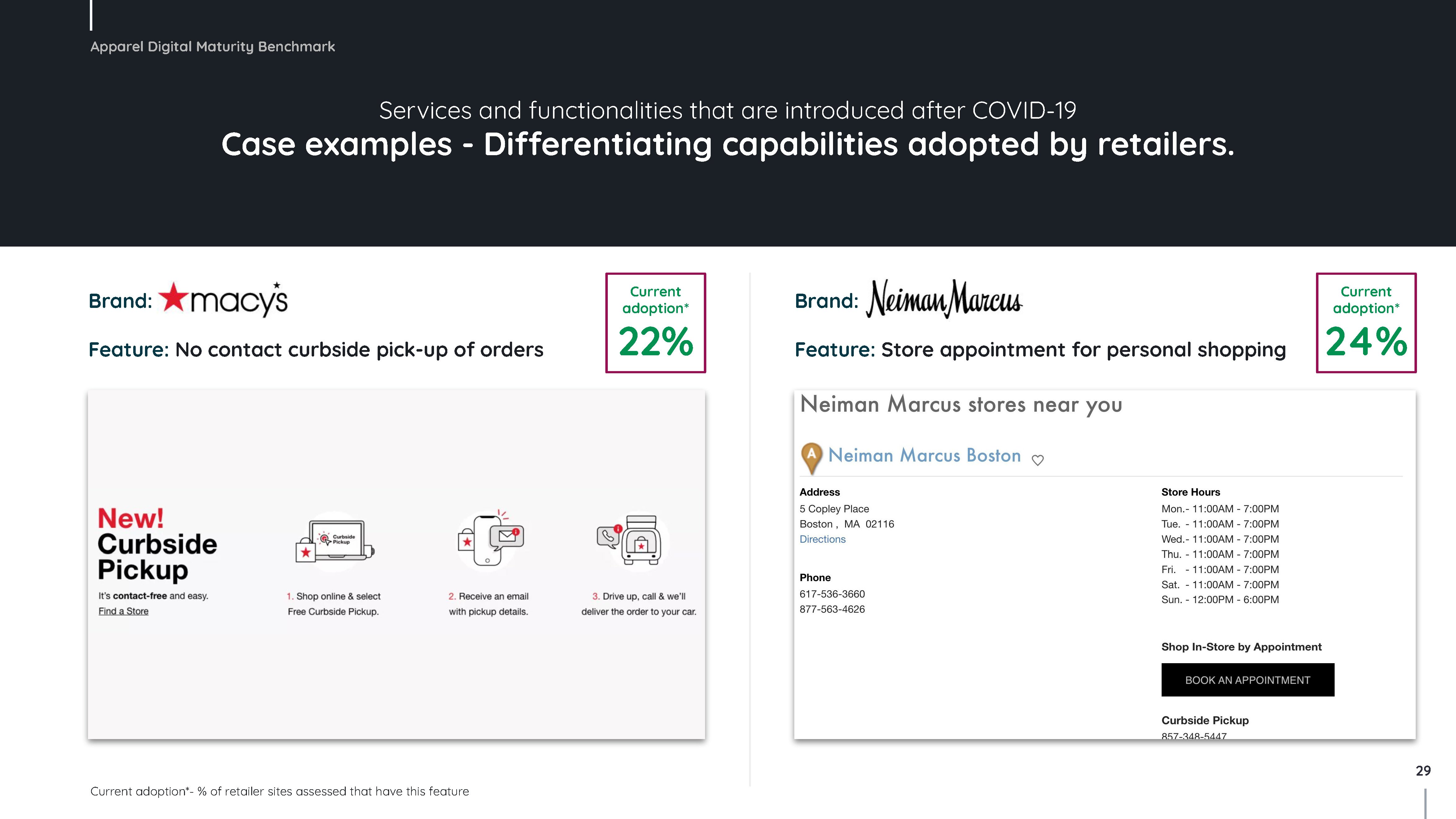

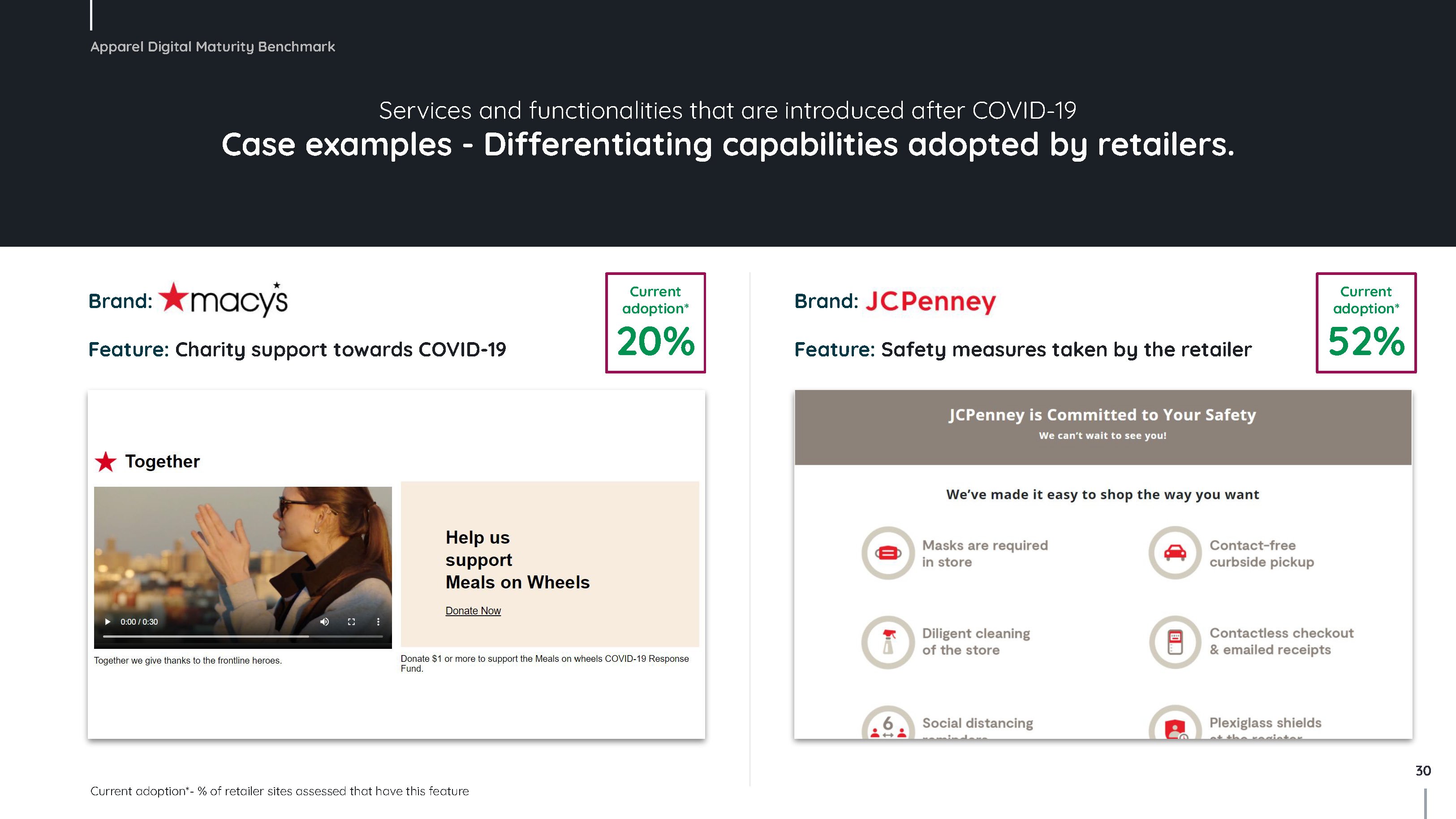

Fulfillment

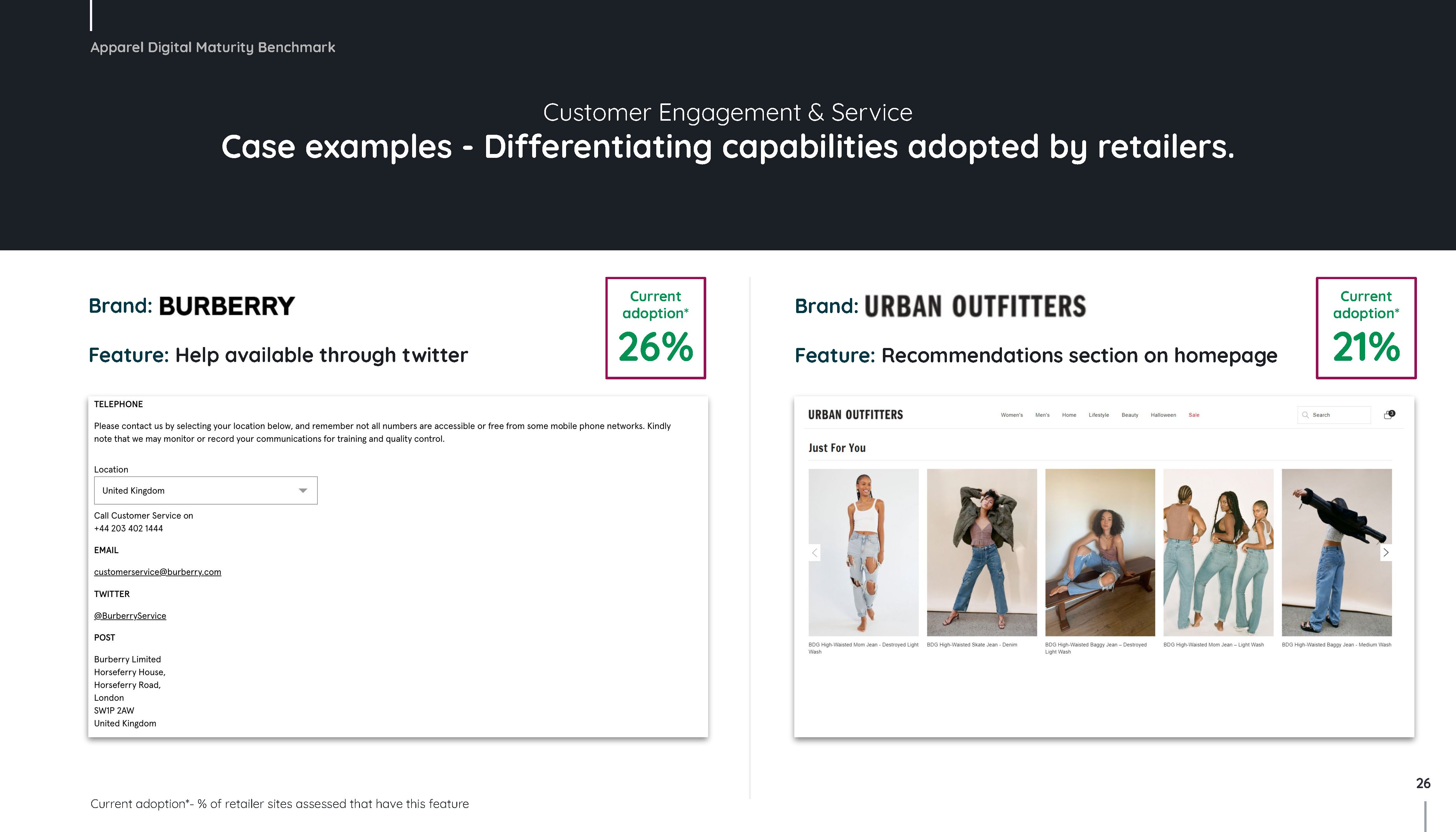

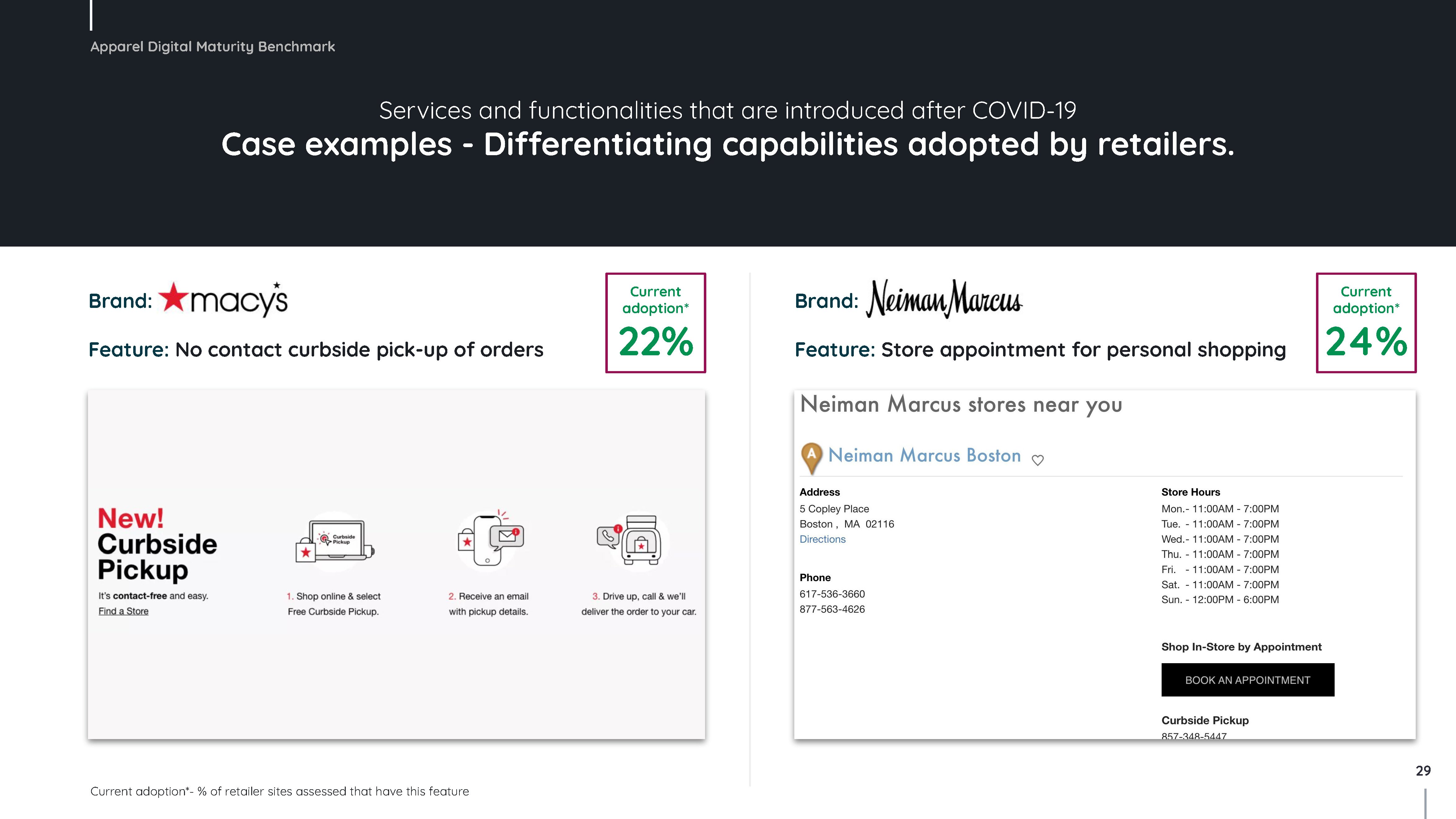

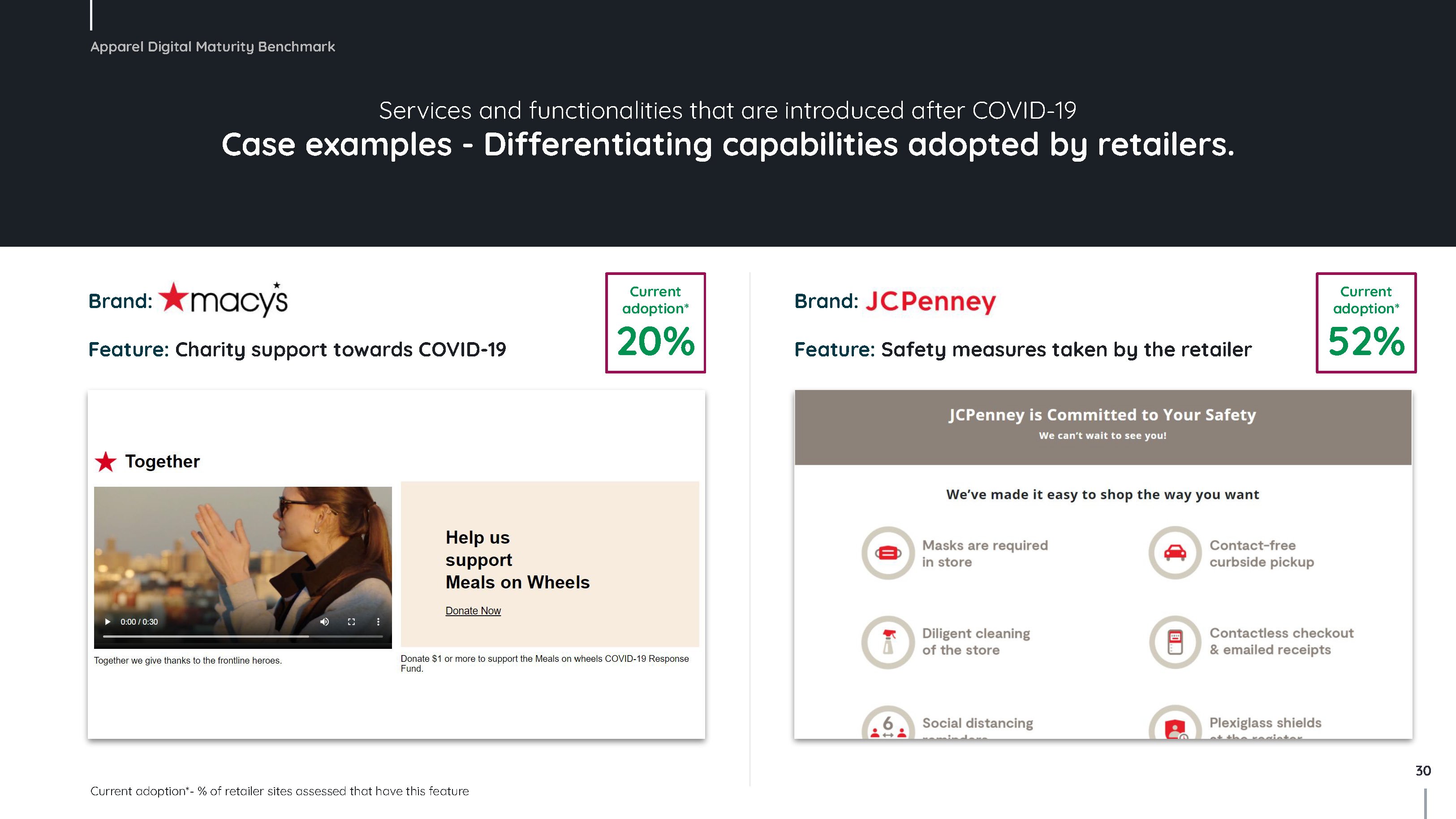

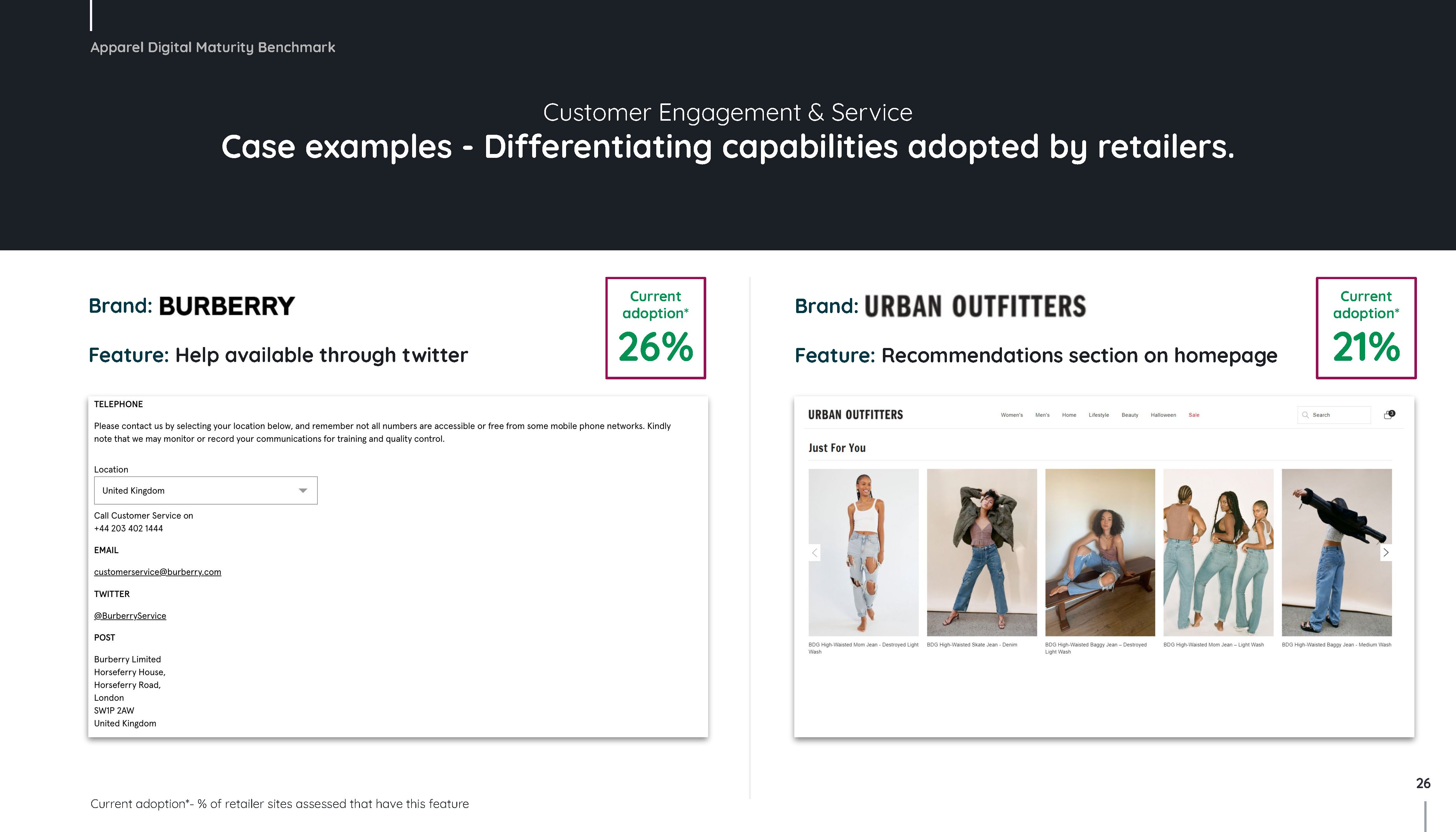

Customer Engagement & Service

Formats benchmarked

Department store

Large shopping stores that offer a wide range of consumer goods in the same building under centralised control.

Discount retailer

Stores that sell products at a lower price (discounts) than the regular retail price.

Footwear

Brands that specialize in selling footwear, often focused on a specific use case.

General apparel

Brands that specialize in selling apparel, often focused on a specific use case like occasions or usage.

Luxury fashion

Brands that are characterized by a high level of price, quality, aesthetics and exclusivity.

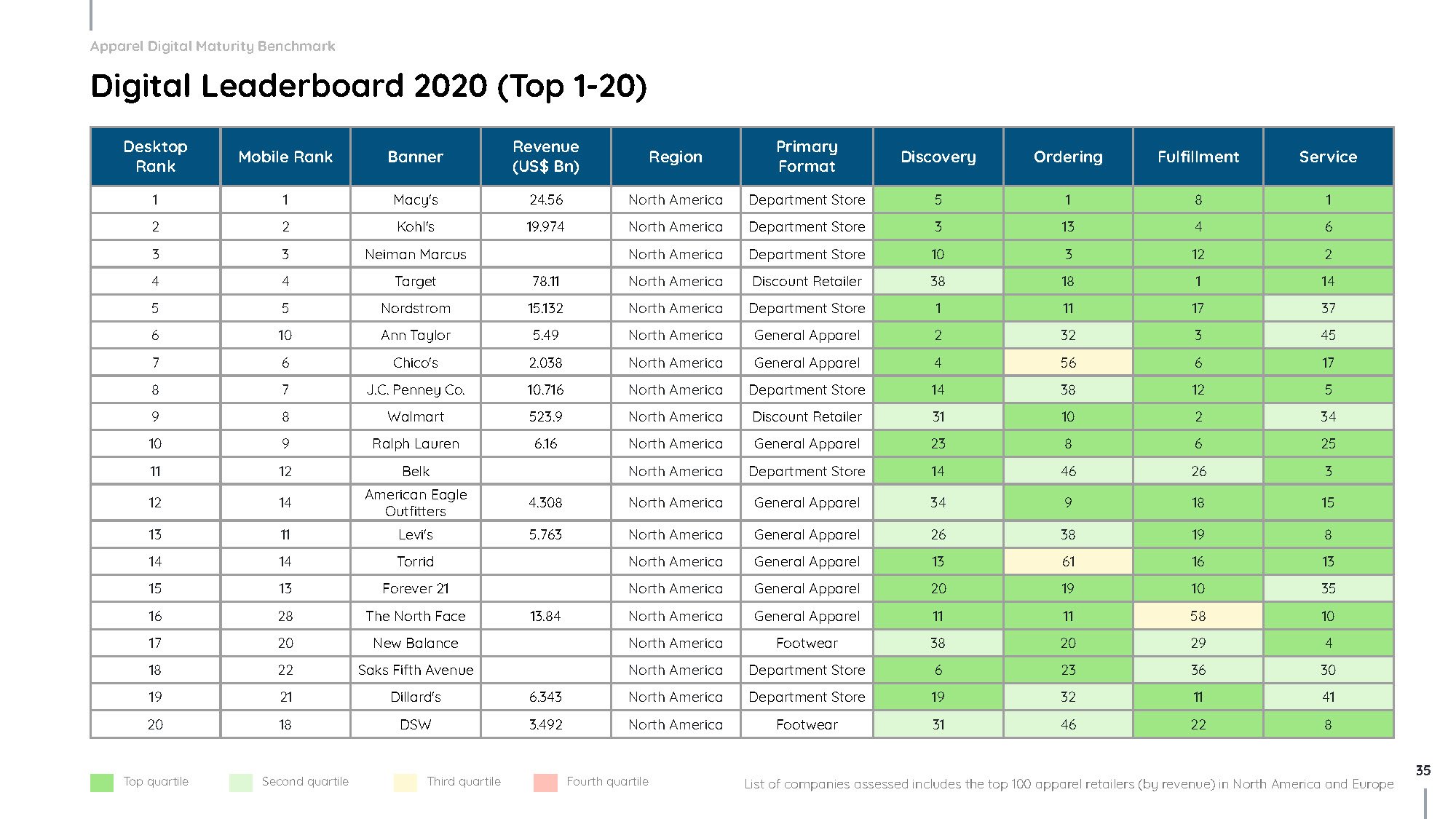

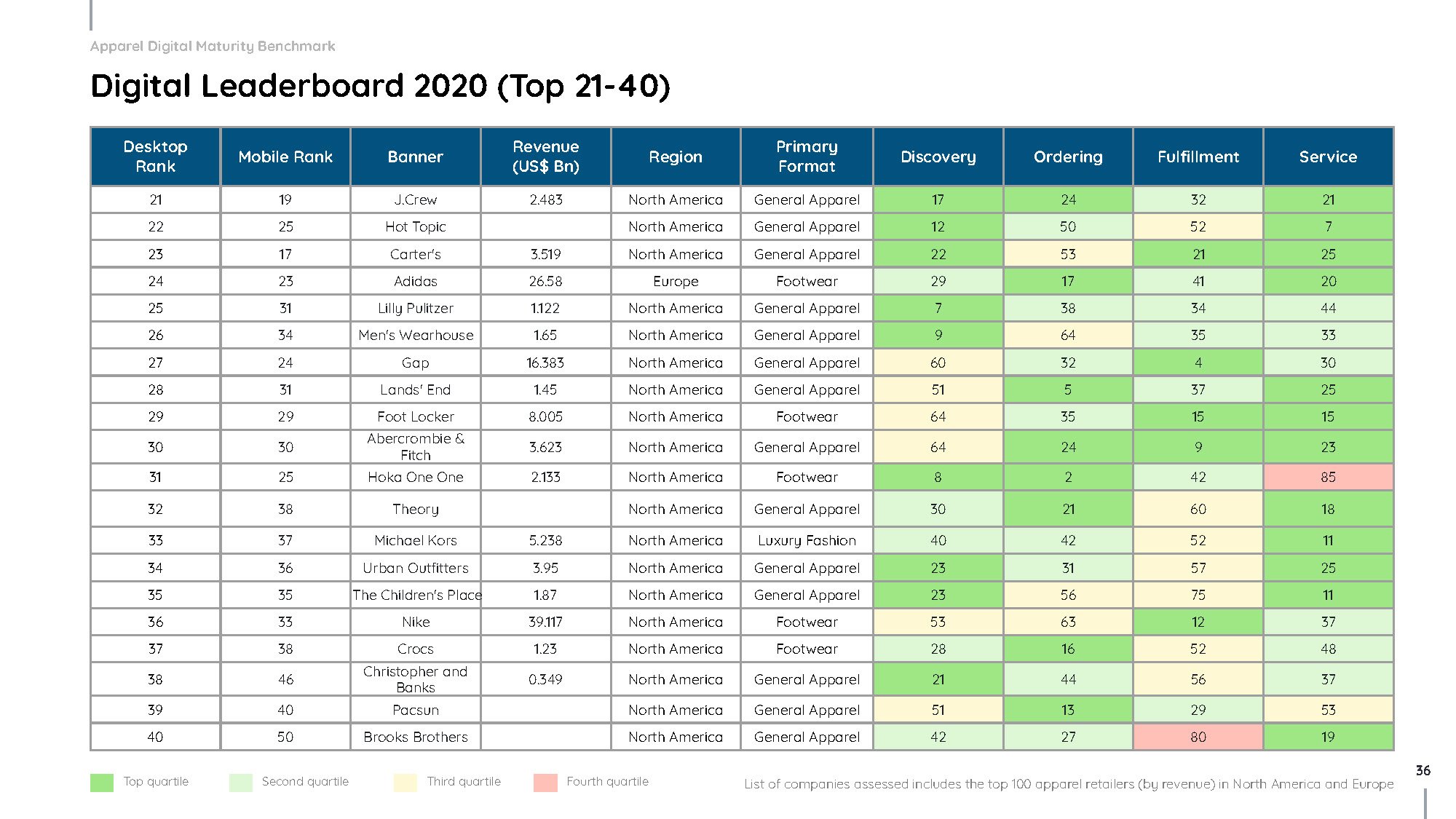

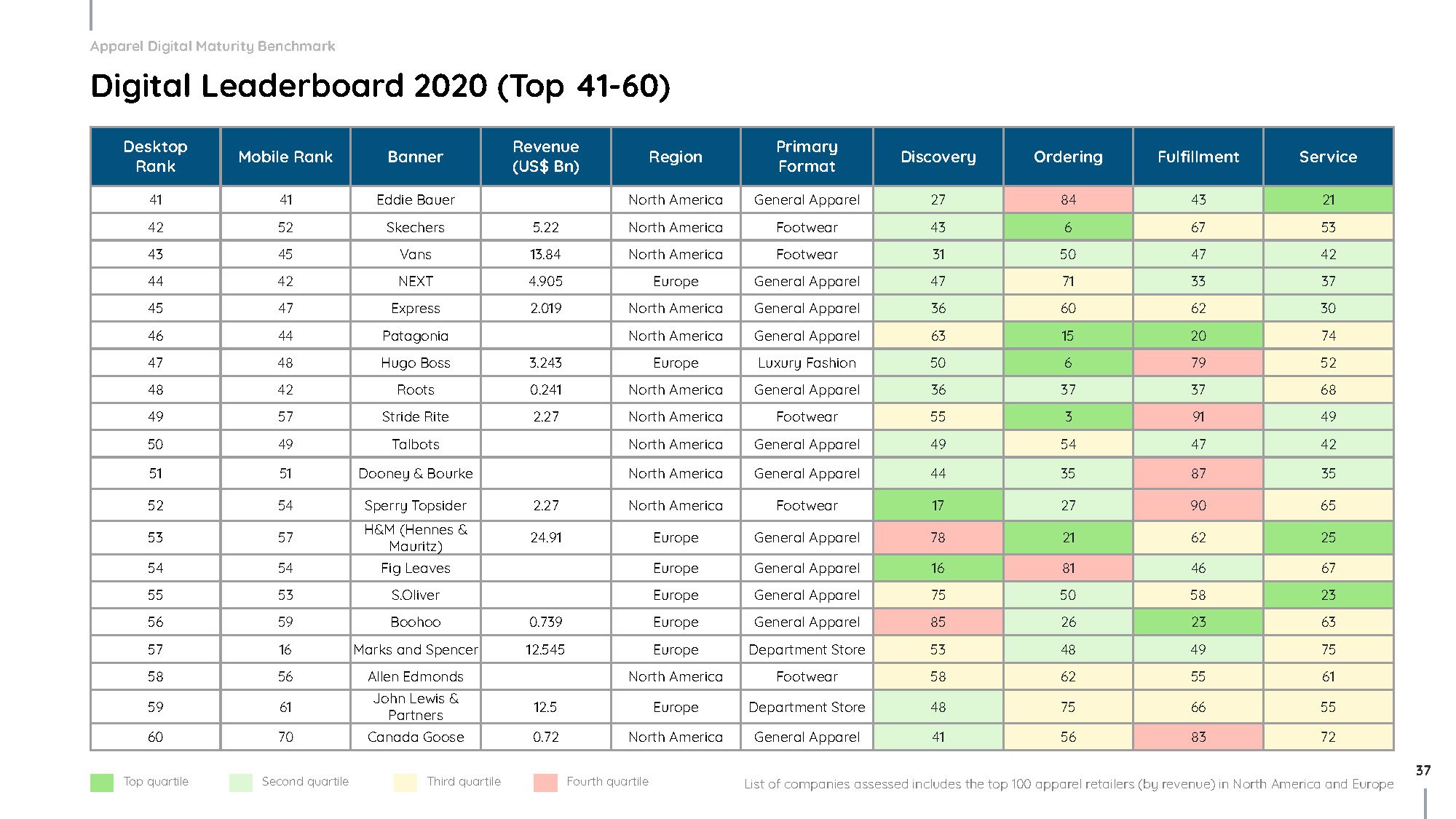

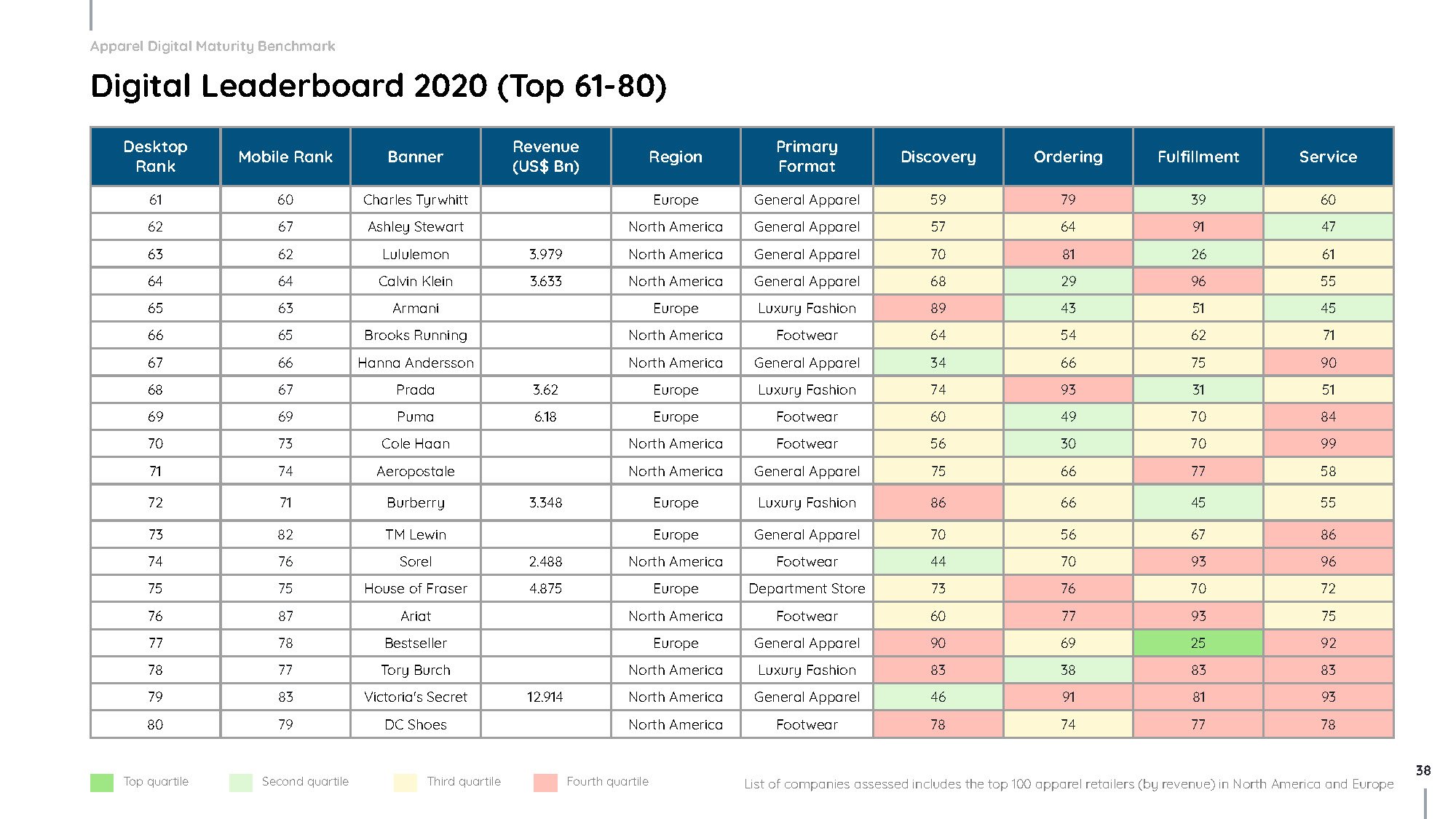

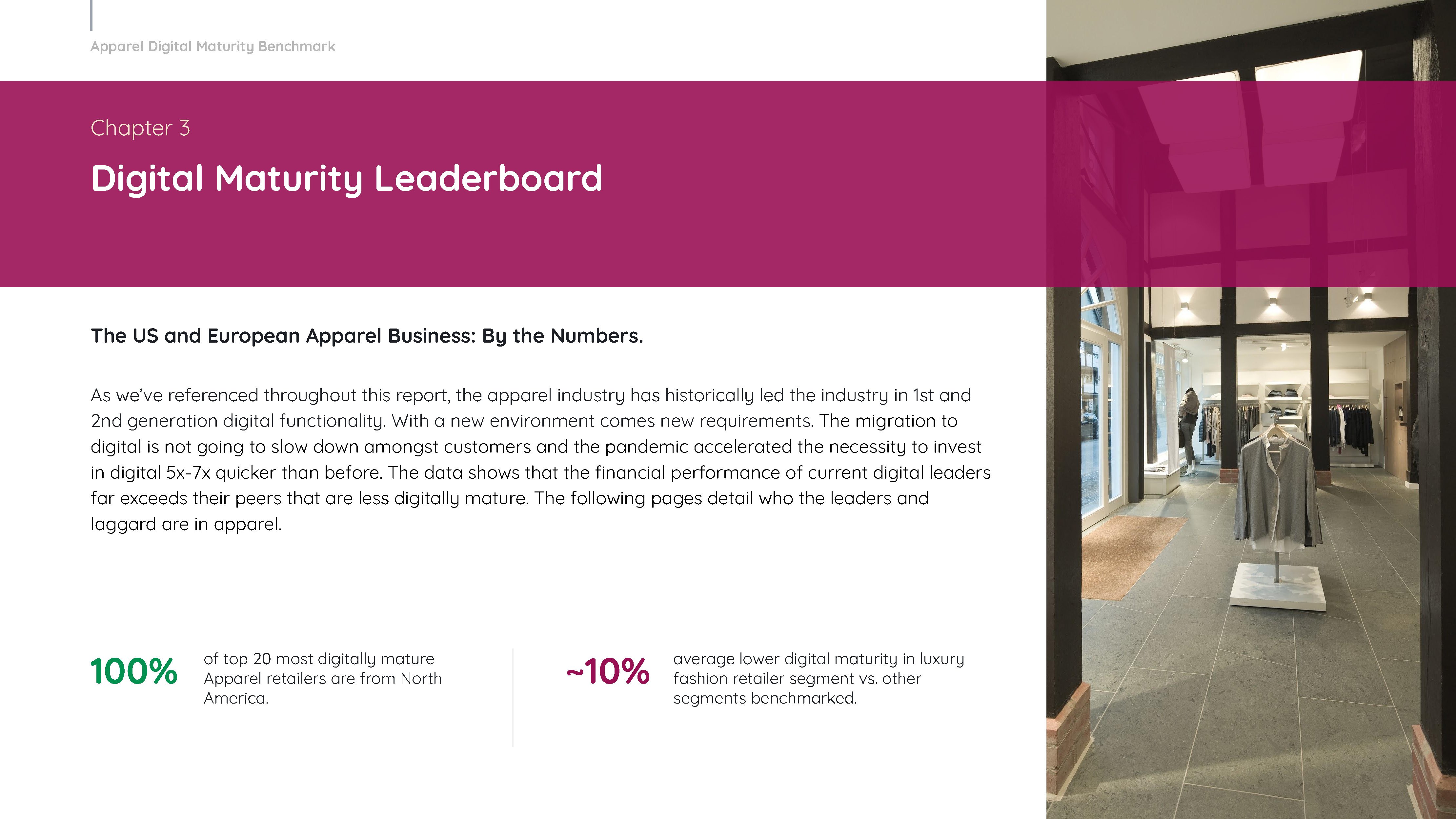

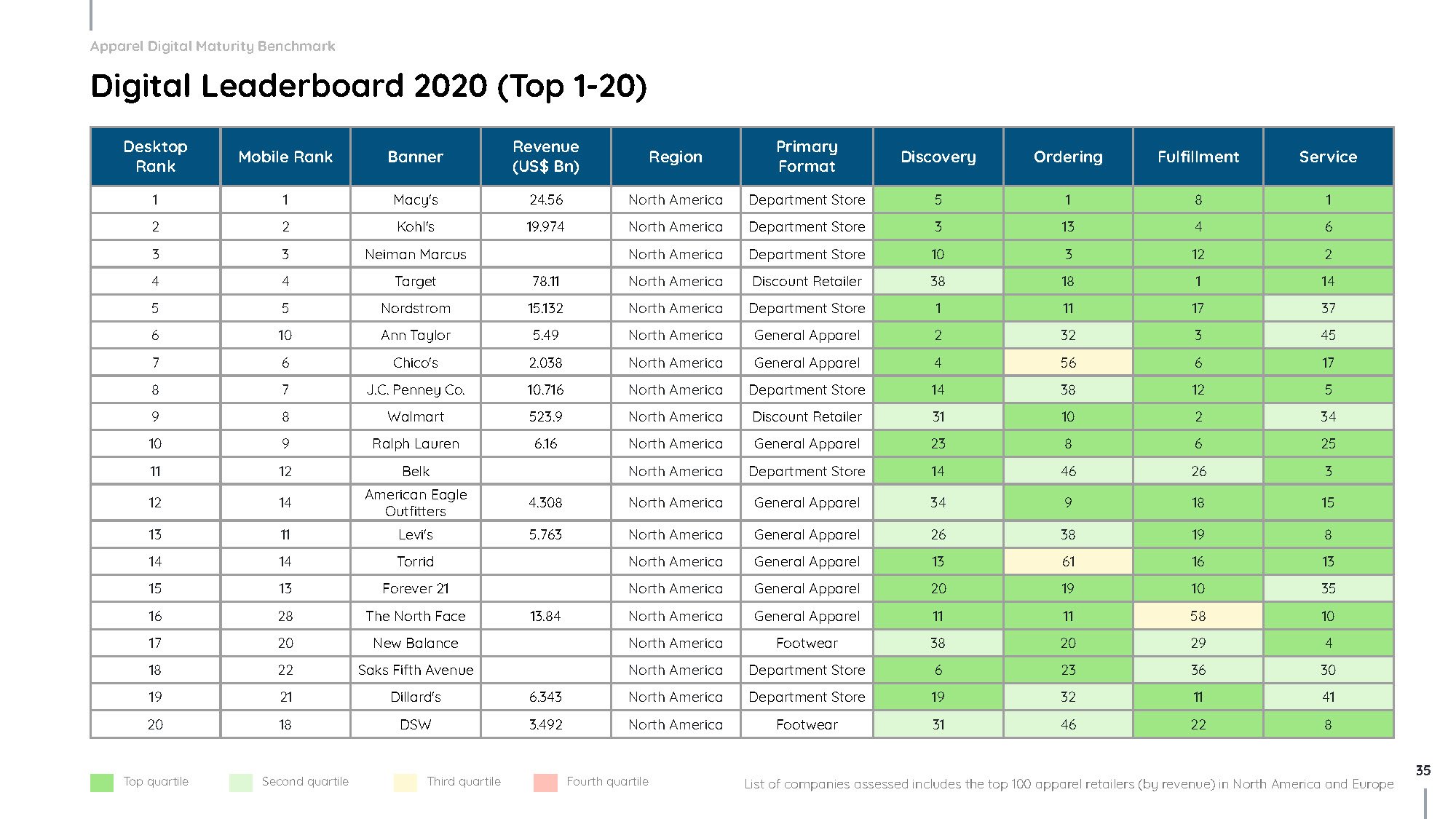

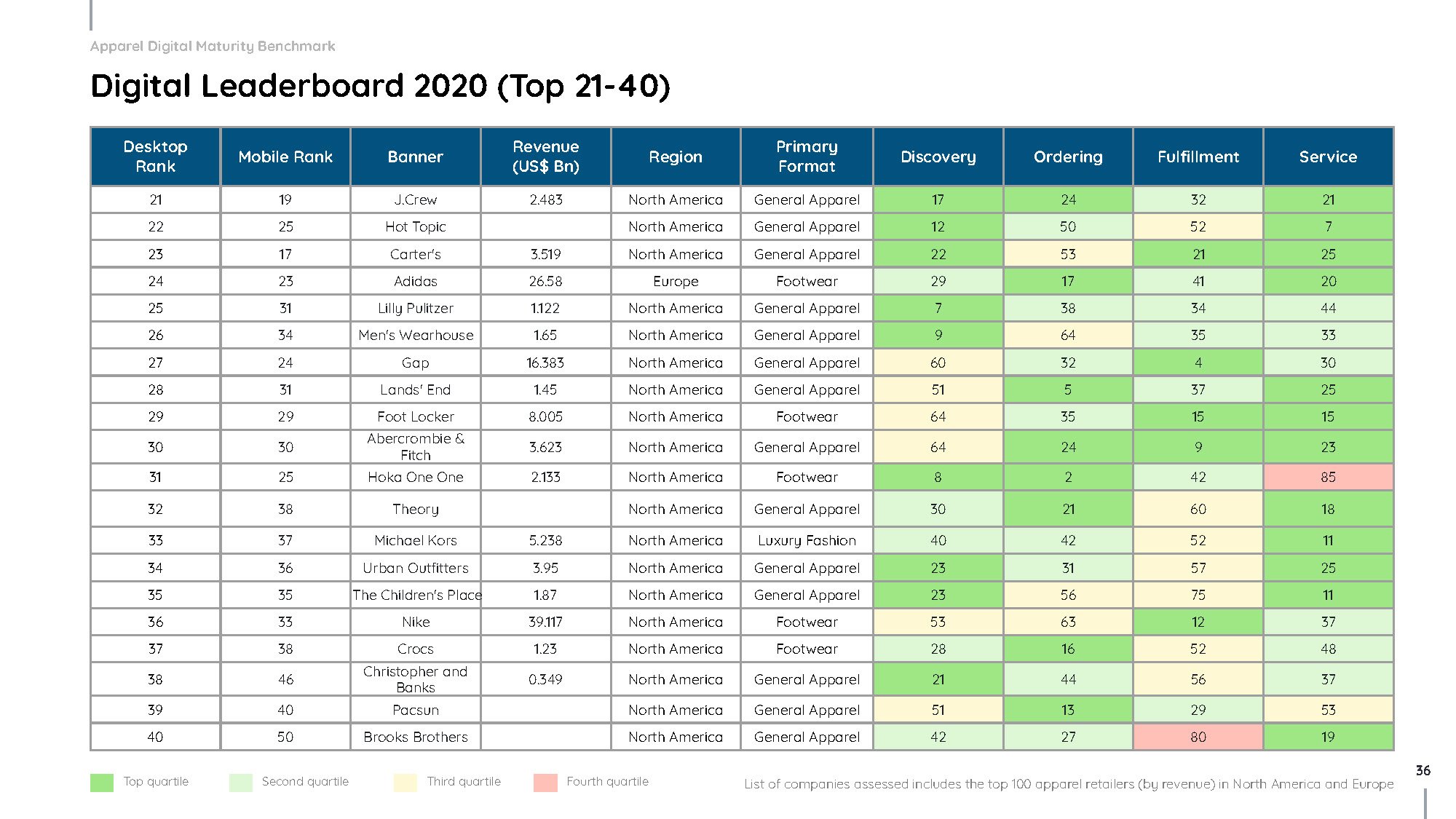

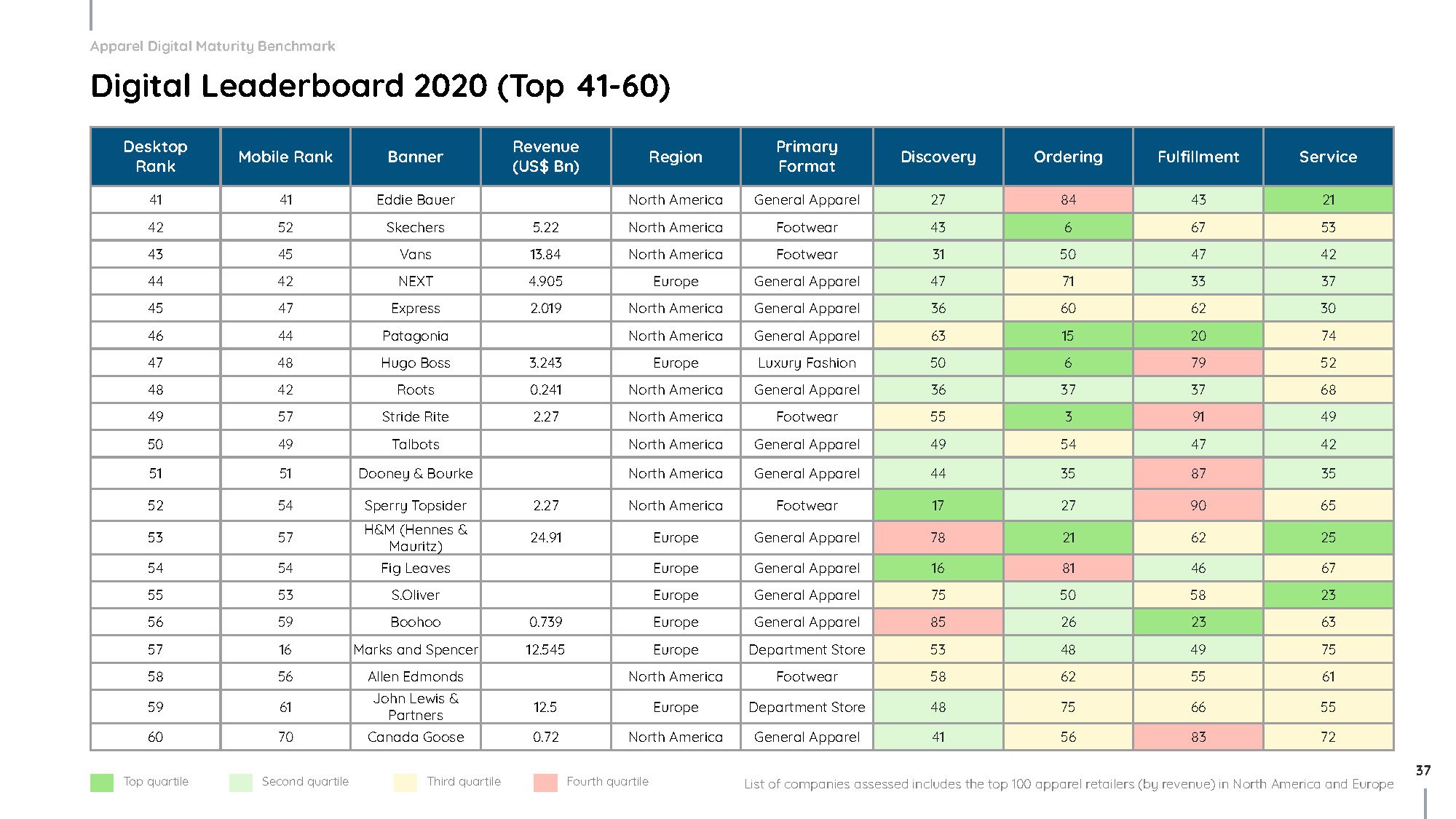

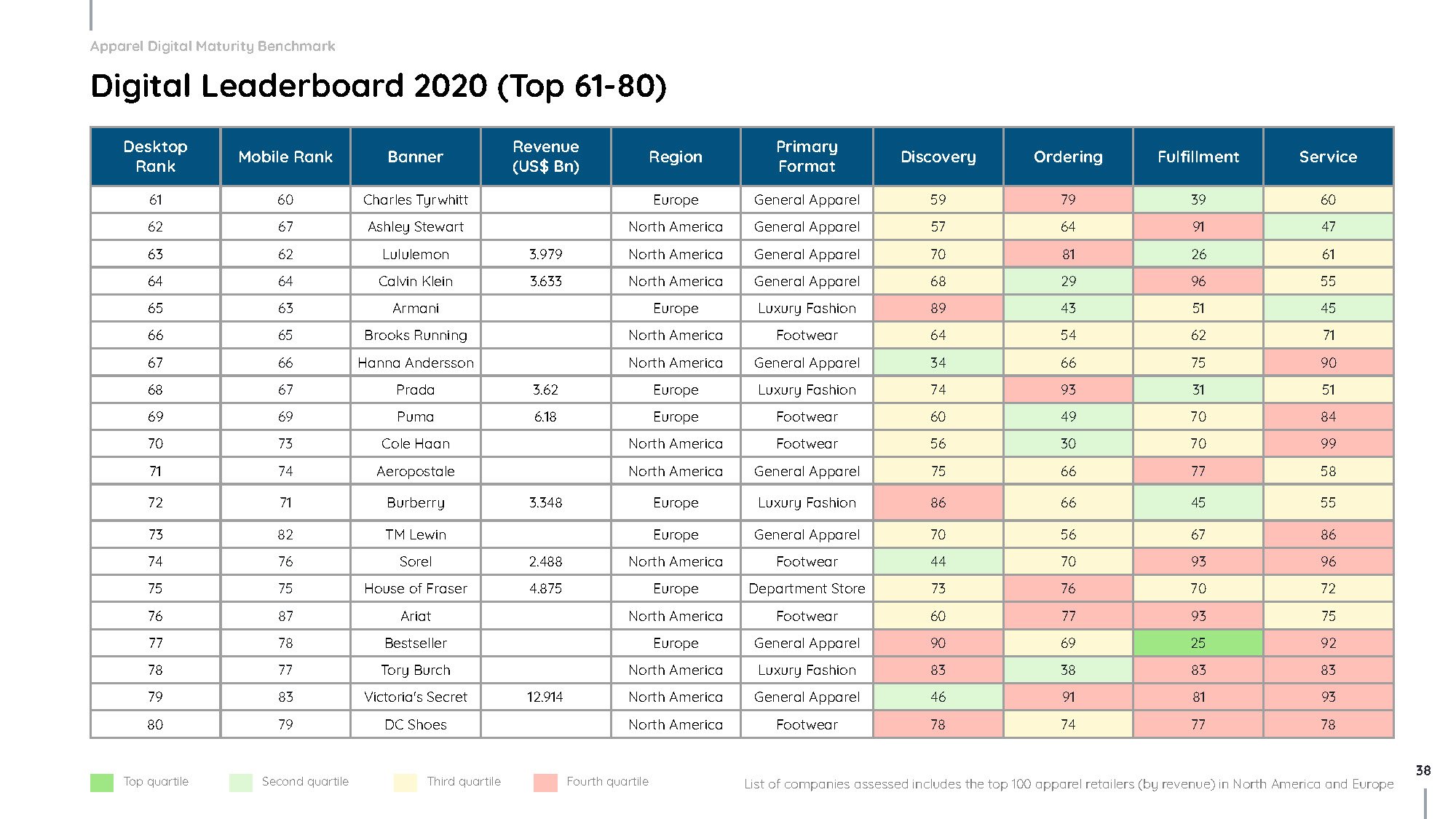

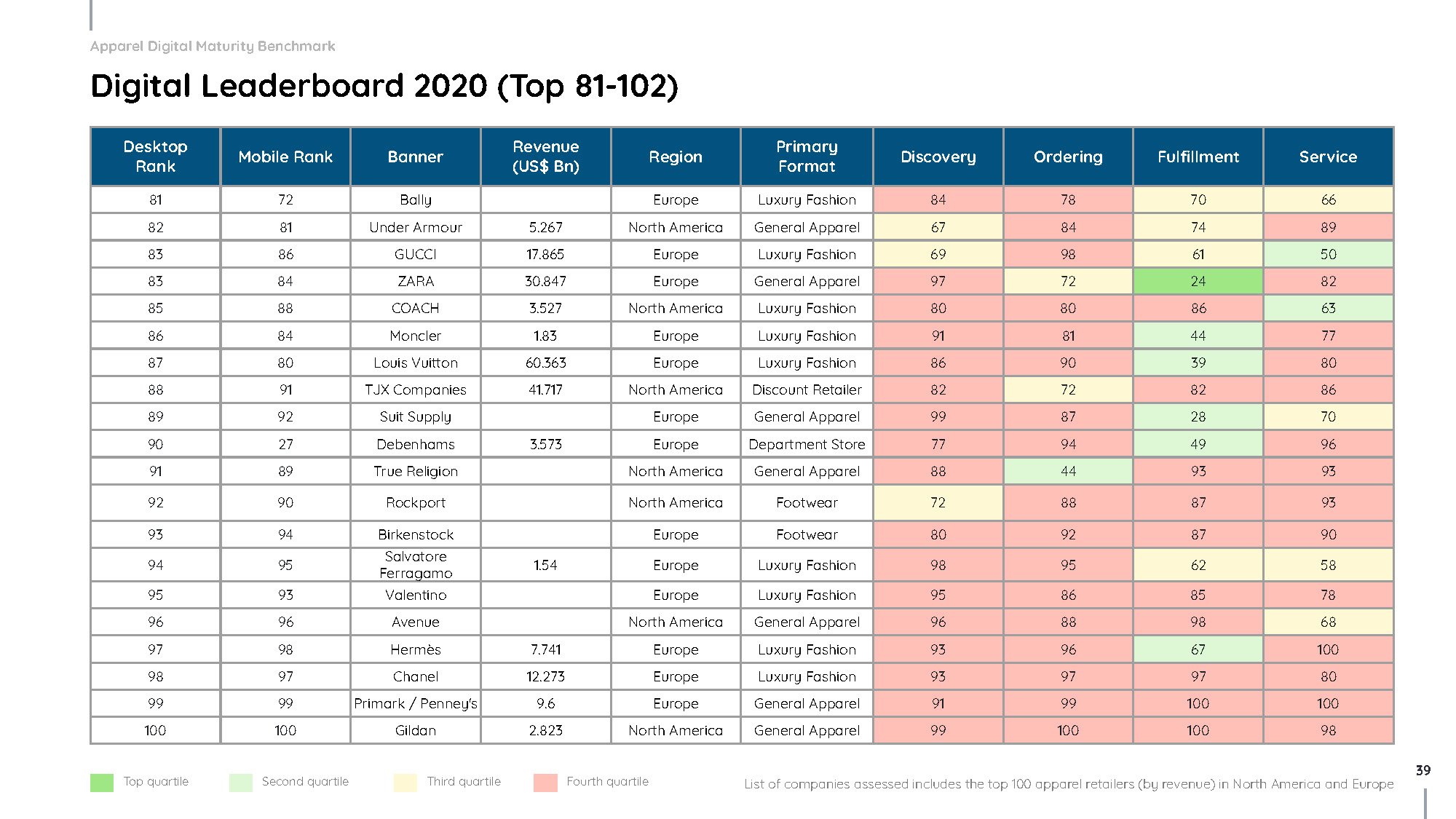

Digital Maturity Leaderboard

To view the complete top 102, download Incisiv’s Apparel Digital Maturity Benchmark, 2020. The eBook also includes top apparel retailer ranks by user journey stage (e.g. Discovery, ordering, fulfillment etc.)

Here’s a preview of the report. The full report is available for free download via the form below.