As retailers continue to invest in transformation, they must focus on a more certain path to customer relevance – a customer experience that shoppers value - and be alert to the distraction a me-too, competitive-parity based omnichannel approach poses.

Co-authored with Gaurav Pant, this two part series lays out an argument for retailers to eschew transformation strategies driven by competitive parity and instead focus on amplifying their customer experience.

Omnichannel’s Shape-Shifting History

“Omnichannel” is a misleading term. It is not an accurate representation of consumer behavior as such - consumers don’t think in terms of channels, they simply shop. It is also not an absolute end-state for retailers to achieve, for there isn’t (and shouldn’t be) a standard definition of what it means to be omnichannel.

It started off as a customer engagement and commerce concept – for retailers to have the ability to engage shoppers seamlessly across channels. As retailers realized this vision was further away than originally imagined, the focus shifted to a lower hanging fruit – exposing enterprise inventory to shoppers across channels. The prior vision now lives on in the form of a trendy new buzzword – Unified Commerce. Omnichannel on the other hand has become synonymous with a variety of customer experience “features” that offer consumers greater choice and flexibility in terms of shipping and delivery.

Omnichannel Basket of Capabilities

Who Put the Omnichannel Cart Before the Customer Experience Horse?

Omnichannel is best viewed as shorthand for the idea of change brick and mortar retailers must institute to revitalize their growth prospects by delivering a better customer experience to their target customers.

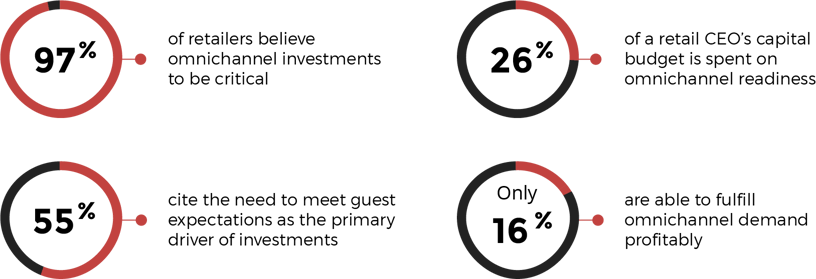

However, retailers, and the echo chamber surrounding them, took a fundamentally sound idea (the need for change) and built a belief structure (omnichannel basket of capabilities as the change) around it.

There is no concrete evidence (yet) of omnichannel – in and of itself – being a sustainable growth strategy for retailers. In that sense, it has increasingly become a defensive strategy – one of competitive parity; one justified by the fear of loss rather than the vision of growth.

To the contrary, most retail success stories of the past decade have eschewed a singular, or even primary, focus on the basket of omnichannel capabilities, and instead made a stronger connection with their customers through a clearer definition and sharper execution of their customer experience.

In the age of next-day deliveries, Zulily convinced shoppers to wait 10-14 days for shipping – focusing instead on offering them the thrill of discovery, a unique product selection and low prices. QVC bought them for $2.4B in 2015.

While store closings reach historic highs, TJ Maxx has built a customer experience wherein ecommerce is supplementary (~1% of sales). You’re missing the point if you boil it down to consumer preference for off-price merchandise.

Even as Best Buy “outsources” product knowledge to its suppliers, and Geek Squad staffers deny being “experts”, Apple’s retail playbook would have a chapter dedicated to store associates as experts and customer advocates.

---

Let Customer Experience Drive Omnichannel Investments.

There is no denying the dynamic shift in consumer behavior over the past decade that’s been driven by a new-normal economy, ubiquitous Internet connectivity, saturation level smartphone penetration, and the coming of age of a digitally native generation. The traditional, linear “Path to Purchase” is dead. What consumers value, how they shop, where they transact, what they expect – have all changed.

Yet – not all consumers are alike. Not all “omnichannel” capabilities are valuable for all retailers in all contexts. The brass tacks of retail ultimately hold – serve a specific need of a segment of shoppers, and double down on your ability to do so better than anyone else. Let’s call that your customer experience. Let your customer experience drive what omnichannel investments make sense, and why.

Primark doesn’t do ecommerce. TJX doesn’t offer in-store inventory look-up. Rather than take omnichannel as a belief – do this, or die – successful retailers focus on their customer experience first, and then on enabling capabilities that move the needle for that experience.

The assault on traditional brick and mortar from newer business models (pureplay online, click-to-bricks, marketplaces, subscriptions etc.) doesn’t mean the component parts of their customer experience can be broken down and adopted en masse. It is shortsighted to simplify someone else’s advantage into catch phrases - “they are not weighed down by legacy”, or “unlike us, they don’t have to turn a profit”. Bonobos is about fit. Rent-the-Runway is about making aspirational fashion accessible.

---

Part 2 will illustrate how a me-too approach can drive flawed execution, introduce “friction” in the customer experience and bleed margin. A complete PDF version including both parts is available for download here (you’ll need to fill out a form).