What is the short and intermediate-term impact of COVID-19 on Retail and Restaurant businesses? How deep will be the impact on different sub-segments? What does the new normal look like? What does the future hold? Incisiv presents its research quantifying the impact of COVID-19 on different retail and restaurant segments, key considerations for retailers and restaurant businesses in the next 1-12 month period and what will it take to survive in the new normal.

The COVID-19 pandemic has brought the global economy to a grinding halt. While it does seem that social distancing is working and the spread of the contagion is slowing down, there is still no clear roadmap on how to re-open the economy.

With no endgame in sight, the economic outlook for the next 9-18 months is bleak and the outlook for the retail and restaurant industry bleaker still.

Between 23rd March and 6th April, 50 national retailers with a total of 150,000 outlets (Department Store, Apparel, Specialty) closed all store operations. In addition, 22 retailers with 122,000 (Home Improvement, Grocery, Pharmacy) outlets reduced hours of operation. Some retail formats like Apparel, Department Stores and Luxury Retail will experience more pain than others like Grocery and Pharmacy which might be spared the direct blow.

The situation is no different for restaurants. 42 states have restricted restaurant operations to drive-thru, carryout and / or delivery only. And some of the biggest players — McDonald's, Wendy's, Chick-fil-A, Dunkin' and Starbucks and a few others have closed all dine-in operations even in states not imposing any restrictions. For restaurant chains, the dine-in revenue in the 4 week period between 15th March to 14th April was only 27%.

The unfortunate reality is that only Retail and Restaurant chains with strong fundamentals and balance sheets will survive.

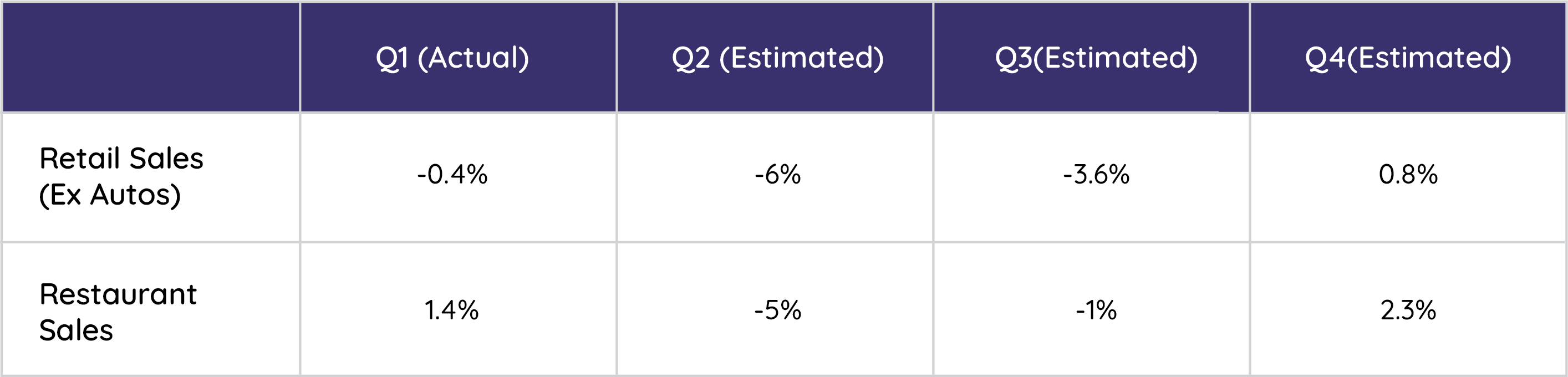

Projected Impact

Sales Impact (YOY)

Source: Incisiv Market Forecasts

Source: Incisiv Market Forecasts

Total Sales Impact of COVID-19 on 2020 Sales

Retail: $500 - $650 Billion

Restaurant: $225 - $300 Billion

Jobs Impacted: ~ 3 Million

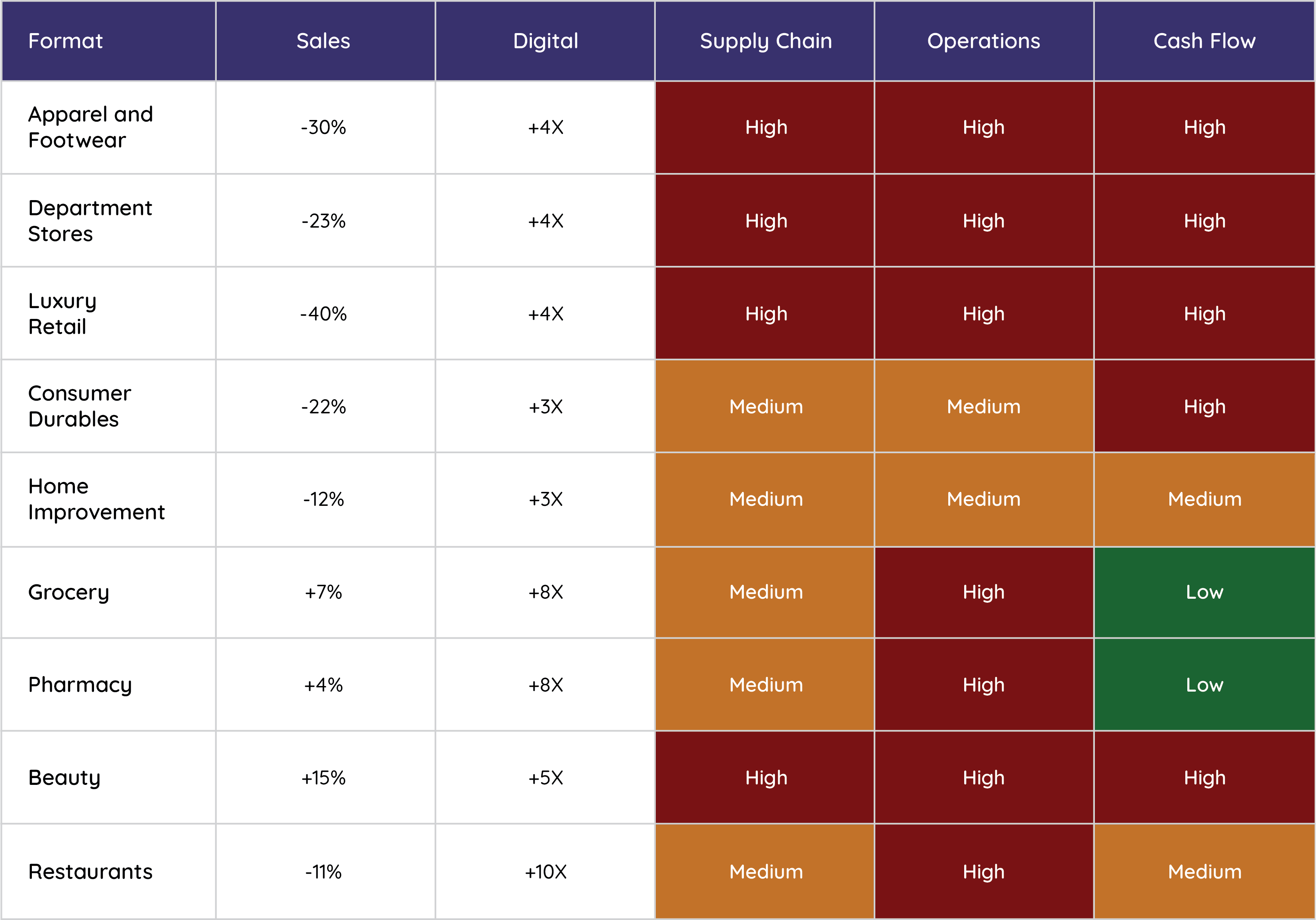

Heat Map

Note:

Sales: Impact compared to 2019 performance

High: Severely impacting all aspects

Medium: Impact limited to some aspects

Low: Impact limited to few aspects

Digital Sales: Increment compared to 2019 revenue

Impact will vary vastly by retail segment. In retail: apparel, department stores and consumer durables will be the hardest hit. With sales almost drying up, unsold and obsolete inventory will result in serious cash flow issues. In addition, non-availability of workforce (due to furloughs) to plan for subsequent seasons and disruption in supply chains is making the return to business for most in this segment really daunting. We project that if social distancing guidelines remain in place till the end of June, 50% of the apparel, department store and specialty retailers might file for bankruptcy.

The Road Ahead

The highly (sales) impacted segments in retail and restaurant business need to develop a playbook for survival:

Key Considerations for Retailer and Restaurant chains

Immediate Term

- Health and Safety: Safety and well being of both staff and customers, sanitation / sanitization standards, shorter operating hours, limiting customers in the store

- Supply Chain: Maintaining and sustaining in-bound and out-bound supply chain, ability to ensure product availability

- Sales: Selling on digital channels (open for business) and react to evolving demand quickly: health and safety to food to personal grooming and entertainment

- Tactical Realignment of Operating Model: Flexible staffing, stores and fulfillment centers, and DC Shifts

Short Term (2 - 3 Months)

- Cash Flow: Optimize spend, supplier negotiations

- Obsolete Inventory: With minimal sell through of spring collection(s) / merchandise and overall drop-off in discretionary spend retailers will need to make tough calls whether to sell store for next season or go off-price

- Consumer Sentiment: With increasing job loss and lack of visibility of bounce back the sentiment will nosedive as people limit spending to essentials in the short to medium term

- Alternate Delivery Models: Need to evolve and implement alternative delivery models: home delivery, stores as re-fulfillment centers, last mile delivery using third parties: Uber etc.

Intermediate Term (3 - 6 Months)

- Business Viability: Staying solvent and building a scenario based plan to restart-start normal operations

- Planning and Execution for Subsequent Seasons: Bring essential staff on at the right time to plan for back-to-school to holiday season

- Funding Transformative initiatives to Stay Relevant: Revise business cases for transformation initiatives and prioritize one with maximum short-term ROI

- Permanent Store Closures: Rationalize store footprint as demand moves online

Long Term (6 Month+)

- Consumer Behavior: Consumers become financially conservative, liquidity decreases and many customers go into default. In addition, as consumers get used to the do it yourself / at home model for everything from coffee to meals to household projects, some of these behaviors will change spending on some categories permanently

- Closures and Consolidation: Opportunities to expand offerings, augment channel will be available at compelling valuations

High Impact Segments (Apparel, Department Stores, Luxury Retail) should focus on:

- Cash Conservation: Radical approach to inventory management and spend optimization

- Operating Model Redesign: Channel optimization, location and workforce optimization

- Investments in Digital: Improving channel, delivery and customer service

Low Impact Segments (Grocery, Pharmacy) should focus on:

- Portfolio Expansion: Increase store footprint, add a category / segment

- Investments in Digital: Improving channels, delivery and customer service

- Operating Model Rejig and Alternative Delivery Models: Delivery, online ordering. Move away from channel P&Ls

- Acquisitions: Look to expand portfolios to bridge key offering gaps and evolve operating models to meet evolving customer needs

One clear opportunity that stands out for all segments is investment in digital. For most consumer businesses the situation will necessitate accelerated investments in digital transformation to just survive.